Life insurance industry sales focus change cited in falling policy counts

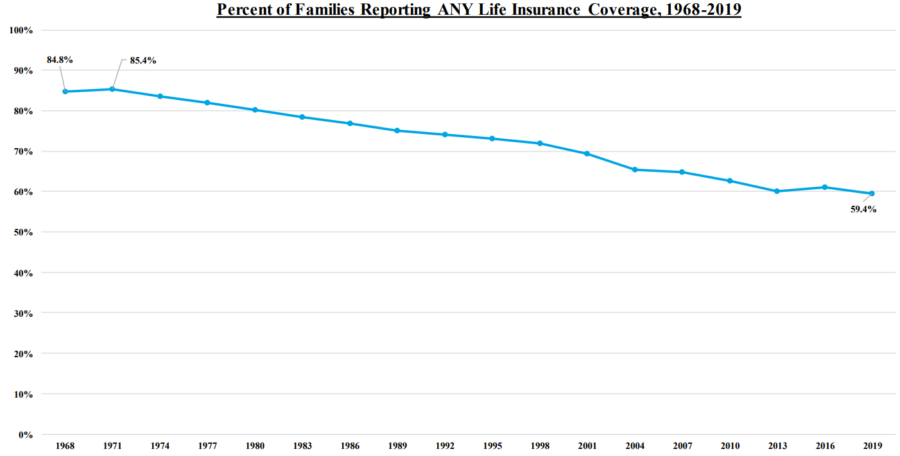

Anyone connected to the life insurance industry knows that the number are Americans covered by life insurance has steadily declined for decades. The reasons behind that decline generated some sharp insights recently during a presentation at the National Association of Insurance Commissioners' spring meeting in Louisville.

The number of families reporting any life insurance coverage peaked at 85.4% in 1971. That number declined nearly every year since and is expected to decline in 2022 from the 59.4% in 2021, Andrew Melnyk, chief economist and vice president of research for ACLI, told the Life Insurance and Annuities Committee Thursday.

The committee is a part of the NAIC and hosted the presentation titled, "The Current State of Life Insurance" by ACLI and the Society of Actuaries.

"Hopes were that perhaps with COVID people become more aware of their mortality and the value of [life insurance]," Melnyk said. "That happened to a certain extent, but whether it's sustainable or not, we're not sure."

Different sales tactics for life insurance?

Everyone in the room agreed with the notion that large segments of the population are "underserved" by life insurers. Opinions on the underlying reasons diverged somewhat.

Birny Birnbaum is executive director of the Center for Economic Justice and a designated NAIC consumer representative. Insurance companies became less interested in selling simple term life insurance as the years went by, he claimed.

In 1955, the U.S. population was about 165 million and there were 22 million individual insurance policies in force, Birnbaum said. By 2021, the population had doubled, yet there were just 10 million individual insurance policies in force. But the amount in force steadily increased throughout the timeframe, Birnbaum noted.

"What you see are these long-term trends in which insurance companies have have started marketing their products more as investments than death protection, and focusing more on more affluent consumers and higher face amount policies," he said.

Speaking for ACLI, Pat Reeder, deputy general counsel and vice president, policy and legal, agreed, in part, with Birnbaum's assessment that the life insurance industry can do better.

"We want to make sure we're bringing products and services to the to the people that need them. Are there barriers? Yes," Reeder said. "Producers want to be comfortable with the person they're working with. And that's someone often that looks like them. If we as an industry are not thoughtful about that and not forward leaning on that, then we're going to continue to struggle."

