The surge continues – annuity sales up 11% in Q3, 21% for the year

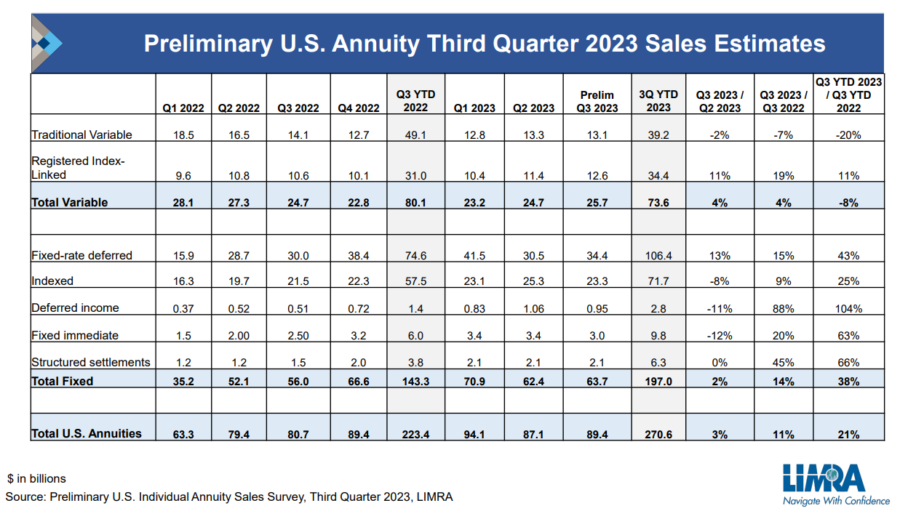

As recently as 2021, full-year annuity sales totaled $255 billion – and it was a great year. Through three quarters of 2023, total annuity sales are up 21% to $270.6 billion.

Third-quarter annuity sales increased 11% year-over-year to $89.4 billion, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey. LIMRA analysts credit continued favorable economic conditions for the annuity sales burst.

“Equity markets rebounding in 2023 combined with a strong increase in interest rates has allowed insurance companies to add additional value in their annuity offerings to investors,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “LIMRA expects 2023 sales will surpass the record sales set in 2022.”

2022 total annuity sales hit $313 billion.

RILA sales hit a new quarterly record, totaling $12.6 billion in the third quarter of 2023, up 19% from the prior year. Through the third quarter of 2023, RILA sales were $34.4 billion, 11% higher than the same period in 2022. LIMRA is predicting RILA sales to have another record-breaking year in 2023, likely increasing at least 10%.

“Investors still seem focused on the value of protection and growth potential that RILAs offer,” Giesing said.

Fixed indexed annuity (FIA) sales were $23.3 billion in the third quarter, up 9% from the prior year’s results. Year-to-date (YTD), FIA sales increased 25% to $71.7 billion.

Income annuities rise with interest rates

Income annuity products have benefited from continued rising interest rates. Single premium immediate annuity (SPIA) sales were $3 billion in the third quarter, 20% higher than the prior year’s results. In the first nine months of 2023, SPIA sales jumped 63% to $9.8 billion.

Deferred income annuity (DIA) sales were $950 million, increasing 88% from sales in the third quarter 2022. In the first nine months of the year, DIA sales jumped 104% to $2.8 billion.

“Income annuities will hit record levels in 2023, with sales in this category expected to exceed $16 billion for the year,” Giesing said.

Fixed-rate deferred (FRD) annuity sales were $34.4 billion in the third quarter, a 13% increase from prior quarter and 15% higher than third quarter 2022 results. YTD, FRD sales totaled $106.4 billion, up 43%.

“While the average FRD annuity crediting rates continue to outperform CD rates, the gap has diminished. Investors — feeling more confident in the economy — are shifting to RILAs and FIAs seeking the potential for greater returns,” said Giesing. “That said, with a significant amount in FRD contracts coming out of surrender this year, LIMRA expects a portion of those assets to be reinvested in FRD products driving total FRD sales to another record year."

VA sales down

Traditional variable annuity (VA) sales remain far below the results from the prior year. Traditional VA sales were $13.1 billion in the third quarter, down 7% from third quarter 2022 results. YTD, traditional annuity sales totaled $39.2 billion, falling 20% compared with the same period in 2022. While economic conditions are improving for traditional VA products, with the slow start to the year, LIMRA is forecasting sales growth in this category to be down in 2023.

Preliminary third quarter 2023 annuity industry estimates are based on monthly reporting, representing 83% of the total market. A summary of the results can be found in LIMRA’s Fact Tank.

Third quarter 2023 top 20 rankings of total, variable and fixed annuity writers will be available in mid-November, LIMRA said, following the last of the earnings calls for the participating carriers.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

PIABA continues effort to prevent erasure of consumer complaints

‘Excess mortality’ continuing surge causes concerns

Advisor News

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News