How COVID-19 Is Rewriting How Life Insurance Is Done

How COVID-19 Is Rapidly Rewriting How Life Insurance Is Done

For all the difficulties that 2020 has dealt the life insurance industry, one positive is that this year has packed the industry into a catapult and flung it into the future.

This Life Insurance Awareness Month finds carriers, distributors and producers using the technology that everybody had been slow to adopt, and building teams that a notoriously solitary field force had been reluctant to form.

Travis Frier said those two elements have been key to success from his vantage point as the Dallas/Fort Worth managing director for AmeriLife, a growing insurance marketer that is widening its presence in new markets such as the investment advising space.

But Frier would throw in another important factor that he sees for a producer’s success.

“It always goes back to the mindset,” Frier said. “There are individuals in life insurance and in any industry who will just make something happen. Regardless of what’s going on around them, they’ll find a way to make it, do it. And there are other people who will find excuses not to do it.

For those who have chosen to find a reason to do it, Zoom and virtual meetings have become the new way of life and, quite honestly, have been very effective. So, I don’t know that they will completely go away once COVID-19 has gone away.”

The “it” Frier is talking about is the advancement that the pandemic accelerated within the industry. But it may take until the next Life Insurance Awareness Month to get to a point where COVID-19 has gone away, at least as a disease. But just as with the positive effects, the negative effects will radiate long after the disease subsides.

These are among those negative effects.

LOW INTEREST RATES: The industry has been struggling with low interest rates since the last recession. It is difficult not only for carriers to make safe money but also to price products attractively. That pressure already had carriers trying innovative product enhancements such as synthetic indexes, which have drawn regulator scrutiny. Now interest rates are closer to zero than ever, forcing carriers back to the charts and tables for more creative products.

MORTALITY DISRUPTION: Soon after the industry brought new mortality tables online in January, along came a pandemic that may be resetting those projections. Because COVID-19 seems to be showing a surprising variety of long-term effects, no one can confidently say how the disease will affect Americans’ health over the next few decades. It is that sort of long-term modeling on which carriers build the financial structure that supports Americans’ life insurance coverage.

FINANCIAL STABILITY: The rising tide of the COVID-19 recession is lifting the richest boats but submerging the poorest. The middle class is treading water, but how will they hold on as job losses pile on and less money flows around the economy? Even the top side of the middle class might be reducing expenses to the essentials. And “essentials” might not include life insurance, no matter how essential insurance is to a family’s economic future.

Those are some of the key challenges. But Frier described some of the reasons to be optimistic about the industry’s future. Many of those trends that rose to meet the challenges of 2020 started long ago. They are:

ACCELERATED UNDERWRITING: Although carriers and the rest of the industry have been working for decades on speeding up and simplifying underwriting, it still seemed to take the process about 45 days for most permanent life policies, especially those above $500,000. Now carriers are rushing to raise the face amount limits on simplified underwriting.

TEAMS: Carriers, distributors and associations have long been advocating a team approach in field sales, even among independent agents. That is not only to help diversify individual practices but also to help fill in the talent and capabilities that individuals might lack.

A LIMRA study showed that more than half of producers know that being part of a team is a route to success, but only 6% were in a formal team environment. However, prospecting and selling in the midst of a pandemic are showing the power and resiliency of teamwork.

TECHNOLOGY: Even producers who started 30 years ago can probably recall hearing some discussion about the promises of technology around the time when they first started.

Even though Frier is 32 years old and comfortable with tech, he had been doubtful that the life insurance industry would have been ramping up any time soon. He was even less hopeful about the typical client and prospect.

“If you asked me a year ago if retirees would be willing to transact business over the internet using Zoom or GoToMeeting, I would’ve told you, ‘No way.’ And I would have been completely wrong. They are doing it by the truckloads.”

His three offices of 37 staffers are writing more business than last year. Mastering the tools of remote selling had everything to do with it.

“It’s a testament to the resolve of the agent in saying, ‘I’ve been provided this resource to utilize and I’m going to use it to the best of my ability,’” Frier said. “And if they’ve got a positive outlook on it, then so will my client. There’s a lot of puppetry and mirroring going on in that.”

