Economists expect recession and persistent inflation this year, survey shows

More than half the economists taking part in a recent survey believe the United States will see a recession and persistent high inflation this year due to economic conditions and the Federal Reserve’s aim to achieve 2% inflation.

The economists’ projection means they think that conditions and the Federal Reserve’s policy are likely to cause a recession while still not achieving the Fed’s aim of 2% inflation, according to data from the National Association for Business Economics’ Economic Policy Survey released Monday.

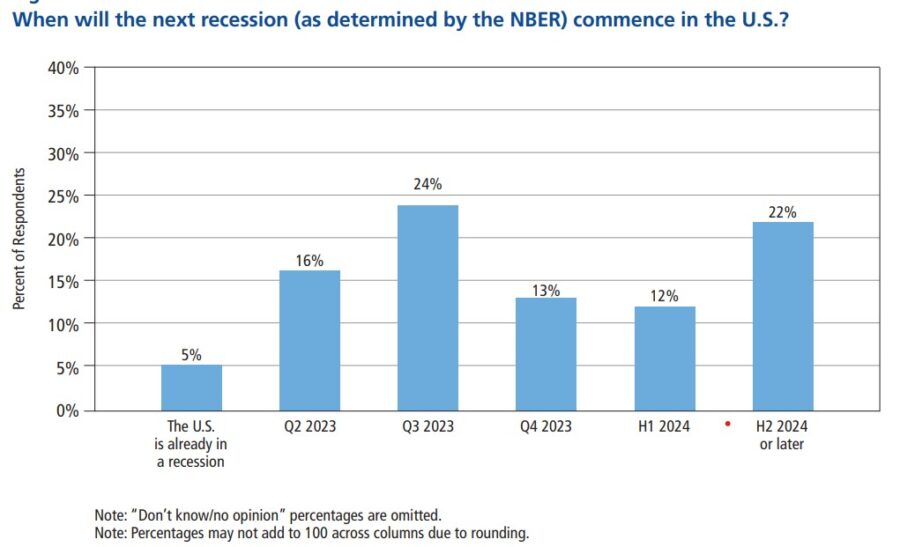

“More than half of NABE Policy Survey panelists expect a recession at some point in 2023,” said NABE President Julia Coronado in a report, adding a glimmer of good news. “However, only 5% believe the U.S. is currently in a recession, far fewer than the 19% who held this view in the August Policy Survey.”

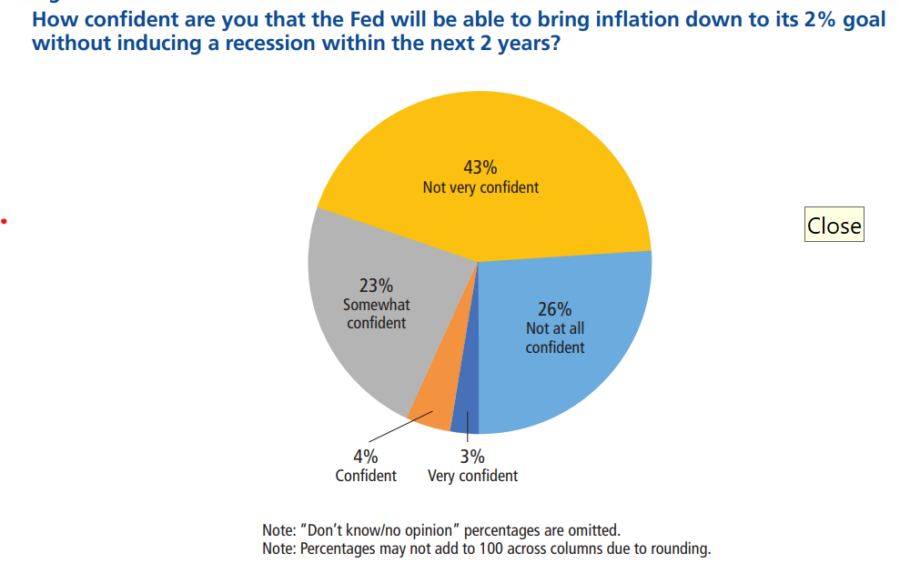

Consensus was strong on inflation, with more than 70% saying they believe inflation will stay above 4% through the end of this year, with 26% of respondents saying consumer price index inflation is “very likely” to stay above 4% through 2023, while 45% said it is “likely.” About as many saying they don’t think the Fed will be able to bring inflation to its 2% goal within the next two years without causing a recession.

A majority (71%) pinned inflation on tighter monetary policy while 44% also cited lower commodity prices, 42% supply chain issues and 40% weaker output growth.

Monetary policy

The March 2023 NABE Economic Policy Survey involved 217 members of the association earlier this month. They predicted that a recession will hit either in the third quarter of this year or the second half of next, according to the two most popular opinions.

