The 5 Secrets To Retaining Financial Sales Professionals

WINDSOR, Conn. and Washington, D.C., May 11, 2022 — New research from LIMRA and the Finseca Foundation reveals five secrets to retaining financial sales professionals.

High turnover rates among those new to sales positions in the financial services industry are an ongoing challenge. Separate LIMRA research shows that, in 2020, only 15% of financial professionals in agency systems that recruit mainly inexperienced individuals remained with their hiring companies after four years, and the majority of those left within their first two years.

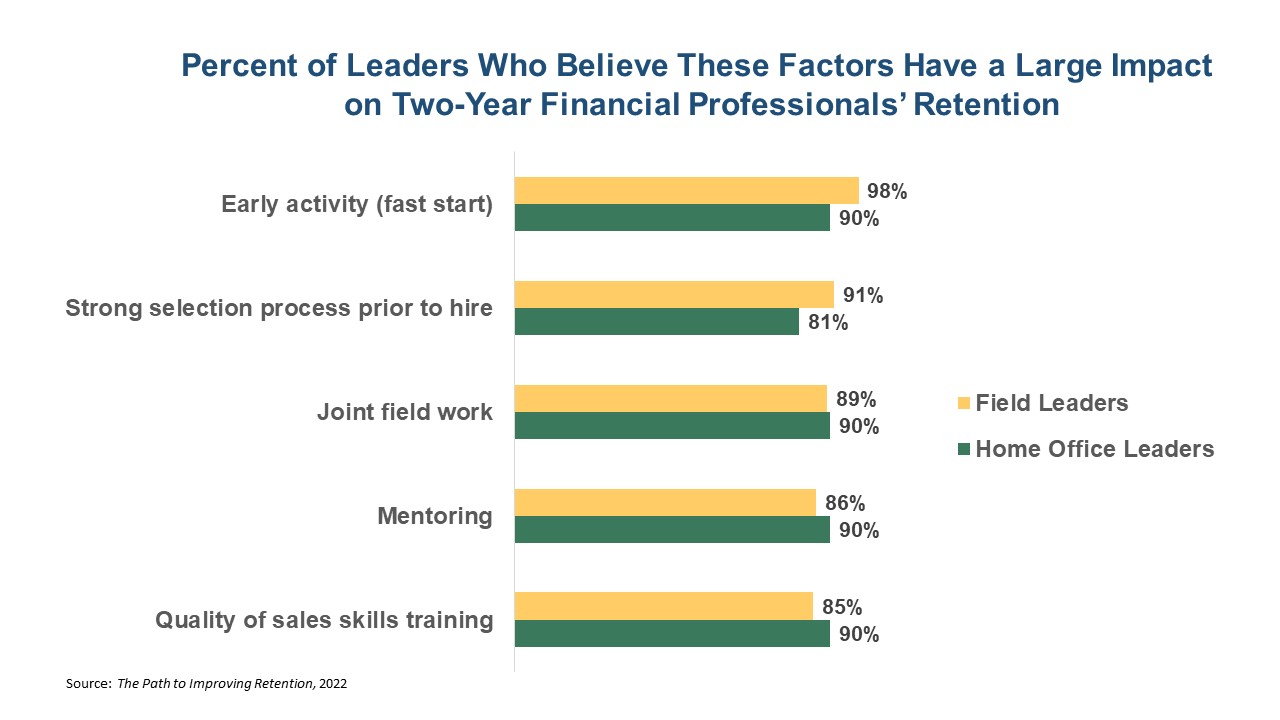

When asked how to combat this issue, field and home office leaders identified five factors that have the greatest influence ― early sales activity (a fast start); a strong selection process prior to hiring; joint fieldwork; the quality of sales training; and mentoring.

“Finding ways to make financial professionals successful in their careers will help companies keep new recruits and ensure the industry has experienced professionals who can help Americans get the products they need to protect themselves and the ones they love,” says Bryan Hodgens, head of LIMRA Distribution and Retirement Income Research.

The top two factors — early sales activity and a strong selection process prior to hire — are closely related. A good selection process not only communicates the performance expectations of the job, but also provides the hiring manager with evidence that the candidate will be able to perform effectively. If the selection process does neither, financial professionals are much less likely to succeed.

New financial professionals need a multifaceted plan on how to build their books of business. Mentoring and joint work are time-tested ways of helping them get started quickly. The COVID-19 environment, however, made it difficult for joint fieldwork and mentoring. This worries some field leaders, especially as it pertains to new recruits entering the business. Some companies have provided incentives for top financial professionals who take on and mentor a junior sales representative. Others rely on formal teams to provide the structure and support new agents need.

Improving the quality of skills-based training can make up for some of the lack of mentoring and joint work. To be successful, however, sales skills training needs to be practical, situational and real-world based.

Most financial professionals want to apply what they have learned, but if what they learn doesn’t seem immediately applicable, they may disengage. Training is not just about transferring knowledge; it is about helping agents understand what companies are asking them to do and, just as importantly, why and how everyone (they, the company, and the customer) will benefit.

What ‘COVID Clarity’ Has To Do With The Great Resignation

Attracting, Retaining Workers Among Top Worries for Small Businesses

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Property and Casualty News

- Too little, too late, too weak: Critics react to proposed insurance legislation

- Q&A on revised FEMA flood insurance maps

- Commercial auto insurance eligibility for nonbusiness owners: A 50-state overview

- How Selma Residents Are Safeguarding Wealth with Precious Metals Amid Economic Recovery

- W. R. Berkley Corporation Names Erin Rotz President of Berkley Fire & Marine

More Property and Casualty News