The ‘perfect storm’ driving annuity sales momentum

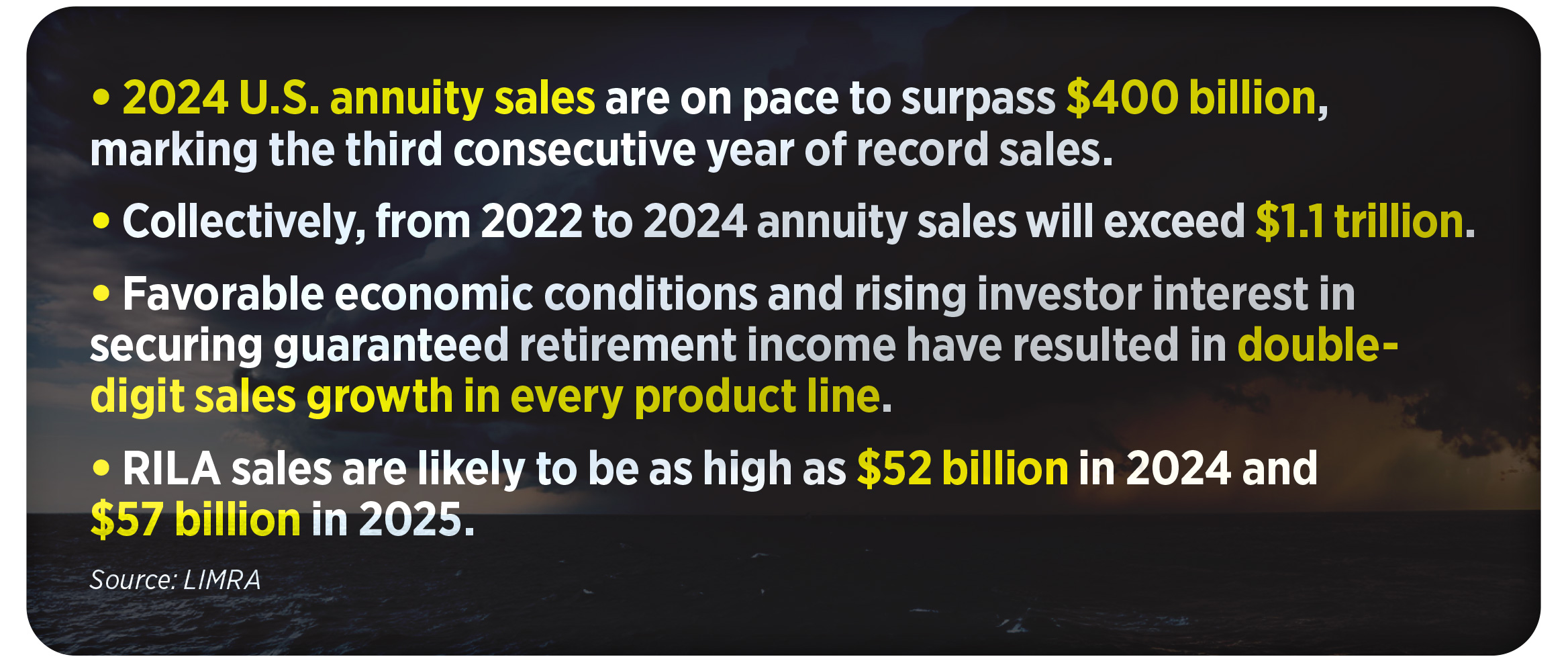

Annuity sales are on track to a third consecutive year of record sales. What’s driving that momentum, and how does the annuity market build it? Two LIMRA executives looked at the factors behind the annuity wave during a recent LinkedIn Live event.

“An interesting intersection where things have lined up perfectly over the last three years,” is how Keith Golembiewski, assistant vice president and director of LIMRA annuity research, described the current annuity sales environment.

Higher interest rates, volatility in the equity markets and a growing number of Americans approaching age 65 are among the factors that converged to create “this sort of perfect combination for annuity sales and the momentum we see behind them,” he said.

A “perfect storm” has led to a skyrocketing demand for annuities, Golembiewski said.

“Coming out of COVID-19, this is not your normal economic environment,” he said. “We have different dynamics happening, whether it’s inflation, the job market, the equity market, volatility, unemployment. There are a lot of things happening that I think have led to the need and the demand for the products that we offer.”

The prospect of the Federal Reserve cutting interest rates in the fall was one motivator for consumers to invest in annuities in the first half of the year, Golembiewski said.

“I think what we’re seeing is a lot of advisors and consumers saying, ‘Hey, you know what? I’m anticipating a rate cut coming. Let me go ahead and get maybe one of these, lock in to something at a higher interest rate,” he said.

