Answering the Call to Serve the Underserved

Expansion into the broad market can be good business for everyone

Pacific Life acquired the new business platform from a long-standing leader in the broad market. Discuss what this acquisition means to Pacific Life and the diversification of the business.

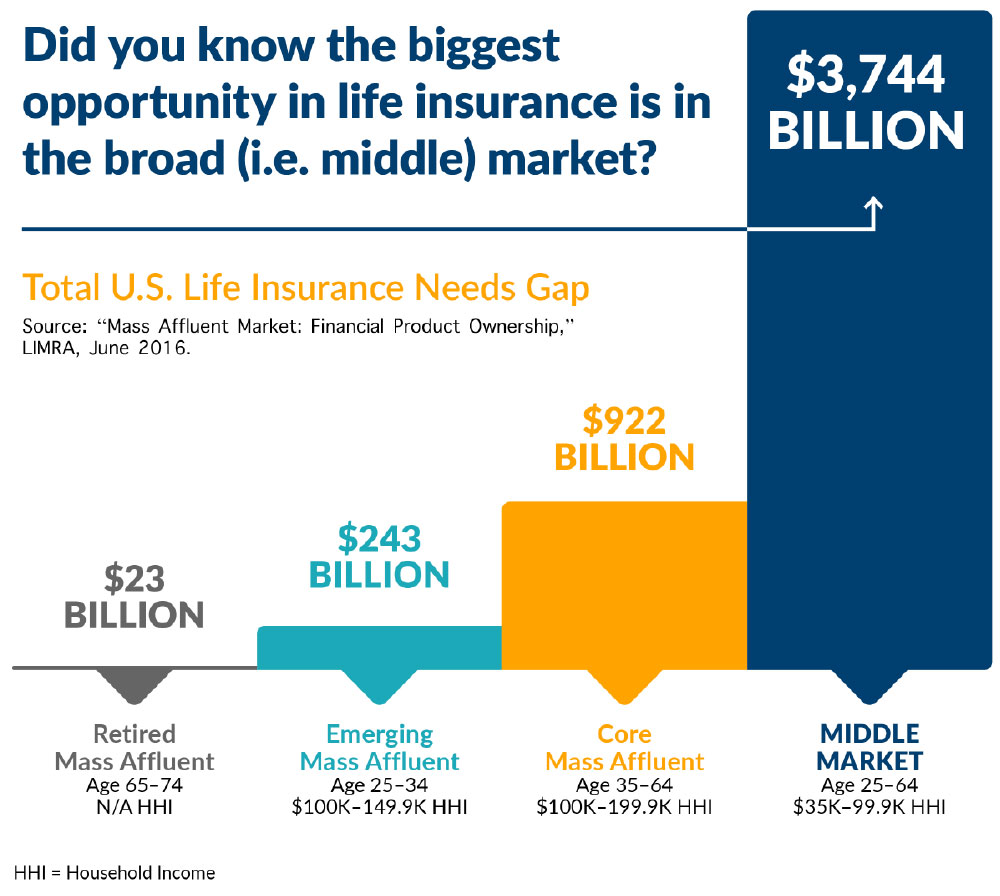

Historically, Pacific Life has been an industry leader in the affluent market, with accumulation-focused life insurance products as well as quality asset-based, long-term care solutions. With the acquisition of the Lynchburg platform, we are expanding into the broad market channel, offering solutions focused on meeting the specific needs of the broad market consumer — affordable death benefit protection-based products. The Lynchburg acquisition diversifies our overall distribution footprint, sales mix, and business and operational results. And, most important, it allows us to expand into the vastly underinsured broad market, which is in desperate need of quality protection products.

Why has Pacific Life elected to make this market a priority?

This is a market segment that’s in crisis. More than one third (35 percent) of U.S. households would feel adverse financial impacts within one month if a primary income earner died.2 This is especially true at younger ages (married couples age 45 or younger with children) who are settling for “several months” of life insurance protection instead of “several years.”

