After The Fever

COVID-19 would claim many victims over 2020; one of them was the life insurance industry. And the patient is still convalescing.

The industry is healing the same way it does most things — slowly. After reacting to the direct effects of the pandemic, carriers and distributors are dealing with the chronic condition of low interest rates.

The life insurance market itself is reviving as the entire product chain learns to onboard tech in a hurry, elevating those savvy enough to take up those tools and leaving behind those who do not.

Annuities are particularly vulnerable to the scourge of low interest rates. Simple products are not doing well. Consumers are loath to take on immediate annuities at historically low rates. The winners are the ones promising some accumulation, with registered index-linked annuities a lone standout.

The health insurance industry actually did OK this year, largely because people did not seek as many medical services other than for urgent needs. Health insurers are prepping for those who deferred health care needs to show up for services in 2021.

The end of this year finds the span of the life/health industries in the middle of an epic realignment. Companies, distributors and sellers say they have absorbed the lessons brought by the pandemic and are ready for what’s next.

In this three-article feature, we will be looking at how they have reacted to this year’s challenges.

— Steven A. Morelli

Life Insurers Regain Footing After Shaky 2020

Sellers are learning how to operate in a remote environment while carriers restructure products.

By John Hilton

Insurers entered 2020 believing that the new principles-based reserving rules would be the biggest disruption of the business of life insurance.

Oh, how little they knew what was to come.

The COVID-19 pandemic throttled sales figures, sent insurance executives scrambling to activate emergency financial plans, and spurred product development and delivery changes all along the distribution chain.

But as the year winds down, the life insurance industry is better off in some ways than when it began. For three reasons in particular:

» Technology. The pandemic threw those long-discussed technology plans into overdrive. Virtual meetings, accelerated underwriting and e-signatures are some ideas that gained widespread traction in the industry.

» Life insurance demand. Perhaps not surprisingly, the pandemic proved better than the best marketing campaign. Interest in the product is very high, and gains are being seen in the coveted age groups.

» Favorable regulation. Rulemaking did not stop in 2020, and regulators approved key life insurance rules that industry groups find acceptable.

The news is not all great, of course. Interest rates plunged as the economy went south and remain near historic lows. Insurers are planning for rates to remain low for at least the next couple years.

The issue is an example of how the industry came together, said David Levenson, CEO of LIMRA, LOMA and LL Global.

“Frankly, it was hard at points to separate low rates from some of the COVID knock-on effects,” Levenson said. “So, we really tackled it all.”

New Reserving Requirements

The year kicked off with insurers having to meet new principle-based reserving, or a modeled approach to statutory reserves. Canada and some European countries previously moved from formula-based reserving to PBR. The old way proved ineffective once insurers began developing more complex product designs.

Insurers had three years to adapt to PBR, but many waited as long as possible. The National Association of Insurance Commissioners adopted PBR standards in June 2016. At the time, Fitch Ratings forecast that “level-premium term and universal life insurance with secondary guarantees are expected to be most affected.”

Fitch expected that large insurers would be more able to adopt PBR, “particularly those that write significant amounts of term insurance, while UL-focused companies will likely move more slowly.”

The first quarter was winding down when the pandemic hit with full force, shutting down or curtailing regular life for weeks.

Insurers reacted swiftly to restrict life insurance sales to older consumers. Prudential is the only insurer known to have completely pulled a product, suspending all sales of its 30-year term offerings in mid-April. Those products returned to the market in mid-July, along with some significant rate changes.

Insurers have said rate increases are enabling them to survive financially in an extreme low-interest-rate environment.

‘Hit A Lot Harder’

