The fear factor: Consumers and their finances

Concern about finances is a common source of stress in America. LIMRA regularly finds about 1 in 3 Americans feeling highly stressed over their household’s finances, similar only to the prevalence of work-related stress among employed individuals. In an effort to understand the nuances of financial stress, a recent LIMRA survey asked 3,000 consumers to candidly share what, if anything, about their finances “scares” them. Though not a source of high stress in all cases, 7 in 10 adults told us about their greatest financial fears.

The nature of consumers’ financial fears differs in important ways by wealth and circumstance that can’t be ignored. Notwithstanding these differences, most adults are scared about something when it comes to their finances, from the financially strained to those with a comfortable nest egg. Their fears fall into the following broad categories: making ends meet, savings and preparedness, economic stability and the stock market, standard of living, and government policies and decisions.

Making ends meet

Nearly 2 in 5 adults described the day-to-day struggles of “making ends meet” — the most prevalent source of financial fear in America. Survey respondents pointed to the unrelenting impact of inflation and insufficient income, making it difficult to cover essentials, pay debts and sustain their families. For others, the fear centers on depleting one’s savings to meet essential needs.

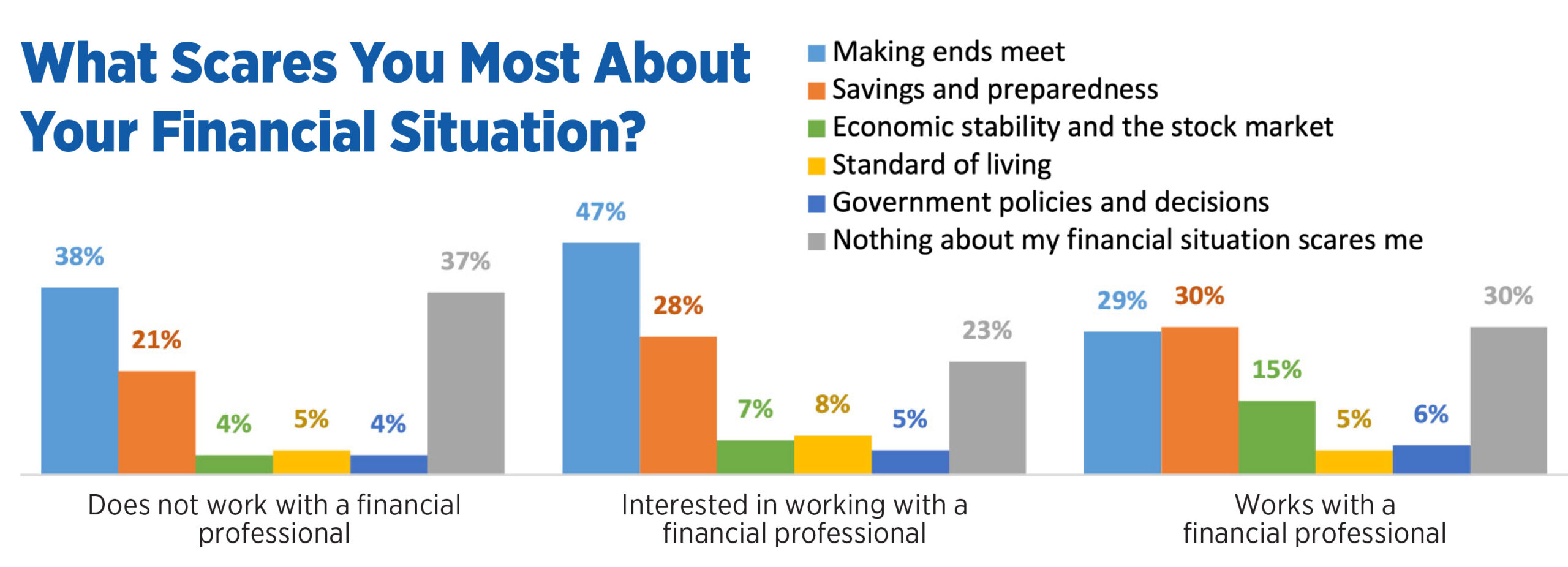

It’s no surprise that these concerns are most pronounced among adults who are grappling with the highest levels of financial stress (67%). A significant portion of those interested in working with a financial professional (47%) also shares these concerns.

Savings and preparedness

The ability to save for the future is a universal concern and a top financial fear for a quarter of adults surveyed, who described being scared about not having adequate savings for expected and unexpected expenses. This fear includes retirement planning — specifically mentioned by 1 in 12 adults — and the need to secure a financial safety net for unforeseen circumstances.

It’s worth noting that consumers’ top-of-mind scariest financial fears do not include worrying about the financial impact of death, mentioned by only 5 of 3,000 respondents. Still, survey respondents who are considering a life insurance purchase in the near future are more likely to have financial stress, to express fears about their finances, and to have concerns about the broader economy. They are also more likely to have higher incomes, trust the financial services industry and already have (some) life insurance.

Economic stability and the stock market

Concerns related to economic stability and market fluctuations were described less often but were present nonetheless. These fears often grow with age and income, affecting individuals who have a significant stake in the financial markets. For the same reason, concerns of this nature were expressed more often by people who currently work with a financial professional (15%) compared with those who are interested in working with a professional (7%) and those who are not interested in working with a professional (4%).

The impact on standard of living

Six percent of consumers described the impact of high interest rates, which affect credit and borrowing as well as their capacity to purchase or maintain homes and vehicles. They also emphasized the strain on managing education costs, high taxes and the overall cost of living, sharing how these factors impede their pursuit of lifestyle goals.

Government policies and decisions

Called out by just 5% of adults, the effect of government decisions on one’s finances is palpable among those who did, encompassing concerns about uncontrolled government spending, dysfunctional politics and geopolitical situations. As people age, these concerns tend to take a more significant role in their financial worries.

Consumers who are interested in working with a financial professional are the most likely to say that something about their financial situation scares them. Faced with an array of consumer financial fears, advisors must be attuned to the nuanced narratives that range from immediate survival concerns to long-term uncertainties. By responding to these diverse fears, financial professionals can offer tailored solutions that provide practical support and foster financial resilience in an ever-changing economic landscape.

Jennifer Douglas is part of a team responsible for implementing and managing processes to ensure the quality of LIMRA’s research program. She may be contacted at [email protected].

Index crediting strategy: Which one is best for your clients?

The science of successful habits

Advisor News

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Ben Franklin's birthday; Meet Mandy Mango; Weekly gun violence brief | Morning Roundup

- Virginia Republicans split over extending health care subsidies

- CareSource spotlights youth mental health

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- Senate report alleges Medicare upcoding by UnitedHealth

More Health/Employee Benefits NewsLife Insurance News