Steps to achieve a sound voluntary benefits program

For plan sponsors, offering voluntary benefits is no longer optional. Voluntary benefits are expected by employees across all generations, who weigh them heavily in their decision to join or stay with an organization.

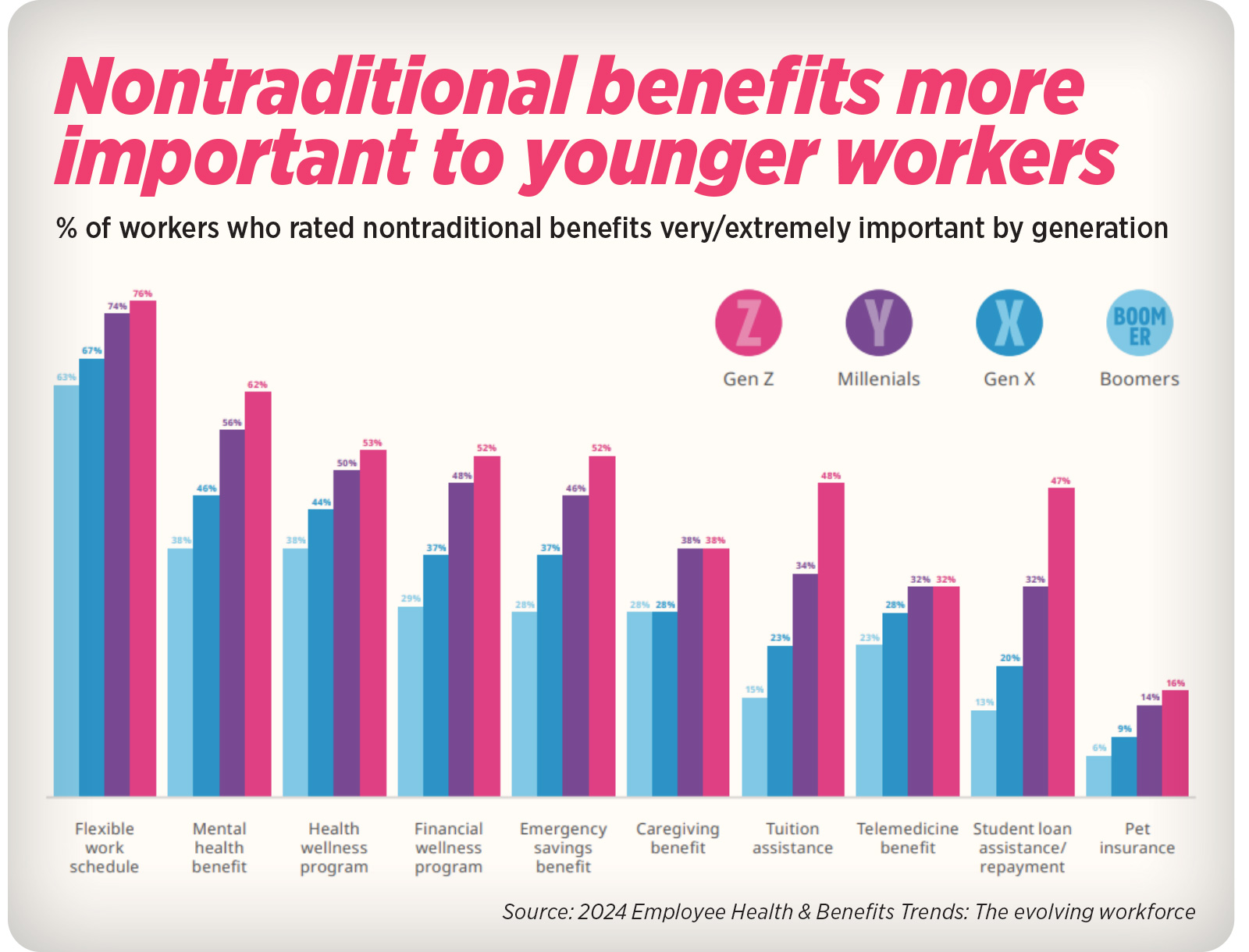

According to the PwC 2023 Employee Financial Wellness Survey, 73% of financially stressed employees say they would be attracted to another employer that cares more about their financial well-being. This finding is consistent with the Marsh McLennan Agency’s “2024 Employee Health & Benefits Trend Report — The Evolving Workplace,” which reported employees say better benefits are the No. 2 reason for switching jobs, after better pay.