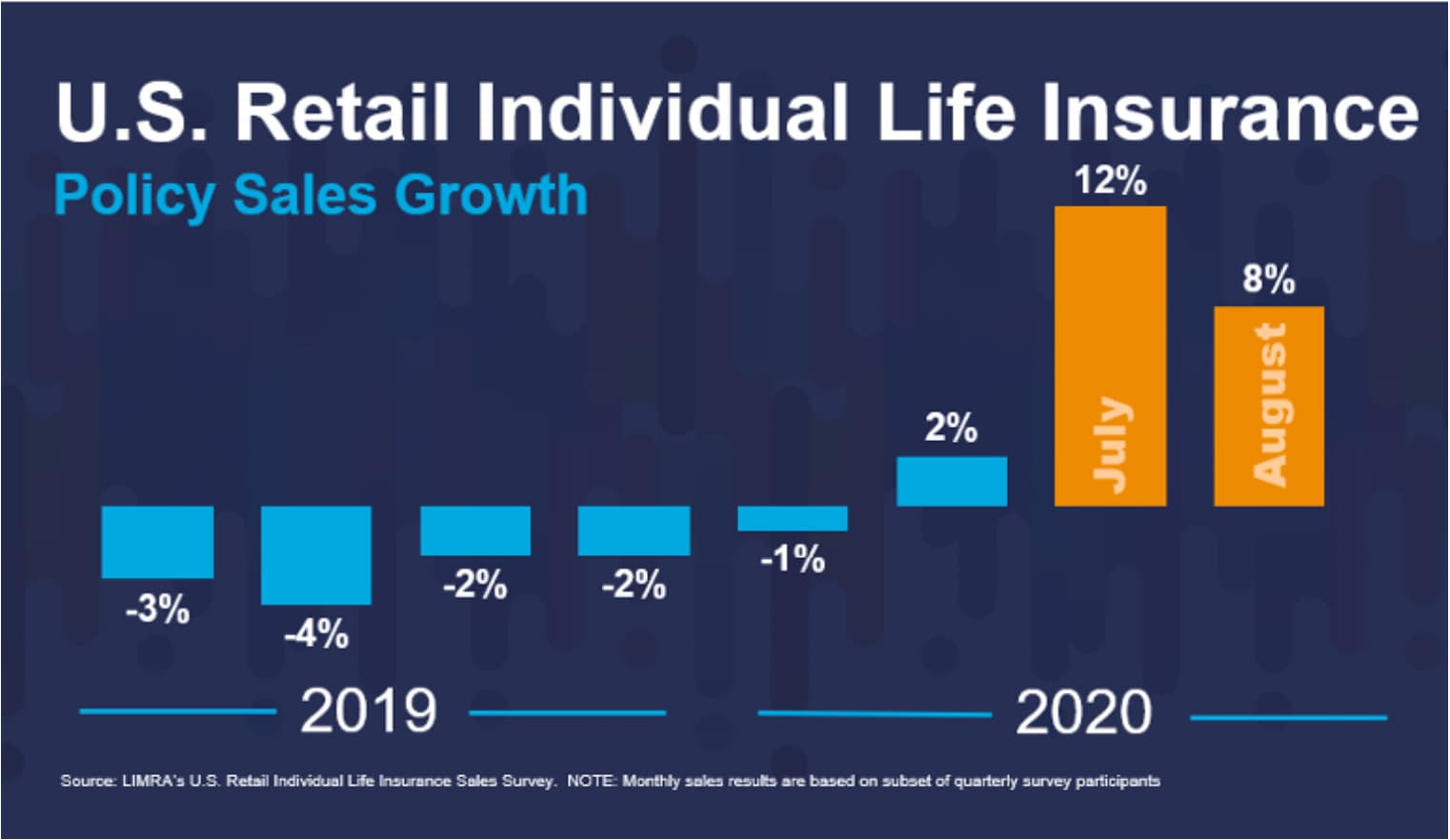

By the end of summer, the industry recognized a sharp uptick in life insurance interest from the coveted under-44 age group. According to the MIB Life Index, life insurance application activity increased 4% through the third quarter, a return to “pre-pandemic normal levels.”

The third quarter experienced the largest quarter-over-quarter gain since 2011, at 9.2%, MIB said, driven primarily by 12.8% growth in 0-44 age group and 9.2% growth in the 45-59 age group.

But application activity to completed sales remained a difficult step for many insurers.

“People were locked up in their houses and not buying insurance because you couldn’t see anyone face-to-face,” noted Sheryl Moore, CEO of Moore Market Intelligence. “Life Insurance has been hit a lot harder and in a lot stranger ways than annuities have.”

Insurers were forced to adapt and adapt quickly. Many insurers increased the face amounts of policies they would issue without a medical exam. Others accepted electronic health records. And seemingly every insurer boosted its website application and communication capability as business flooded to online exchanges.

“We came out with things that were a lot more customer-centric maybe more quickly than we would have otherwise,” Levenson said. “That ranges from a suite of digital tools to extended use of accelerated underwriting to other uses of technology.”

The acceleration is pushing the industry closer to what Levenson called an ideal client experience with digital tools, such as the expansion of automated underwriting and electronic delivery of policies.

Those are some welcome changes, with the momentum for more going into 2021, he said.

