Health Insurance Disruptor Start-Up Nabs $10 Million

Decent, a startup disrupting the health insurance industry by creating affordable health plans for small businesses and self-employed professionals, announced today that it has received $10 million in new Series A funding led by QED Investors. In total, Decent has raised more than $18 million since it launched two years ago.

|

|||||

With its partner, the Texas Freelance Association, Decent initially created health plans for self-employed workers in Austin, Texas — working with independent Direct Primary Care (DPC) doctors and partners including AXA, HCA Healthcare, Medlion, Hint, and Costco Health Solutions. With the additional funding, Decent is expanding throughout Texas, creating affordable health plans for individuals as well as small businesses.

“The COVID-19 pandemic has made quality health insurance more important than ever, while also compressing our economy and forcing small businesses to cut costs. This is why we founded Decent, to make affordable health insurance within reach for groups often left with inadequate or expensive options,” said Nick Soman, Decent’s CEO and cofounder.

How Decent Disrupts Health Insurance

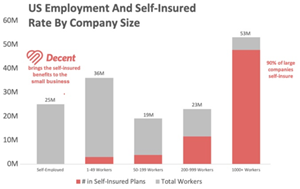

Decent is unique in that it helps small businesses and entrepreneurs band together to take advantage of a business practice called “self-insurance”. Large employers have been using self-insurance for years to control and reduce their medical costs.

“Big companies shouldn’t be the only ones with great benefits. We’re helping level the playing field for small businesses when it comes to purchasing healthcare,” explained Soman. “The cost savings we offer can make the difference between a small business offering coverage or leaving their employees with no health insurance at all.”

As part of Decent's expansion, it will now serve small businesses, starting with those in the technology industry. This allows technology companies or those companies that primarily service technology companies the opportunity to purchase Decent’s comprehensive health plans for an average of 40% less than currently comparable options.

All of Decent’s plans are Affordable Care Act (ACA)-compliant and built around convenient, free primary care. To date, they have an overall Net Promoter Score (NPS) of 73 from members, more than five times the health insurance industry average. Members may select a Direct Primary Care physician, which allows them to receive unlimited and free access to same-day appointments with a local doctor, or they may choose a virtual Direct Primary Care doctor. The “virtual health plan” is the first of its kind in the U.S., offering extra savings for those who prefer connecting to their dedicated primary care doctor via a smartphone or computer.

“Forgoing health insurance is like sitting atop of a ticking financial time bomb,” explained Soman. “Affordable, comprehensive health insurance helps to safeguard the future for small businesses and their employees. Decent is working to make sure that all businesses can afford to do that.”

New Decent investors include Vulcan Capital, Santander InnoVentures, Asset Management Ventures, Future Positive, Work Life Ventures, the Airbnb syndicate AirAngels, and Unpopular Ventures. They join existing investors Foundation Capital, Core Innovation Capital, Sure Ventures, Healthy Ventures, Meridian Street Capital, Precursor Ventures, Maverick Ventures, Necessary Ventures, and Digital Currency Group.

Click here for more information about how Decent is changing health insurance.

About Decent

Decent envisions a world where everyone has the freedom to do the work they want without sacrificing access to affordable and comprehensive health insurance. Decent’s affordable health insurance plans for small businesses are available in Austin, Texas, and will soon expand throughout Texas and then to other parts of the US. To learn more, visit www.decent.com or contact [email protected].

Attachment

Ellen Decareau MedVoice PR (512) 300-3334 [email protected]

Source: Decent

Marla Ridenour: Kareem Hunt’s extension can’t affect Browns’ top priority —keeping Nick Chubb

Hub International Acquires The Assets Of Louisiana-Based Todd & Associates, LLC

Advisor News

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

- Implications of in-service rollovers on in-plan income adoption

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News