Fighting To Serve

When you think of a samurai, you picture the elite Japanese warrior who fought for his daimyo, or master, with absolute loyalty, even unto death.

Amir Ali looks at the samurai and sees more than the swords or the fighting. He sees someone who serves. It’s from that desire to serve others that Ali calls himself The Insurance Samurai.

Ali’s Washington, D.C., practice works with 10-15 different partners outside of his office to provide a wide range of services — both on the life insurance and financial side and the property/casualty side.

“I have clients who are millionaires, clients who barely have two nickels to rub together — and a lot of people in between,” he said.

The 45-year-old Ali became interested in the financial world when he was still in middle school. “I saw the movie “Wall Street,” and I had this dream of being Gordon Gekko — minus the prison sentence,” he said. He began studying the stock market listings in the daily newspaper and reading as much as he could about the business world.

As a student at Howard University, Ali took a temporary job with a division of New York Life that sold health insurance, providing support for agents. After graduation, Ali began working as a health educator but realized the nonprofit sector wasn’t where he wanted to be. Six months later, he returned to New York Life and assisted the health brokers, doing their quotes and helping them prepare for client meetings.

It didn’t take long for him to realize that assisting brokers wasn’t where the money was. “I saw the bonus checks some of the brokers received, and they were more than my annual salary,” he said. “So I got licensed.”

After a couple of years, Ali went to work for a husband-and-wife brokerage firm, and then in 2002, when he was 27, he started his own practice. “I wanted to do my own thing because I was young, and I knew everything there was to know about everything,” he laughed. “And I was moderately successful in spite of myself.”

Ali’s love for learning was as great as his love for the industry, so he set out to educate himself.

“I really dug deep,” he said. “I was hungry to learn everything I could about the industry. I went to as many industry trade shows as I could, and I studied and honed my craft by reading everything I could about the industry.”

A Mentor’s Wisdom

Ali found a mentor in Galen Kimbrue, partner in The Versia Group, a Washington-based professional services firm providing risk and organization solutions to businesses and nonprofits. Today, Ali is the firm’s vice president of commercial insurance.

“He gave me such wonderful information that helped propel me forward,” Ali said. “And there were a bunch of other people as well who took the time to give me their wisdom and allowed me to convert it to my wisdom.”

Ali said one piece of that wisdom that stuck with him is to always be listening. “It’s the adage, you have two ears and one mouth.”

Another nugget of wisdom that Ali said helped him in his career is to develop relationships with the “behind-the-scenes” employees with the companies he works with.

“Go talk to the underwriters and develop a relationship with them, learn how they think. The people in the claims department, the people in the enrollment department — form relationships with them because all those people will help you do your job successfully. Make sure you understand how the insurance company’s internal operations work.”

Kimbrue said Ali’s samurai approach to his work “is what makes him special.”

“His approach to the business is useful to clients; he is very well-rounded, and he wants to serve,” Kimbrue said. “When you look at someone like him who has the wide-ranging background, who has great relationships in the industry, who has the versatility — all of that gumbo makes him valuable to clients.”