Coaching Is Key

Frier did not think tech adoption would come quickly, even though he was part of an AmeriLife program to build a process in which the advisor meetings and client transactions all would be virtual.

Although some, usually younger, independents had been doing their whole process online or over the phone, it was a small group, often dealing in smaller-face term sales. That process wouldn’t come easily to older producers dealing with bigger cases involving permanent products.

In fact, Frier said a purely remote process was rare in that group. “That’s never happened before,” he said.

Frier is the youngest of his 37 people. They were accustomed to the traditional way of doing business. But Frier found that if he could just help producers pivot their mindset and approach from the first phone contact with a client, they would be able to help clients — even older clients — down the tech track.

“You might get a phone call that says, ‘Hey, somebody told me to call you. Can we sit down and talk?’” Frier said, turning to the producer’s response. “Yes. I would love to sit down and talk to you. However, due to social distancing guidelines, we are using Zoom. Have you used Zoom before?”

At the beginning of the pandemic, few older prospects were familiar with video platforms, so producers had to adopt the zen of a patient IT helper.

After clients said they were not familiar with Zoom, the producer could respond, “I’m going to send you an install link. I want you to put it on your phone or on your computer, whichever one you prefer. When you get the link, I want you to call me so that I can step you through making sure you can activate it. And then when it’s time for the meeting, I’ll call you again to make sure you can activate it and make sure your audio is connected.”

Once the prospect or client had been walked through the process, they were as comfortable meeting virtually as they were face to face, if not more so, Frier said.

“It’s definitely a coaching process. And the more you do it, the better you get at it,” Frier said, adding that patience and planning are required because clients will struggle with the technology.

“So, you’ve had to block out some more time for meetings. Maybe not an hour this time. Maybe you need an hour and 30 minutes because you might need 20 minutes just to get somebody connected.”

Tough Country For Old Guys

Getting on board and comfortable with tech is one reason why some older independent agents ran into trouble when the pandemic closedown started clanging shut across the nation.

Another factor is the difficulty in getting large cases sold and underwritten. More complex cases require more meetings, often involving other players such as lawyers and accountants. Not to mention that the higher-end clients are used to a certain level of handling that might not translate well over Zoom.

Then underwriting is difficult or impossible because of the medical exam that carriers require of high-face-value policies.

It has been so difficult to get prospects and clients to undergo medical exams that a large paramedical firm, EMSI, closed so suddenly in July that carriers asked agents to resubmit requests for medical exams that EMSI was fulfilling to other agencies.

“EMSI has become a casualty of these unprecedented times, as the pandemic has severely depressed service volumes,” the company announced on its website.

Fully underwritten, large cases tend to be written by more advanced, older agents.

AmeriLife focuses on the near-retirement market, but the marketer relies more on simplified-issue whole life and term — so business has been good. Sales have not been as free-flowing for larger and more complex cases, said AmeriLife CEO Scott Perry.

“Fully underwritten life business has definitely been hit the hardest,” Perry said, estimating that only 20% of the company’s life business is fully underwritten.

Insurance companies were not prepared to change their underwriting processes so suddenly on larger cases any more than older agents were.

On top of that, large, complex cases tended to come from the Northeast, which was harder hit earlier in the pandemic. But AmeriLife tends to sell more simplified issue through the 150,000 agents and advisors who write business through the organization.

Business is up for the simpler products because the processes lend themselves to a remote sale. And it is making even more financial sense for life carriers to make the jump in the bigger cases — and quickly, Perry said.

Insurers are losing revenue in covering fewer large cases and also because of bringing in less return on long-term investments. Carriers need to find ways to cut expenses.

“Because if you have to make up for margin that you’re losing in your investment return, you’re going to look for other places to find margin,” Perry said, adding that cutting underwriting and processing costs can provide big returns.

