States where people spend the most, least on insurance

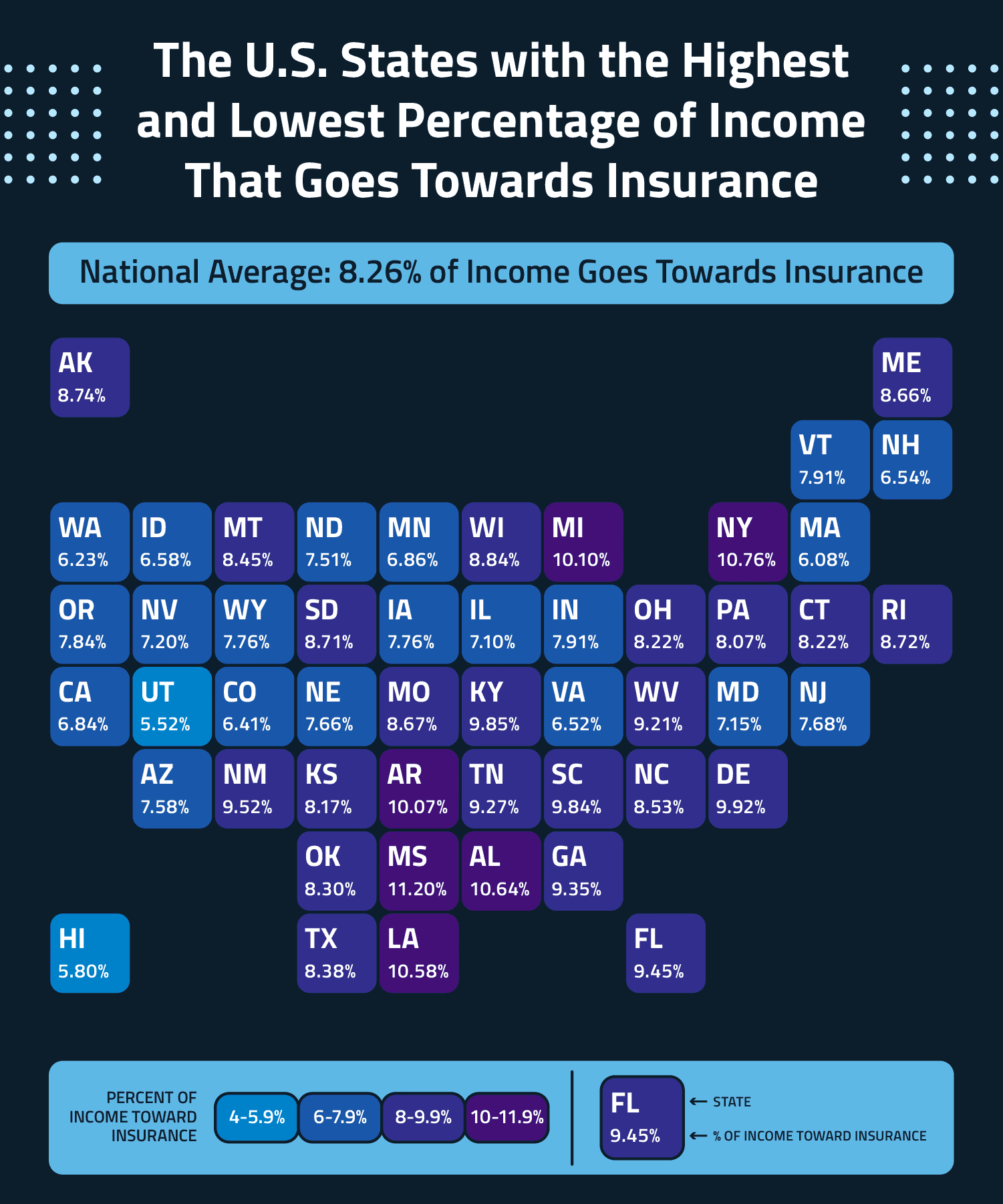

People who live in Mississippi pay the highest percentage of their annual income toward insurance while Utah residents pay the least, according to an Assurance survey.

Mississippians spend an average of 11.2% of their annual income – or $5,501 – on insurance. Meanwhile, people who live in Utah spend an average of 5.52% - or $4,368 – on coverage.

When looking at the dollar amounts spent on coverage among residents of the 50 states, New York residents pay the highest annual average amount at $8,084 for auto, life and health insurance. Idaho residents pay the smallest annual average amount at $4,168.

Americans spend an average of 8.26% of their annual income on insurance, the survey found.

In Mississippi, where people pay the highest percentage of their annual income on coverage, the average yearly cost for car insurance is $1,939 and the average yearly life insurance cost is $581. The annual average employee contribution toward health coverage is $1,653 and the average health insurance cost for private enrollees is $4,310.

In Utah, the state with the lowest percentage of income that goes toward insurance payments, the average annual car insurance cost is $1,340 and the average annual life insurance cost is $636.

New Yorkers spend the highest dollar amount on coverage each year, with an average yearly cost of car insurance at $3,424, which is the highest across the 50 states. New Yorkers are second to Alaska residents on the cost of private enrollment health insurance, with an average of $6,264 going toward coverage in New York and Alaska residents shelling out an average yearly spend of $6,523.

However, even though Idaho residents spend the least amount for insurance annually – an average of $4,168 – it still eats up 6.58% of their annual income.

When it comes to spending money on auto insurance, New York residents have the highest percentage of their annual income going toward coverage on their wheels at 4.56%. Michigan is a close second, with its residents spending 4.19% of annual income on auto premiums. Mississippi rounds out the Top 3, with its residents spending 3.95% of their annual income on auto coverage.

When it comes to the percentage of annual income going toward life insurance, Mississippi again takes the top spot, with its residents spending an average of 1.18% of their annual income. West Virginia residents aren’t far behind, spending an average of 1.16% of their annual income on life premiums. Arkansas, at No. 3, sees its residents paying 1.12% of their annual income on coverage.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Financial professionals still favor tried and true investments

‘Dark data’ muddies picture, holds promise for insurance industry

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Local lawmakers, advocates talk about BadgerCare expansion

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News