Where did Social Security come from?

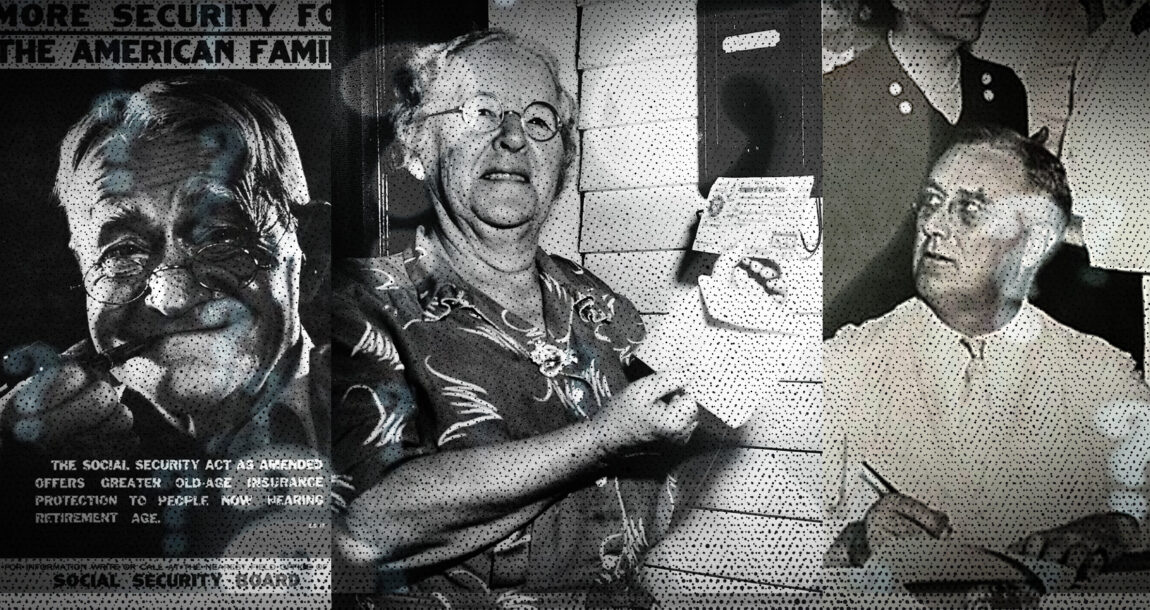

The most influential social programs in America today, which touch the financial plan of every household and business, stem from the Great Depression era. To be precise, most of these developments were born out of Franklin Delano Roosevelt’s advisory group, known as the Brain Trust. In 1932, three very progressive professors from Columbia University guided then President-Elect Roosevelt with the framework for FDR’s New Deal, and an enormous new government.

The greatest of these initiatives – the Social Security Act - was passed by Congress on Aug. 14, 1935. Like its purpose today, the act aimed to address unemployment, disabilities and retirement pensions. Old-Age, Survivors and Disability Insurance, as it’s known, entwined itself into the fabric of America. What many considered to be a temporary rescue package in a time of crisis - meant to relieve poor, older citizens no longer able to work and without children around to care for them - became a new and permanent framework for American society. They are called entitlements.

What is an entitlement?

Although the layperson might consider an entitlement to be any privilege one has a right to or is inherently deserving of, the Congressional Budget Office defines it more technically. According to the CBO, an entitlement is “a legal obligation of the federal government to make payments to a person, group of people, business, unit of government or similar entity that meets the eligibility criteria set in law and for which the budget authority is not provided in advance in an appropriation act. Spending for entitlement programs is controlled through those programs’ eligibility criteria and benefit or payment rules. The best-known entitlements are the government’s major benefit programs, such as Social Security and Medicare.”

Conversely, welfare typically refers to a range of government programs that provide financial or other aid to individuals who cannot support themselves. Social Security and Medicare may have begun with the general intent of providing welfare and assisting older adults with inadequate income, but they morphed into an entitlement not always connected to being needy. Although the definitions are continually debated, one might assume that all welfare is entitlements, but not all entitlements are welfare.

The early days of Social Security

At Social Security’s inception, American employees and employers each paid 1% of a worker’s first $3,000 of wages. After almost three years of funding, the program got to work. As the Great Depression faded into the background, Social Security retirement benefits solidified the first federal government program not dependent on need, meaning benefits would still be provided to someone whether they were poor or whether they were affluent. While a concrete formula tying benefits to contributions did not exist, nor does it exist nearly a century later, FDR was wise enough to make every American emotionally vested in the program, labeling it an entitlement, not a charity.