“If you could go from 100% of your $500,000 to $1 million face amounts being fully underwritten the old-fashioned way to 100% of that business or even 50% of that business not being touched by an underwriter and being turned around in seven to 10 days versus 30 to 45, it’s a huge difference, big savings,” Perry said. “It’s a win for the client. It’s a win for the agent.”

Another area that is a boon for younger agents but not as much for older independent agents is the trend toward a more holistic, team approach to selling.

AmeriLife has received a bit of attention for the number and the wide array of acquisitions, seven this year, as of press time. One of those this year was adding FormulaFolios to AmeriLife’s Brookstone, creating a $6.5 billion registered investment advisory.

It is one of many businesses AmeriLife added to offer full service to clients. That multidisciplinary model has been promoted by regulators and associations to serve clients better.

But adopting that model also helps distributors, because they don’t have to hand off clients who have needs that the company cannot fulfill.

“The long-term goal is to assemble a platform that allows us to address the holistic financial planning needs of those people near and in retirement,” Perry said. “So, think about protection needs, income needs and legacy needs.”

The platform is growing while the company develops its ecosystem of partnerships and collaboration.

“So, we can really provide the omnichannel customer experience, where the customer may come in via the call center because they have a protection need,” Perry said. “But they may also have an income need and a legacy need.”

Perry said he had a few ideas why that system might not be so appealing to older agents.

HABIT: Agents who have been successful for decades selling life insurance a certain way just may not see the need to add other products such as health or property and casualty.

“They think, ‘It hasn’t hurt me so far, so I can’t really think about retooling my business, even if you make it easy for me,’” Perry said.

OWNERSHIP: They’re protective of their clients. The agents know they serve their clients well, but can they trust another agent or advisor to do the same?

RISK AVERSION: If agents dramatically change the business and it is not successful, or not quickly successful, older agents don’t have decades left to rebuild their business, Perry said. “As opposed to a younger agent, who’s earlier in their career and building their business, who sees the way collaboration is working in other industries and other markets outside of ours and says, ‘This is obviously the future.’”

Old-School Lessons

Although AmeriLife is building tech platforms and ecosystems, one of its most successful offices still relies on fundamentals to pull in business even in difficult times.

Joe Young, general manager of AmeriLife’s offices in central Florida’s Polk County, said his operations went mostly virtual early in the pandemic but now they are more of a mix, with some agents coming into the office and others remaining remote. Some are even going to in-person meetings again, while wearing a mask and observing safety protocols.

Success was a matter of drive.

“Our top producers have figured out a way like they always do,” Young said. “There are several in my office who have not missed a beat. There are some who have had their challenges, but I think with technology today, you can pretty well figure it out.”

In many cases, figuring it out meant pushing harder with more outreach.

“Really it’s just more activity to get more people to want to talk to you,” Young said. “Maybe you’ve got to make more phone calls than you did previously, going back and following up with existing clients where you have that relationship.”

They also did campaigns in which they did such things as explain how the CARES Act works and how it will affect consumers and their health plans.

In those cases, it wasn’t email or direct mail but getting on the phone that was the most successful.

The COVID-19 closedown was tough on Young’s own production because he had relied on seminars for about half of his prospects. When COVID-19 closed that door, he turned to his book of business to do the reconnecting that he did not have the time for in the past.

“It forced me to get back to things I’ve been wanting and needing to get back to, instead of chasing the next seminar,” Young said. “I was able to close several deals over the phone and several over Zoom.”

That last part was a big change for an old-school guy who likes to hit the phone and stand up in front of a roomful of people. The room he stands up in now is a studio in the office.

“A lot of these people, quite honestly, who are willing to do the Zooms, especially the ones that have truly quarantined themselves, are ecstatic to talk to somebody via Zoom,” Young said.

He also found something else has changed — the retirees. Earlier in his career, retirees tended to be from the silent generation and had no use for technology. Now retirees are aging baby boomers. True, there is the “OK, Boomer” stereotype, but boomers are more willing to give tech a chance.

“It’s no big deal for them to click on a link and join a Zoom,” he said.