“I think financial advisors and agents have become better users of technology and communicating with their clients,” Levenson said. “That creates an efficiency that is good for the customer and is good for our industry.”

Rule Changes

Rules are constantly changing, and COVID-19 did not stop that process. The NAIC approved a significant rule update this fall that will change how indexed universal life policies are sold.

The newly named Actuarial Guideline 49A requires that IUL designs with multipliers or other enhancements should not illustrate better than nonmultiplier designs. Also, it permits the IUL illustration crediting rate to be 50 basis points higher than the policy loan rate, down from 100 basis points.

The original AG 49 was adopted by the NAIC in 2015 to rein in IUL illustrations that were showing consumers unrealistic returns. Critics say insurers almost immediately got around the new rules by offering IUL bonuses and multipliers.

IUL has been a strong seller for insurers and agents. Regulators vowed to keep a close eye on sales practices and did not rule out reopening the new AG 49A should they see abuses resume.

Despite the rocky year, life insurers see better days ahead. Low interest rates are likely to persist, but the public is rediscovering the value of life insurance and what it means for families.

A record number of Americans (41%) say they have “extreme” or “quite a bit” of confidence in life insurers, LIMRA found in a recent survey. Confidence in financial professionals also hit a new high, with 33% of consumers saying they have this level of confidence in insurance agents and brokers and 37% when it comes to financial advisors.

“Other research we have done throughout the pandemic has shown how much insurers and financial professionals have done to adapt and offer digital solutions to help their customers virtually when they couldn’t meet face-to-face,” said Alison Salka, senior vice president and head of LIMRA Research. “I think these efforts, combined with the growing understanding of the value of life insurance, have increased consumers’ awareness of our industry and the people who work in it.”

Constant Drip Of Low Rates Deteriorates Annuity Distribution

Sales drop across products except registered index-linked annuities.

By John Hilton

Annuity sales fell as COVID-19 spread in 2020, and the year is ending with products and the people who sell them staring at painful transitions.

The obstacles to selling in person were in addition to historically low interest rates, which do not allow for appealing products based on rates.

As this issue went to press, third-quarter sales figures showed a small rebound from the devastating second quarter. Total annuity sales were $54.8 billion in the third quarter, up 13% from the second quarter, but down 8% from 3Q 2019, according to preliminary results from the Secure Retirement Institute.

Those numbers masked deeper problems, with too many low-rate products unsuited for the uniquely fragile economy and a dwindling sales force hamstrung by the pandemic and unneeded by slimmer distributors.

“Insurance companies have had to adjust dramatically to accommodate COVID,” said Sheryl Moore, CEO of Moore Market Intelligence. “Their sales are down, and it’s like, ‘We’re not able to make up for what we’re losing.’ And I’m concerned about that. Because when people aren’t able to make it paycheck to paycheck, it’s going to hit their retirement savings. And that’s what we’re seeing.”

Painful Downsizing

The fourth quarter brought painful news as producers were laid off across the industry. Among insurers, Pacific Life, MetLife, Transamerica, Lincoln Financial and others trimmed hundreds of employees. Independent marketing organizations and wholesalers also laid off producers, Moore said.

Many of them might have trouble getting back in the door, she added.

“Everybody’s transitioning to working virtually, and if you can do the wholesaling thing by Zoom, why the heck do I have to pay you a couple hundred thousand dollars a year to go out and spend my money on expensive dinners with distribution groups if I could pay a guy to just sit here in the office and do Zoom and get the same results?” Moore asked.

The industry downsizing in response to the pandemic-scarred economy is likely to continue through the holidays, she added.

“That’s really scary for the industry,” Moore said. “And it’s scary for Des Moines, or Indianapolis, or Omaha and Hartford. Any big insurance hub in the United States could see an increase in their unemployment rates.”

Fine Start

The year started off well, with many annuity products selling well. Variable annuities rose 16% in the first quarter, the fourth consecutive quarter of sales increases. But the 10-year Treasury rate was already falling, entering the year at about 1.9%.

Products like fixed-rate deferred and indexed annuities fell along with interest rates. The first case of COVID-19 on Jan. 21 made few big headlines. By mid-February, the pandemic was taking off worldwide, and the Federal Reserve funds rate bottomed out at 0.50% on March 9.

Tanking rates meant insurers took a double-barrel shot. The guarantees on in-force books are substantially higher than bond rates, a drag on profitability. In addition, insurers are making a far less return on their safe investments.