Describing Social Security’s political shield of having every worker’s skin in the game, Roosevelt bragged, “We put those payroll contributions there so as to give the contributors a legal, moral and political right to collect their pensions and their unemployment benefits. With those taxes [Social Security portion of income tax withholdings] in there, no damn politician can ever scrap my Social Security program. Those taxes aren’t a matter of economics, they’re straight politics.”

On Jan. 31, 1940, Ida Fuller received the first Social Security check for $22.54 at the age of 65. She paid $24.75 into the system between 1937 and 1939 based on her total income of $2,484 in those few years. Ida went on to live be 100 years old. She collected $22,889 from Social Security before her death in 1975, or 924 times what she contributed to the system.

Despite this ominous warning, Social Security initially appeared to be mathematically sustainable. In 1945, there were 41.9 tax-paying workers to every Social Security beneficiary. Only 8% of the American population was over the age of 65, the normal retirement age to collect benefits. The average life expectancy for men was 64 and for women, 68. America welcomed the growing program and its ability to help niche cases.

On the other end of the spectrum, the Fair Labor Standards Act in 1938 said that persons under 18 years old could no longer work in mining or manufacturing, but those older than 14 could work in any situations deemed not to be “oppressive.” The need for this act illustrates just how many young people were seeking any work possible. In 1945, 52.1% of children dropped out of high school to pursue full-time work. In summary, there were a lot of people working for a long period of time to help a few people for a short period of time. It fit the population and the population fit it.

The current days of Social Security

Fast-forward roughly 80 years, about one lifetime, and what was once an idea in a time of despair has become America’s second-largest budget item, costing more than $1 trillion annually. More than 66 million Americans are Social Security beneficiaries; that’s more than half of the entire population of the U.S. when the program began. The average retirement benefit in 2023 is $22,116 annually. This is funded by 181 million workers who pay a 6.2% contribution from earnings up to $160,200 in 2023, which their employers match. Roughly 40% of current beneficiaries also pay income taxes on a part of their benefits. Any shortfall in the system is covered by national debt.

According to the Organization for Economic Co-Operation and Development, America’s Social Security program is actually smaller than most other developed nations, in respect to replacement of career earnings. Social Security replaces close to 40% of wages, whereas the international average is 49% and is almost 80% in Italy.

Despite Roosevelt’s words of caution, Social Security has long passed the realm of niche assistance. The Center on Budget and Policy Priorities cites that 38% of seniors would live in poverty without Social Security. Nine out of 10 Americans over the age of 65 receive benefits, accounting for the bulk of America’s active beneficiaries. For half of America’s older adults, it provides more than half of their income.

The future days of Social Security

Can FDR’s baby survive? The pessimist will point to the Social Security Administration’s own admittance that trust funds, totaling $2.77 trillion in 2022, will be exhausted by 2033 if nothing changes. It is the unraveling of an evolving equation; as in 2022, there are only 2.8 taxpaying workers per beneficiary.

But the optimist will note that the long-term gap between funds and benefits amounts to only 1% of annual gross domestic product over the next 75 years. Not to mention if Congress opts to push forward without any changes to taxes or benefits, taxable income should cover 76% of projected benefits in each year after the trust funds are exhausted.

Although Social Security is synonymous with retirement, it is not only for seniors. Of the nearly 66 million Social Security beneficiaries, 9 million of those are on disability. Fortunately, there has been a steady decline of Social Security Disability Insurance applications since 2010.

Social Security is one of the touchiest subjects for politicians to navigate in a system revolving around reelections. The statistics and demographics of the future days certainly look different than the early days, but changing with change is easier said than done.

Bryan M. Kuderna is a Certified Financial Planner and the founder of Kuderna Financial Team, a New Jersey-based financial services firm. He is the host of The Kuderna Podcast and author of What Should I Do With My Money? Economic Insights To Build Wealth Amid Chaos. Contact him at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Bryan M. Kuderna is a Certified Financial Planner™ and the founder of Kuderna Financial Team, a New Jersey-based financial services firm. He is the host of The Kuderna Podcast. His new book,”What Should I Do With My Money?: Economic Insights to Build Wealth Amid Chaos” is available wherever books are sold.

Fed says era of spiraling interest rates may not be over

Little progress for regulators on LTC rate review standard

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- ‘Absolutely ferocious’: Idaho introduces plan to repeal Medicaid expansion

- PEOPLE IN NEED OF DISABILITY BENEFITS ARE FACING NEW BARRIERS AND GOVERNMENT CUTS AND OVERHAULS ARE TO BLAME

- ANALYSES FIND HOSPITALS 'DRIVING UP HEALTH COSTS' WITH 'OPAQUE' BILLING PRACTICES, ANTI-COMPETITIVE CONSOLIDATION

- New Generation MyCare Program – What is it?

- Local lawmakers, advocates talk about BadgerCare expansion

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News