2020 Vision — Or Revision?

Will it be another THWACK! of the tennis ball back to the fiduciary side of the court after the election?

That is one of the critical questions to be answered in November in one of the most consequential elections of our time.

Agents and advisors can expect that the fiduciary standard is likely to loom larger if Joe Biden wins, especially if he is accompanied by a Democratic majority in the Senate and House.

President Donald Trump’s push to remove or simplify regulation led to a harmonization of standards across the product-selling spectrum, much to the dismay of many fee-only fiduciary advisors.

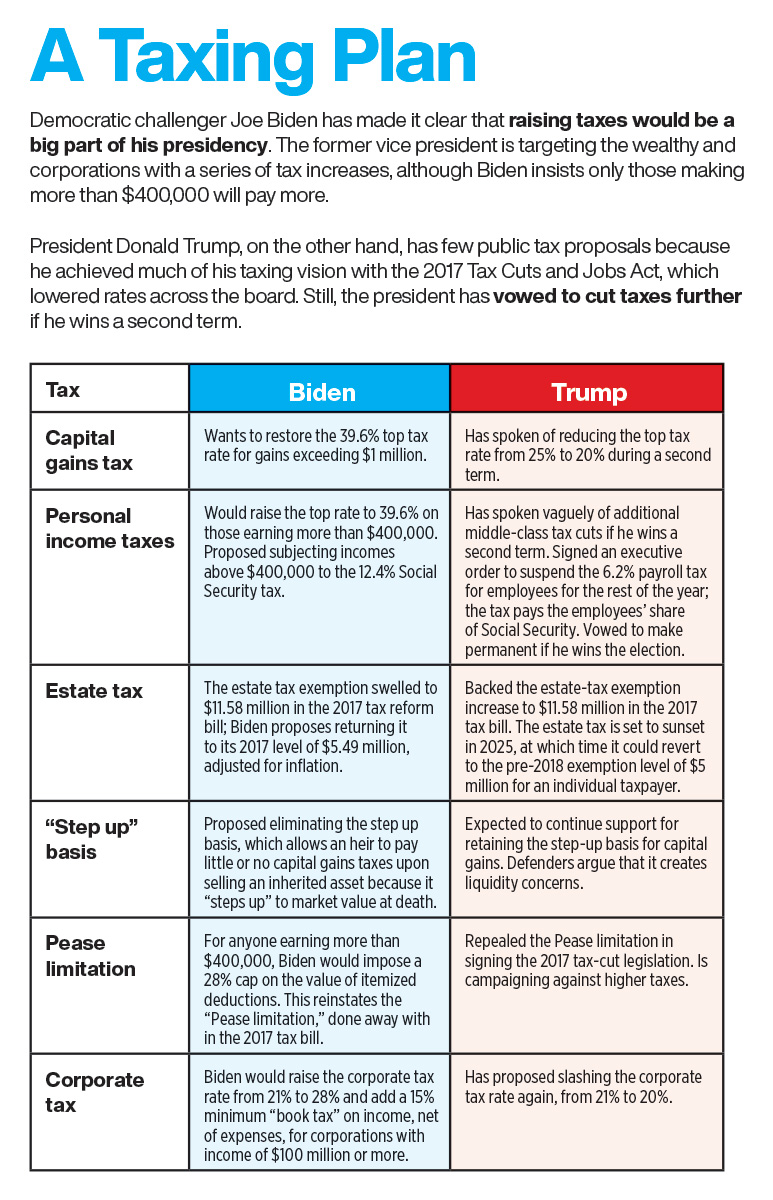

Another key change advisors can expect is some serious restructuring of taxes. If Democrats regain control of the presidency and both houses of Congress, they are likely to go after Trump’s 2018 tax changes, along with other moves that might be necessitated by the national debt and policy preferences.

The economy is concern No. 1 for 79% of people polled in an August Pew Research Center survey. Health care, which was No. 2 at 68%, is likely to be another top target for Democrats if they capture the presidency and Congress.

Regulation. A Biden administration approach to regulation would likely cause a sea change that would take time to have real-world impact. A Biden Department of Labor is expected to pursue a true fiduciary standard for retirement account advice.

In the interim, the Trump DOL is racing the clock to pass rules reinforcing the right to sell products into retirement accounts on a commission basis. If that rule is finalized and Trump loses the election, the Biden DOL would have to undergo a lengthy rulemaking process to repeal it and issue new rules. But the Democratic Party platform insists the Biden-Harris team is committed to doing just that.

