Study: Young people buying insurance worry about wrong risk

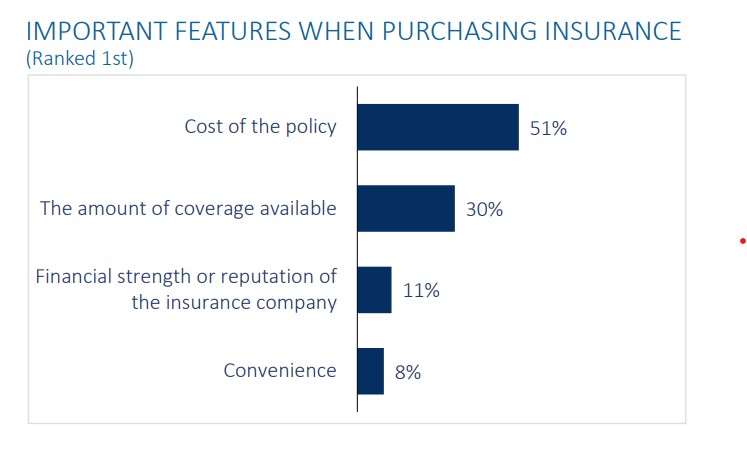

What is the most important factor for young people buying insurance?

Cost of the policy.

The amount of coverage available.

Financial strength of reputation of the insurance company.

Convenience.

Eric Sondergeld, managing director of Greenwald Research, bets that most people in his audience at the Life Insurance and Annuity Conference will say the answer is “convenience.”But the study that Greenwald did for the Society of Actuaries showed that convenience was dead last. Cost was No. 1 by far.

“That's one finding that I think people will be surprised to hear, that it's not just about creating a great experience,” Sondergeld said in an interview before the conference. “They would rather get a better price, and they don't want to sacrifice that.”

The study, “Perceptions of Younger Generations on Risk and Insurance,” was based on a survey of 1,000 people from 21 to 42 years old focusing on all insurance from life/health to property/casualty. The age range spanned Gen Z and millennials.

Another intriguing finding was the disconnect between perceived and actual risk. In what could be a happy accident for the life insurance industry, young people think they are closer to death than they actually are. Nearly a quarter (23%) said they might die in the next 10 years, but their actual chance spanned from 1.3% to 3.6% along the 21-42 age range.

“It’s interesting that the chance of dying prematurely and the chance of becoming totally disabled the next 10 years they pegged equally,” Sondergeld said, “even though the latter is actually much more likely.”

Another of the respondents’ concerns that might be closer to actual risk is that about half said they expect to have an emergency savings or retirement savings shortfall in the next 10 years.

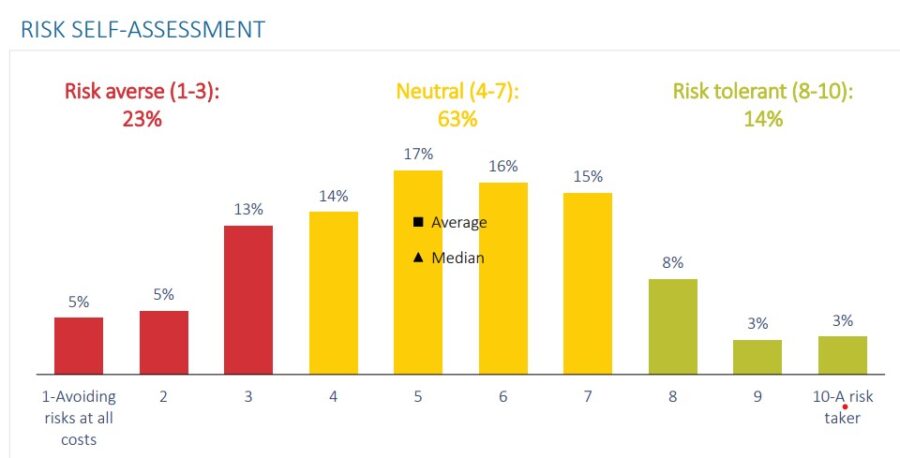

Role of risk tolerance

Although risky behavior might be expected of young people, the average was actually neutral, in fact leaning a little risk averse.

Those more likely to be risk averse were women (30% vs. 16% of men), whites (26% vs. 15% of Hispanic/Latino/Latinx) and those with less than a college education (27% vs. 19%).

It’s a bit of counterintuitive good/bad news when considering the impact of risk aversion on consumers. Risk-averse people were more likely to prioritize cost over other considerations when buying insurance – 53% of the risk-averse said they consider the cost of insurance to be most important vs. 40% of the risk-averse. Risk-tolerant people were more likely to place high trust in insurance companies by a wide margin, with 53% of risk-tolerant vs. 24% of risk-averse saying so, and may take precautions such as buying accident insurance, 38% vs. 21%.

