The insurance industry’s best-kept $5B secret — With TruStage’s Terrance Williams

The name “TruStage,” said its president and CEO, Terrance Williams, “is meant to represent trust at every life stage. If that’s our brand and what it means to be TruStage, we’ve got to live up to that by ensuring that we are catering to these individual consumers at all their various life stages.”

TruStage distributes its products through credit union partners. As an example, Williams said, “65% or so of our $5 billion in revenue is distributed through the credit union system. We reach an agreement, a partnership, with a credit union, and then that allows us to market to their end members. The remaining 35% or so of our revenue is driven by partnerships. We distribute through partners like Ethos.com.”

“We are the best-kept secret when it comes to $5 billion companies in the country,” he continued, “and some of that is because of our go-to-market approach. We are a B2B2C company. We are not a company that you’re going to hear about during an NBA basketball game. You’re not going to see a TruStage commercial or an ad. Because our focus is getting to that middle-market consumer through a partner.”

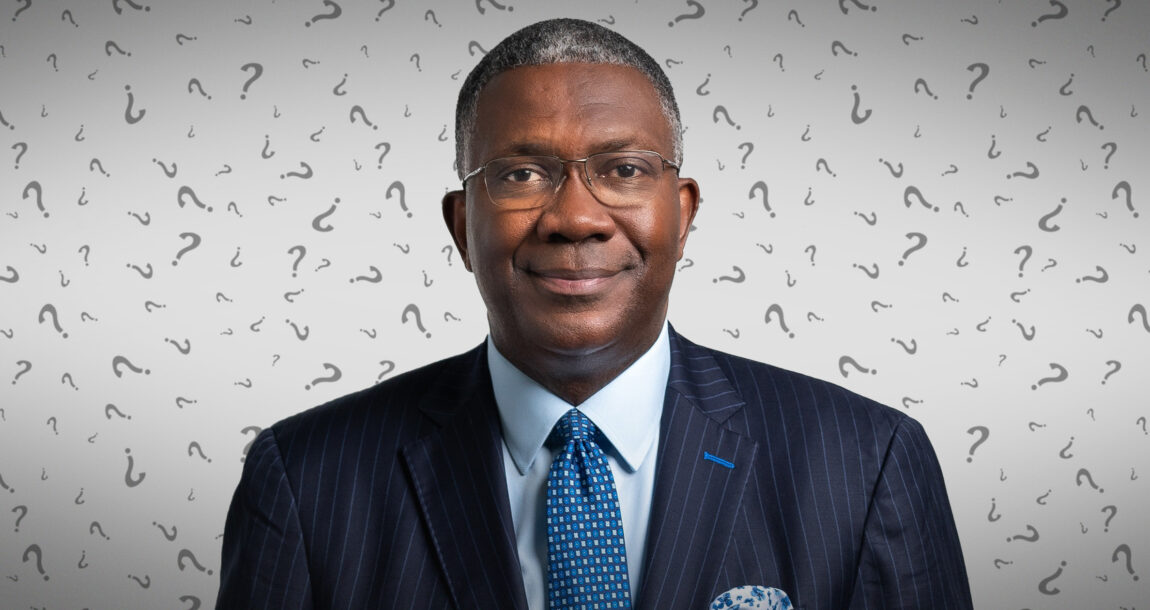

In this interview with publisher Paul Feldman, Williams discusses TruStage’s approach to the middle market.

Paul Feldman: You started as CEO of TruStage in October after joining the company in June 2023. You’ve had an impressive career. Tell me a little bit about how you got into the industry and a little bit about where you were before joining TruStage.

Terrance Williams: My path to the insurance industry is somewhat unique. Most people fall into the insurance business. But that’s not true for me. Through the influence of some family members, I actually planned to pursue a career in insurance. When I was looking for a college, I sought out a school that had a risk and insurance program, which again was not the norm, particularly back in the 1980s. But that’s what I did.

My career path took me to Nationwide and Allstate. I’ve lived all over the United States. I worked for a small regional right out of college, so four companies, but about 10 different moves during that time. Those moves afforded me the opportunity to work in all aspects of the insurance business — product underwriting, sales, various general management roles. All this allowed me to have a holistic view of the industry and of the business.

Feldman: You said your career started out in some part due to the influence of family members. Tell me about that.

Williams: I had an aunt who had a significant influence on exposing me to the industry. She went on to become an executive at a well-known, publicly traded insurance company based in New York and spent 30-plus years with them. During the summer months, my mom’s side of the family would often return to South Carolina, where I grew up.

Often during those visits, I would hear her perspective about her career, about the various aspects of insurance and, more importantly, the societal impact that insurance can have, particularly on communities that haven’t had access around wealth building and some of the benefits that insurance can bring to the table. As a 17-year-old, I was exposed to that, which again is unique. That sparked my interest in insurance, why it matters and how I wanted to be part of that industry.

Feldman: Now that you’ve had a little bit of time in your new role as president and CEO, how’s it going?

