What agents need to know about the cost of long-term DI

Disability insurance replaces a portion of a policyholder’s regular income — usually between 40% and 60% — if physical injury, medical illness or mental health issues leave them unable to work and earn a paycheck.

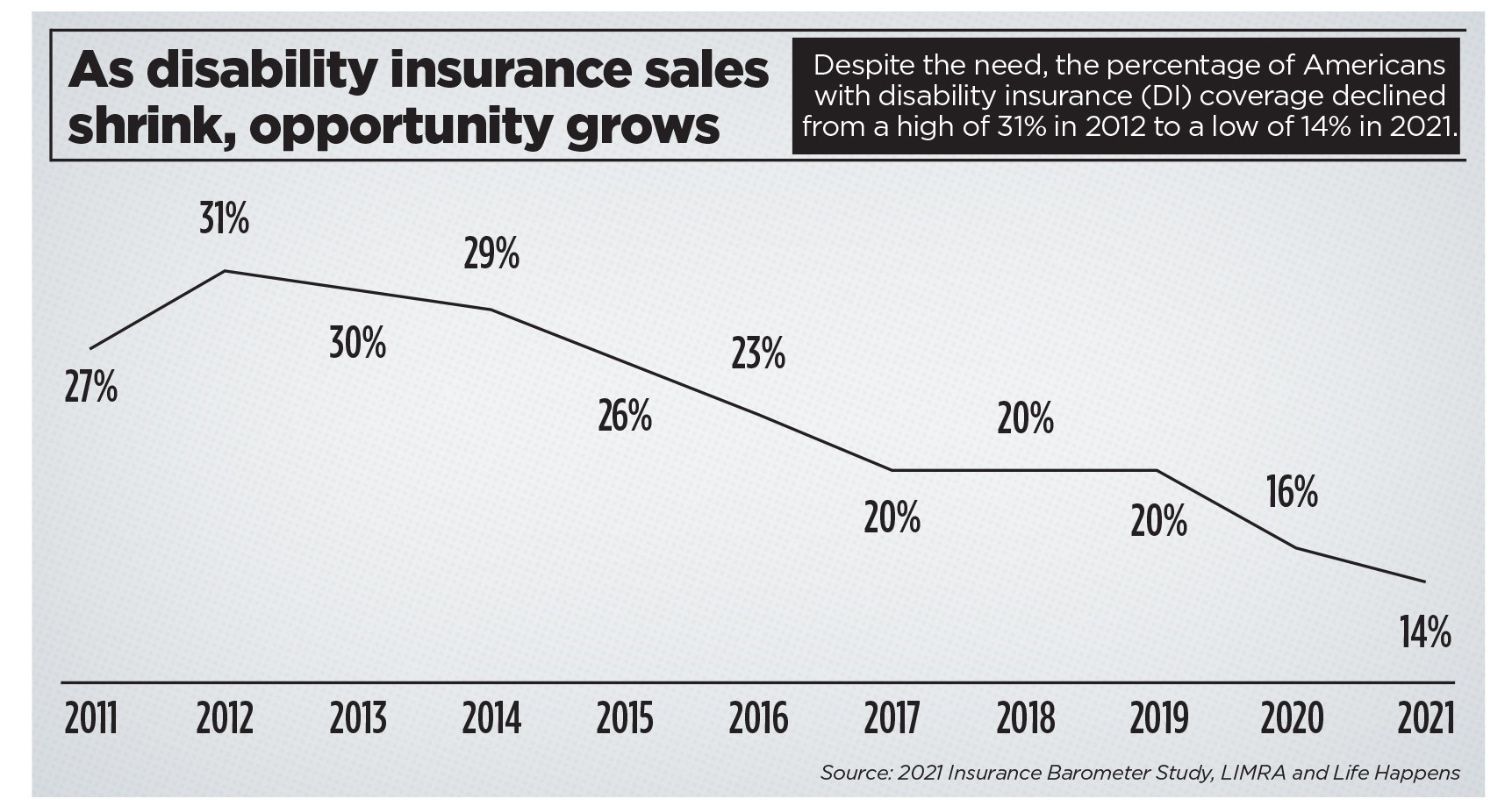

When compared to life insurance, disability insurance is a massively undersold product, even though statistics should suggest otherwise. Here’s what brokers and advisors who may be interested in adding this relatively untapped product to their arsenal need to know about its cost.

According to LIMRA, 52% of Americans own life insurance, compared to only 14% who own disability insurance.

