What ‘COVID Clarity’ Has To Do With The Great Resignation

Why are people joining the great resignation? It has a lot to do with practical issues such as getting dependable childcare, but there is also a bit of “COVID Clarity.”

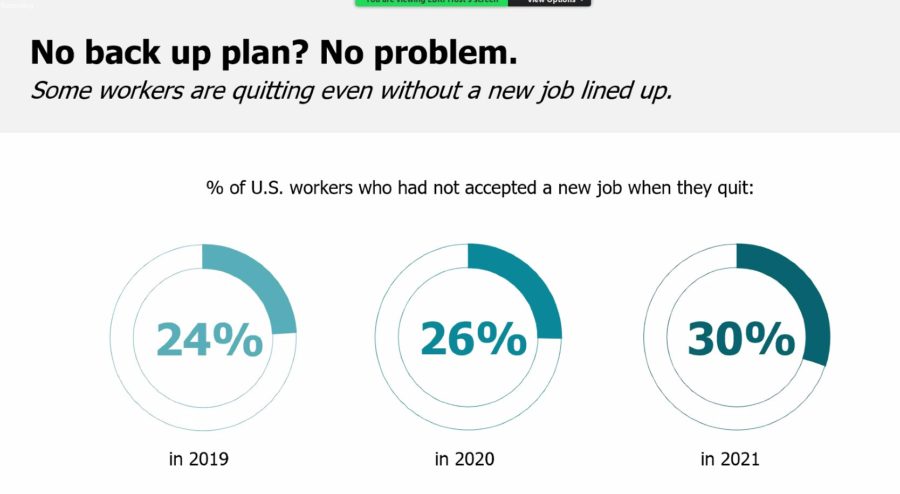

That’s what Ragan Decker, a senior researcher at Society for Human Resource Management, said during an Employee Benefit Research Institute’s Spring 2022 Policy Forum panel discussion. Before COVID, people were a little more likely to leave their job over compensation. Although that is still the top reason for people to leave, other factors indicate that it’s not all about money – in fact, 30% left their job without having the next one.

“We're suggesting that this might be due to COVID clarity,” Decker said. “The pandemic has led people to reevaluate their life and really reflect on what is most important to them. And for some, this means reevaluating the meaning of work, which I do think might be contributing to some of what we're seeing right now.”

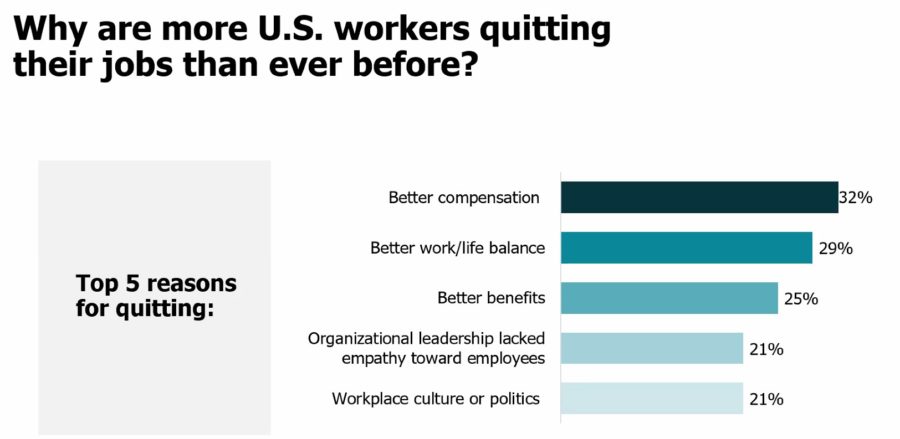

The top five reasons people left their job are compensation, work/life balance, benefits, leaders lacked empathy and workplace culture or politics were disagreeable.

The top three aren’t surprising, Decker said, but the last two are.

“Empathy is one of the most important aspects of leadership,” Decker said. “It's about being able to put yourself in the shoes of the people you lead and making a real effort to understand how people are feeling at the core. This is just about treating employees like people. And then the fifth reason is due to workplace culture, which just I think highlights the importance of focusing on building a strong culture.”

