Worry about IRS refunds rises as refund amounts drop, survey says

Remember when tax refund season filled the air with millions of WOOHOOs! as Americans clicked Pay Now for big-screen TVs and spring break trips? Yeah, that was a different time.

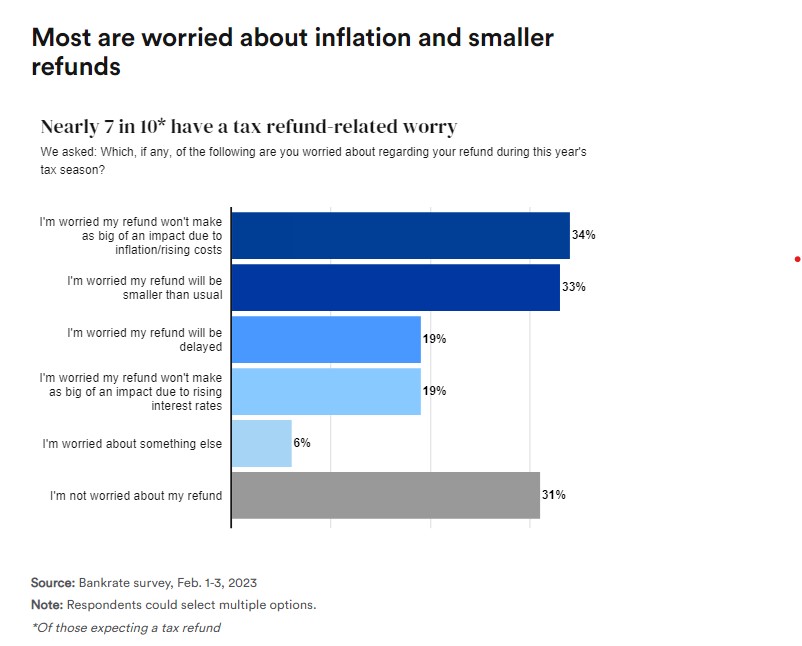

This year, more people are paying down debt and a tad anxious that the refunds are not going to have the impact that they are hoping for, according to a Bankrate survey. In fact, worry is the key term this year with only 31% of respondents saying they were not worried about their refund.

People are worried that higher inflation and interest rates will take a chomp out of their check, and that the refund will be smaller than usual and delayed.

There is a bit of good news/bad news on those concerns. The good news is it turns out that refunds are more rapid than usual this tax season.

As of Feb. 24, tax filings are up slightly, 1.3%, compared with Feb. 25, 2022, according to the IRS. But processing is happening at an even higher rate, with a 4.3% increase over last year. A little bit more good news is the number of refunds is up substantially, 18.2% over last year.

Thank the Inflation Reduction Act for the improvement, according to the Treasury Department. The IRS had already started upgrading by hiring 5,000 more customer service representatives, for example, along with boosting its automated options, and the increased funding is helping accelerate those improvements.

The not-so-great news is that the Bankrate respondents’ worry that refunds will be down is justified. Refund amounts were down 11.3% compared with last year, according to the tax agency.

The IRS warned that refunds would be lower because of expiring pandemic-era relief measures. The reduction in some tax credits is substantial. For example, the Child and Dependent Care Credit dropped to a maximum of $2,100 in 2022, down from $8,000 in 2021.

A tax break for charitable deductions was also taken away for people who do not itemize on their return. A pandemic measure had allowed people to take up to $600 even if they did not itemize.

