Annuities hit nirvana moment – will it last?

Annuity sellers are sitting atop a mountain of goodness.

Nearly all product lines are selling strong or boast a positive outlook, and successful technology adoption is proceeding with alacrity. States coast to coast are adopting the industry-favored best-interest sales rules.

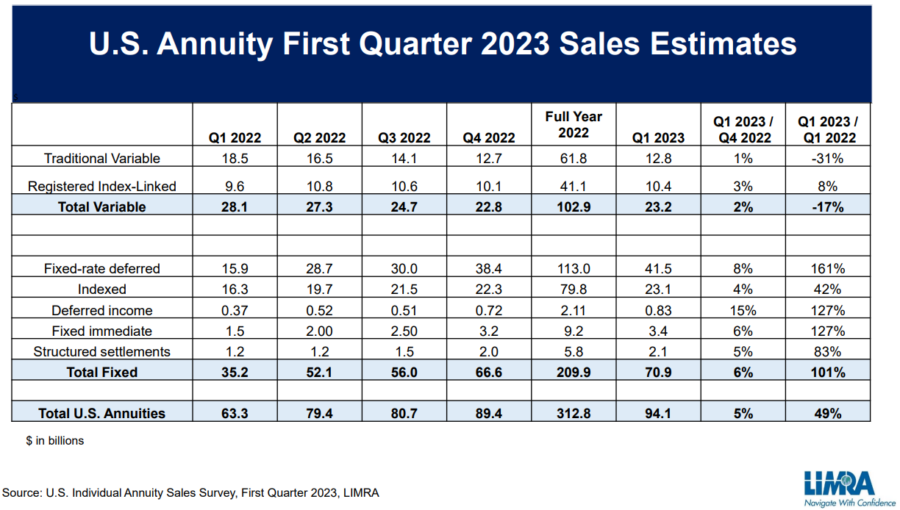

It’s all contributing to sales so strong that calling them simply “record breaking” almost undersells the market heat — more like record shattering. First-quarter annuity sales totaled $92.9 billion, a 47% increase from the prior year, according to LIMRA’s U.S. Individual Annuity Sales Survey.

That follows sales of $310.6 billion in 2022, a 22% increase from 2021 results and 17% higher than the record set in 2008.

But faint as they might be, there are potential storm clouds lingering on the horizon.

The Department of Labor is expected to publish a new fiduciary rule by the end of 2023, a rule change that would likely upend annuity sales practices. It’s the second attempt by the DOL to extend a fiduciary duty to annuity sales and other retirement fund transactions.

Finalized in 2016, the first fiduciary rule forced the industry into a costly revamp of sales practices. It also swung many more potential annuity sales into the unsuitable category. And the bottom line suffered. In 2017, annuity sales plunged to $204 billion, the sales nadir of the past decade.

Jim Szostek is vice president and deputy, retirement security for the American Council of Life Insurers.

“Fiduciary-only advisors generally require account holders to invest at least $100,000 up front,” Szostek said. “It is also worth noting that fiduciaries charge a fee for advice, generally on an ongoing basis based on assets under management. This works for those with significant assets. “But it doesn’t work for most working-class families who are most likely to benefit from income guarantees in retirement through an annuity.”

Bulls and bears

The S&P 500 stock tracking index firmly turned bearish last June. Since the start of 2022, the index is down 14%. Combined with other skittish economic indicators, such as rampant inflation and recession talk, retirement investors fled the market in fear.

Protection-focused annuities is where they ended up parking their money — products like fixed-rate deferred annuities and indexed annuities, which shield owners from the volatility of stocks and bonds.

Even a solid rebound for equities this year — the S&P was up nearly 7% as this issue went to press — is doing little to subdue the desire for protection annuities.

“Market conditions continue to drive investor demand for annuities,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “Every major fixed annuity product line experienced at least double-digit year-over-year growth.”

Demand for annuities is so strong, many carriers are having trouble keeping up. Industry social media chatter is buzzing with talk of annuity applications delayed for weeks.

“We obviously had a ton of volume coming through in protection-focused annuity product,” Giesing explained. “And that was simply a distraction. We’re hearing from the industry that there have been backlogs and that insurance companies had to quickly expand their headcount in new business processing to be able to handle the volume.”

Many insurers are quickly pivoting to technology to help process applications faster. During Prudential’s first-quarter earnings call last month, Chairman and CEO Charlie Lowrey noted “a significant increase” in sales of fixed annuities. He credited technology, in part, for the boost.

