Advisors Talk About Fraud In 401(k) Plans

It is well known that fraud follows the money, so it may seem like it was only a matter of time before fraudsters expanded into what are many consumers’ largest individual accounts: their 401(k) plans. The Secure Retirement Institute has been exploring the evolution of this threat with consumers, plan sponsors and major record-keepers.

In a recent survey, the SRI asked more than 250 financial advisors in the defined contribution industry to describe the impact of financial fraud and the importance of fraud prevention programs within the institutional retirement space.

The study found that recent experience with fraud — and concern about future events — are far stronger among the largest advisory practices, with momentum seemingly driven by their plan sponsor clients. However, fraudsters tend to target individuals and not the plans themselves. So advisors with smaller DC practices may want to take more of a lead, particularly as an avenue to strengthen relationships with (current or potential) wealth management clients, who are often the most likely to be targets.

Largest Advisors Most Likely To Report Growing Risk

For most financial advisors in the DC industry, advising 401(k) plans represents a relatively small part of their practice. In fact, more than half (51%) of respondents derived less than 20% of their professional income from advising DC plans in the preceding year, while only 15% had earned at least half of their income from these plans.

In our analysis, we use advisors’ share of income from 401(k)s to create three profiles: occasional (1%-19%), medium (20%-49%) and core (50%+). These three advisor segments report considerably different experiences and expectations regarding fraud. Similar trends emerge when considering an advisor’s number of plans or their assets under management. In each case, the advisors with greater exposure to the DC market have far stronger concerns about and expectations for fraud prevention.

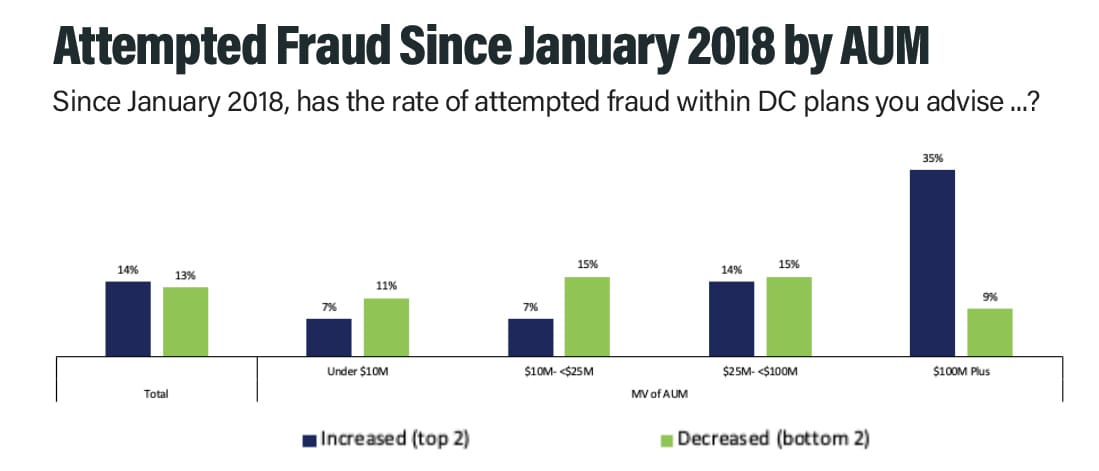

Advisors with at least $100 million in AUM are significantly more likely than their peers to report that fraud had increased over the past two years. For most advisors, fraud experience had not changed significantly over that term. Nearly half of all advisors (47%) feel that the rate of attempted fraud within their DC plans had stayed the same since January 2018, with another quarter (26%) indicating they were unsure.

While 14% of advisors reported an increase in the rate of fraud attempts, they were nearly matched by the 13% who reported an overall decrease. Among advisors with at least $100 million in AUM, however, more than one in three (35%) had seen an increase over two years, fully five times the rate observed among advisors with less than $25 million in AUM.

Concern Is Being Driven By The Sponsors

Although relatively few advisors reported an increase in fraud, far greater numbers (43%) indicated that they and, to an even greater extent, their plan sponsor clients (51%) are growing increasingly concerned.

While the disparity here is not particularly large, it is notable that advisors across the board report higher sponsor concern than personal concern. For example, while 55% of core advisors are increasingly concerned about fraud, 66% report the same for plan sponsors. On the other end, only 36% of occasional advisors are personally growing more concerned, while 44% believe their plan sponsor clients are. As such, increased awareness and focus on fraud prevention programs seem to be driven more by plan sponsor clients than by the advisors themselves.

More than half of advisors (52%) believe their prospective plan sponsor clients are raising their expectations for retirement plan service providers’ fraud prevention capabilities, but this rate improves to 78% for advisors with $100 million in AUM. Those with more exposure to the market, or a focus on the large market, are far more likely to see plan sponsors raising their expectations. While advisors to smaller plans may feel less pressure to prioritize fraud prevention, the value of proactively bringing this concern to the attention of potentially unaware clients should not be overlooked.

Ryan Scanlon, analyst with Secure Retirement Institute, is the project director for four institutional retirement benchmarking surveys and runs the Not-for-Profit Study Group. Ryan may be contacted at [email protected].

Make The Call

Fighting To Serve

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- IF FINALIZED, PROPOSED CHANGES TO MEDICARE ADVANTAGE AND MEDICARE PART D WOULD IMPACT SENIORS' COVERAGE AND CARE IN 2027

- ASSEMBLYMEMBER WILSON INTRODUCES LEGISLATION TO PROTECT CALIFORNIANS FROM GENETIC AND BIOMARKER DISCRIMINATION IN INSURANCE

- SENATORS HASSAN, COLLINS INTRODUCE BIPARTISAN BILL TO HELP PEOPLE DIAGNOSED WITH TERMINAL ILLNESS OR SERIOUS DISABILITY ACCESS THEIR EARNED BENEFITS FASTER

- Study Results from Johns Hopkins University Broaden Understanding of Managed Care (Medicare Advantage Networks for Surgical Specialists): Managed Care

- How Personal Injury Claims Affect Future Health Insurance Coverage in Charlotte, NC

More Health/Employee Benefits NewsLife Insurance News

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

- Baby on Board

More Life Insurance News