As the months of low rates and poor sales dragged on, insurers sought out de-risking partners to take some of their annuity blocks. In one of the bigger deals, Athene Holding agreed to fully reinsure $27.6 billion of Jackson National’s in-force book of fixed and fixed index annuity liabilities in exchange for approximately $1.25 billion in ceding commission.

AIG went one step further in a shocking October announcement that it will spin off its life and retirement business into a separate company, a move reminiscent of MetLife peeling off its life/annuity business, which became Brighthouse Financial.

‘Very Attractive’

As the third-quarter sales numbers showed, just one annuity design has widespread attraction for consumers now — registered index-linked annuities.

RILA sales jumped 33% to $6.4 billion in the quarter, the 23rd straight quarter-over-quarter growth for the product. Through three quarter, RILA sales were $15.8 billion, up 26% from 2019 results.

“In this economic environment, RILA products are very attractive to investors seeking downside protection with greater growth potential,” said Todd Giesing, senior annuity research director, SRI. “In addition, we are seeing more carriers enter the RILA market, also spurring RILA growth.”

The RILAs, or “structured annuities,” as Moore calls them, give the buyer a chance to do better than a fixed-income vehicle, while sidestepping some of the risk that comes with a variable annuity.

“Structured annuities are going to continue to experience sales increases just because fixed and indexed annuities have been affected adversely by the pricing environment,” Moore said.

Warming Up

One place annuities could see some growth is with fiduciary advisors. Prejudices against annuities in the advisory world are fading, and firms such as DHR Investment Council in the San Francisco area are turning to guaranteed income to counterbalance a client’s securities portfolio, said Shannon Stone, financial planner, advisor and operations manager at DHR.

“Up until a few years ago, I was pretty negative on annuities,” Stone said during an October webinar hosted by DPL Financial Partners.

The problem with the advisors’ traditional investment-only retirement plan is that it often leads to advisors telling clients they need to spend less than they had planned.

“Behaviorally, it’s not necessarily something that consumers want to be told,” said David Lau, founder and CEO of DPL Financial Partners. “And the other thing is, it’s IF you can spend less. You know, spending is not always in the control of the retiree.”

Lawmakers are trying to help the pro-annuity trend. The year started with the newly passed Setting Every Community Up for Retirement Enhancement (SECURE) Act, which removes some of the barriers to annuities inside 401(k)s and other retirement plans.

The act creates a safe harbor that employers can use when choosing a group annuity to include as an investment within a defined-contribution plan. With a minimal amount of gatekeeping, a plan sponsor can add an annuity option, which doesn’t have to be the lowest-cost option, to a plan with little liability.

A SECURE II bill was introduced in late October and would build on the first piece of legislation.

Eventually, there is a route out of the darkness, Moore said. Once the pandemic subsides and is better controlled, annuity sales should bounce back in lockstep with the overall economy, she said.

“We’re eventually going to see a great rebound,” Moore added, “and even maybe some extra annuity purchases that we didn’t have before because people are saying, ‘I need to catch up because I took so much out.’ I just don’t think we’re there yet.”

Health Insurance Emerges Surprisingly Healthy For 2021

Americans stayed away from health facilities for noncritical needs, but those needs are not going away.

By Susan Rupe

Health insurance experienced a bounce-back year in 2020 — in terms of profitability and in terms of participation in the Affordable Care Act marketplaces.

Even though health insurers picked up the tab for COVID-19 testing and treatment, the pandemic led to record profits for many health insurers in the first half of 2020. Why? Because pandemic-related restrictions and fears kept many policyholders from undergoing expensive elective surgery and caused them to postpone things such as annual physical examinations and preventive health screenings. But those record profits appeared to level off by the third quarter as consumers returned to the doctor in numbers closer to normal.

UnitedHealthGroup, parent company of the nation’s largest health insurer UnitedHealthcare, registered its most profitable quarter in history in the second quarter, with $6.6 billion in profits, according to an analysis of company financial data from FactSet. But the third quarter told a different tale with net income of $3.17 billion, compared with $3.54 billion in the same three-month period in 2019.

Likewise, Anthem, which operates Blue Cross and Blue Shield plans in 14 states, had a stunning second quarter, with its profits doubling to $2.3 billion. But that was followed by a drop in 3Q income, as expenses grew despite an increase in revenue from higher premiums. Humana followed suit, with its 2Q income more than doubling to $2.6 billion. Cigna’s 2Q net income rose to $1.8 billion in 2Q, an increase of $400 million over the year-ago period.