When it comes to purchasing, it’s probably not a surprise that younger people prefer to buy online, although it might be less than expected with about half saying they prefer to purchase insurance online. Purchasing in-person was the second most popular option, followed by over the phone.

Another perhaps unexpected finding is that the youngest cohort, 21-23, was more likely than the 24-42 group to prefer buying each type of insurance in person.

Important factors for buying insurance

Overall, cost and coverage were the most important factors for the respondents when purchasing insurance, and financial strength and convenience came in a distant 3rd and 4th place in the ranking.

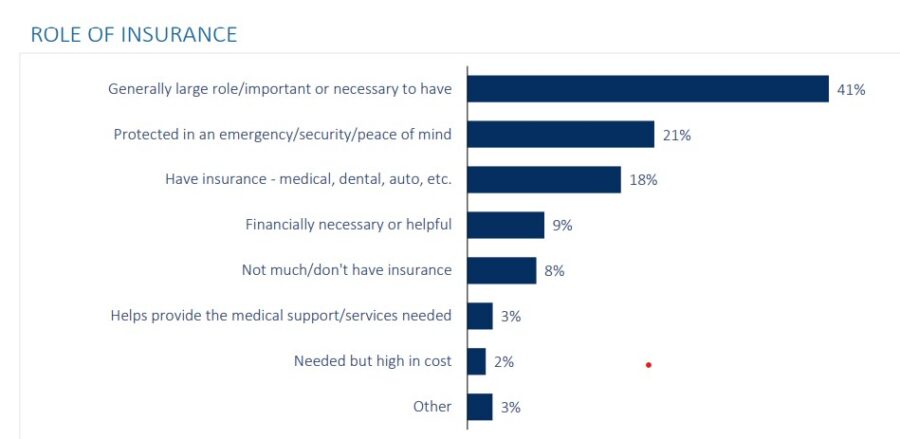

The respondents were not likely to see insurance as important or even necessary.

Less than half (41%) said insurance played a large role or was important or necessary to have. Only 21% said insurance protected in an emergency and gave a sense of security or peace of mind.

People who were more likely to say insurance plays a large or necessary role include those over 23, (42% vs. 33% under 24), have household income of at least $50,000 (46% vs. 33%), were risk neutral (44% vs. 33% of those who are risk averse), and have children (47% vs. 35%).

A bit of good news for life insurance is that young consumers are more likely to have life coverage than disability or critical illness. And that tendency increases with age.

Those who are risk-tolerant are more likely than those who are risk-neutral to have purchased life insurance (60% vs. 50%). Those who are risk-neutral are more likely than those who are risk-averse to have bought critical illness insurance (9% vs. 4%).

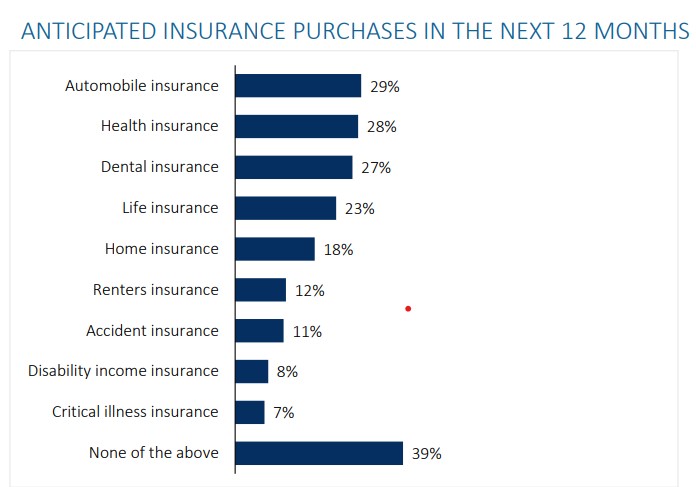

Another spot of good news for life insurance, 23% of the respondents said they expected to buy life coverage in the next 12 months, more than home, renters, accident disability or critical illness insurance.

Young consumers were more likely to go right to the source for information. The largest percentage would go online to research insurance, and the second choice would be to got right to the company’s website. No. 3 was an insurance agent or financial advisor.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Working mothers need support through employee benefits

What Gen Z wants in workplace benefits

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Rising health costs could mean a shift in making premium payments

- SENSITIVITY OF THE DISTRIBUTION OF HOUSEHOLD INCOME TO THE TREATMENT OF HEALTH INSURANCE FROM 1979 TO 2021

- Thousands in state face higher health insurance costs

- Thousands facing higher health insurance costs

- Trump wants GOP to 'own' health care issue but show 'flexibility' on abortion coverage restrictions

More Health/Employee Benefits NewsLife Insurance News