“If I were a betting man, I would say that we do have a fiduciary standard for taxable accounts within five years,” said Chip Roame, managing partner of Tiburon Strategic Advisors. “That would mean either in the next administration or in the first year of the one after that.”

Taxes. Biden will most certainly raise a variety of taxes as soon as possible. The former vice president has pledged to limit tax hikes to those Americans earning more than $400,000, a vital constituency for financial services. This issue alone will keep advisors very busy.

A Biden administration will “use taxes as a tool to address extreme concentrations of income and wealth inequality,” wrote a campaign task force. “A guiding principle across our tax agenda is that the wealthiest Americans can shoulder more of the tax burden.”

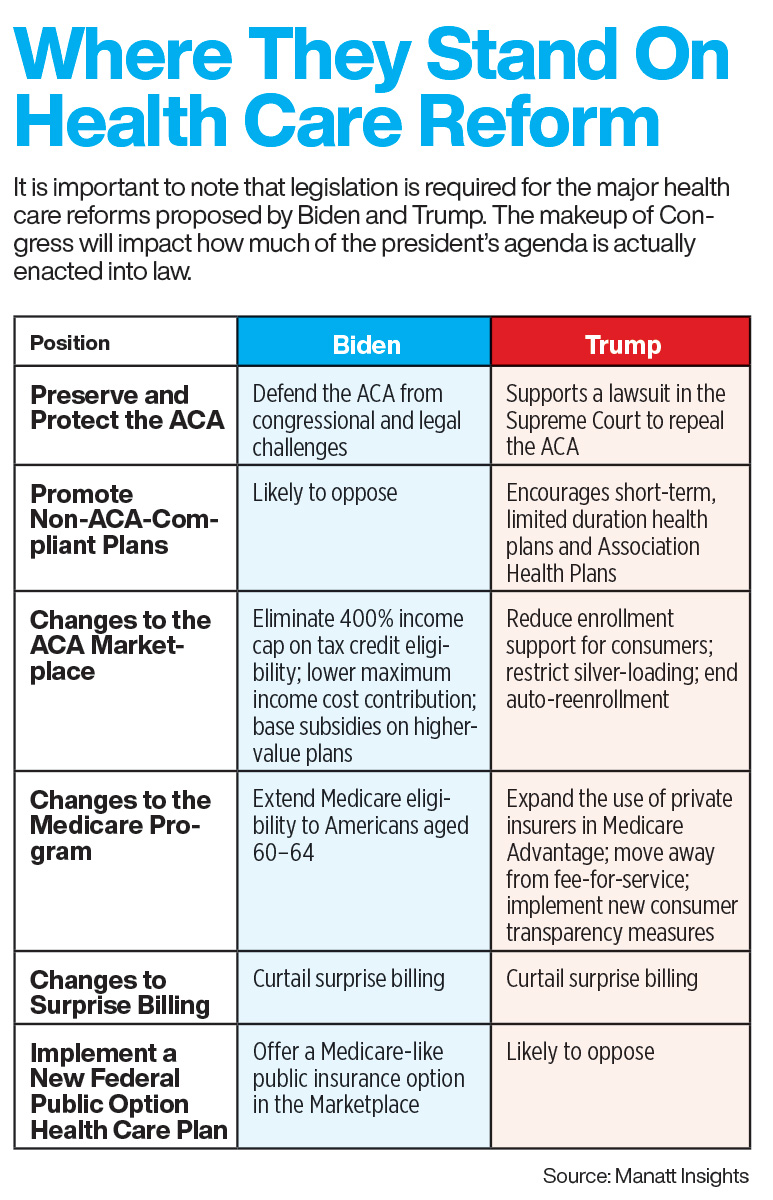

Health care. Of course, Biden had a front-row seat working with President Barack Obama, House Speaker Nancy Pelosi, D-Calif., and Senate Majority Leader Harry Reid, D-Nev., to pass the Affordable Care Act in 2010. The vice president has said he prefers shoring up and saving the ACA over more liberal alternatives.

The Biden plan contains a number of measures, such as a public option and tackling “surprise billing” and high prescription drug prices. While not ideal for health insurers and agents, a Biden presidency would appear to forestall the “Medicare for All” momentum.

