Study: Americans who lost Medicaid likely besieged by false marketing

A new "secret shopper" study shows how health care options are being improperly marketed to the millions of Americans removed from Medicaid rolls.

Underwritten by the Leukemia and Lymphoma Society, the Georgetown study was conducted in June and the results shared last week with state regulators at the National Association of Insurance Commissioners' summer meeting in Seattle.

"Misleading marketing of limited benefit products is continuing as millions of people lose Medicaid and look to the private market for coverage," said Rachel Schwab, a senior research associate at the Georgetown University Health Policy Institute’s Center on Health Insurance Reforms.

Schwab presented the study results to the Improper Marketing of Health Insurance Working Group. The working group continues to work on amendments to the Unfair Trade Practices Act. In particular, the group wants to add a definition of "health insurance lead generator."

The proposal applies the prohibitions against unfair and deceptive acts or practices in the insurance business to health insurance lead generators and requires them to maintain records, including marketing and complaint records, for at least two years.

'Terri' and 'Lorraine'

Georgetown researchers have shared the results of past "secret shopper" studies with the working group. Concerns are heightened now that an estimated 15.5 million Americans are being removed from Medicaid rolls. The federal government prohibited states from removing people from Medicaid during the coronavirus pandemic — a roughly three-year moratorium that ended in April.

"Many former Medicaid enrollees will be eligible for comprehensive and affordable plans on the Affordable Care Act marketplace," Schwab said. "But a recent [Kaiser Family Foundation] survey showed that more than a quarter of Medicaid enrollees would not know where to look for coverage if they lost Medicaid and less than a third of enrollees would look to the [ACA] marketplace for health insurance."

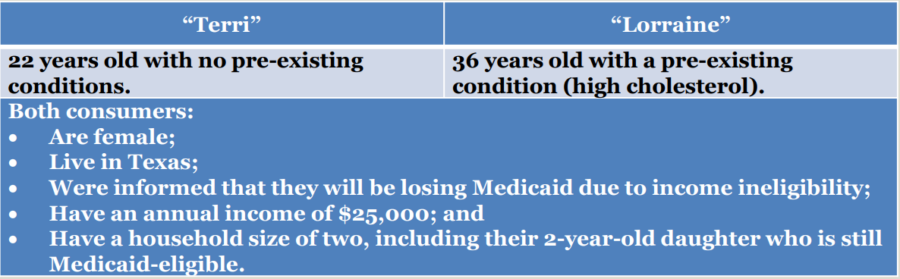

For this study, researchers created fictionalized "Terri" and "Lorraine" and started their research for health insurance options online.

They encountered misleading and false information right away, Schwab said. Both Terri and Lorraine would be eligible for $0 silver plans, including plans with no deductibles. Instead, a Google search using terms such as "cheap health insurance," returned sites promoting limited benefit products, usually paid advertisements.

"These products do not have to comply with the ACA consumer protections or coverage requirements and subsequently offer consumers only paltry protections against catastrophic medical bills," Schwab said.

The researcher spoke to 20 sales representatives, 10 as "Terri" and 10 as "Lorraine."

"Not one of the 20 sales representatives told Terri or Lorraine that they could access a plan with no premium and no deductible on the [ACA] marketplace," Schwab said. "Representatives also gave false or misleading information about the limited benefit products they were selling."

In one egregious example, two sales representatives claimed their limited benefit product would cover pregnancy-related care, she explained. It was later revealed that the plan would not even cover the cost of labor and delivery.

"One representative described a prescription drug benefit that covered up to $50 per day, but failed to mention a $750 annual maximum for this benefit, which was later discovered in a plan brochure," Schwab said.

Most sales representatives failed to provide written plan information even after being asked for it, she added. And they were very aggressive.

"Many urged the consumers to commit to a plan over the phone, despite refusing to share written plan information about the products they were selling," Schwab said.

No Medicaid bailout

States have the power to regulate limited benefit plans more stringently, Schwab said, as well as use the Unfair Trade Practices act to weed out misleading marketing.

"It's been described as a game of Whac-A-Mole as a companies subject to enforcement actions may reform under a new name," Schwab said.

Last month, the Biden administration proposed rules to limit the duration of short-term plans to three months with the option of a one-month extension. It would also require that plans provide consumers with clear explanations of their benefits.

Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Kansas urges state regulator group to abandon data privacy proposal

High net worth clients and homeowners insurance: The art of insuring to value

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News