For example, a majority of annuities applications are now submitted with electronic signature, Lowrey added, “which has reduced processing time by several days and improved our environmental impact.”

RILAs roll on

Historically, the stock market gains over time and the bulls will eventually run again. The Dow Jones Industrial Average gained a modest 1% through the first four months of 2023. LIMRA is predicting slow and steady growth in equities through 2028.

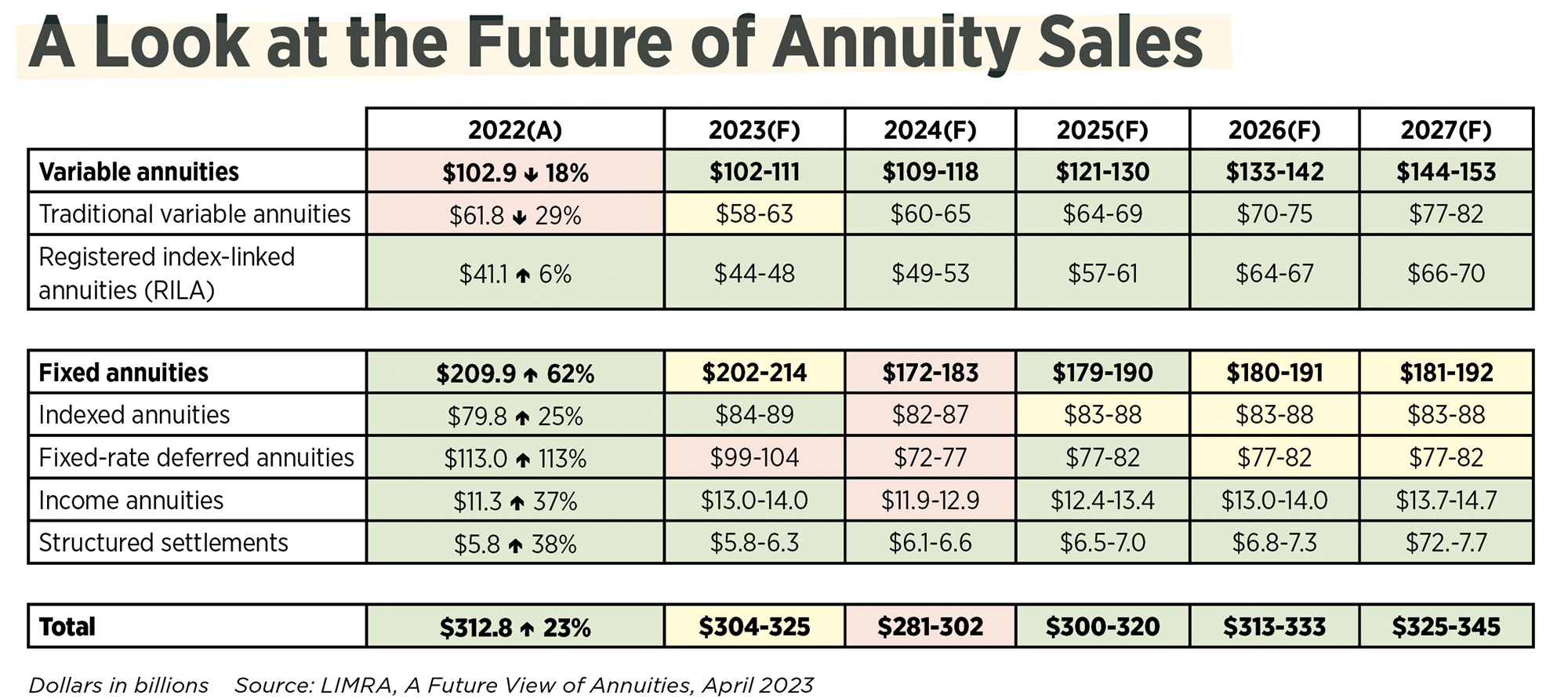

In response, annuity buyers will surely turn away from protection-centered products such as fixed-rate deferred. LIMRA forecasts about a 30% decline in this category, but Giesing noted that even with the projected decline, those are still historically strong sales.

But that decline does not mean the selling party has to end. If the industry has proven anything, it’s that annuity manufacturers have a product for all seasons.

In good market times, that product is registered indexed-linked annuities. Also known as structured or buffered annuities, RILAs are a tax-deferred long-term savings option that limit exposure to downside risk and provide the opportunity for growth, usually through a market index.

RILA products offer more growth potential than fixed annuities, but less potential return and less risk than variable annuities.