Kaiser Family Foundation polling shows increasing public support for Obamacare. The foundation’s polling found that, in July 2014, 55% of voters opposed the law, while 36% favored it. By July 2020, that had flipped, with 51% favoring the law and 38% opposing it.

Appointments. In many partisan quarters, the biggest power of the presidency comes via appointments. For financial services, who chairs the Securities and Exchange Commission is a big deal. Chair Jay Clayton’s term ends next year, and there’s been rumors that he wants to move on.

In the bigger picture, the next president is likely to appoint one or two justices to the Supreme Court. The Trump circle made judicial appointments a central theme of his administration, giving conservatives an ideological edge in the courts. The Left will be looking for Biden to appoint a liberal justice if and when that opportunity should present itself.

A Second Term?

Despite Biden holding a consistently strong lead in the polls, analysts in the financial services world see a close election. In fact, Roame is predicting a Trump victory, adding that he has no strong conviction in that outcome.

“This is the reason I’m guessing right now that Trump wins — because I think there’s a lot of Trump supporters who just don’t admit it,” Roame explained. “I think they’re out there, and they’re going to come out for the election.”

In its assessment for clients, LPL Financial chief market strategist Ryan Detrick calls the election a toss-up. The margin of victory in the popular vote has been under 5% in four of the past five elections, he noted, and in two of those elections the outcome in the Electoral College differed from the popular vote.

“A 5% difference is small enough that an election can easily swing one way or the other based on what happens in the months and weeks before the election,” Detrick wrote. “And there are scenarios in which even a 5% difference in the popular vote could mean a different outcome in the Electoral College.”

Off-Key Harmony?

This is where regulation of financial services stands after a major push from the Trump administration, with lobbying from industry groups, to establish a consistent, best-interest standard across regulatory bodies. If challenger Joe Biden is elected, he is expected to support a widespread fiduciary standard.

State Insurance Regulations

The National Association of Insurance Commissioners produced a model law supporting a best interest standard that contains four obligations: care, disclosure, conflict of interest and documentation. But the standard was not stringent enough for some states, leading New York and Massachusetts to adopt rules that track closer to a fiduciary standard.

DOL Investment Advice Standard

The Department of Labor rule carves out a prohibited transaction exemption allowing product sellers to be compensated for a sale involving ERISA-qualified money, as long as the sellers meet three criteria: a best interest standard, a reasonable compensation standard and no misleading statements. The rule revision under the Trump administration is less onerous on product sellers, particularly independent marketing organizations. A final rule is expected to be published by Dec. 31.

SEC Regulation Best Interest

The Securities and Exchange Commission rule requires broker-dealers to recommend financial products that are in their customers’ best interests and to clearly identify any potential conflicts of interest and financial incentives that benefit the broker. This is not the fiduciary standard that consumer advocates and many Democrats wanted. Enacted by President Trump’s appointed chairman and took effect June 30.

Plan Now While Taxes Are Low

If Joe Biden and a Democratic majority are elected, taxes are likely to increase. If Donald Trump is reelected, chances are good this will still be a low tax year, historically speaking.

Pundits say the differences between President Donald Trump and Democratic challenger Joe Biden are as significant as any election in recent memory. That includes tax policy.

With Biden holding a steady and substantial polling lead, smart advisors are preparing financial plans so their clients can pay the expected increased tax burden in the most efficient manner possible.

And those who are not already prepared better get going, said Robert Keebler, a partner with Keebler & Associates, a tax advisory and CPA firm in Green Bay, Wisc. Waiting until the election is decided is not smart, he said, as any decent accountant and firm will be booked solid through the end of the year.

Smart planning will likely mean huge savings for clients, Keebler noted. For example, Biden wants to restore the 39.6% top tax rate for capital gains. That is a big jump from the 20% top rate set in the Tax Cuts and Jobs Act of 2017. Teaming up with Sen. Bernie Sanders, I-Vt., Biden’s task force left no doubt who they see footing the bill for increases in government revenue.

A Biden administration will “use taxes as a tool to address extreme concentrations of income and wealth inequality,” the task force wrote. “A guiding principle across our tax agenda is that the wealthiest Americans can shoulder more of the tax burden, including in particular by making investors pay the same tax rates as workers and bringing an end to expensive and unproductive tax loopholes.”