Approximately 37.5 million U.S. households currently have no life insurance coverage.3 Of those who do own life insurance, 48 percent recognize that they need more — with an average gap in coverage need of $200,000 per U.S. household — representing a $12 trillion market opportunity.3 We feel this lack of adequate coverage presents a significant financial risk to the consumer broad market, characterized by U.S. households with incomes of $50,000 to $250,000.

What is Pacific Life doing differently to meet the needs of the broad market?

We have developed solutions specifically for this market that offer simple products with lower minimum coverage amounts and competitive pricing, especially when paying monthly. Our products are primarily protection-focused products with underlying guarantees to ensure predictability of premiums. In addition, our consistent, predictable underwriting means no surprises, even with fluidless underwriting that offers clear qualification criteria and no surprise knock outs.

Pacific Life’s leading-edge digital capabilities can help financial professionals deliver the best possible service to their clients. For example, our ePolicy platform enables clients to electronically complete and submit outstanding forms, eliminating the work from the distributor while keeping them updated through status feeds. Our application upload feature bypasses labor-intensive data entry and delivers faster cycle times. In addition, we’ve built in flags for our underwriters to use when assessing the potential opportunity for an upsell, for distributors who continually look to offer upsell opportunities to their clients.

Our technology team is eager to explore opportunities to work closely with distributors, allowing us to be a true extension of the broker general agent (BGA) office and further streamline the process to issue a life insurance policy.

Being a mutual company puts Pacific Life in a unique position in this middle market space. Talk about how that position has shaped your core philosophy.

There are two kinds of insurance companies: mutual and stock life insurance companies. There are a lot of great stock companies out there. But stock companies tend to exist for the benefit of their shareholders. A mutual life insurance company like Pacific Life exists for the benefit of our policyowners, and that can be a meaningful difference for the financial professional and consumer.

We’re proud that Pacific Life is celebrating its 150th anniversary this year as a mutual life insurance company. And, above all else, our goal is to do good business. We’re always thinking about the decisions we make; the products we put on the street; how we price them; and how our insureds, policyowners, producers and distributors are impacted by our decisions.

Why is this market space — and your philosophy about how to approach it — exciting for the independent financial professional and the BGA?

Most carriers try to serve both the affluent and broad markets through a single sales team, product portfolio and service model. Pacific Life has taken a focused approach and created different business segments that focus solely on either the affluent or the broad market. This helps ensure the products, solutions and service models meet the needs of distributors and consumers in each market. It also lets our sales teams focus on positioning the offerings for their unique markets.

What advantages do the independent financial professional and the BGA enjoy by being part of Pacific Life?

We have a highly recognizable and well-respected brand within our industry. We’ve made a significant commitment to expanding our distribution via the independent BGA life brokerage channel through the acquisition of the Lynchburg life platform. We’re building a comprehensive product portfolio as well as bringing leading-edge technology platforms to the marketplace, allowing the financial professional to acquire broad market clients in an efficient and cost-effective manner.

Financial professionals and distributors can be proud to represent our company because we have a unique value proposition that will resonate within the marketplace and with the consumer. We’re a quality company that, for the past 150 years, has always acted in the best interest of our policyowners, our insureds and our distributors.

Want to learn how Pacific Life’s broad market channel can work for you and your BGA? Call 855.538.6445, option 3.

*In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

1. “Mass Affluent Market: Financial Product Ownership,” LIMRA, June 2016

2. LIMRA’s 2018 Insurance Barometer Study, April 2018.

3. LIMRA’s Life Insurance Ownership in Focus, U.S. Household Trends, 2016 LIMRA Ownership Study, Sept. 2016.

This article is intended for Financial Professional Use Only. If you are not a Financial Professional, please visit our public website @www.pacificlife.com.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues. Insurance products and their guarantees, including optional benefits and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company. Look to the strength of the life insurance company with regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency, or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the life insurance company.

Life insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

InsuranceNewsNet is not affiliated with Pacific Life.

This article is distributed through Pacific Life, Lynchburg, VA (844) 276-5759.

Pacific Life’s home office is located in Newport Beach, CA.

18-324A

Survey Says: Life Insurance Discounts Can Motivate Healthy Behavior

Life Insurance or Life Invasion?

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

More Health/Employee Benefits NewsLife Insurance News