Yet the Social Security Administration estimates today’s 20-year-olds have a 1 in 4 chance of becoming disabled during their career. Comparatively, a 25-year-old man has a 1 in 6 chance of dying before retirement, while that chance is 1 in 9 for a 25-year-old woman.

Moreover, 48% of mortgage foreclosures are due to disability, compared to only 3% due to death.

With only 14% of Americans owning disability insurance, DI presents a big opportunity for insurance agents.

There are some challenges in selling the product. Chief among those challenges is a complicated and lengthy application and underwriting process. This challenge is being addressed by insurtechs that have brought the process online and use predictive analytics to expedite underwriting.

Another challenge is a lack of awareness and knowledge about the product. A Consumer Federation survey found that only 13% of employees know “a lot” about disability insurance, compared to 52% who know “nothing at all.”

Another survey found 38% of millennials are not very familiar with either long-term or short-term disability insurance. Considering their chances of facing disability, this is concerning. With this disability insurance knowledge gap in mind, let’s focus on the cost of disability insurance so that agents, advisors and brokers can have the most up-to-date pricing data when their clients ask for it.

The cost of DI

When talking about the cost of disability insurance, the general rule of thumb is that either type (long term or short term) will have an annual premium cost between 1% and 4% of a policyholder’s annual income.

Another rule to follow is that policyholders should expect to pay between 2% and 6% of their monthly benefit amount in premium.

While those are generalizations about the cost of disability insurance, Breeze recently put together a report on disability insurance pricing. We analyzed all of our long-term disability insurance quote data from the past two full years to provide the average cost of long-term disability insurance by age, gender, occupation and state.

According to the report, the average annual disability insurance cost in 2021 was $1,297, which breaks down to $108.11 in monthly premium. In 2020, this annual figure was $1,084, or $90.33 monthly.

Although that does represent a year-over-year increase in the price for long-term disability insurance, it’s important to note consumers were looking for a much larger benefit in 2021 compared with 2020.

In 2020, the average monthly disability insurance benefit, according to our data, was $2,561. This figure surged 23% in 2021 to $3,151. It’s possible the COVID-19 pandemic encouraged consumers to seek a larger financial security net by way of a larger disability insurance benefit.

By age, there were significant differences in the annual long-term disability insurance cost. For the 18-24 age group, the annual premium cost in 2021 was $451. For those between 25 and 34, it was $863, while it was $1,354 for those ages 35 to 44.

For the 45-54 age group, the average annual cost was $1,800, while it was $1,642 for those ages 55 to 64.

There’s a significant financial advantage to taking out disability insurance at a younger age, which is something to note with clients.

Also, the average annual premium cost for women ($1,352) was higher than for men ($1,117), which falls in line with historical data that shows more women than men suffer disabilities that impact their careers.

When it comes to occupation, physicians ($3,027) and dentists ($2,460) had the highest annual premium figures, while drivers ($509) and customer service professionals ($619) had the lowest.

Factors impacting disability insurance cost

Many factors can impact the price of disability insurance, so it’s important to have this information handy for inquiring clients. Like all insurance prices, the price of disability insurance is tied to risk.

In terms of physical factors, the healthier a client is, the less they likely will pay. A nonsmoking 25-year-old with no negative health history will likely pay a lower rate than a 45-year-old smoker who has undergone multiple medical procedures.

When it comes to occupational factors, income and occupation will come into play. The higher their income, the more a client will likely pay, because the benefit will have to be bigger. The riskier the occupation, the higher premium one might pay. A roofer has a much greater chance of getting injured than an accountant does.

Policy details also will have an impact on the cost of disability insurance. Selecting a longer benefit period likely will increase the premium, as will selecting a shorter waiting period. And last, selecting a larger benefit amount will also probably raise the premium rate for disability insurance.

Disability insurance is a great opportunity for insurance agents, advisors and brokers, but client education remains a hurdle. Keeping your clients informed on what they might pay for disability insurance will go a long way toward producing policies.

Three things advisors want recruiters to know

On a journey to understand the changing financial landscape

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

- National Health Insurance Service Ilsan Hospital Describes Findings in Gastric Cancer (Incidence and risk factors for symptomatic gallstone disease after gastrectomy for gastric cancer: a nationwide population-based study): Oncology – Gastric Cancer

- Reports from Stanford University School of Medicine Highlight Recent Findings in Mental Health Diseases and Conditions (PERSPECTIVE: Self-Funded Group Health Plans: A Public Mental Health Threat to Employees?): Mental Health Diseases and Conditions

More Health/Employee Benefits NewsLife Insurance News