The man with the $50B plan — With Eugene Mitchell

In 1957, Cirilo McSween became New York Life’s first Black insurance agent, earning his way into the Million Dollar Round Table his first year in the business and blazing a trail for numerous Black agents to follow.

More than a half-century later, Eugene Mitchell, corporate vice president and African American market manager at New York Life, developed and initiated the $50 Billion Community Empowerment Plan. The $50 Billion Plan is an initiative to accumulate $50 billion of in-force life insurance in the African American community. By the middle of 2017, six years after announcing the initiative, Mitchell and his team crossed that $50 billion mark. The vision behind the plan was that 200,000 families with $250,000 of life insurance will create $50 billion of protection and tax-free future income.

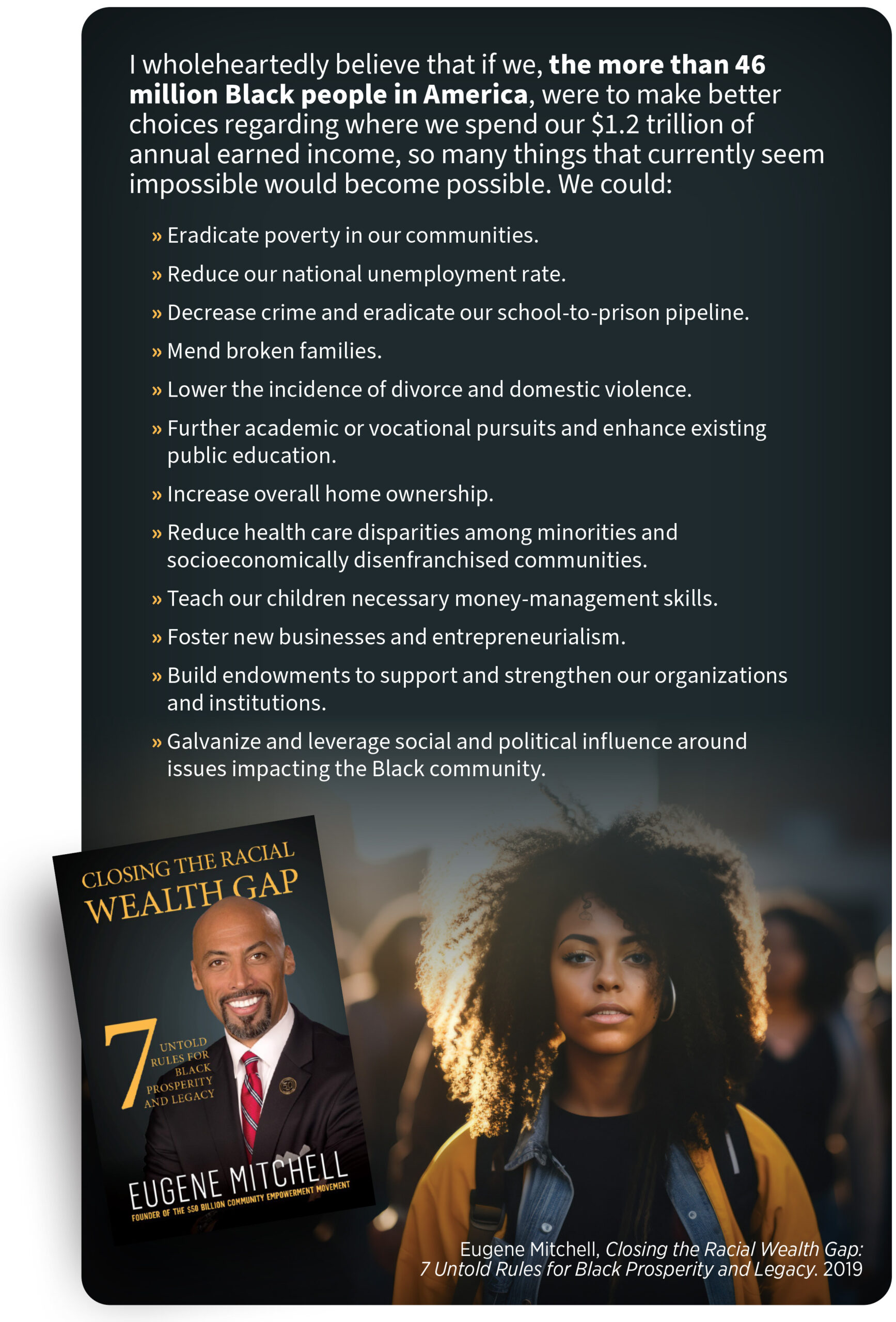

Today, Mitchell is president and CEO of E. Mitchell Enterprises, a financial consulting and services firm. He also is the author of Closing the Racial Wealth Gap: 7 Untold Rules for Black Prosperity and Legacy.

Mitchell first became aware of the need for creating wealth in the Black community when he was a young man with a newly earned associate degree and working at a correctional facility in Florida while figuring out what to do with the rest of his life.

“As I looked out at this majority Black and Brown inmate population, I started asking myself why it is this way here in America,” he said. “People usually say it’s because of crime or drugs or non-nuclear households. But I thought those were symptoms of a deeper-rooted problem, which is about economics. Had these gentlemen been set up with a college savings plan, their path in life would have been different. I totally believe that if they had been given the down payment for a home or startup capital for a business, they would not be in prison.”