Paying down or stacking bucks

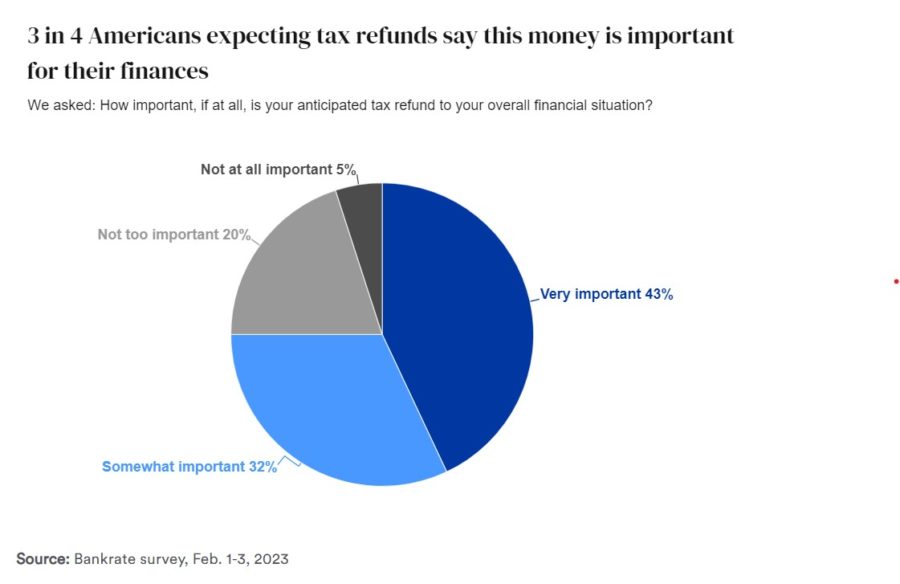

In perhaps a sign of where Americans are financially, a substantial proportion of respondents to the Bankrate survey said the refund is important, with 75% saying it is at least somewhat important to their financial situation.

Almost half, 45%, expect to get a refund, with 19% expecting to owe money and 16% breaking even, according to the survey. The number of those expecting a refund is up 5% over last year.

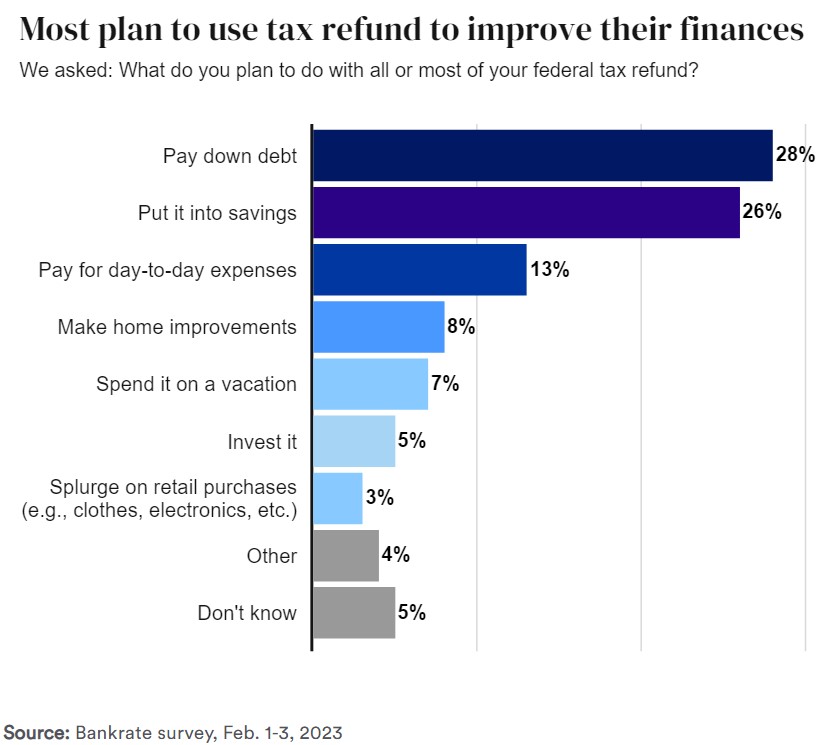

In past years, Americans might have made a beeline to Best Buy with their refund burning in their hands but not this year. Most plan to use the money to improve their finances either by paying down debt or socking it away. In fact, splurging was way down on the list, with only 3% planning on a big spend.

Surely the young and reckless are looking for a big pop with the windfall, right? Again, not so much. The younger generations are more likely to be responsible with it, with 31% of Gen Zers looking to bank the bucks, while 33% of their Gen X parents are using it to pay down debt.

The younger folks are also more worried about the refund, with 82% of Gen Zers, 78% of millennials, 69% of Gen Xers and 50% of baby boomers having at least one worry.

One less worry is whether they will have to claim special payments that were made by 21 states, according to the IRS.

“The IRS has determined that in the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns,” the agency said early last month.

Those are payments related to “general welfare” and disaster relief in the states of California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island. In other states, filers will not have to claim payments if they meet “certain requirements.” They are Alaska, Georgia, Massachusetts, South Carolina and Virginia.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Goldman Sachs: Threat of recession is most important issue for equities

A tax-advantaged solution for long-term care needs

Advisor News

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

- A recession could leave Americans humming 'Oh, Canada'

- Market volatility driven by fear, emotion

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Hanyang University Reports Findings in Anterior Uveitis (Epidemiologic study of pediatric uveitis and its ophthalmic complications using the Korean National Health Insurance Claim Database): Eye Diseases and Conditions – Anterior Uveitis

- Proxy Statement (Form DEF 14A)

- Corporate Responsibility Report

- Gov. celebrates ACA's 15th anniversary

- Texas’ biggest health insurer may drop these Tarrant County hospitals from some plans

More Health/Employee Benefits NewsLife Insurance News