Introduced in 2010 by AXA Equitable Life Insurance Co., now known as Equitable, it took some time for RILAs to catch on. Sales topped $11 billion in 2018, and carriers rushed products to market to catch the RILA trend.

Today, there are 17 carriers offering RILAs and more than $41 billion in annual sales. Transamerica, Global Atlantic and Sammons all brought new RILA versions to the market in 2022.

With interest rates climbing higher seemingly each time the Federal Reserve meets — the Fed hiked its benchmark borrowing rate again in May to a target range of 5% to 5.25%, a rate not seen since 2007 — RILA sales growth was expected to halt.

That has not happened.

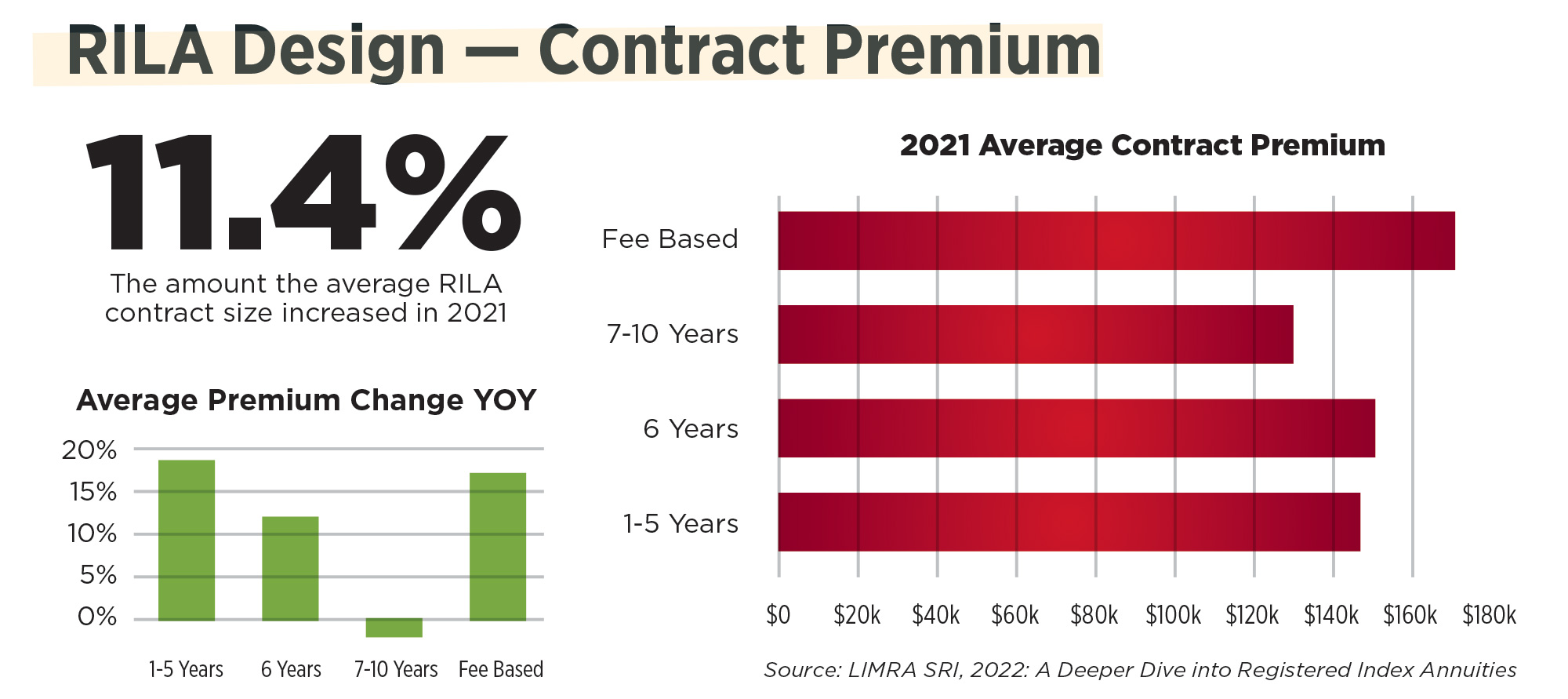

In fact, RILA sales expanded by 6% from 2021 to 2022, said Sutton White, head of annuity product for Life Innovators.

“We’re still seeing growth, even as we’re seeing new carriers [introduce RILAs],” White pointed out. “You would expect to see growth potential flatline or to start to see some share get diluted from top carriers. We’ve seen a little bit of that, but for the number of carriers that have come into the market and you’re still seeing exponential growth? It’s almost unprecedented.”