Trump, on the other hand, is calling for further and immediate cuts to the capital gains tax. While a favorite target of Republicans, support for such a measure was questionable as of press deadline. But it could be on the table if the incumbent wins a second term.

The Checklist

Keebler addressed several tax planning areas that are likely to change if Biden wins the election. Some additional areas to keep an eye on include:

Roth conversions. “Roth conversions should be red hot up toward the end of the year regardless of who wins the election, but more so if vice president Biden were to win,” Keebler said.

The reasoning is simple: Converting money from a traditional IRA to a Roth IRA will be cheaper to do this year. Doing so will lock in today’s tax rates of 10%, 12%, 22%, or 24% on taxable incomes up to $326,600 for joint filers. With the taxes out of the way, the converted funds will resume growing tax free inside a Roth.

Income harvesting. This is a similar strategy, Keebler said. By claiming as much income as will fit into a specific tax bracket, high-income clients can save plenty.

“Gain harvesting can be really important this year, because one of the vice president’s policies is to take the capital gain rate to 39.6% for those Americans earning more than a million dollars, so you would push that way up,” Keebler said.

There are a number of different harvesting strategies to maximize the tax benefits, he added.

Personal income tax. The Biden plan includes many changes to the income tax code. In particular, Biden wants to raise the top individual income tax rate to 39.6% from 37% and apply it to taxpayers with taxable income over $400,000, according to the Tax Policy Center.

In addition, Biden supports increasing the earnings that are subjected to the Social Security payroll tax to more than $400,000, according to the Tax Policy Center. Wages up to $137,700 are subject to the tax as it stands, with the employee paying 6.2%.

Among the many other potential changes and strategies, Keebler points to a big one in the Coronavirus Aid, Relief, and Economic Security (CARES) Act passed in March: Charitable contributions of cash up to 100% of adjusted gross income are allowed for 2020.

Estate planning. It is “imperative” to have estate planning done by Dec. 31, Keebler said. The Democratic platform calls for returning the estate tax to the “historical norm.”

The 2017 tax bill doubled the amount that individuals can pass on before the 40% estate and gift tax kicks in. In 2020, that number is $11.58 million.

Biden would likely favor elimination of the step-up in basis, a provision in the tax code that allows an individual to hold on to an asset for years while it appreciates, then bequeath it to an heir at death.

The heir is subject to little or no capital gains taxes upon selling the asset because it steps up to market value at death. While it is unclear if the top 39.6% tax rate would apply, Keebler nevertheless calls elimination of the step-up “a fundamental shift to the taxation of wealthy families.”

There are many other possible tax changes on the table in a hypothetical Biden administration, Keebler said. Corporate tax rates are likely to change, as are gifting rules and exemptions, among others. The important thing is to have clients prepared to pivot.

“What we’re doing is putting together action plans on a client-by-client basis and getting the clients to agree to those, so when the day comes where we have to implement,” he said, “there is no thinking required.”

Health Care Fight Is Still About ACA

President Donald Trump wants to kill it. Joe Biden wants to save it.

