State insurance regulators resume effort to clean up misleading health ads

State insurance regulators picked up work last week to crack down on the deceptive marketing of health insurance products.

The Improper Marketing of Health Insurance Working Group is considering amendments to the Unfair Trade Practices Act. In particular, the group wants to add a definition of "health insurance lead generator."

The proposal applies the prohibitions against unfair and deceptive acts or practices in the insurance business to health insurance lead generators and requires them to maintain records, including marketing and complaint records, for at least two years.

The National Association of Insurance Commissioners' Executive Committee gave the working group the go ahead to amend the Unfair Trade Practices Act during last week's spring meeting in Louisville.

Since the working group had not met for several months, it held a one-hour meeting to review public comments received last fall on the proposed changes.

Lucy Culp, an NAIC-designated consumer representative, pointed to the results of a 2021 Georgetown University "secret shopper" survey. Researchers made numerous searches for health plans on Google and other places. What happened next was troubling, Culp said.

"They were bombarded by the calls and texts and emails," she said. "And when they did talk to folks, of the 20 phone calls only five were directed to a qualified health plan."

Culp, executive director, state government affairs, for The Leukemia & Lymphoma Society, said her organization is "really concerned" about the unwinding of Medicaid.

"We're really concerned about a repeat of that kind of misleading and misdirection of consumers toward plans that just aren't going to meet their needs," Culp explained. "Nobody wins when consumers are defrauded into purchasing plans that don't meet their needs. And often, the lead generator or the third party is long gone when a consumer has that realization of the type of plan that they're in."

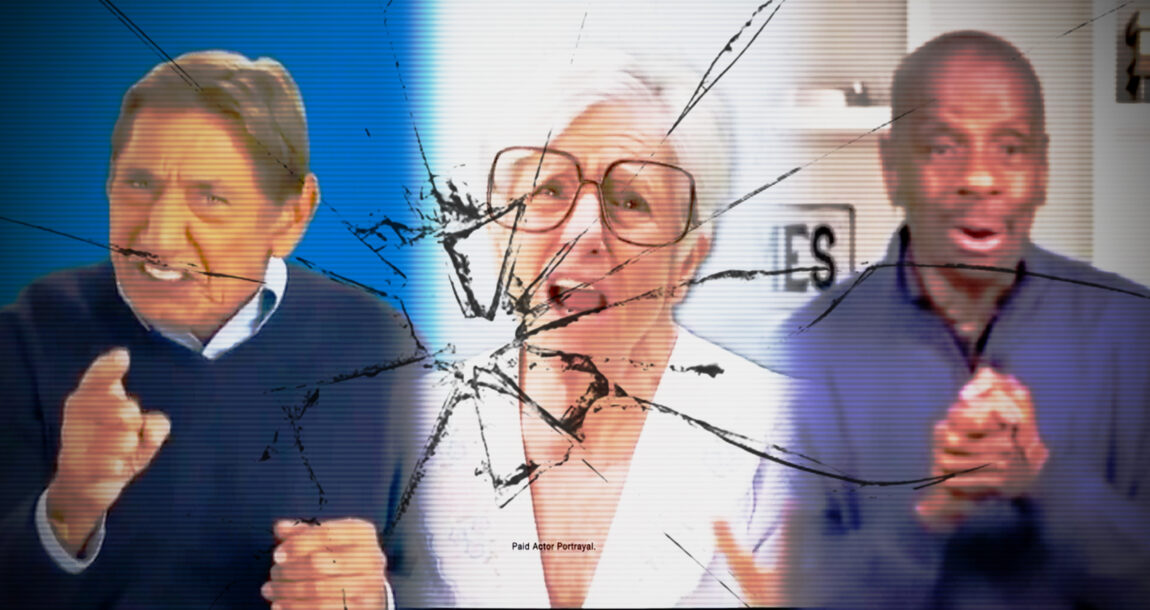

TV commercials featuring celebrity endorsers urging viewers to call a toll-free number to sign up for Medicare Advantage plans, and advertising selling short-term, or “skinny” health plans, that are not compliant with the Affordable Care Act are two of the best-known examples of improper health plan marketing, state insurance regulators have said.

Definition too broad

Industry representatives expressed concerns that the definition of health insurance lead generators is "too broad," as Meghan Stringer, senior policy advisor, product and commercial policy, for America's Health Insurance Plans.

"It might unintentionally encompass advertising platforms," Stringer said. "So a local television news station that has an ad run on it, a local newspaper where someone took out an ad [for example]. We would like to see some changes to the definition to address that."

Cindy Goff is vice president, supplemental benefits and group insurance at the American Council of Life Insurers. She noted that "there's a lot of lead generation activity that's very legitimate and is used by all kinds of different insurers."

"If it is going to include other types of lead generators for other types of insurance, we would want to have a much broader discussion because some of the implications might be different," Goff added. "So, we had asked that the definition be limited to health insurance for now.

Consider other models

Teresa Kroll is chief examiner, market conduct for the Missouri Department of Commerce and Insurance. She suggested that regulators open up several related model laws, including Model 660, which establishes guidelines for Medicare supplement insurance advertising.

As for the model under consideration, Kroll said the updated definition of health insurance lead generator does not improve regulatory functions as long as other actors remain undefined.

"In Missouri, we do not feel like the current proposed changes would would give us any further authority over these entities," Kroll added.

Martin Swanson, deputy director at the Nebraska Department of Insurance, chairs the working group. He left the door open for state insurance regulators considering amendments to other model laws in the future.

"We're not going to preclude not looking at something else if that's what the [Market Regulation and Consumer Affairs] committee wants us to do," Swanson said. "Because you know, we do answer to them."

Stringer later commented on the idea of opening Model 660, saying that AHIP would have "strong opposition."

"Medigap and marketing of Medigap has not previously been identified by this working group, nor in any of these conversations, as being a product where there have been specific concerns," Stringer pointed out.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Life insurance illustration rules on the clock as full rework looms

Economists expect recession and persistent inflation this year, survey shows

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

More Life Insurance News