Yellen ‘wrong’ on inflation, while even some wealthier Americans struggle

Treasury Secretary Janet Yellen admitted Tuesday she had been wrong last year in downplaying the potential risk of inflation. Recent high inflation rates are one of the factors that currently have many Americans, including some in higher income brackets, living paycheck to paycheck, according to a recent survey.

“Look, I think I was wrong then about the path that inflation would take,” Yellen said during an interview on CNN on Tuesday. “There have been unanticipated and large shocks to the economy that boosted energy and food prices and supply bottlenecks that have affected the economy badly that at the time I did not fully understand.”

Yellen was responding to a clip anchor Wolf Blitzer played of Yellen last March saying that inflation was a small, manageable risk that she did not anticipate would be a problem.

The Biden administration realizes the heavy burden Americans are bearing with inflation, she said. President Joe Biden said on Tuesday that inflation was the top domestic issue.

Yellen laid much of the solution at the feet of the Federal Reserve after Blitzer reminded her that former Treasury Secretary Larry Summers said the Fed needed to do some “soul-searching” about how it has handled inflation.

Yellen says 'Fed has the tools'

Yellen said she was not critical of the independent Fed, which she led during the Obama administration, and she emphasized that Chairman Jerome Powell is working on it. “Chair Powell has made it clear that he has every intention and believes, as I would, that the Fed has the tools to bring inflation down and that’s his focus,” Yellen said.

Biden also said on Tuesday as he met with Powell that he would not be interfering with the Fed’s independence. The Fed has been raising rates and has started tapering its bond buying, but there have been some hints that the central bank might slow down its rate increases and not increase them during its September meeting.

Meanwhile, the Biden administration is “supplementing” the Fed by lowering household costs, such as prescription drug and health care costs, Yellen said without going into specifics. She added that Congress could move on some energy measures.

“If Congress is willing to pass some of the proposals to boost the use of non-renewables, I think that can serve to bring down important costs that households face,” Yellen said.

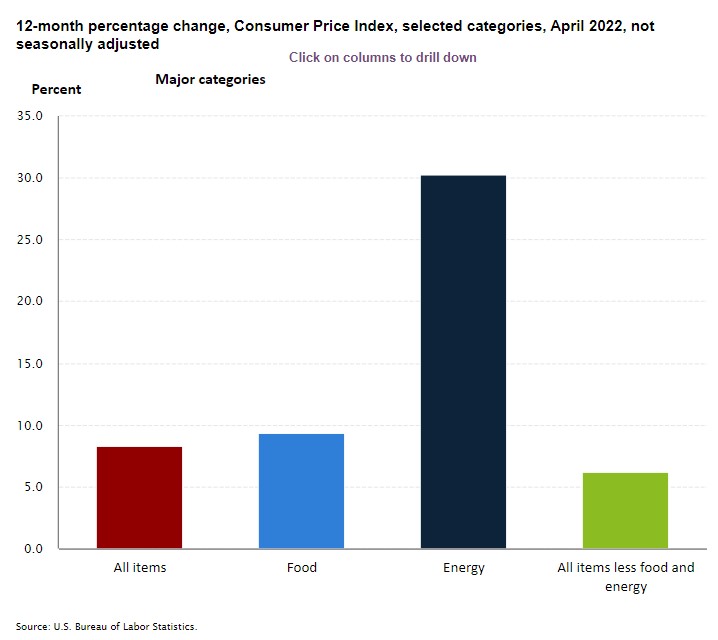

She also said that core inflation has recently decreased but oil prices are still too high, which she blamed largely on the war in Ukraine.

Even Wealthier Americans Struggling

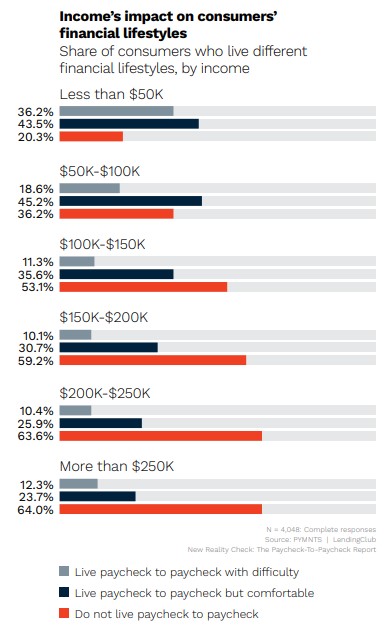

A monthly survey of household finances found that more wealthier Americans are living paycheck-to-paycheck than a year ago, a trend that the researchers at PYMNTS pinned on inflation.

“We find that consumers in all income brackets — including those who make more than $100,000 annually — are living paycheck to paycheck,” according to an April survey conducted by PYMNTS and LendingClub.

The survey found 61% of consumers in April were living paycheck-to-paycheck, a 9 percentage point increase from 52% in April 2021, according to the report, “meaning that approximately three in five U.S. consumers devote nearly all of their salaries to expenses with little to nothing left over at the end of the month.”

More than a third of Americans earning more than $250,000 are living paycheck-to-paycheck, with 12.7% having difficulty doing it.

Those earning more than $250,000 are seeing an impact on credit scores, with one third of them bearing average or below average scores. Half of those making between $100,000 and $250,000 also had average or below average scores. But even with a third of top-earners with middling scores, consumers in that income bracket have more of a credit cushion to absorb higher costs.

“These top-earning consumers handle their financial lifestyles in interesting ways, however, as they are associated with stronger credit scores and more intense credit usage and likely to moderate their cash flows,” according to the report. “Those earning over $250,000 are 40% more likely to use financial products than consumers in the lowest bracket and as many as 63% of them have above average credit scores, exceeding 750 points.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

AmeriLife, American Home Life team up on Medicare Supplement/final expense solution

Fidelity’s crypto currency moves continue to stir industry response

Advisor News

- Unlocking hidden AUM: Prospecting from within your client base

- Protests in D.C. Take Aim at Health Insurance, Financial Institutions, Oil & Gas Interests

- Charitable giving tools available for taxpayers; due to expire

- Study: How should lawmakers fix the Social Security gap?

- Could Trump seek revenue via a sharp cut in 401(k) contribution limits?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- 6 Republicans join Democrats, pass Medicaid funding bill in Oregon House

- Medicaid funding bill easily passes Oregon House

- California has a lot to lose if Trump slashes Medicaid. Seniors, kids and more could face coverage cuts

- As I See It: Your concern should be your health (and our nation)

- SD19 DEMOCRATS: Health care coverage a key topic at 2025 Legislature

More Health/Employee Benefits NewsLife Insurance News