Survey: Life insurers want to be better at meeting technology challenges

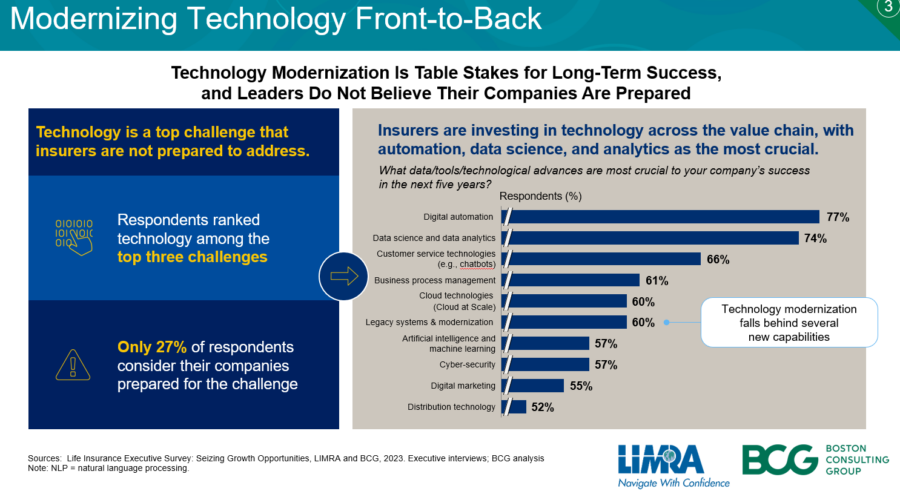

Life insurers know that technology is one of their biggest challenges to capitalizing on the enormous market appetite for life insurance and annuities.

And they don't feel ready to meet that challenge. New survey data from LIMRA and Boston Consulting Group revealed that insurance executives are falling short of their own goals from a technology standpoint.

Bryan Hodgens is corporate vice president, distribution and annuities, member benefits, for LIMRA and LOMA. He shared the survey data during a session at the recent LIMRA Distribution Conference in Fernandina Beach, Fla.

Insurers are no doubt feeling overwhelmed by the rapid growth and changes with technology, Hodgens told InsuranceNewsNet this week. Artificial intelligence is one area of massive potential that many insurers are tapping into, he added.

"You think about chatbots, voice automation, voice recognition. This is all AI technology that's been around for a few years," Hodgens explained. "Some companies have made investments in it and others are still making investments in it. So I think that's where you see some of these executives saying they still have that challenge."

Major sales potential

Technology is a major challenge because it is where the coveted Gen Z and millennial consumers are getting financial information, advice, and at time, making purchases. The untapped potential for product sales is enormous.

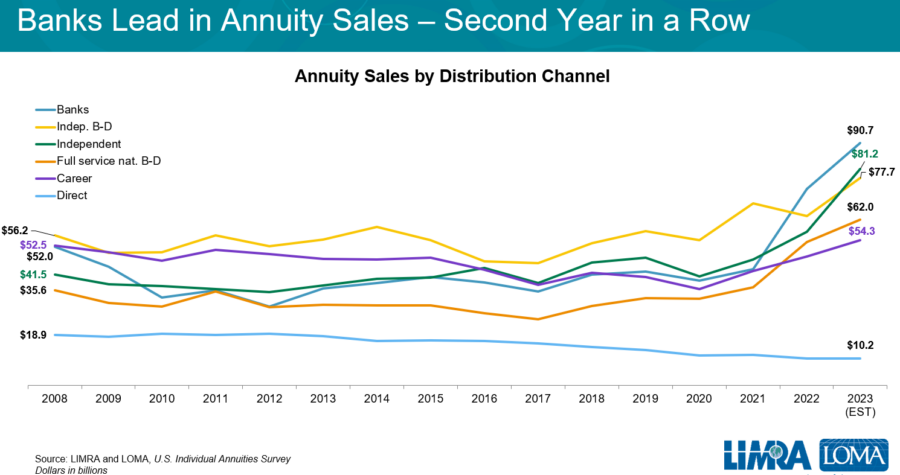

As it stands, total annuity sales hit a record-high $385.4 billion in 2023, jumping 23% year over year, according to LIMRA’s U.S. Individual Annuity Sales Survey. The survey saw the continued growth of a relatively young juggernaut in Athene Life and Annuity, which took over the No. 1 sales spot from old-guard insurer New York Life.

"Fixed-rate deferred, fixed-indexed annuities, RILAs [registered indexed-linked annuities], deferred income annuities and SPIAs [single-premium income annuities] all had record years," Hodgens noted.

LIMRA and LOMA data shows strong sales across all channels, with banks leading the way again.

So much growth, so little time

LIMRA sales projections show no letup in sales, at least on the annuity side. That means insurers not only need to get their technology right, but also need a strong talent base to grab a piece of the pie.

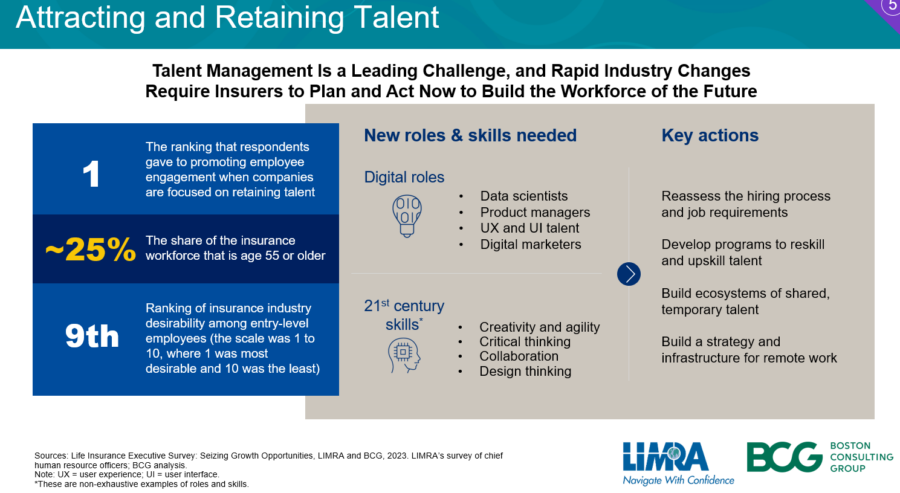

"Talent management" ranked just behind technology as a top challenge listed by insurance executives in the LIMRA-BCG survey. "Growth" ranked as the top overall challenge as executives ponder how to capitalize on opportunities.

"There is obviously a lot of growth opportunity with all this automation," Hodgens explained. "So they see that as an opportunity and challenge at the same time. The investments that they've made to this point. That's a challenge in trying to see is that yielding more growth? Are they starting to see the return on those investments that they've been making?"

Insurers face a twofold problem in turning over talent in the industry. For starters, the perception of an insurance career isn't great in comparison to other industries. In "desirability," a career in insurance ranked ninth on a scale where a 10 is least desirable, the LIMRA-BCG survey found.

Secondly, the need to drive technology change and growth means different skill sets are needed. Insurers needed digital-focused people with creativity and critical thinking skills. In other words, the kind of skills most other industries are seeking.

"We've got to do a better job as an industry to help attract this next generation of talent," Hodgens said. "Finding new talent through reassessing the hiring process and the job requirements and developing programs to rescale and upskill talent, maybe that's existing in your firm, that's really important going forward."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

No Surprises Act results in more disputes than expected

Women redefine financial advising as both leaders and clients

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News