Tailor A Disability Plan To Your Client’s Needs And Budget

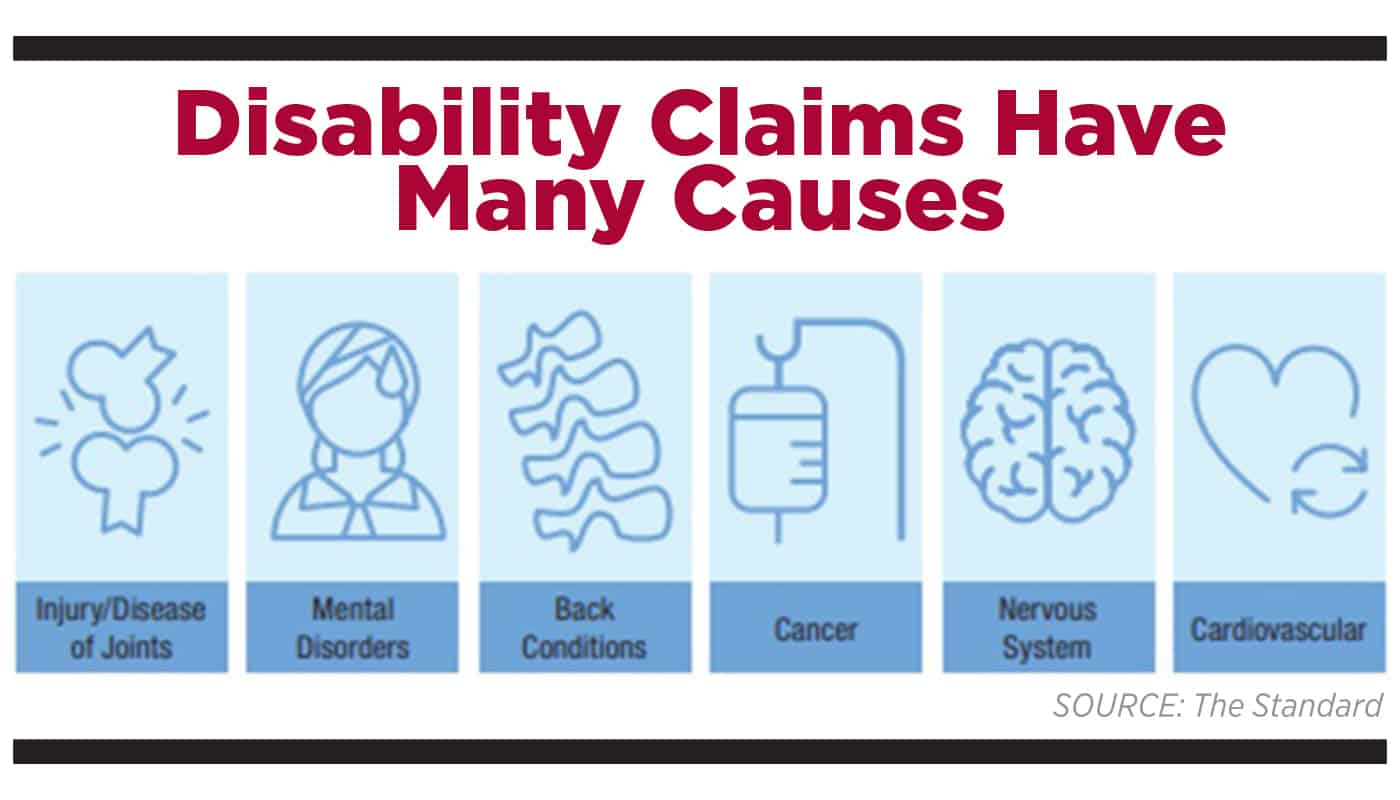

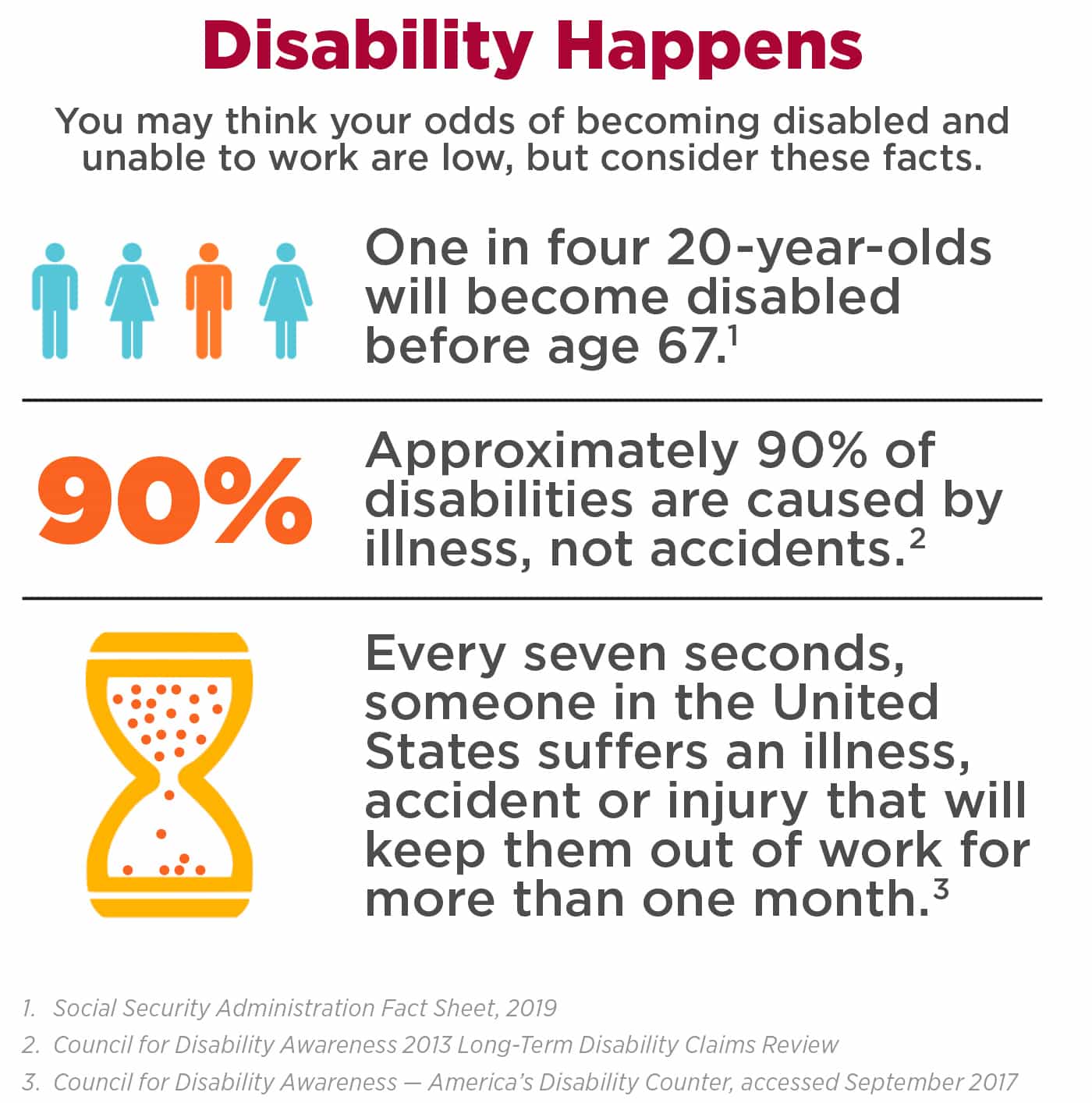

Individual disability insurance, also known as income protection insurance, is a vital part of any financial plan. Your clients may have a plan in place to reach their goals. However, these plans are only as good as clients’ abilities to fund them. What will happen if they get sick or injured and can’t earn their usual income for an extended period of time? And if they have little or no income, how will they continue to fund their plans for the future? Or fund their plans for retirement?

Income protection insurance can provide your clients an extra layer of protection to help cover their bills if they become too sick or injured to work. But it’s not a one-size-fits-all solution.

Today’s income protection insurance products are often flexible, providing tailored coverage to meet your clients’ personal and budget needs.

Some clients might think they’ll be able to rely on their savings to self-fund a break in income.