Williams: Things are going very well. As you might imagine, one of the natural instincts when you join an organization is to take a step back to listen, to observe, to learn, to understand. I spent the first six months or so doing just that, understanding the organization as a whole. I also spent considerable time out in the marketplace — meeting credit union CEOs, meeting our employees, meeting partners — to begin to craft a framework for understanding our strengths. What are we good at that’s not easily repeated? What are the opportunities for us? What are the headwinds that we may face? Through that work, the leadership team and I crafted a long-term vision for the company and a road map that we are now following so that we can maintain relevance.

I talk a lot about the importance of relevance within an organization. Especially considering a company that has been around for 90-plus years, I believe it’s necessary that you maintain the essence of who you are as a company. But yet you find ways to evolve and to recommit yourself to your end consumer, your end member, realizing that your members’ expectations have changed dramatically over the last five, 10, 20 years.

Feldman: To follow up on that point a little bit, we’ve been doing some reporting on the direct-to-consumer aspect of the business, companies such as Lemonade and Ethos. They’re not doing quite as well as I think everybody expected — maybe because the human factor is missing. I think we are finding that you need a human voice in the process to help a consumer understand what life insurance means. How are you finding that?

Williams: I would agree with that. My belief is that we must find ways to create broad access. Broad access, in essence, means that you meet the consumer where they are. In some instances, that means a completely digital experience. In some instances, that means being able to call someone on the phone, and perhaps in some other instances that may mean walking into a credit union branch to take care of your needs. But what’s most important is to be able to create an omni-like approach and to meet that customer wherever they are.

As you point out, some of the solutions that we sell are not as easily understood, which means you must continuously find ways to create a simple approach to your products. But you also must find ways to make sure that you create that access to meet the customer.

I have a 23-year-old son. All his life efforts are done on his phone. If we wish to cater to my 23-year-old son, we must ensure that there is a crisp digital journey that allows him to engage in a manner that he feels best engaging in. Also, we do business with 94% of the credit unions in the United States. Our credit union members, whether they prefer face-to-face interaction or engaging with a piece of direct mail or calling a phone number, we want to cater to them in that way. Again, meeting the member where they are.

Feldman: TruStage is a mutual company. Talk a bit about the advantages and challenges of selling insurance products as a mutual company.

Williams: I view it as more of an asset than a liability. I’ve spent time at a mutual organization as well as a publicly traded company, and there are advantages to both. However, my experience has led me to believe being a mutual company allows you to take a long-term view of the end consumer. Recognizing that there are times when you’re making an investment that will yield longer-term benefits. Realizing that perhaps you won’t see some of those benefits for the first 24 to 36 months. But being able to take that long-term view, I believe, is an advantage.

Now how you strike the best of both worlds, in my opinion, is when you maintain the executional excellence, the financial discipline, that some would associate with public companies, but yet you have that mutual structure that allows you that long-term view. Having spent time in both types of organizations, our goal is to blend the best of both worlds.

Feldman: ZoneChoice is an interesting concept for your flagship annuity line. What is unique about ZoneChoice?

Williams: ZoneChoice is a flagship in that it gives the end consumer the opportunity to select and choose the types of investments based on their comfort level around returns. Because we know that many of our consumers — middle-market consumers — are those who may not have the investable assets to be able to absorb a certain loss or a life-changing event. So we believe we should create solutions that allow those consumers to get into this space to prepare for the future, while also giving them options that meet their comfort level with gains or losses overall — recognizing that everyone comes to the table at a different starting point and with a different level of comfort as it relates to investment.

Feldman: I noticed the company lists its annuities under an investments tab on the TruStage website. Talk about how you view annuities as an investment in retirement.

Williams: When you’re introducing the concepts of wealth building and long-term planning to some consumers who aren’t historically engaged in that, I believe that annuities are a sound entry foray into helping them to prepare for the future through an investment product. It’s not only about what we call our historical investment products. I believe that a life insurance product is just as important a part of your portfolio as an investment product or an annuity product.

So many middle-market consumers and households are devastated in the event of the loss of a primary breadwinner. A $50,000 life insurance policy, or even a $25,000 life insurance policy, can make the world of a difference for that household. We sell tons of those policies, realizing that sometimes these customers don’t even have access to policies at those levels because some carriers have opted to only play in the higher face amounts place.

Feldman: I’ve heard from a lot of different IMOs, FMOs that the upcoming Department of Labor fiduciary rule will limit financial services to lower-and middle-income people. Are you concerned about that?

Williams: The short answer to your question is, I believe that many of our target consumers would be adversely impacted due to this potential rule change that’s coming down the pipeline right now. Because in my view, it will create less access as opposed to more access. One of the things we solve for is creating access for this consumer who may not have the ability to invest or may not have the investable assets that some firms cater to. I’m concerned that these rules could have a negative consequence for that access piece.

It’s something we’re having a lot of dialogue about. The goal here is to ensure that we are providing a perspective as an industry expert and to ensure that we are trying to paint that picture of what the unintended consequences could look like as far as the impact on consumers. It’s a very fair question and one that we’re concerned about.

Feldman: Tell me where you see the life insurance industry going — where are the opportunities that you’re leveraging and that you’re moving toward?