Pandemic impact on life insurance

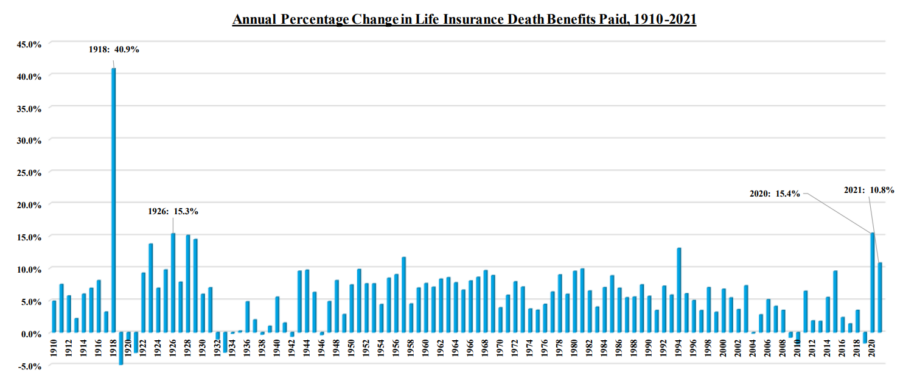

The life insurance industry saw its second-largest increase in death benefits paid in 2020, Melnyk pointed out. The COVID-19 pandemic had an enormous impact on the industry.

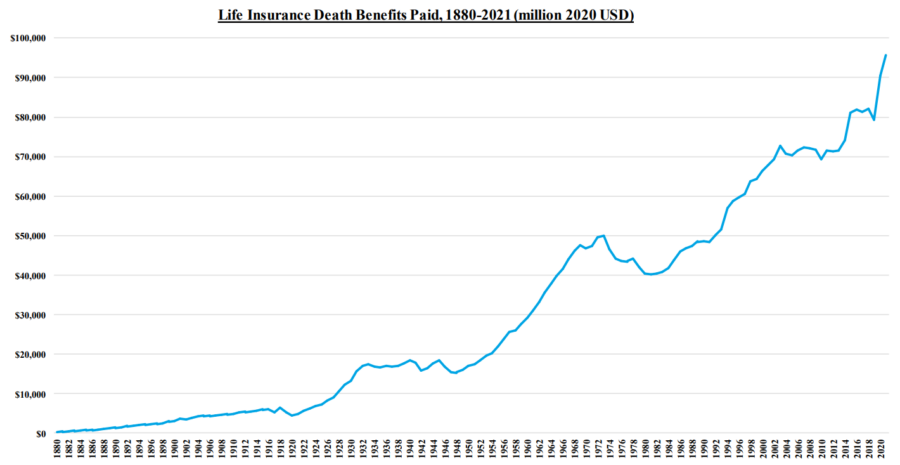

"In both in 2020 and 2021, these were record payouts," Melnyk noted. "In 2020, we paid out $90.4 billion in death benefits. In 2021, $100.2 billion in death benefits."

In fact, death benefits paid generally increased strongly throughout the history of life insurance in the United States, he added.

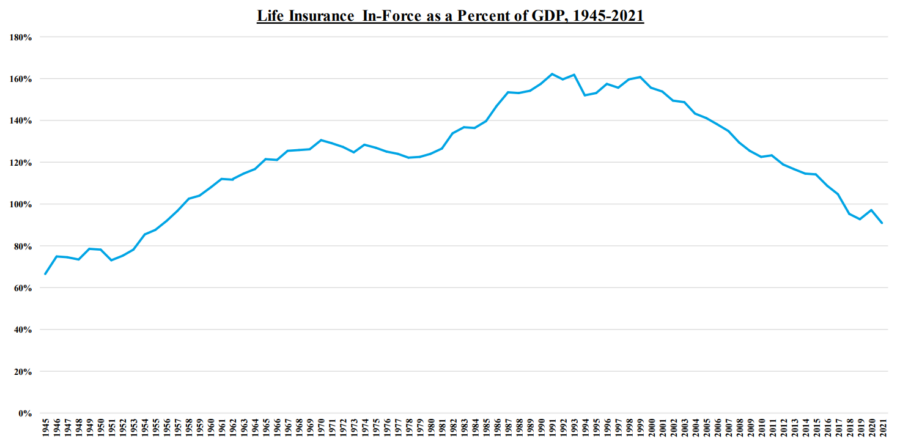

Interestingly, as a percentage of Grose Domestic Product, life insurance steadily declined this century.

This chart measures "life insurance consumption," Melnyk explained, stripping away price premium from the equation. To determine the why behind the steady decline would take another full-blown study, he added, but likely reflects larger societal life changes.

"Things have changed in many ways. Households have changed, families are smaller and so on," Melnyk said. "Part of that could be driving it but there could be many other things as well."