While agents and office staff are trying out new things, they are grabbing the tech that works, whatever that tech is, and building a new way to sell, even when they do an old-fashioned in-person meeting.

“We’ve worked on some best practices where new agents — or any agent, for that matter — go out, and if they get stuck or they need the help of a specialist in the office, they can quickly throw out on our WhatsApp, ‘Hey, can somebody pop in and help me?’ and then pull that life insurance specialist or financial specialist into a Zoom meeting on the agent’s iPad and bring them into the meeting like they just walked in the front door,” Young said.

“We’re trying to set up days where the specialists have multiple appointments booked and they’re sitting in their office where they’re just getting brought on via Zoom from an agent who has a company-issued iPad,” Young said, adding that the pandemic has forced him and his agents to take a leap that they might not have made for years.

Electronic applications and platforms, along with communication technology, all came together at the right moment. Not only are they helping make sales in a tough environment but they also have agents and managers such as Young rethinking how they sell.

“Usually in a situation where I’ve got somebody who wants to talk to me and they’re eight hours away, in the past, I would have probably just referred them to an office up in that area,” Young said. “Now, I can have that meeting. So, it’s really helped us. We’ve grown tremendously as an agency and as an office, and I am thinking about things a little bit differently.”

Out With The Old

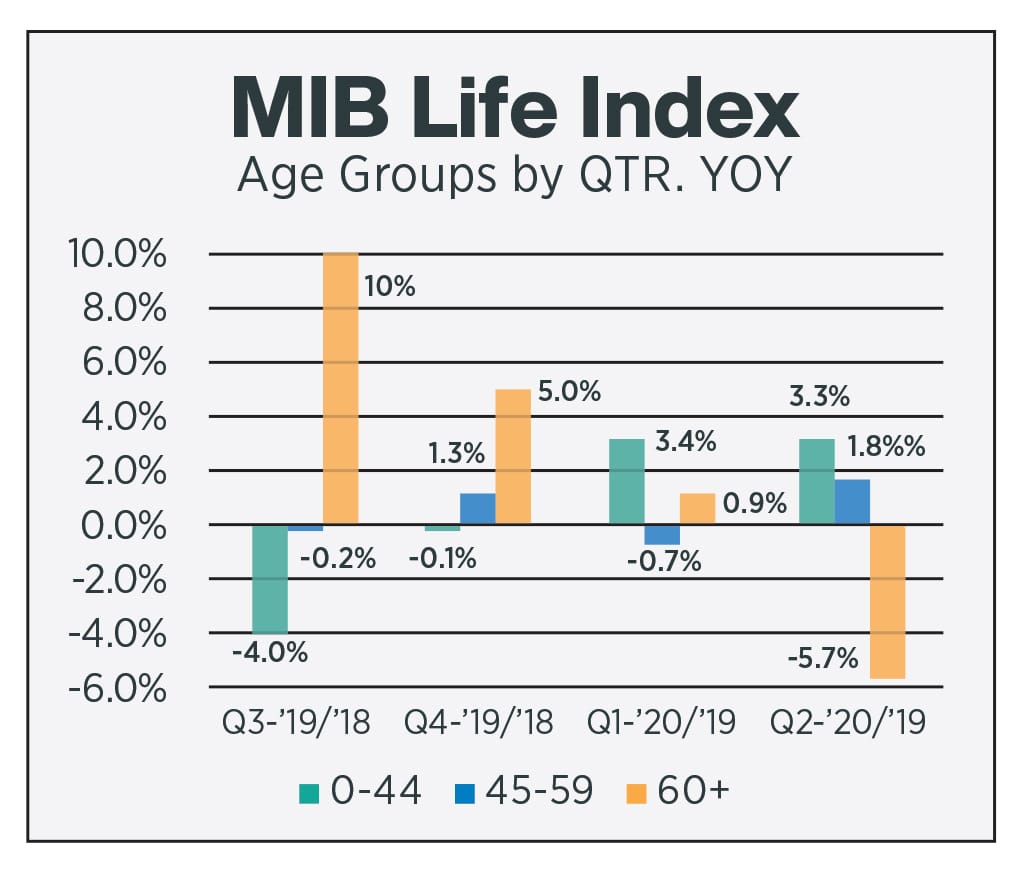

Life insurance applications were up slightly despite a plummet in the number of over-60 applicants, which is usually the strongest age group in sales.