RILA contract premium increased 11.4% in 2021, and White noted that 61% of RILA premium is money new to the industry — in other words, not funds swapped from an existing annuity.

RILA legislation

The RILA Act awaits President Joe Biden’s signature and could further boost sales. The bill would lower barriers to retirement income products by requiring the Securities and Exchange Commission to revise rules regarding developing and offering certain annuity products, including RILAs.

If signed into law, the bill will direct the SEC to create a new form to replace the forms annuity issuers currently are required to use when filing RILAs with the commission. These forms require the disclosure of financial information in line with GAAP, as well as other extensive information that is irrelevant for prospective annuity purchasers, industry lobbyists say.

Most notable is the S-1 form, filed with the SEC. The number of carriers offering RILAs could double if the RILA Act becomes law and they are not required to file the more cumbersome S-1 form, White predicted.

Furthermore, talks with the Interstate Insurance Product Regulation Commission to add RILAs are nearing a successful conclusion, White said.

Created by the National Association of Insurance Commissioners in 2002, the interstate insurance compact reviews and approves (or disapproves) individual and group annuity, life insurance, disability income, and long-term care insurance products.

“RILA is not in the compact currently,” White explained. “So not only do you have to go through the arduous process of filing Form S-1, but you also then have to do a state-by-state filing of the final product, which ‘tedious’ doesn’t even begin to describe because there’s not really a lot of consistency [from state to state].”

