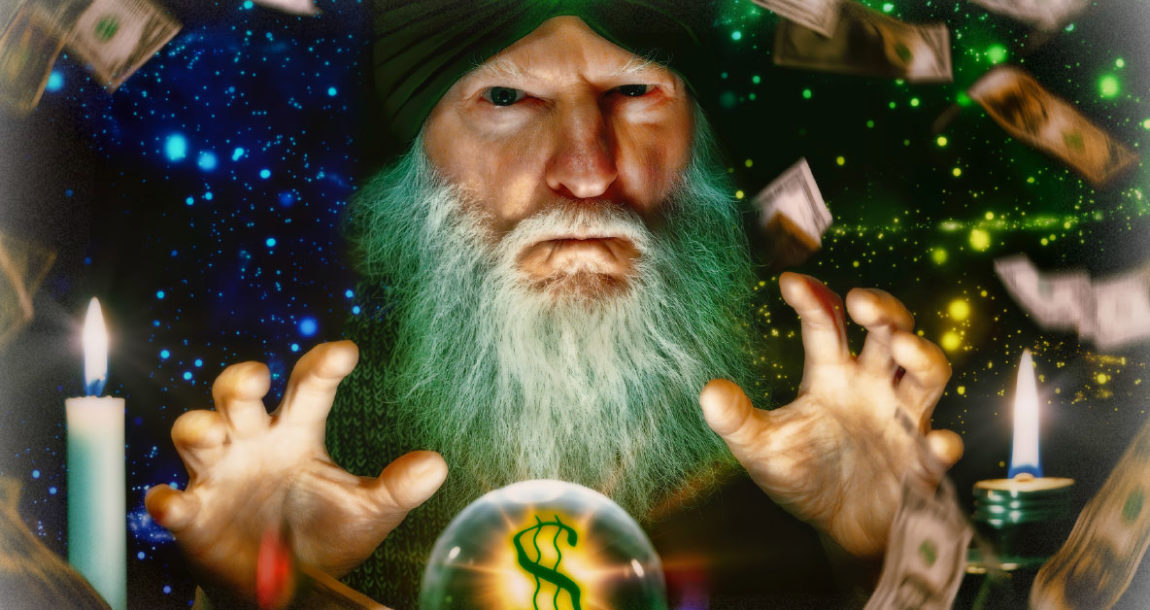

The crystal ball is murky

As you might imagine, Insurance News Net magazine is written a couple of months in advance. As I’m writing this Letter from the Editor, it is late July. What’s interesting is that it has been a long time since there were great questions about what the economic landscape is going to look like a couple of months ahead. Until recently, the country was on a steady economic course, and most economic news was on the upswing.

With gas prices settling a bit but still very high, the war raging in Ukraine, and inflation showing few signs of abating, what things might look like in September is indeed a mystery.

The factors that provide additional disquiet also appear to be gaining steam. For example, during the first half of 2022, the U.S. had three convective storms, each causing more than $1 billion in damage. And the worst storm damage usually arises during hurricane season in the second half of the year, particularly the third quarter. According to Aon’s Global Catastrophe Recap report for the first half of the year: “From a hazard perspective, the fingerprints of climate change continued to become more evident in the individual event behavior and longer-term temperature and precipitation trends in 1H 2022. Warmer than average temperatures were cited across a broad swath of the globe.”

In the U.S., we’ve seen prolonged record-high temperatures in some areas, bringing everything from drought to wildfires. As the damages in the natural disaster sector pile up, we’ve also seen higher costs in other areas of the insurance market. Auto costs — for both new and used cars — have gone up significantly as vital chips have become scarce. In addition, inflation has ballooned the cost of auto parts — and therefore repair costs — and supply chain issues have worsened the overall impact.

Inflation has increased from a four-decade record of more than 8% in the past month to a new record of over 9%. That, along with steep Federal Reserve rate increases to stem the inflation tide and a litany of recent market reactions, has likely brought us onto a path to recession.

Over the past decade as we moved past the 2008 recession, we’ve become accustomed to the predictably strong market and low inflation. Looking out a mere two months or so and not having a good idea of what the economy might look like at that time can shake your sense of calm.

I’ve heard a variety of viewpoints on this unpredictability. Life insurance has taken a more prominent strategic position in the retirement planning arena since the market has become more unpredictable. Many advisors have said the classic 60/40 investment strategy can’t be counted on. The increase in interest rates has piqued new interest in annuities. And the indexed product market continues to grow at warp speed with many new indices — some of them so new, they have very little history to support current performance claims.

Despite the unpredictability, many who have been through such economic storms before say that there is opportunity during this period of financial tumult. One person said you should ignore the day-to-day noise, which will free you up to do what you do best. Most of our conversations about financial investment and insurance revolve around risk and the future. We know there will be down markets and challenges, and the goal is to put a financial strategy in place to provide security and a viable future despite those challenges. Many of the insurance products and investment strategies we put in place serve that end.

This is the time that the lessons of the past are most important — and putting a plan in place for an unpredictable future is what clients most count on the financial services industry for.

Please reach out with your thoughts: [email protected].

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

Not every sale can be a ‘whale’

Policy review: Make sure your clients’ life insurance is still working for them

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News