What To Do About It?

Even as hiring picked up, 98% of employers still have open positions. Employers have to expand their toolbox of incentives to compete in that market.

Obviously, compensation is top on the list, and wage inflation is definitely happening. SHRM found in September 2021 that 58% of companies were increasing compensation to recruit workers. By December, that percentage grew to 68% of employers, and that percentage is probably even higher now with inflation, Decker said.

A higher starting salary is only one aspect of attracting and retaining talent in this market, especially for knowledge workers. Here are some of the incentives that employers are using to prevent turnover.

Remote work: For people who don’t have to be physically present to do their jobs, remote work was key. SHRM found that 45% of organizations offered remote work or flexibility.

Bonuses: SHRM found that 35% are giving merit-based salary increases, 31% are giving current employees referral bonuses, 25% are giving spot bonuses (bonuses that are not holiday or annual bonuses).

Training: 25% are providing training and career development opportunities.

Team-building: 22% are investing in team-building activities.

Those options assume that employers know what retains their workers. But many companies are going the next step and finding out directly by conducting “stay interviews,” Decker said.

“This is just a way for organizations to try to be more proactive rather than reactive and try to make some changes before an employee leaves,” Decker said.

Two-thirds of organizations are conducting stay interviews for retention, with a third of them having just started the practice within the past six months, probably driven by the great resignation, Decker said.

Additional Strategies

SHRM also had other strategies for companies to try.

Boomerang employees: As companies continue to struggle to fill their open roles, former employees represent a potentially untapped pool of talent. The institutional knowledge helps reduce onboarding and training costs. SHRM found that 86% of organizations are willing to rehire employees who previously quit – and workers are also open to going back.

“I do think it's important though to point out that workers who quit their last job due to workplace culture are actually much less likely to say that they've considered going back to their last job,” Decker said. “So, why and and how an employee quits is definitely important to consider for both organizations and the worker.”

Organizations are also recruiting more from traditionally untapped or underutilized talent pools than they have before. The top two untapped talent pools besides former employees are newly graduated college students and veterans, but some are also looking at people with criminal records.

A sense of belonging: To retain current employees, organizations may want to consider fostering a sense of belonging, Decker said.

SHRM’s research found that 86% of workers who are not actively searching for a job and are not planning to search for a new job anytime soon, feel a strong sense of belonging to their organization, as compared to 47% of workers who are actively searching are planning to search for a new job.

“Less than half of those who are searching for a job say that they feel a strong sense of belonging to their organization,” Decker said.

Management training: Workers are often promoted to management roles because they excelled in a technical role, but that does not automatically make them good managers.

“This is why it's important to really invest in the development of your people managers,” Decker said. “The SHRM Research Institute found that over two in five U.S. workers who quit their previous job said it was their supervisor micromanaging them that influenced their decision to quit.”

That problem grew in the past two years, jumping from 31% pre-pandemic citing micromanaging to 51% in 2020.

“I think this makes sense as many employees began working remotely,” Decker said. “Many managers didn't know how to manage in such an environment, and unfortunately micromanagement signals to employees that their supervisor does not trust them.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

COVID-19 Made A Mental Health Crisis Even Worse, EBRI Speakers Say

The 5 Secrets To Retaining Financial Sales Professionals

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- HEALTH INSURER FINANCIAL PERFORMANCE IN 2024

- THREE CONGRESSIONAL MISSTEPS ON HEALTHCARE

- PORTER: 'WE CAN FIGHT FRAUD WITHOUT IMPACTING HOOSIERS' COVERAGE'

- REP. AGUILAR ANNOUNCES DR. CAMEO CARTER, M.D. AS 2026 STATE OF THE UNION GUEST

- WELCH TO BRING VERMONTER HIT BY SKYROCKETING HEALTH INSURANCE COSTS TO STATE OF THE UNION

More Health/Employee Benefits NewsLife Insurance News