Athene hits record fixed-indexed annuity sales in just 9 months

Athene Life & Annuity does fixed-indexed annuity sales better than anyone and it showed during the third quarter.

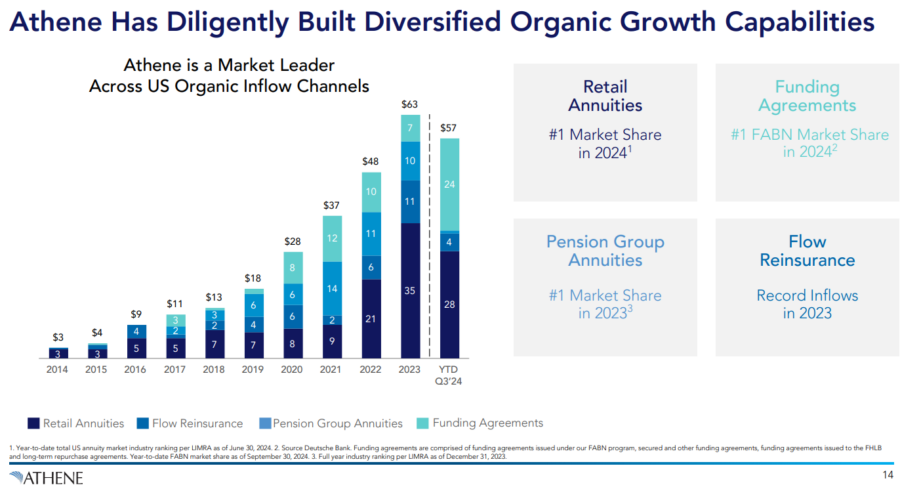

In the retail channel, year-over-year sales increased nearly 40% to more than $9 billion, which CEO James Belardi credited to strong FIA and multi-year guaranteed annuity products, “as well as product and distribution expansion.”

On a year-to-date basis, retail volume totaled $28 billion an increase of 27% from the prior year period. FIA sales were nearly $11 billion through nine months, already surpassing Athene’s full-year high, Belardi noted.

He was joined by outgoing Chief Financial Officer Martin Klein in a shorter-than-normal call with Wall Street analysts Thursday. While most earnings call last nearly the entire allotted hour, analysts wrapped up short of 40 minutes.

Athene is the dominant player in the annuity business, maintaining a firm grip atop sales charts.

“Financial institutions drove 80% of our retail volume in the quarter, reflecting our multiyear effort to expand distribution,” Belardi explained. “In October, we launched our complete product set at Merrill Lynch, a top 15 platform. We've now launched new business relationships with five large-scale financial institutions in less than 24 months, and we continue to prepare for additional launches with even more partners.”

Athene recently launched a new single-premium income annuity, as well as an “enhanced” FIA, Belardi said.

“Both products are designed to provide guaranteed lifetime income in retirement with improved income payouts,” he said. “With Social Security replacing only about 40% of pre-retirement earnings, these income annuities help close the gap so individuals can live more comfortably in retirement.”

The only question analysts had is whether the insurer is too concentrated in a specific channel. Athene is growing heavily in the bank distribution channel, Belardi said, with Merrill Lynch, Wells Fargo and others.

“Those are big producers. We're, for the most part, the largest producer within those systems,” he added. “We're not really worried about concentration there, because we have so many different financial institutions. There's a few more distribution partners that we're bringing on over time.”

Athene is a wholly owned subsidiary of Apollo Global Management, which held its earnings call last week.

With the election still fresh, Belardi fielded a question on how the tax and regulatory landscape changes now that President Donald Trump will return to the White House.

“I think, in general, the view was that the Trump administration was going to have a lighter touch on regulation than if the Harris team had won,” Belardi said, “but we're prepared for whatever comes up.”

Quarterly Snapshot:

- The market leader for annuities, via LIMRA rankings, with 2 million U.S. policyholders. Still, it represents “our largest opportunity,” Belardi said. “Our overall market share is just 12% which reflects significant potential to capture additional share.”

- Strong capital and liquidity profile. Athene’s consolidated risk-based capital ratio ended the quarter at 412% and the insurer boasts $68.4 billion of available liquidity.

- Flow reinsurance inflows in the quarter were about $1 billion, with the majority coming from Asia-Pacific clients. Completed another flow life reinsurance partnership in Singapore and expect to execute another in Japan in the fourth quarter.

- Ended the quarter with $243 billion in net invested assets, 95% in fixed income or cash.

- A1 or A+ rating from Fitch Ratings Service, S&P Global, Moody’s and AM Best.

Management Perspective:

“Today's environment continues to be an attractive time to be growing organically. As disciplined operators, we manage Athene’s business for the long term. We are not growing for growth’s sake, and are not a near-term profit maximizer. By running a business with an owner's mindset, we have generated strong returns for customers and shareholders through a variety of market environments.”

– James Belardi, chairman and CEO

By The Numbers:

- Total Revenue : $6.5 billion ($1.4 billion in Q3 2023)

- Net Income (gain or loss): $1.5 billion ($331 million in Q3 2023)

Correction: A previous version of this story inaccurately described Athene's share price. Athene is a wholly owned subsidiary of Apollo Global Management, which closed yesterday at $164.31.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Trump 2.0: Planning around uncertainty

Election creates an opportunity for advisor/client dialogue

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsLife Insurance News