Although many employers, unions and associations do offer voluntary benefits, few have taken essential steps to ensure that their voluntary benefits program is sound and meets the needs of their employees or members. When developing a voluntary benefits program, it is important to understand the overall marketplace, related challenges, how to determine the benefits to offer, how best to communicate and educate employees regarding these benefits, and how to leverage the experience of benefit advisors and carriers.

Today’s voluntary benefits market

There are several factors driving the voluntary benefits market.

» The correlation between voluntary benefits and attracting and retaining employees, with 46% of workers actively considering a job change in 2024 for better benefits (according to Gallagher’s 2024 Wellbeing and Voluntary Benefits Survey).

» The increasing focus on whole-person well-being and the heightened role of voluntary benefits in employees’ well-being.

» The high cost of living, inflation and economic uncertainty.

» Rising out-of-pocket costs and deductibles associated with health care services and prescription drugs.

» The benefits gap — employer-paid benefits do not meet all of an employee’s needs.

Communications, education and challenges

Each of these drivers has caused many plan sponsors to rethink their voluntary benefits programs. In doing so, they need to overcome certain challenges.

First are the costs and time investment employers incur to implement a voluntary program. Further, a company must develop a well-thought-out communication strategy for its voluntary benefits program (i.e., developing employee portal/website content, developing a mobile app and printing literature). This can be quite extensive given the wide range of voluntary benefits available. Language is also a consideration, with many organizations required to offer information in multiple languages due to their multicultural workforces.

Financial literacy also poses a challenge, requiring a concerted effort to educate employees on the role of each voluntary benefit and the coverage or services provided. This could entail hosting educational seminars or webinars and lining up product specialists to present the benefits and answer questions. Education is an ongoing process that should be conducted year-round and not solely before or during benefit enrollment periods. When building a sound voluntary benefits program that incorporates effective communications and education, plan sponsors should proceed in a disciplined manner, following certain steps that involve their human resources team as well as their insurance broker and carrier.

Know what employees or members want

Developing a strong voluntary benefits program begins with a survey of employees or members to determine what they seek. The goal of the survey is to capture data on key criteria that will be instrumental in building the program. This includes:

» Individuals’ age, gender, marital and parental status, other dependents (e.g., aging parents), medical condition(s), and special needs

» Level of understanding regarding various benefits

» Preferences relating to benefit communications (i.e., formal in-person or phone calls, or informal via email or text messages, or video calls, etc.)

» Physical and mental health concerns

» Financial concerns

» Which voluntary benefits matter most to them

Once this data is collected and organized, it is advisable to enlist an experienced benefits advisor with deep knowledge of the voluntary benefits market and current trends, and relationships with high-quality carriers offering a suite of voluntary products at competitive prices. Keep in mind that it is best to offer a broad selection of voluntary benefits, which a Corestream survey found 7 out of 10 employees wanted. Additionally, make sure that there is full leadership buy-in for the enhanced voluntary benefits program, which can promote better employee engagement.

Partnering with an experienced benefits advisor

It is a good idea for an organization’s leaders to conduct their own research to learn more about what voluntary benefits are available, and what their features and related costs are. It is also wise to partner with an experienced benefits advisor and carrier who can further share their knowledge regarding these benefits and plan design trends, particularly within certain industries. Voluntary benefits advisors can help with a comparative analysis between products offered and make recommendations regarding carriers whose product portfolios align with an organization’s needs. They can assist in developing a program that best serves each employee demographic group.

Additionally, benefits advisors can provide guidance regarding digital benefit technologies such as mobile applications and employee/member portals that facilitate plan member communications, education and claims filing. It is recommended that plan sponsors consider using a single platform for the administration of their voluntary programs. The right platforms are driven by artificial intelligence and offer user-friendly features, automated billing and adaptable communications.

After a voluntary benefits program has been rolled out — backed by effective communications, education and benefit technologies — benefits advisors along with carriers can provide support in how best to benchmark which benefits have been purchased by employees and their usage trends. This information can be helpful in consolidating benefits, if necessary. Regular communications with employees or members to gauge whether they believe their voluntary benefits are meeting their needs, and that communications and education are adequate, are also valuable.

As the focus on voluntary benefits continues to grow, employers, unions and associations offering these programs must recognize their importance to their employees or members. It is not enough to offer a perfunctory voluntary program. Program sponsors must be thoughtful and strategic when assessing and developing their voluntary offerings. Experienced advisors and carriers can provide strategic guidance for the optimum program.

John Thornton is executive vice president, sales and marketing, Amalgamated Life Insurance Company. He may be contacted at [email protected].

Annuities gain traction with middle-market consumers

Shifts in the regulatory landscape impact financial professionals

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News