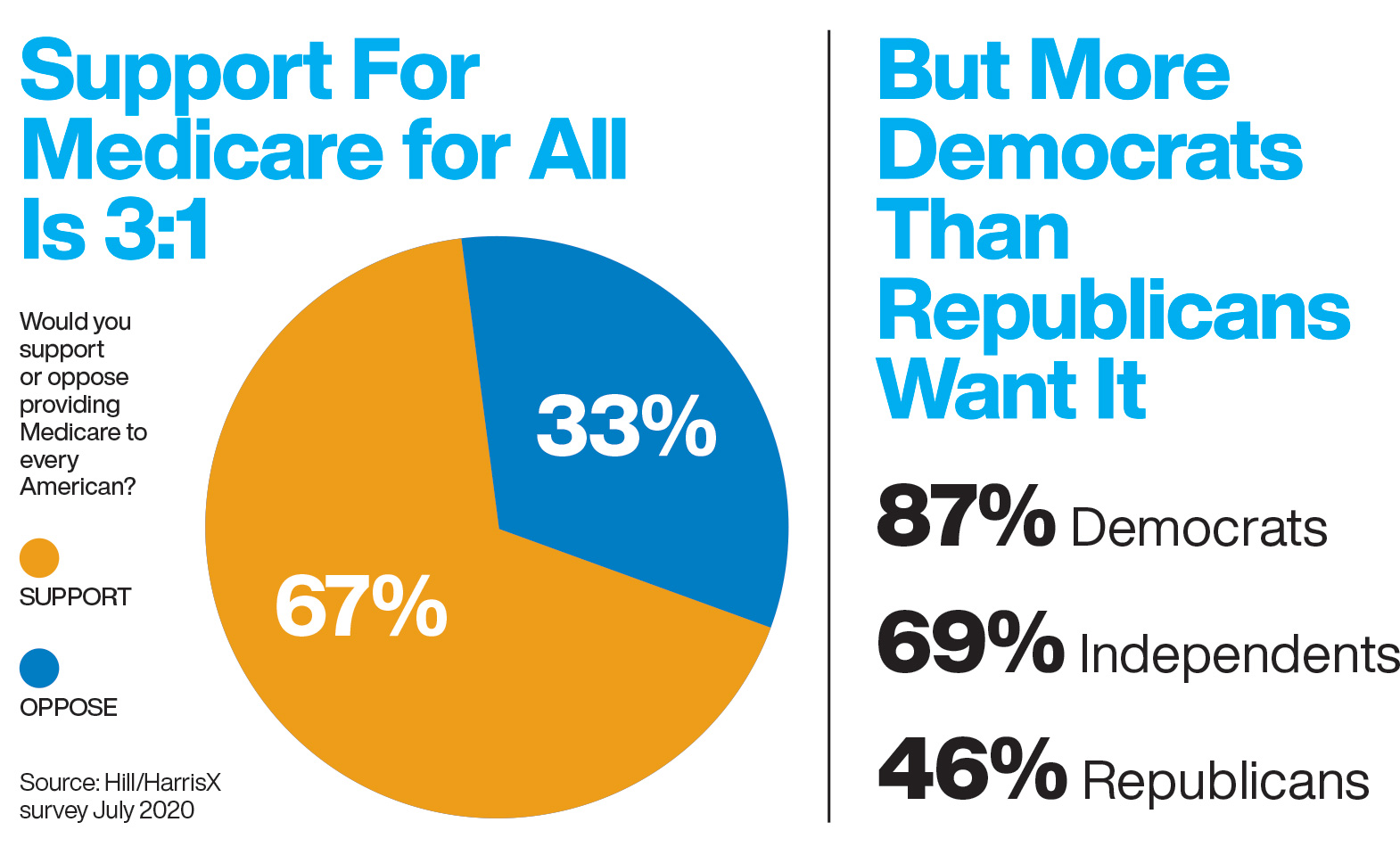

When former Vice President Joe Biden became the Democratic presidential nominee, it essentially took “Medicare for All” off the table, even though a majority of Democrats say they want it.

Medicare for All, a government-run single-payer health plan, was supported by many Democratic presidential candidates during the primaries as well as a number of Democrats in Congress.

Public support is about 3-1 in favor of Medicare for All, according to a Hill-HarrisX survey. About two-thirds (67%) of registered voters in the July 26-27 survey said they would support providing Medicare to every American, while 33% said they oppose it. Nearly nine in 10 Democrats (87%) said they favor Medicare for All, while only 46% of Republicans said they want it.

When the same survey was taken in October 2018, 70% of voters supported the idea, while an April 2020 survey found that 69% approved of providing Medicare to every American.

But Biden does support adding a government-run public option, a Medicare-like public insurance option in the health insurance marketplace. The public option would give consumers the choice to purchase health insurance through a program that would compete with private insurance. The industry opposes the public option, contending that it would be less expensive than private insurance and would eventually drive private companies out of business.

Initial Priorities

Biden also wants to expand on and strengthen the Affordable Care Act that became law while he was vice president to President Barack Obama. Meanwhile, incumbent President Donald Trump wants to move forward on his goal of dismantling Obama’s health care law.

But any moves to change the current health care system will take a back seat to getting the nation up and running after the COVID-19 pandemic crippled the U.S. economy, according to Michael Kolber, partner with Manatt Health.

“If Joe Biden takes office in January, his No. 1 priority is going to be COVID-19. It won’t be making structural changes to the health insurance market,” Kolber told InsuranceNewsNet.

A Trump presidency also will face challenges relating to moving the nation back to normal in the COVID-19 world, Kolber said, and Trump is expected to forge ahead with repealing the ACA. The Supreme Court is scheduled to hear arguments on Nov. 10 in a Trump administration-backed lawsuit to strike down the ACA.