Inspired By The Bushido

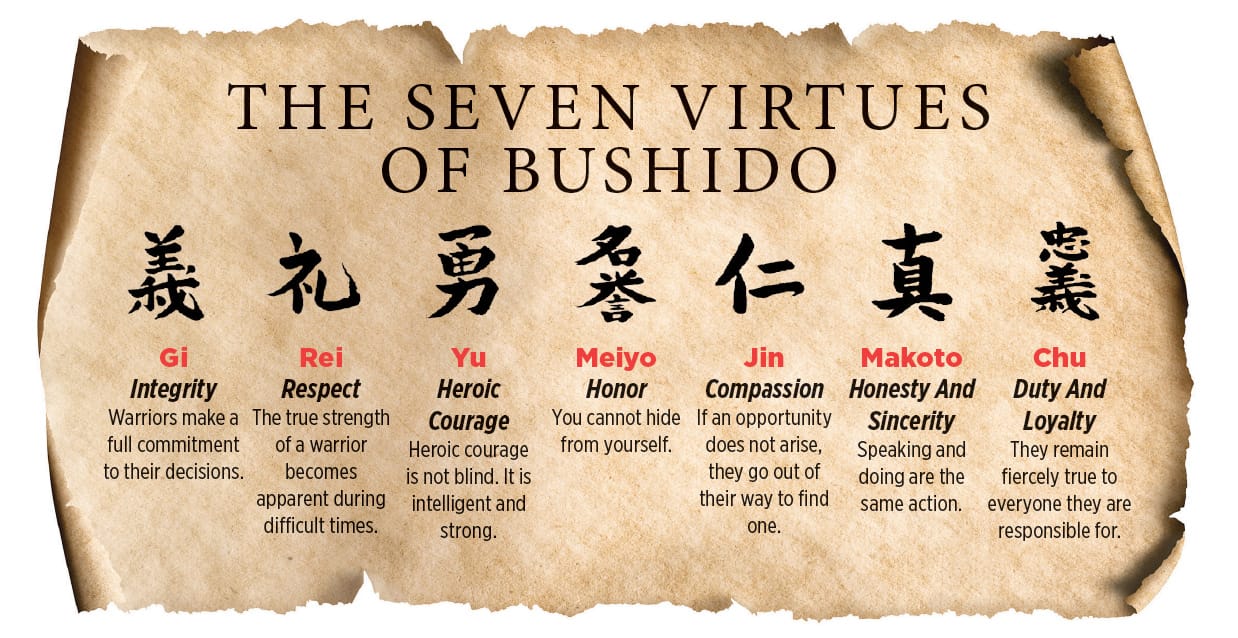

Ali loves to read about history, and that love led him to study the Bushido, the code of honor of the samurai of feudal Japan. The Bushido emphasizes courage and loyalty.

He said he was inspired by reading a book, , which tells the story of a man who was taken from Africa as a child and eventually ended up in Japan with some Jesuit priests who were setting up churches there. The African man later lived with one of the Japanese shoguns and became a samurai in his household.

“I finished the book, and I said to myself, ‘Perfect. Someone is trying to tell me something here.’ I was thinking about how to brand myself, and I thought, ‘What does an insurance professional do?’ And the word that came to me is ‘serve.’ That’s the meaning of the word ‘samurai’ — someone who serves.

“So I married those two philosophies. What I do every day is serve my clients, serve my family, serve my community. I defend my clients by making sure they have the proper protection in place to defend themselves and to protect themselves, their loved ones, their assets, their businesses. And then I serve them as necessary.”

Ali said his favorite clients are small-business owners, particularly new entrepreneurs. He also does some government contracting work and works with a number of nonprofits. He said he has a multicultural client base of Blacks, whites, Hispanics and Asians.

Denise Lloyd-Withrow is president and CEO of D.H. Lloyd and Associates and has worked with Ali in the past. “Amir is fearless,” she said. “There is never an account too challenging for him. He is excited about the industry, and he always looks for opportunities to solve client issues. He’s like the Energizer bunny, and he never stops learning.”

Reaching Out To The Next Generation

The mentorship Ali received in his early years has inspired him to expose college students to the insurance and financial services profession. He has spoken to students at Howard, and he has plans to reach out to several historically Black colleges and universities in the Baltimore-Washington area whenever the COVID-19 restrictions ease up.

“I don’t hear much about where the next generation in this industry will come from,” he said. “I think it’s kind of frightening, and we need more people to reach out to college and university students.”

Ali said he believes the insurance business “gets a bad rap for being boring.”

“But think about it, insurance touches every aspect of our lives. When you think about the way insurance has a place in everything from the life insurance policy that helped fund someone’s education to the roller coaster you ride in the amusement park to the Uber that drives you across town, you’ll quickly understand that insurance is not boring.

“I try to get students to understand that insurance can be as exciting as you want to make it. It touches every aspect of your life. And if you stick with it, you can make a lot of money.”

Ali said his 6-month-old son Langston Xavier is his inspiration for continuing to find ways to serve his clients and to improve himself.

“The way to be successful in anything is to stay with it and become better every day,” he said. “There’s something in the Bushido that says, ‘Your life is something you build every day. You must convince yourself that you surpassed yesterday. And tomorrow, you must feel that you have surpassed today. In this way, there is no end to your mastery.’”

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Advisors Talk About Fraud In 401(k) Plans

‘A Busy Advisor Is A Happy Advisor’

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News