A tax-advantaged solution for long-term care needs

As more adults enter retirement age, many have dreams of vacationing, seeing grandchildren, volunteering with their favorite charities or catching up with all of their bucket list items. After a lifetime of working and saving, many consumers are expecting to lead this relaxed life courtesy of their investment returns and accumulated retirement plans. Most have been taught the rule of 4% withdrawals and have done the back-of-the-envelope math to understand how much of a nest egg they need in order to relax in retirement. Unfortunately for these future retirees, many experts agree that the 4% rule in today’s environment could have dire consequences for many thanks to several factors including inflation, escalating health care costs and market volatility.

In addition to these issues, most Americans are unprepared for a long-term care event during their lifetime. According to the Aspe Research Brief presented to the U.S. Department of Health and Human Services in 2020, more than 50% of people over age 65 will require long-term care at some point, making this a huge pothole for half the population on their retirement road map.

Long-term care needs may be brief for some, but the average — a length of three years, and a cost of more than $120,000 - will have a significant impact on the portfolios of those impacted. It’s estimated that the U.S. population ages 65 and older will exceed 70 million by 2030. The vast majority of this age cohort is unprepared for this type of expense, since many are on fixed incomes.

Given this conundrum, there are several ways to solve this aging dilemma, one of which comes courtesy of the Pension Protection Act. When this was passed by Congress in 2006, it gave non-qualified deferred annuities some significant tax advantages. According to Internal Revenue Code 7702(b), long-term care benefits are generally treated as excludable accident and health insurance benefits and are income tax free. However, in order to qualify for these advantages, the taxpayer must be chronically ill. They must be certified by a licensed health care practitioner as being unable to perform at least two of six activities of daily living or have severe cognitive impairment. This ability to trigger tax-free payments from a tax-deferred vehicle is an enormous tax efficiency opportunity for those impacted by an LTC event.

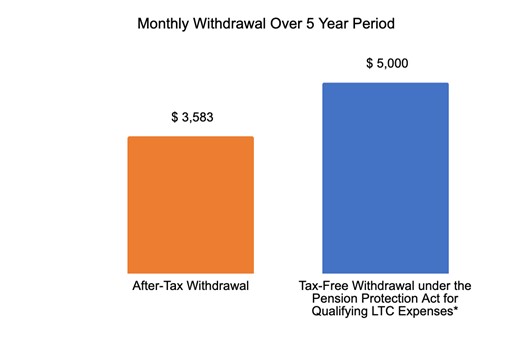

Let’s look at an example of how the taxable and tax-free withdrawals look: An annuity owner has accumulated $250,000 in a tax-deferred non-qualified annuity with a $50,000 cost basis. In the case of regular withdrawals and assuming a 34% income tax rate, the policyholder would receive $3,583 per month in benefits for a five-year period. That policyholder would receive $5,000 per month if they withdrew the same $250,000 to cover a qualified long-term care event, if the underlying annuity had a long-term care rider.

*Assumes 34% income tax rate. Based on $250k in accumulated gains on a $50k initial investment. Tax-free withdrawals are only available when an individual is deemed "chronically ill" (inability to perform 2 out of 6 activities of daily living or severe cognitive impairment) by a certified healthcare practitioner. The annuity contract must meet guidelines for qualified long term care insurance under IRC Section 7702(b).

The advantages of a fixed indexed annuity is that a policyholder can aim for more equity market-like returns and potentially drive greater accumulation. Add the long-term care rider to this and suddenly, the policyholder turns this accumulated, tax-deferred growth into a tax-free income stream, assuming they qualified under 7702(b).

Many annuity products also offer consumer-friendly features such as guaranteed underwriting approval, where every applicant is medically approved to purchase them. This allows all clients who desire tax-deferred growth and long-term care coverage needs to buy the product, irrespective of their health status. One of the major downsides of traditional long-term care insurance is that by the time a consumer is aware of the need for coverage, they often can’t qualify for it. With the guaranteed underwriting approval, all applicants are able to purchase (subject to suitability of the annuity purchase), regardless of their health. Some features include embedded wellness programs, aimed at helping policyholders age in place by staying active and engaged in their own healthy lifestyle.

Guaranteed underwriting approval and embedded wellness programs are just two of the more friendly features. You also can find annuity combination products that have multiple accumulation strategies, rebalancing and dollar cost averaging abilities and varied liquidity features among other consumer-centric design elements.

Retirement planning, even when done correctly, is still dependent on variable factors, such as inflation, rising health care costs and market volatility. Add to this the likelihood of needing long-term care assistance and the problem is more complex and even harder to solve. The good news is the introduction of new products that allow consumers to try to overcome these issues, while also protecting them from long-term care needs. This is an area that is growing and will have an impact on the aging populations of the future.

Larry Nisenson is the chief growth officer at Assured Allies. He may be contacted at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Worry about IRS refunds rises as refund amounts drop, survey says

Middle-income families offer opportunity for financial advisors, report says

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News