At issue is whether the law’s individual mandate to have health insurance is constitutional. The administration contends that the law cannot survive without an individual mandate for health insurance. The financial penalty for not having insurance was repealed as part of the GOP tax law in 2017.

“I think that, depending on how this court case goes, you’ll see the Trump administration continue to challenge the ACA and push for more free market positions,” said Diane Boyle, senior vice president of government relations for the National Association of Insurance and Financial Advisors. “Things like, will you be able to get health care across state lines, or will you give the states more flexibility with their Medicaid programs? I think those would be the types of issues that we’d see in a Trump second term.”

With the billions of federal dollars already spent on pandemic relief and recovery, can the U.S. afford either a public option or a single-payer system? Boyle said she doesn’t believe the money is there.

“So far, we’ve spent more than $2 trillion on providing recovery and relief from COVID-19, and we’re looking at spending another $1 trillion-3 trillion. So that’s as much as $5 trillion, and it will have to come from somewhere, no matter what administration is in place.”

Boyle said that if Congress wants to fund a health care system, it will have to change the tax code in order to raise the money. “So I think that if you are looking at expanding health care, it’s going to be dependent more on the results of the congressional elections than the administration, because even if you have a Democrat-controlled Senate and House, you still have a number of fiscal hawks in Congress. They’re going to say, ‘How do we pay for that?’ And we’re not done

paying for COVID-19. We’re not in recovery mode yet; we’re still in relief mode.”

Changes To Medicare

In addition to his push for a public option, Biden favors lowering the eligibility age for Medicare to age 60. Whether this makes it through Congress depends on the federal budget, according to Marcy Buckner, senior vice president of government affairs with the National Association of Health Underwriters.

“Can we afford to expand Medicare? Will Medicare be financially solvent? Some are even saying that the Medicare age should be raised in order for it to be solvent.”

Buckner said that the fiscal issues raised by implementing Medicare for All would be there “in a micro level” by lowering the Medicare eligibility age.

“In addition, there may be issues with access to care because some physicians who treat those in the 60-64 age range may not want to take Medicare reimbursement. So there may be limitations on choice for physicians and availability of care. All of these are concerns.”

Regulatory And Executive Action

Many of the changes that Trump made to health care during his first term came about through regulatory action rather than legislative action. If Trump is reelected, we can expect to see more of those regulatory actions, Buckner said.

“In many cases, taking action on the regulatory side is easier than getting something through Congress,” she said. “So I think we will see Trump, if he is reelected, taking even more regulatory steps to try to take away some of the pieces of the ACA. And if Biden is elected president, I also think he will use the federal agencies and the regulatory process to try to patch up some of the pieces of the ACA and then possible try to expand on it with the public option that he is interested in establishing.”

Buckner said she believes the chances of a public option being passed by Congress in the next two years under a Biden presidency “is not very high.”

“I think it’s going to be very tight in Congress, and I don’t think we will see a 60-vote majority in the Senate,” Buckner said. “It’s also projected to be very close in the House, possibly ending up with 224 Democrats, 197 Republicans and 24 toss-ups. So any effort to pass a public option will take bipartisan effort. I think the chances of this happening in the next two years is very low.

There may be some attempts to open up the market, possibly for specific age groups, but I think it would take beyond the four years of a President Biden to get there.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

How to get EVERYTHING you can out of EVERYTHING you have

A Tough Sell: Why Life Insurers Need A Better Customer Experience

Advisor News

- 4 things every federal worker should do to safeguard their benefits

- Six steps to turn HNW friends into clients

- The two-bucket investment approach to making money last

- Republicans confront difficult Medicaid choices in search of savings to help pay for tax cuts

- Economy showing momentum despite uncertainty

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Senate passes bill capping medical insurance coverage

- Targeted by Trump, Medicaid funding stirs debate as CT changes rules for hospitals

- Studies from University of Occupational and Environmental Health Provide New Data on COVID-19 (Avoiding the Use of Outpatient Rehabilitation Services Under Long-term Care Insurance During the Covid-19 Pandemic): Coronavirus – COVID-19

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- This West Linn house, birthplace of Oregon prepaid health plans, is on National Historic Register

More Health/Employee Benefits NewsLife Insurance News

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

More Life Insurance News