Or they might believe their employer-provided income protection will be enough. The reality for most is that self-funding, or relying on employer-provided insurance, will leave them without enough income to cover all their expenses. Help them evaluate the protection they have in place and whether it would provide enough money to fund their normal expenses, their financial plan and their retirement if they were unable to work for a year or more.

It’s beneficial to research carriers and products to find a policy to best fit your clients’ unique needs. You’ll find there are many options when it comes to income protection insurance. You can think of these options as levers that can be pulled to increase overall coverage, choose special protections or lower costs as needed. Here are the most common levers you’ll find with an effective and sound income protection insurance policy.

Maximum benefit periods. Clients can choose a maximum benefit period. This is the longest amount of time the carrier will pay benefits. The longer the period chosen, the more expensive the premium will be. Common options include two, five or 10 years or maximum benefit periods that can last until age 65 or 67, ensuring steady income until retirement age even if disabled.

Benefit waiting periods. All income protection insurance policies also have a choice of waiting period. This is the number of days of disability clients would have to wait before they would be eligible to collect disability benefits. The most common options are 90 days and 180 days, but some carriers offer shorter and longer options. Clients with significant savings may want to choose a longer waiting period to save on premiums.

Definition of total disability. Most policies will pay a benefit to insured individuals who have lost all their income because they can’t work due to disability. Some policies also offer an expanded definition that will allow insured individuals to work in another occupation and still receive their full total disability benefit. Highly specialized professionals may find this expanded definition, often called Own Occupation coverage, helpful if they can no longer perform their specialty, but can still work in another capacity or field.

Definition of residual disability. In situations where clients become sick or injured and can’t work full time — or can’t perform all their duties — most policies will offer a residual disability benefit that pays a portion of the basic monthly benefit if the insured individual has lost some — but not all — income.

Some residual riders have a minimum benefit guarantee to pay a certain amount, such as at least half of the monthly benefit, for six months or 12 months. Although a loss of income is usually required for benefits to be payable, some carriers offer an option that requires only a loss of time, duties or income to satisfy the benefit waiting period.

Renewability. Many carriers offer guaranteed renewable policies. This means the carrier can’t change or cancel a policy before the policy’s termination date as long as premiums are paid when due. The carrier can raise premium rates, but not for the first three years, and only if they raise rates for an entire class of policies, which is rare. However, for an additional cost, your client can lock in rates (as long as they don’t purchase more coverage) by opting for a noncancelable policy.

Specialized riders. Clients can add special riders to their policies to cover specific circumstances.

For example, clients with large student loans may gain greater peace of mind with a student loan rider that will reimburse student loan payments if they become totally disabled. Or if clients are concerned about extra costs they could incur if they become catastrophically disabled — such as a disability that leaves them cognitively impaired or needing daily assistance to perform basic functions — they could purchase a catastrophic disability rider that pays an extra benefit, in addition to the total disability benefit, in that situation. Another popular option is a cost-of-living rider that will increase benefits each year after the first year of claim to keep pace with inflation.

With multiple options to select, you and your clients have the flexibility to choose only the provisions they truly need, making sure they’re protected and not overpaying for coverage they likely won’t need or don’t value. An income protection insurance policy built just for them can provide protection when it’s most important without breaking the bank. Ultimately, you want to ensure each of your clients has the appropriate protection in place so their plans aren’t sidelined if they’re faced with an unexpected injury or illness.

Jill Frohardt is second vice president of individual disability insurance sales at The Standard. Jill may be contacted at [email protected].

3 Simple Steps To Creating Lasting Relationships

Pandemic Increases Interest In Combination Products

Advisor News

- Social cultivation: How to talk with wealthy prospects

- How important is a written financial plan?

- Coalition wants to advise people impacted by policy changes in new administration

- Diagnosing miscommunication in retirement planning

- Election creates an opportunity for advisor/client dialogue

More Advisor NewsAnnuity News

Health/Employee Benefits News

- AI usage outpacing regulation, NAIC panel told

- Workers show growing interest in mental health, caregiving and leave benefits

- November Issue of Best’s Review Ranks U.S. Workers’ Compensation and More

- Doctor’s bills often come with sticker shock for patients − but health insurance could be reinvented to provide costs upfront

- Are $0 premium plans for medical insurance for real?

More Health/Employee Benefits NewsLife Insurance News