Don’t forget about VAs

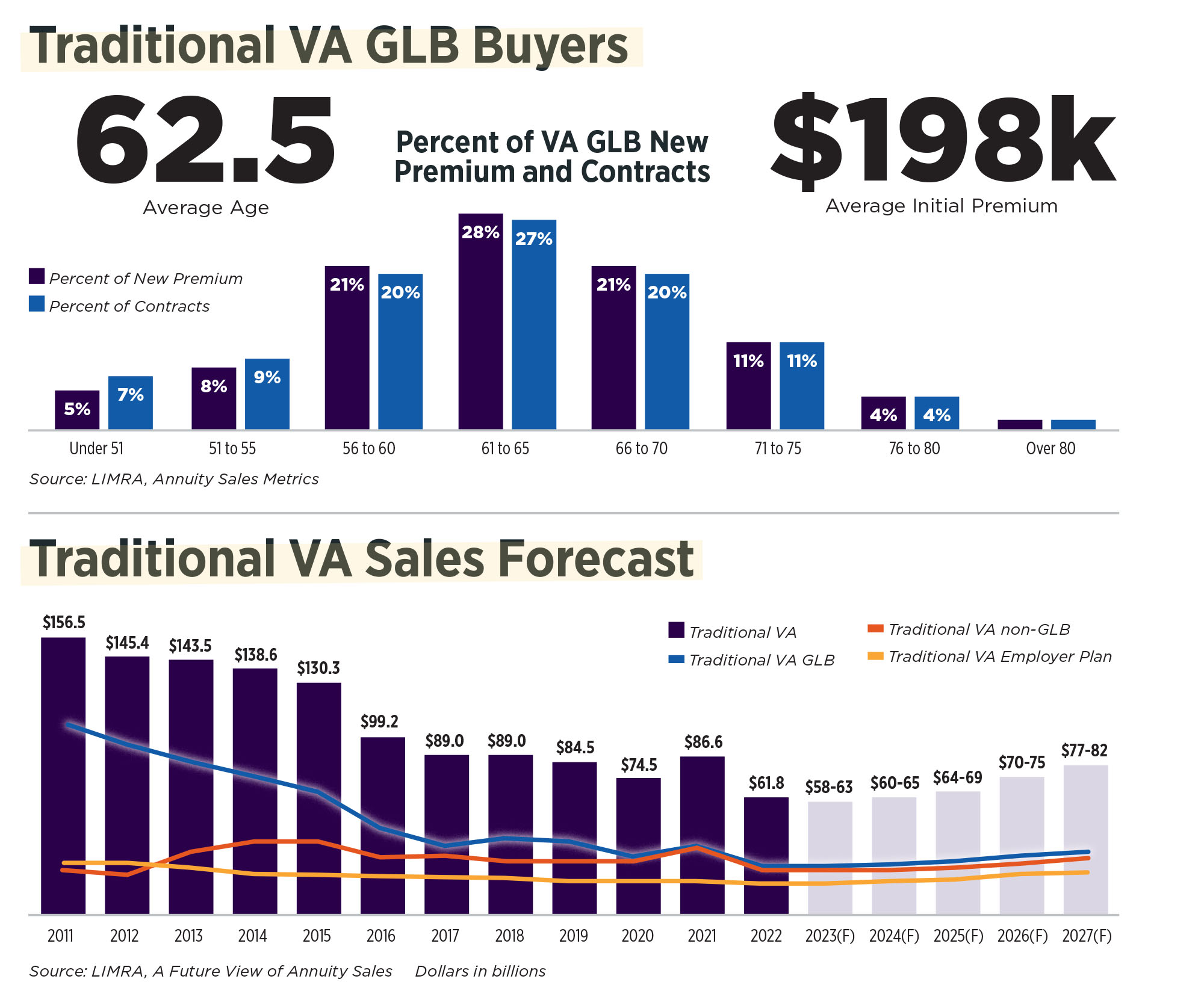

Variable annuities were once the prettiest products on the shelf. At their 2011 peak, VA sales topped $156 billion, the majority of them with guaranteed living benefits.

Traditional VAs include an investment account that may grow on a tax-deferred basis and include certain insurance features, such as the ability to turn an account into a stream of periodic payments. VAs grew wildly popular while the stock market regained strength in the years after the 2008-09 economic crisis.

Sales were too good.

Eventually, carriers became nervous about the amount of VA guarantees on their books, Giesing noted, and adopted different strategies to counter that risk.

“Carriers started to say, ‘Okay, we want to balance out our annuity portfolios and our annuity sales,’” he said. “So they started diversifying, offering products without guaranteed living benefits or looking at other product lines and putting an emphasis” on other annuity categories.

VA sales plummeted steadily, registering just $61.8 billion in 2022, the lowest full-year sales since 1995. Traditional VA sales were $12.9 billion in the first quarter of 2023, down 30% from first-quarter 2022 results.

But Giesing and LIMRA say VAs still have a place in the market. LIMRA forecasts call for a gradual uptick in VA sales to the $80 billion range by 2027. At $198,000, the average new contract premium for VAs with guaranteed living benefits is very high.

“Very lucrative and one of the highest average commission premiums for contracts,” Giesing noted.

Fiduciary rule, part deux

The lone Debbie Downer in this whole rosy scenario is the looming fiduciary rule. DOL officials are notoriously tight-lipped about rules in progress and could not be reached for comment.

However, industry lobbyists feel good about having a precedent set by the 5th U.S. Circuit Court of Appeals in 2018, when a 2-1 ruling tossed out the fiduciary rule published by the Obama-era DOL.

Since then, the Trump administration published the investment advice rule, a surprisingly strong effort. The department was immediately sued twice over a portion of guidance issued in 2021 that expanded the definition of a retirement plan fiduciary.

The DOL wants most of all to extend fiduciary duty to advisors who handle “rollover” planning. According to the Investment Company Institute, 401(k) plans hold $6.3 trillion in assets as of Sept. 30, 2022, on behalf of about 60 million active participants and millions of former employees and retirees. When recipients retire and the money is “rolled” out of those plans, many advisors earn a commission.

Regulators consider that a conflict of interest and want it to be considered fiduciary advice. The fiduciary standard is based on the “five-part test” established in 1975, in which one of the prongs is whether the advisor and client are in an “ongoing relationship.” In order to satisfy that prong, the DOL claims a one-time rollover contains the expectation of future advice rendered.

A federal district court judge in Florida struck down the guidance in a February ruling that has been appealed by the DOL.

Judge Virginia M. Hernandez Covington ruled that a portion of the department’s frequently asked questions guidance illegally widened its regulatory lane and failed to comply with the agency’s own regulations.

“While an offer to provide future advice may, as the Department suggests, be the beginning of a relationship, that relationship is inherently divorced from the ERISA-governed plan,” she wrote. “Because any provision of future advice occurs at a time when the assets are no longer plan assets, it is not captured by the ‘regular basis’ analysis.”

So, we wait.

In April, Washington and Wyoming became the 35th and 36th states to adopt the NAIC best-interest standard for annuity sales and recommendations. States have swiftly responded to lobbying efforts that ramped up following the 2020 model adoption by insurance commissioners.

It mirrors the best-interest regulation adopted by the SEC in 2019 for broker-dealers and registered representatives.

“A best-interest standard is better,” Szostek said. “It protects consumers without making making access impossible for working-class Americans.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Turning millennials into millionaires — With Bryan Kuderna

Product bundling, information key to annuity, LTCi purchases, studies show

Advisor News

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

More Advisor NewsAnnuity News

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News