The application decrease in the oldest age band is not surprising, because most carriers limited or banned sales to that group starting in March. Companies just started reopening to older applicants in July.

Second-quarter earnings were just being revealed at press time, with early indications showing that companies had performed better than expected but were still down significantly year over year.

AIG and Prudential, for example, reported that they were suffering more from the historically low interest rates than from the direct effects of the COVID-19 pandemic.

Life applications reversed the usual trend, with the youngest age group being the strongest, increasing 3.7% in June, year over year, according to the MIB Life Index. Applications were down 5.8% for the over-60 group. Overall, applications were up 1.2%.

Agents and marketing organizations that specialize in simple-issue, smaller-face products have been reporting more sales, whereas those who sell fully underwritten, complex cases have been hardest hit. Those larger cases tend to involve older people whose coverage options have been limited, and pandemic restrictions have made medical exams difficult or impossible.

Why Don’t Independents Want To Team Up?

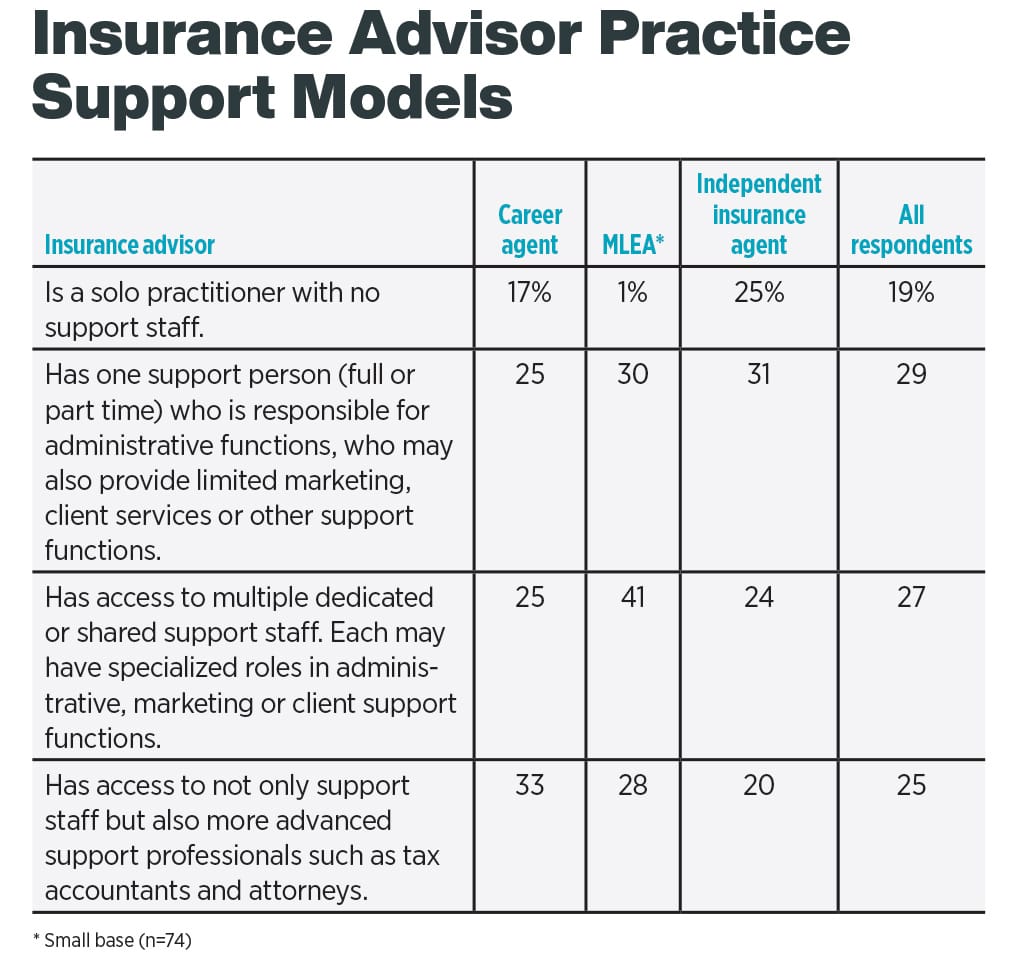

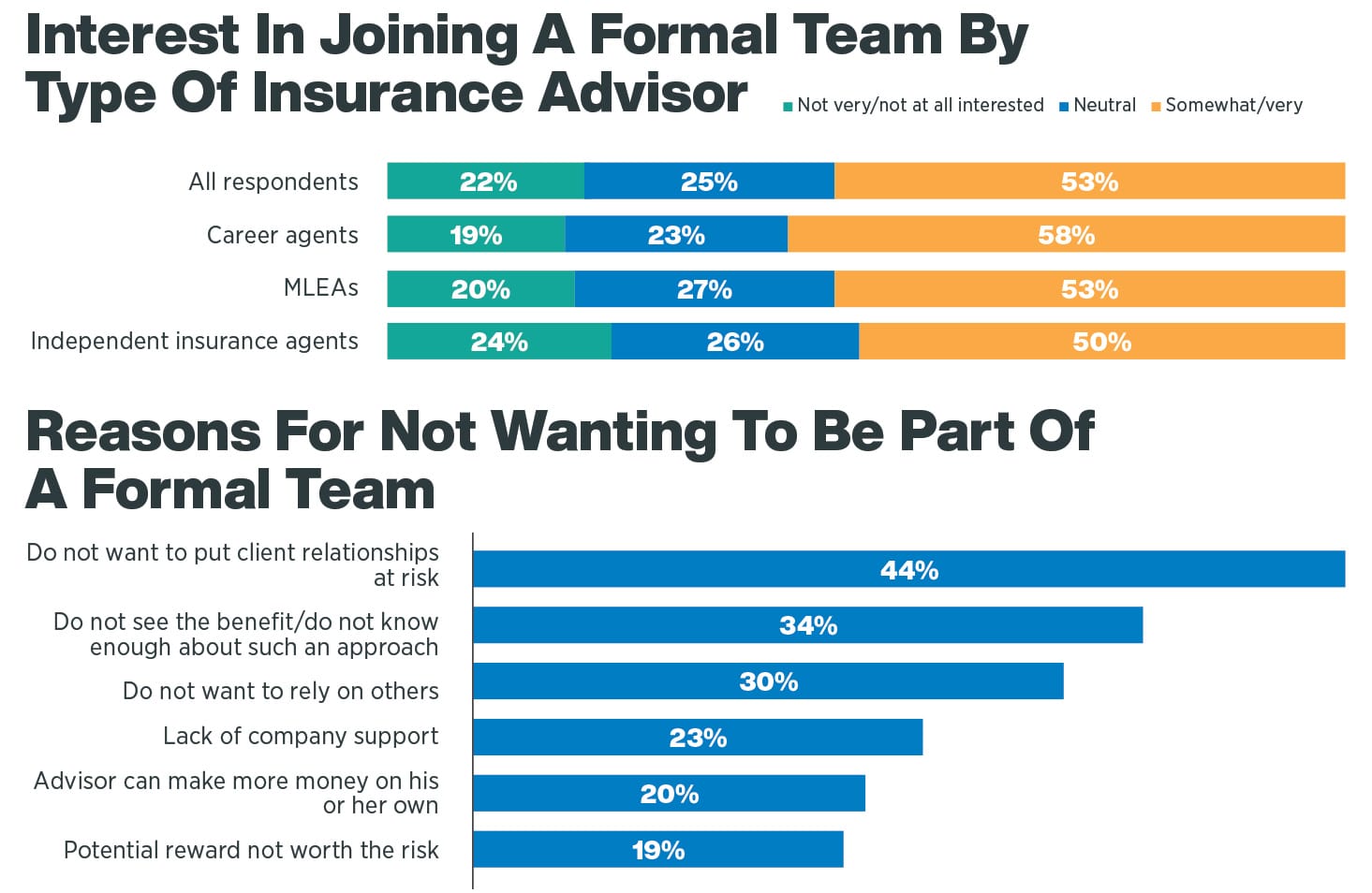

Independent producers know that building a team environment is the way to succeed in today’s life insurance sales world, but trust issues might be holding them back, according to a LIMRA researcher.

