Socially Responsible Investing And ESG: It’s Not Just A Millennial Trend

While millennials seem to be the generation most interested in applying their ideals on environmental, social and governance (ESG) issues to their finances, Gen Xers and baby boomers are also expressing growing interest, according to the ESG Investor Sentiment Study* from Allianz Life Insurance Company of North America (Allianz Life®).

The study found that although millennials are more likely to make investment and purchasing decisions based on issues that are important to them, Gen Xers and boomers are also putting their values into action.

Millennials get much of the attention for driving socially responsible investing, but older generations are also interested, according to a new study. (Graphic: Allianz Life)

Nearly two-thirds (64%) of millennials said ESG issues are important in their investing decisions with Gen Xers not far behind at 54% and boomers at 42%. In addition, majorities across all generations say ESG is a key factor in which companies they choose to do business with (77% of millennials/64% of Gen Xers/61% of boomers).

“Millennials get a lot of attention for driving ESG investing,” said Todd Hedtke, chief investment officer for Allianz Investment Management LLC. “But when it comes to investing in and doing business with good corporate citizens, there is interest across the board and it’s only going to grow.”

Currently only 17% of millennials are participating in ESG investing (compared with Gen Xers at 7% and boomers at 3%), yet nearly half of Gen Xers and boomers say they are interested in having some money in ESG investments at 49% and 47%, respectively.

In fact, baby boomers are more likely than millennials and Gen Xers to say that the reason they want to participate in ESG investing is to encourage companies to be good corporate citizens (61% of boomers, compared with 51% of millennials and 48% of Gen Xers).

Areas of Focus for All Generations

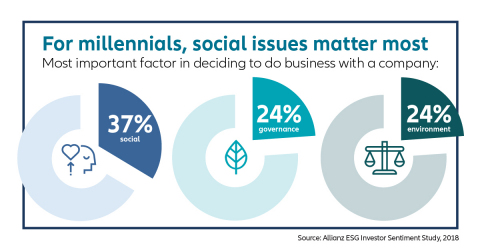

Asked about the single most important issue when it comes to doing business with a company, all generations agree social issues such as diversity in the workforce and consumer protection are most important, followed by corporate governance issues and environmental topics.

When it comes to making investment and business decisions, millennials are more likely to take action based on issues that are important to them. But there are a few key issues that make baby boomers more likely than other generations to take their business elsewhere, including transparency in business practices and finances, levels of executive compensations, and charitable contributions made by a company.

The study also found that millennials are more likely to be interested in learning about various types of ESG information. But all generations are in agreement that they aren’t sure how to evaluate if the companies included in an ESG investment care about causes they support (71% of millennials/64% of Gen Xers/69% of boomers).

“These stats show us that people from all generations are looking to learn more about ESG and want to put their values into action,” said Kelly LaVigne, vice president of Consumer Insights, Allianz Life. “But they feel they need more education and guidance on how to best make ESG investment decisions.”

Opportunities for Financial Professionals

In addition to the generational differences, the study also found that most financial professionals have yet to take a proactive approach helping clients learn about and participate in ESG investing.

Only 30% of Americans working with a financial professional say they have discussed ESG investing with their advisor, and most of the time it was the client who initiated the conversation (69%). This, despite the fact that three-quarters of respondents currently working with a financial professional said they have positive perceptions of ESG investing, and over half (51%) of those currently not involved with ESG investing are interested in it.

“Financial professionals have a huge opportunity in front of them to proactively discuss ESG investing with clients,” said Hedtke. “It’s important to work with them to identify what issues are important and help them build their portfolio in a way that reflects their values.”

New White Paper on Responsible Investing

Allianz Life released a new white paper outlining the findings of the ESG Investor Sentiment Study. The white paper, Ethics and Investing: How environmental, social, and governance (ESG) issues impact investor behavior, provides insights into this growing investing trend and how it is changing the way Americans make investment decisions. Visit http://www.allianzlife.com/ESG for more information.

About Allianz Life Insurance Company of North America

Allianz Life Insurance Company of North America, one of the FORTUNE 100 Best Companies to Work For® in 2019, has been keeping its promises since 1896 by helping Americans achieve their retirement income and protection goals with a variety of annuity and life insurance products. In 2018, Allianz Life provided $2.8 billion in benefit payments that helped policyholders achieve their financial goals. As a leading provider of fixed index annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with over 142,000 employees in more than 80 countries. Allianz Life is a proud sponsor of Allianz Field in St. Paul, Minnesota, home of Major League Soccer’s Minnesota United.

*Allianz Life Insurance Company of North America conducted an online survey, the Allianz Life ESG Investor Sentiment Study, in December 2018 with a nationally representative sample of 1,000 respondents ages 18 years or older.

Pacific Private Fund Advisors Surpasses $1 Billion Milestone

Help is on the way for Pennsylvanians who buy insurance through the marketplace l Opinion

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- New Mexico sees record health care exchange sign-ups despite rising costs

- Fleming files transformational Kentucky Medicaid Reform Act

- Healey unveils health insurance reforms

- Guest Column: I lost my mom to cancer. Better advocacy is needed.

- Unable to reach a new agreement, LVHN's contracts with UnitedHealthcare begin expiring Monday

More Health/Employee Benefits NewsLife Insurance News