Mortality on the decline

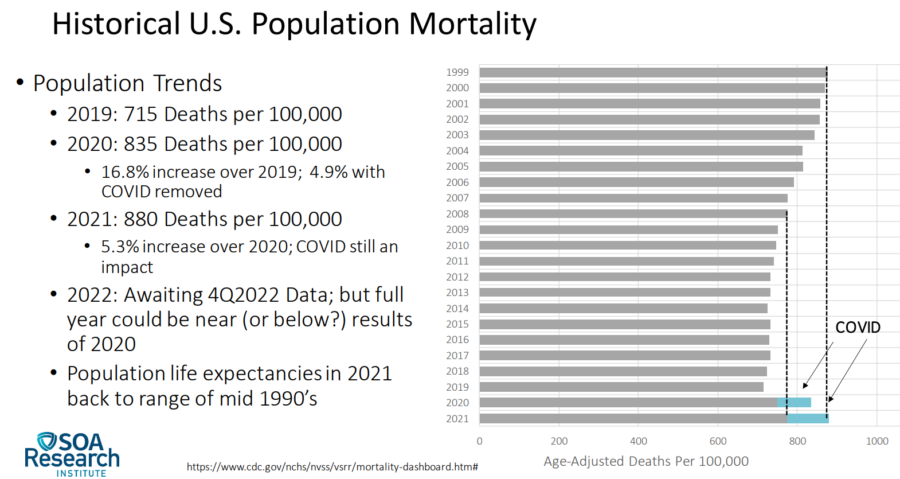

Dale Hall is managing director of research for the Society of Actuaries Research Institute. He briefed the committee on mortality data. Deaths per 100,000 people steadily declined this century to a low of 715 deaths in 2019.

With the onset of the pandemic, that figure rose 16.8% in 2020, or 4.9% with COVID-19 removed, Hall said. The pandemic is being blamed by the Centers for Disease Control for reducing life expectancy to 76.4 years, the lowest since 1996.

The 2022 mortality data is not yet complete, Hall said, but is expected to show a reversal from 2021's high of 880 deaths per 100,000 people. The full-year death toll will likely mirror 2020 numbers and maybe even end up lower, he said.

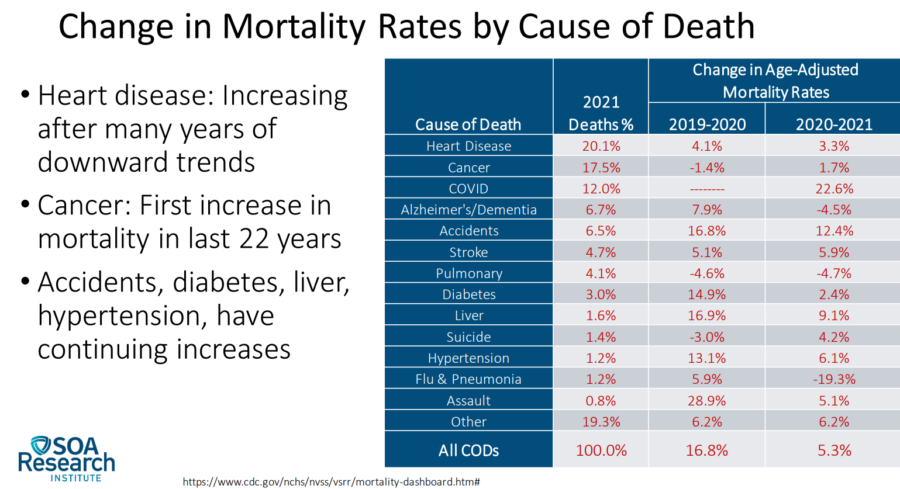

The bad news is decades-long positive trends in chronic diseases such as heart disease and cancer turned negative during the pandemic. Deaths in these categories are again rising, Hall noted. It's the first increase in cancer causes of death in 22 years.

"Because of deferral of health care and interruption of health care and some other things, we're just seeing that across the whole population," Hall said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Economists expect recession and persistent inflation this year, survey shows

What financial advisors need to know to serve high-net-worth clients

Advisor News

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News