What impact did COVID-19 have on the Affordable Care Act marketplace?

Kaiser Family Foundation looked into it and found that rate filings among insurers planning to offer ACA coverage for 2021 considered COVID-19 costs in determining their premiums for the coming year.

The most common factors that insurers cited as driving up health costs in 2021 were the continued cost of COVID-19 testing, the potential for widespread vaccination, and the rescheduling of medical services delayed from 2020. At the same time, many insurers expect health care usage to remain lower than usual next year as people continue to observe social distancing measures and avoid routine care.

In addition, record-high unemployment is forcing millions of workers off their employer-based plans and into the ACA marketplace, America’s Health Insurance Plans reported.

A number of health insurers jumped ship from ACA plans a few years ago after seeing huge losses resulting from higher-than-expected claims. But more recently, some insurers have concluded that Obamacare is a safe and stable business, in part because people with preexisting conditions have guaranteed access to coverage under the ACA. UnitedHealthcare announced it would reenter the marketplace in 2020, while Anthem and Cigna continued to increase their reach this year.

The wave of newly jobless Americans is providing a new market for insurers that want to serve them through the ACA marketplaces. “The puck is going to those places,” Kathy Hempstead, a health insurance expert at the Robert Wood Johnson Foundation, said in a recent Politico report. “That whole [employer] sector is shrinking. You have to go where people are going.”

Kaiser found insurers serving the ACA market saw continued profits last year, and that there were no signs that the elimination of the law’s individual mandate, which took effect in 2019, led to a widespread exit of healthy customers. Obamacare plans typically can charge high deductibles and copays and count on paying out less in claims for all but the sickest patients, Kaiser said.

ACA Marketplaces: More Issuers, More Stability

The Obamacare marketplaces turned seven years old in 2020, and this year was marked by more choices and lower premiums in much of the ACA world. As enrollment for 2021 opened in November, consumers saw more carriers in the marketplace and premiums expected to stay somewhat level.

“It’s the third year in a row with premiums staying pretty stable,” Louise Norris, an insurance broker in Colorado who follows rates nationwide and writes about insurance trends, told Kaiser Health News. “We’ve seen modest rate changes and an influx of new insurers.”

The last major wave of ACA premium increases came in 2018, after the Trump administration cut some payments to insurers.

Twenty-two more issuers will offer coverage in the marketplace, the Centers for Medicare & Medicaid Services reported, bringing the total number of ACA issuers to 181.

The average premium for the second-lowest cost silver plan (also called the benchmark plan) dropped by 2% for the 2021 coverage year. Three years of declining average benchmark plan premiums combined to deliver an 8% premium reduction across HealthCare.gov since the 2018 coverage year, CMS reported.

But although CMS said the ACA marketplace has stabilized, affordability remains a challenge for many who buy health insurance on the exchanges but don’t qualify for a tax credit to help pay for coverage. The average benchmark plan premium for a typical family of four has increased from $794 in 2014 — the first year the ACA went into effect — to $1,486 for 2021.

Employer-Based Insurance Costs Keep Climbing

Despite massive unemployment, the majority of Americans continue to receive coverage through employer-based plans. The cost of those plans continued to climb in 2020, as did the share paid by workers and their families for that coverage.

Average family premiums rose 4%, to $21,342, in 2020, according to Kaiser Family Foundation. Kaiser’s annual survey found workers on average paid nearly $5,600 toward family coverage in 2020, up from about $4,000 in 2010 and $1,600 in 2000.

Despite that modest percentage of increase, Kaiser found the cost of family coverage rose 55% in the past decade — more than twice the pace of inflation and wages.

Since 2012, the cost of family coverage has increased 3% to 5% annually. On average, workers pay 17% of the premium for single coverage and 27% for family coverage, the survey found. Workers at smaller companies pay 35% of the premium for family coverage, compared with 24% at larger companies, the survey found.

The average annual deductible for single coverage is $1,644 in 2020, up 25% in the past five years and 79% in the past decade.

The Hero Of Zero

McConnell: Senate Will Vote To Add Christopher Waller To Fed Board

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Eden Prairie couple charged in alleged $15 million medical fraud scheme

- Op Ed: Health insurance crisis facing America's small businesses

- Health insurance crisis facing America's small businesses

- States try to reign in claim denials

- Colorado Commissioner of Insurance threatens to shift health insurance funds to illegal immigrants

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

More Life Insurance News