Mitchell said that his work in the corrections system led him to his life’s purpose: to help Black Americans create wealth and improve their economic status. He earned a bachelor’s degree in finance from Florida International University and went on to earn an MBA from New York University.

After graduating from NYU, Mitchell was an intern at a technology company in California, right before the tech bubble burst in 2001. With a career in tech looking less attractive, Mitchell returned to New York, where a friend suggested he look into New York Life’s leadership development program.

Marketing to Black Americans

New York Life’s cultural marketing group has spent the past 25 years targeting consumers in the country’s Chinese, Vietnamese, Korean, Hispanic and Indian markets. But Mitchell said that when he began his career at New York Life, there was little to no outreach to Black Americans. He set out to change that.

“There’s a belief that Black people don’t want to buy life insurance, or they buy only small policies to cover their burial expenses,” he said. “Their policies often lapse, and the agents who sell them often don’t make it. So, carriers determine they don’t see the value or purpose in creating resources for agents to serve the Black community.”

Mitchell began to write a business plan for serving the African American market and eventually created an African American market within New York Life’s cultural marketing group. In the 17 years since that market was created, the Black agent force in that market has grown from 500 to 1,500.

Changing the conversation

One reason behind creating the $50 Billion Plan in 2011, Mitchell said, was “to change the conversation about life insurance.”

“So many Black Americans think of life insurance only as a way to pay for burial,” he said. “There’s a whole missed opportunity out there in telling people about the potential of using life insurance as a tool to create wealth, to protect income, to provide living benefits and to create a legacy for the future.”

Mitchell eventually left New York Life to write his book and create his own consulting business. He continues to speak and write about the impact that life insurance has on the Black community and why the industry must better serve that market.

There are two challenges in serving this market: Reaching more Black consumers, and recruiting and retaining more Black advisors. Attracting more Black advisors into the industry would go a long way in spreading the life insurance message to Black consumers, Mitchell said.

“My focus is on what we can do to recruit, train, develop and retain more Black agents in this business, because they’re on the ground and they will spread that message,” he said. “But I ask, how many Black agents have a $1 million policy on themselves? If not, why not? Most of us have never inherited anything, so it’s still just a concept for many Black agents. It’s about getting them to be the messengers in this.”

Playing catch-up

Mitchell said the Black community has some catching up to do with other ethnic groups in the U.S. in terms of buying large amounts of life insurance coverage. “During my time working in the cultural markets group, I saw other families – Asian, Spanish, Jewish – who understood the power and the potential of life insurance and took out sizable policies to pass something to their children,” he said.

During his time working with New York Life’s African American market, Mitchell said, he spent much of his time trying to understand the agents who worked in that market, as well as working in marketing and advertising to the market.

“I went to the advertising department, I went to underwriting, I went to legal, I went to marketing, I looked at all the messaging,” he said. “Then I looked at the distribution side and agent recruitment. Initially, I was trying to understand the company’s positioning and messaging. Then as I started working with agents, we talked about community engagement.”

Mitchell helped agents conduct workshops in Black churches and do outreach among Black labor unions and other organizations and institutions in the Black community. He also spearheaded efforts to recruit students from historically Black colleges and universities into the industry.

“We had, and still have, the belief that if every Black family in America who could afford it had a life insurance policy, we could close the racial wealth gap in one generation,” he said. “We could create generational wealth and eradicate GoFundMe as a way of paying to bury folks. We were getting the message in front of pastors, in front of educators, in front of everyone who needed to hear the message.”

The story continues

With the $50 Billion Plan hitting its goal, the story continues, as about $1 billion in death claims have been paid out since 2011. Mitchell shared several examples of how Black families and individuals benefited from the coverage they put in place.

» A nurse from Philadelphia originally wanted to buy $100,000 in coverage but eventually bought a $1 million policy. When she died four years later, the death benefit was split between her mother and her daughter. The daughter is using those funds to attend medical school.

» The widow of a tech company owner received a $1 million death benefit that will enable her to keep her late husband’s company going after his death.

» Three members of one family died from COVID-19, and their death benefits paid off the mortgage on their home as well as supported the children left behind.

» Living benefits enabled a cancer patient to pay for treatment and living expenses since she was unable to work because of her illness.

Mitchell said his goal is to see $1 trillion of coverage in force in the Black community in the next 10 years.

“We’re trying to spread this on a larger scale across the industry now and inviting other companies to join with us, helping people set up secure futures,” he said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Grit: Embracing the daily grind in pursuit of your goals

Helping high net worth clients sleep at night

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Researchers’ from Huntsman Cancer Institute Report Details of New Studies and Findings in the Area of Cancer [Adaptation, Feasibility, and Acceptability of a Health Insurance Literacy Intervention for Caregivers of Pediatric Cancer Patients …]: Cancer

- State-by-state report by Dems projects millions could lose Medicaid coverage

- CT bill would prohibit AI use by health insurers

- Evil stalks the land

- Idaho House approves Medicaid reform bill

More Health/Employee Benefits NewsLife Insurance News