Williams: We have this unique advantage that others don’t have in that we have access to 94% of the credit unions in the United States. This means we have access to millions of members who trust their credit union. We have a distribution methodology that allows us to cater to these members that is in alignment with their credit unions. I think that’s unique.

Where is it going? You asked specifically about life insurance, but I could make this answer about any of our solutions. I believe that we must continue to help the credit union movement and credit union system evolve. Recognizing that in many credit unions, they still maintain a brick-and-mortar approach where they engage with members in a branch location. Some members want that. But how do we find ways to evolve that model to create and meet the customer, the member, where they are?

I want to be part of the solution with our credit union partners in helping to build that digital journey, allowing us to meet members in a different way. Also, I believe that you’ll continue to see innovation and advancements in underwriting from a life standpoint. I wear a ring on my finger that not only represents my commitment to my wife of 28 years, but it also measures my steps, my heart rate and a number of other health-related items for me. The data that my ring collects is incredibly valuable to be able to underwrite me as a life insurance customer. I believe that wearables, technology and artificial intelligence will continue to advance our ability to get crafty and specific on how we go about underwriting consumers of the future.

Feldman: There are a lot of direct response components that I assume go into communicating with those credit union customers and your other customers. What have you learned from that?

Williams: It’s interesting because what we see is that our experience with our credit union members differs from the other 35% of our book of business in a positive way. We see stronger persistency. We see credit union members who are simply more loyal to the products that they acquire through us. I believe it’s due to this connection through the credit union to these end members. It drives a different outcome that the data clearly tells me is an advantage for us. These members tend to be more loyal, more engaged and more committed.

I’ll give you an example. I can send out two pieces of direct mail to a credit union member. I can send something out that’s branded solely TruStage and something that’s co-branded. If I put the credit union logo on it and my logo on it, it’s not even close. By far, direct mail that includes the credit union logo does significantly better. There’s this loyalty, this commitment from these credit union members that I believe is a unique advantage for us as well.

Feldman: TruStage is a big brand in the insurance industry, but not a lot of people are familiar with the brand.

Williams: It’s interesting. I would say that we are the best-kept secret when it comes to $5 billion companies in this country. Some of that is because of our go-to-market approach. We are a B2B2C company. We are not a company you’ll see during an NBA basketball game. You’re not going to see a TruStage commercial or an ad. Because our focus is getting to that middle market consumer through a partner. Now, once they become a policyholder for us, I believe that should change how we engage with them. This is somewhat new for us. This is our focus now.

We have 39 million relationships across the country. That’s the good news. The bad news — for most of those 39 million relationships, it’s one customer, one product. In other words, we historically haven’t thought about that customer through a holistic life cycle approach. Now that’s what we are beginning to do, particularly since the brand name change in May 2023. We were marketing 12 or 13 brands before; now we go to market under one brand.

Feldman: Tell me about those other brands.

Williams: The company went to market under these various brands due to acquisitions, and several other things that have happened over the last decade or so. In many instances, people wouldn’t even recognize that this is all under what was then the CUNA Mutual group umbrella. Now we should cater to an individual consumer to meet their needs throughout. I’ll give you an example. Let’s assume that we sell a $10,000 term life insurance policy to a credit union member. Let’s assume they’re in their 30s. We have data that would allow us to understand perhaps they have a need for auto insurance. Perhaps they have a need for an annuity product.

We need to use the data that we have access to for that individual member and then cater to them based on what they are most likely to buy, personalizing it and ensuring we can cater to them based on the life stage that they are in. Not simply looking at it through this lens of, well, they have a life insurance policy with us, let’s move on to the next customer. We do need to move to the next customer, but we also need to cater to that existing customer.

The TruStage brand is meant to represent trust at every life stage. If that’s our brand and what it means to be TruStage, we must live up to that by ensuring that we cater to these individual consumers at all their various life stages.

Paul Feldman started the website InsuranceNewsNet in 1999, followed by InsuranceNewsNet Magazine in 2008. Paul was a third-generation insurance agent before venturing into the media business. Paul won the 2012 Integrated Marketing Award (IMA) for Lead Gen Initiative for his Truth about Agent Recruiting video and was the runner-up for IMA's Marketer of the Year, a competition that includes consumer and B2B publishing companies. Find out more about Paul at www.paulfeldman.com.

Planning for a full house — With financial advisor Alex Chan

Aging: How to help clients avoid a crisis

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- Florida Blue expands cancer support for Medicare Advantage members

- Data from Stanford University Provide New Insights into Managed Care (The environmental chemical exposome and health insurance: Examining associations and effect modification of epigenetic aging in a representative sample of United States adults): Managed Care

- National Center for HIV Researcher Details Research in Health Insurance (Behavioral Readiness for Daily Oral PrEP in a Diverse Sample of Gay, Bisexual, and Other Men who have Sex with Men Who Have Not Been Offered PrEP by a Provider): Health Insurance

- When health insurance costs more than the mortgage

- Farmers Now Owe a Lot More for Health Insurance

More Health/Employee Benefits NewsLife Insurance News