Looming interest rate cuts open a door for financial professionals to have the annuity conversation with clients.

“Nobody has a crystal ball,” he said. “But it might be a fantastic time to lock in some of these annuity rates because we don’t know where rates will go.”

A look at products

Golembiewski broke down the annuity sales numbers and projections by product.

» Fixed indexed annuities. FIAs hit another record in 2024, with nearly $60 billion in sales in the first half of the year. Golembiewski said interest rates are making FIAs “competitive and marketable.”

“The levels of participation rates in caps and, of course, some of the income features and solutions, continue to resonate. FIAs are definitely on a strong path for another record year.”

» Fixed-rate deferred annuities. FRD sales slowed a bit, but they are still a competitive product, Golembiewski said, especially in light of the Fed’s keeping interest rates high through midyear.

“If you compare a three-year or five-year FRD product with a bank CD — there’s about a 200 basis point difference between the annuity and the bank CD. They’re very competitive — especially for a lot of money that’s on the sidelines, maybe in liquid products such as CDs or money market accounts or even savings accounts. So we predict FRD annuities will continue to sell and have strong sales through the remainder of the year.”

He noted that fixed-rate annuities began to take off two to three years ago as high interest rates and market fears led consumers to see annuities as a safe choice.

“Now we’re seeing some of those contracts are coming out of the surrender period next year, and it will be interesting to see where that money goes. Will it go into another fixed product, or will it go into something that takes on a little more risk?”

» Variable annuities. VA sales had been in decline over the past decade but picked up in the past two quarters, which Golembiewski said could indicate that VAs “finally hit the bottom” and are back on the rise.

“There’s clearly a need for a product like the traditional variable annuity, whether it’s access to tax deferral or the various investments,” he said. “And I think there might be a renewed focus on having some of those living benefit guarantees, guaranteed income. In addition, there’s a continued focus on the fee-based market. Now we have products that can support the RIA channel.

The equity market remains strong even with recent volatility, and that makes it a good environment to choose a VA, Golembiewski said. “VAs typically do fairly well in more bullish markets. I think if you throw in some of these guarantees that some of the manufacturers are offering, and then with some of the distribution growth, I think they reached the bottom, and now this could be a more slow-growing product. I don’t think it’s going to grow as much as we see on the FIA side or the registered index linked annuity side, but it is something that we are seeing some demand for.”

» Registered index linked annuities. RILA sales “are a big story here,” said Bryan Hodgens, senior vice president and head of LIMRA research, with record sales every year since their introduction.

Product innovation and the number of carriers entering the RILA space are two factors behind RILA sales growth, Golembiewski said. “I think the third element is getting advisors and firms more comfortable with this product.”

He predicted that the industry will launch RILAs with longer terms — six or seven years. Various custom indices within RILAs make the product easier for clients to understand, he said.

“This product will continue to grow even with interest rates coming down or if the equity market continues to be volatile. This is where a RILA really shines. This is where we will see strong growth, not just for the remainder of this year but over the next few years.”

Annuity sales coming from ‘new money’

A “good chunk” of the $1.1 trillion in annuity sales over the past three years was “new money,” or money that had not been invested in annuities previously, Golembiewski said, and he expects that trend to continue.

“I think that in 2025 through 2027, a lot of money will come out of CDs, and it gives the financial professional another chance to sit down with their clients and ask them if they have any changing needs. Are there certain things that we need to focus on now?

Maybe its income versus preservation or protection. Maybe it’s growth. I think from the risk/reward spectrum, the industry has a lot of products that can meet various needs.”

More consumers in the ‘sweet spot’ for annuities

The U.S. population hit the “Peak 65 Zone” in 2024, with the largest surge of Americans hitting age 65 in history. More than 4.1 million people will mark their 65th birthday each year through 2027.

Peak 65 is another tailwind for the annuity industry, Golembiewski said.

“There are a lot of individuals who are in that sweet spot — those between 55 and 65 years old — who need protection and guaranteed income. These are things that resonate with that age group and should be a tailwind to help the industry over the next three to five years.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Talking about it: Industry voices on retirement income

The evolution of indexed products

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- WA lawmakers push to expand mental health insurance coverage

- Researchers’ from Huntsman Cancer Institute Report Details of New Studies and Findings in the Area of Cancer [Adaptation, Feasibility, and Acceptability of a Health Insurance Literacy Intervention for Caregivers of Pediatric Cancer Patients …]: Cancer

- State-by-state report by Dems projects millions could lose Medicaid coverage

- CT bill would prohibit AI use by health insurers

- Evil stalks the land

More Health/Employee Benefits NewsLife Insurance News