Financial professionals still favor tried and true investments

Financial professionals are interested in recommending alternative investment vehicles for their clients but are concerned about the lack of liquidity and overall cost associated with those investment vehicles.

That was among the findings of the 2023 Trends in Investing survey by the Financial Planning Association and the Journal of Financial Planning, which looked at where investment professionals were looking for opportunities for their clients as the COVID-19 pandemic comes to an end.

The survey found some planners indicated a general lack of trust in the ability of alternative investments to meet client needs. In addition, more than 90% of investment professionals surveyed said they use or recommend exchange-traded funds for their clients, and nearly half said they plan to increase their usage over the next year.

Investment professionals are embracing a blend of active and passive strategies, the survey found, after a turn toward one or the other over the past couple of years. More than 70% of those surveyed expressed some level of confidence in the traditional 60/40 portfolio’s ability to provide similar returns as it has historically.

ETFs topped the list of investment vehicles that professionals said they currently use or recommend for their clients in 2023 as opposed to 2019. Ninety percent of those surveyed said they use or recommend ETFs in 2023 while 88% said the same in 2019.

Private equity funds and structured products saw the biggest increases in use or recommendation between 2019 and 2023, the survey showed. Twenty-three percent of professionals surveyed said they used or recommended private equity funds in 2023, up from 12% in 2019. Structured products were recommended or used by nearly 21% of professionals in 2023, an increase from the nearly 11% of those who recommended or used the products in 2019.

Cryptocurrencies and precious metals were at the bottom of the list of products recommended or used for clients both in 2019 and 2023, with crypto used or recommended by 2.8% of professionals and precious metals used or recommended by 7.9% in 2023.

Products seeing a decline in use or recommendations between 2019 and 2023 included cash and equivalents, mutual funds, individual stocks, and individually traded real estate investment trusts not held in mutual funds.

Looking ahead to the next 12 months, nearly half of financial professionals (49.7%) said they plan to increase their use or recommendation of ETFs for clients. Twenty-four percent said they plan to increase use or recommendation of cash or equivalents while 23% said they plan to increase use or recommendation of individual bonds.

More than one-quarter of those surveyed (25.7%) said they will decrease their use or recommendation of mutual funds for clients while 15% said they will be less likely to recommend clients keep their funds in cash.

Financial professionals were asked specific questions about their investment approach regarding alternative investments for 2023. Twenty-eight percent said they were actively investing in or searching for alternative investments suitable for their clients. Meanwhile, 30% of investment professionals said they were familiar with alternative investments but did not intend to invest in them or recommend them to their clients, and 11% were either not familiar or not interested.

Half of investment professionals are investing in or recommending that clients invest in funds that provide access to alternative investment classes or strategies, while one in five is making direct investments in a product, project, or company. The most important objectives for investment professionals who recommend or invest in alternatives for their clients were diversification (55%) and risk mitigation (41%).

Their biggest obstacle was the lack of liquidity, which 48% of professionals cited as a concern. Fees and expenses were a challenge cited by 41% while 38% said identifying suitable opportunities for client objectives was preventing them from implementing alternatives in their clients’ portfolios.

Private equity was the most popular category of alternative investment strategies, with 29% of professionals saying they are adopting or recommending them for clients. That was followed by a multistrategy approach (24%) and a long-short strategy (16%).

Financial professionals are bullish about the long term

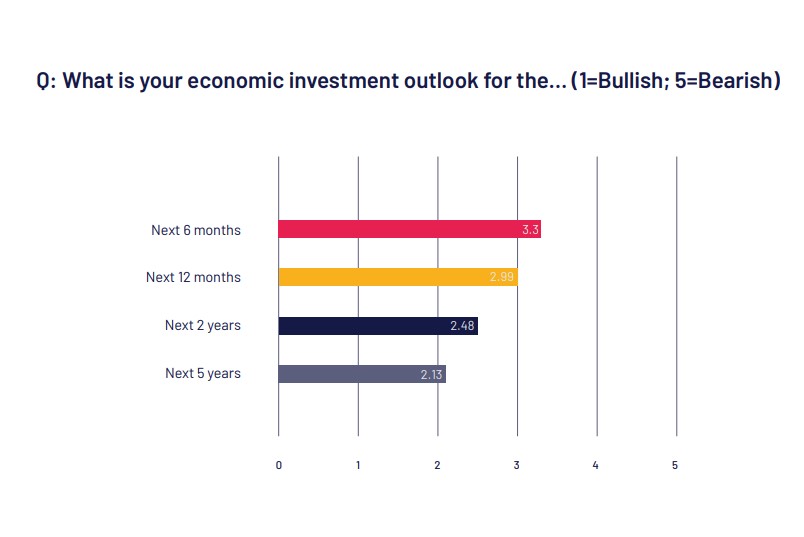

Investment professionals have a lukewarm outlook on the economy in the near term and they are increasingly bullish about their economic outlook over the next five years, the study showed.

When asked to rank their outlook on a scale of 1 to 5 (1 being bullish and 5 being bearish), survey respondents rated the next six months at a 3.3 while giving the next three years a 2.4 and the next five years a 2.1.

More than 71% of respondents expressed confidence in the ability of the traditional 60/40 stocks and bonds portfolio to perform similar to how it has historically. Only 7% had a neutral outlook, while 21% were more hesitant, down from 24% last year.

Clients are most concerned about the effects of general volatility on their portfolio, with the survey showing 85% of financial professionals saying their clients inquired about that topic in the past six months. Eighty-two percent of financial professionals said their clients asked about the effects of inflation on their portfolio or retirement plan while 36% said clients inquired about the effects of SECURE 2.0 on their plan.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

ESG rule needed to counter ‘chilling effect,’ DOL says

States where people spend the most, least on insurance

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- New Generation MyCare Program – What is it?

- Local lawmakers, advocates talk about BadgerCare expansion

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News