Metromile Leverages Artificial Intelligence And Sensor Data From Low-Impact Car Crashes To Tackle Insurance Fraud

Experience the interactive Multichannel News Release here: https://www.multivu.com/players/English/8357351-metromile-artificial-intelligence-machine-learning-insurance-fraud/

"With machine learning technology, our team will be able to better prevent insurance fraud and assist customers with hard-to-prove but common claim types, like hit-and-run collisions, car theft, and rear-ends," said

Crashing cars at roughly five miles per hour,

Not wanting to keep the crash test fun and learning all to themselves,

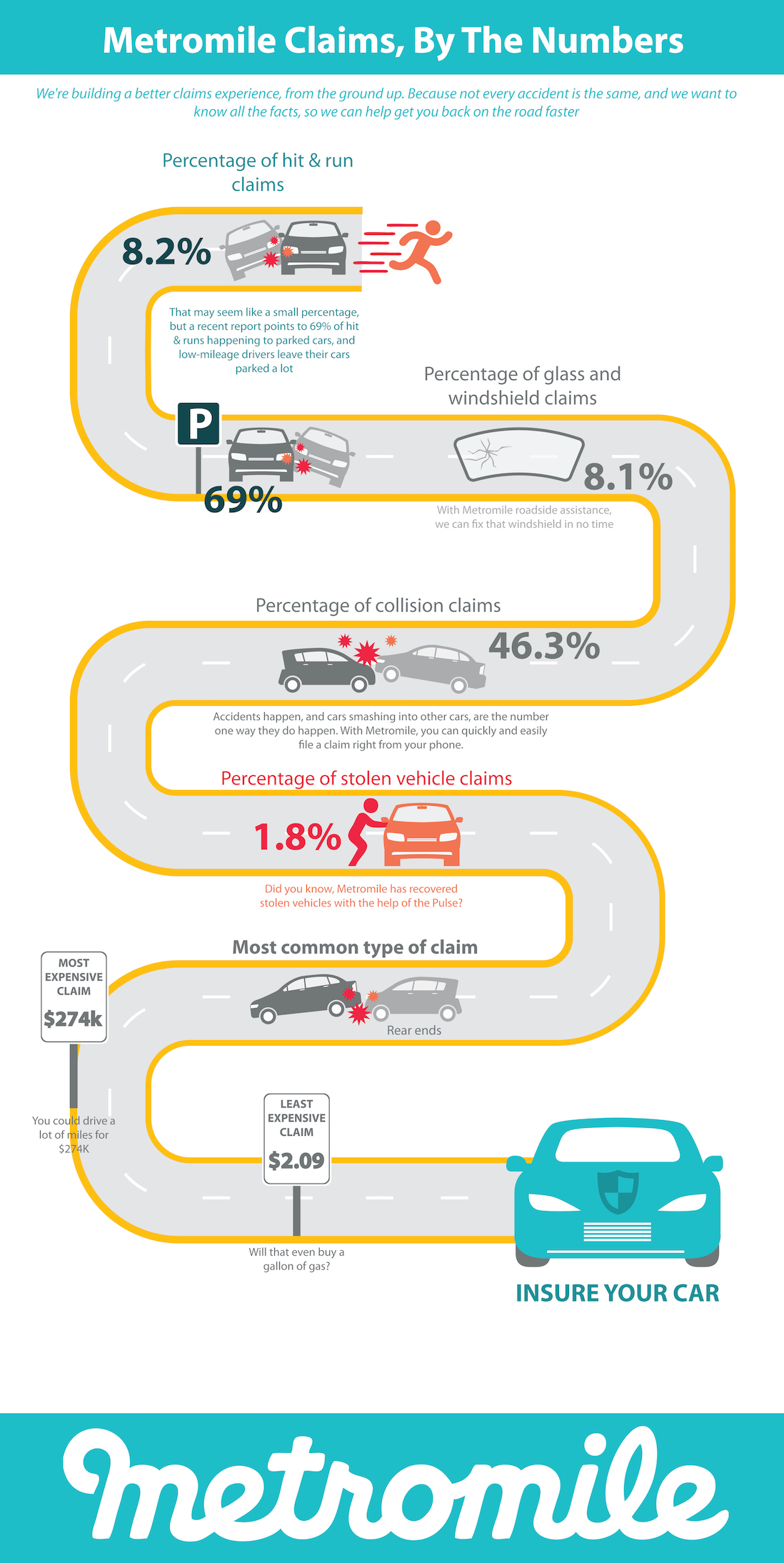

Technology Meets Car Insurance : There were over 4.5 million car accidents involving property damage in theU.S. last year. And while not every accident turns into a claim, and not every claim is handled byMetromile , it's still important to care. Why?Metromile is building a seamless claims process so that even the most minor fender benders can be resolved quickly and customers can get back on the road faster.- AVA and Data:

Metromile is building a better claims experience, from the ground up. Because not every accident is the same, andMetromile wants to know all the facts, so they can help get consumers back on the road faster. The best way to get to the truth of what low-impact and hit-and-run crashes would look like to the Pulse and AVA is to truly measure those collisions in the field. So that's precisely what the pay-per-mile auto insurer did.Metromile found a couple of used cars and put Pulse devices in them. Then they crashed them. Over, and over again. - Door Dents: Thanks to the work of our Data Scientists, who were able to create a machine learning technique to distinguish between crash types, AVA can now determine what is and what is not a "crash event." So, no matter what life throws at our customer's car,

Metromile will have their backs.

- Solving Hit & Runs: With Metromile, consumers never have to wonder if their insurance company has their back. Thanks to AVA,

Metromile can tell where, when, and how hard the impact was. - My Word Against Theirs:

Metromile always has their customer's back with AVA, our AI claims system, who can use sensor data to see what happened. - Complicated Claims, Solved: With Metromile, customers can file a claim, locate a repair shop, book a rental car, and get paid -- all from the

Metromile app.

For more information about

About

1 National Highway Traffic Safety Administration: "Quick Facts 2016 Report"

2 Insurance Information Institute: "Background on: Insurance Fraud"

View original content:http://www.prnewswire.com/news-releases/metromile-leverages-artificial-intelligence-and-sensor-data-from-low-impact-car-crashes-to-tackle-insurance-fraud-300674239.html

SOURCE

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News