“We thought that we would see more advisors in the formal team models because there’s a lot of interest in the industry around that,” said Patrick Leary, vice president, distribution research, referring to a survey report, “Leverage and Collaboration: How New Practice Models Are Changing the Game.”

The survey found interest in teams among agents themselves. Half of the independent agents among the respondents said they were interested in being part of a team. But only 20% of independents had access to support staff and expert help from professionals such as tax attorneys.

Most independent producers came from career shops and pushed off on their own to have control of their own operations and results, Leary said. It is difficult to turn around decades of independence and become part of a team — even if they do see the benefit.

“It’s the kind of thought, ‘I can do it better myself. Why should I give up advantage for a cut of half?’” Leary said. “We found in this report that when you’re part of the team, one of the big concerns is surrendering that control of client, best practices, et cetera.”

Even agents who might want to take the leap would have to figure out how to find the right people and build the practice model to include them. Quite the task when they are also trying to prospect and sell.

They need help to do it, and their favorite marketing organization just might be the one that can do it, Leary said.

“That’s where the intermediaries come in for those guys,” Leary said. “Leaning on the BGAs and IMOs to provide that support.”

But even with that support, there are the control issues. And that is not necessarily a bad thing. Independent agents built their business and reputations serving one client at a time and don’t want to hand over what it took them decades to construct.

“’What if my clients that I’ve had for 10 years — and we have this great relationship — clashes with whoever I’m bringing in?’” Leary said. “’Uh oh, that could create an issue, and I may lose that client.’”

Why Team Up?

More Business: A big plus to going with a team model is the leveraging opportunity, which means producers would be able to expand their own personal capacity.

“So, if I’m an advisor, I’m doing my own thing, I have a limited amount of hours in the day and my personal capacity is limited,” Leary said. “I start leveraging other professionals, specialists, and I partner; I can bring things to the marketplace, both with my own clients as well as bringing on new clients.”

More Happiness: New advisors especially thrive in a team environment. That is a crucial issue when turnover is a problem throughout the industry.

More Complexity: As advisors work their way up the income ladder, they find more complex cases that require more expertise. “The established advisors are saying, ‘OK, how do I meet those needs? I’m not an expert in some of these.’ So, it’s estate planning, high-level corporate upside investment strategies, tax planning and all sorts of advanced skills.

— Steven A. Morelli

‘A Busy Advisor Is A Happy Advisor’

COVID-19 Turned More Americans Into Savers

Advisor News

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

- Making the most of Financial Literacy Month

- Tariffs alter Q2 economic outlook downward, Morningstar says

- Women need an advisor who’s also a coach

More Advisor NewsAnnuity News

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

More Annuity NewsHealth/Employee Benefits News

- Friday roundtable in Rochester to focus on possible Medicaid cuts

- Studies from University of Southern California (USC) Yield New Information about Military Medicine (Health Insurance Coverage and Hearing Aid Utilization In Us Older Adults: National Health Interview Survey): Military Medicine

- Pritzker's Proposed Budget Will Take Away Health Coverage From Immigrants Without Legal Status

- A fifth of Americans are on Medicaid. Some of them have no idea.

- Proposed ban on drug middlemen owning retail pharmacies passes

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Symetra Partners with Nayya to Introduce Digital Leaving Planning Solution

- Krispy Kreme's owner is seeking approval to buy Shenandoah Life

- Krispy Kreme owner to acquire Roanoke-based Shenandoah Life

- Directors' Report and Financial Statements 31 December 2024

More Life Insurance News