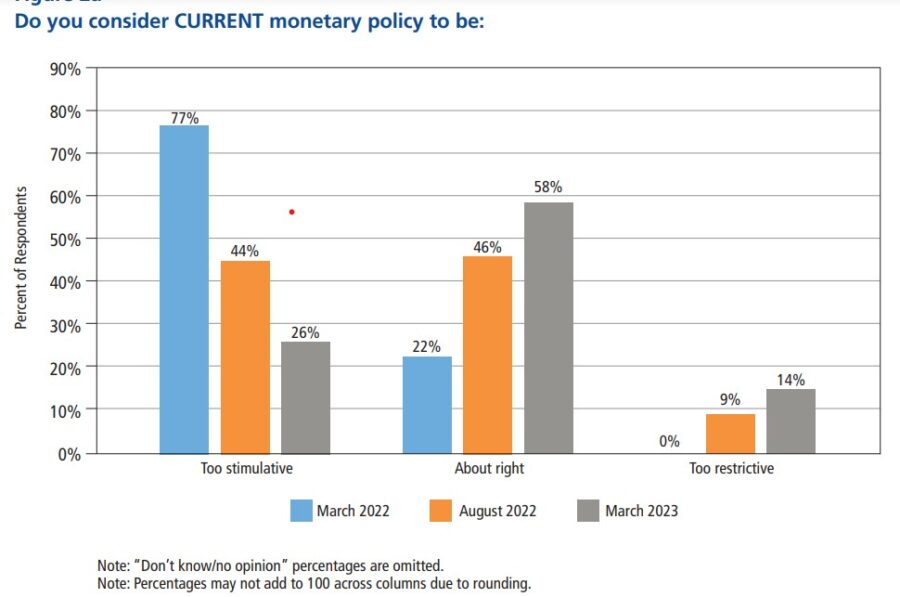

Although they said that the Fed would be the cause of a recession, the economists tended to be in favor of what the central bank’s policy, with 58% saying the monetary policy is just “about right.” This is a stark turnaround from last March, when 22% said it was about right and 77% said it was “too stimulative.” Monetary policy involves interest rates and the supply of money in circulation.

Fed Chair Jerome Powell said last week that the bank’s board expected to raise the funds rate steadily this year, but the latest economic turmoil has made the board a little less strident, although it did increase the rate another quarter point to just under 5%.

A majority (65%) of the economists expect the bank to end up with between 4.75% and 5.5% by year end, with 25% expecting it to be even higher – at least 5.75% at the upper end.

Opinion breaks up for the year end of 2024, with 41% predicting it will be between 4.75% and 5.5% or higher by then, 39% saying between 3.75% and 4.5%, 16% seeing 2.75% and 3.5% and only 2% saying 2.5% or lower, to get even close to the Fed’s 2% target.

They don’t even think the Fed will do it in 2025, with 80% predicting the rate will be between 3.75% and 4.5% by year end.

Fiscal policy

Although the economists gave the Fed props for its current monetary policy, they aren’t giving out prizes to policymakers for fiscal policy.

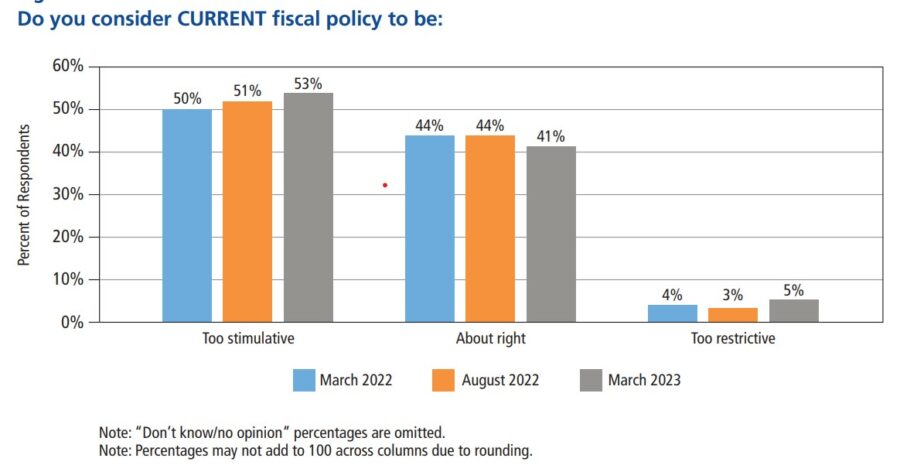

A slim majority (53%) said government policy is “too stimulative,” close to what they said last March and August. They were also steady on “about right,” with 44% saying so, and only 4% said policy was “too restrictive.”

Last August, a majority (59%) said the government should be pushing policy to promote economic growth in the medium-to-long term, but in a turnaround, only 47% said that this month. More than a third (35%) said they believe policymakers should be cutting deficit and debt; and 8% said they should focus on income inequality.

Immigration was the most important policy issue for Congress for a majority (62%) of the economists, followed by fiscal policy (42%), climate (35%), energy (28%), infrastructure (24%) and tax (23%). The shares citing trade, industrial, monetary, public health and social policy as top issues were all in single digits.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

State insurance regulators resume effort to clean up misleading health ads

Life insurance industry sales focus change cited in falling policy counts

Advisor News

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Ben Franklin's birthday; Meet Mandy Mango; Weekly gun violence brief | Morning Roundup

- Virginia Republicans split over extending health care subsidies

- CareSource spotlights youth mental health

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- Senate report alleges Medicare upcoding by UnitedHealth

More Health/Employee Benefits NewsLife Insurance News