‘Some of the best quarters for stocks’ may follow midterm elections, experts say

The markets have gone through a rocky patch during the first three quarters of 2022, but better days may be coming now that the midterm elections are mostly over.

That was the word from two Carson Group experts who said that the midterms are giving the markets a much-needed boost now that the uncertainty surrounding who will control Congress over the next two years largely has been settled.

“We know that midterm years tend to be rough on equities during the first three quarters, then you get a rally,” said Ryan Detrick, Carson Group chief market strategist. “The calendar seems to be playing out here again where you have a rough stretch and then a boost.”

Detrick pointed to the Dow up 14% in October, which he said was the best-ever October return for the Dow.

“Some of the best quarters for stocks are here,” he said, noting that years 2 and 3 of a presidential cycle tend to be strong-performing years for the S&P 500.

The midterms “could give us tailwinds,” Detrick said, as midterm years tend to see a big bounce off the lows for the S&P 500. He noted that the S&P 500 average intra-year pullback in a midterm year is -17.1%, with the average return of 32.3% a year after the lows.

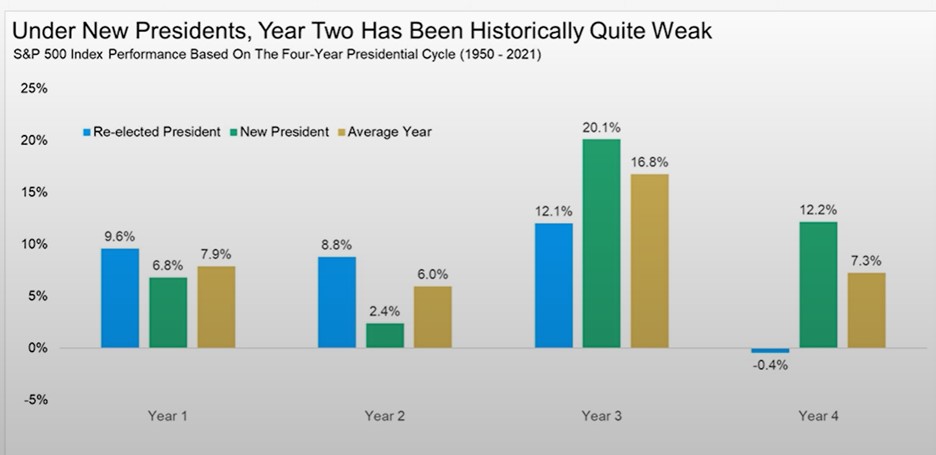

Stock performance historically has been week in the second year of a new presidency, Detrick said. But they bounce back stronger in Year 3.

There is more uncertainty in a midterm year than in the other three years of a presidential term, said Jamie Hopkins, Carson Group managing director, wealth solutions. “Year 1 as a new president, you are just getting started, just getting your cabinet in place,” he said. “There’s uncertainty in Year 2 because of the midterms. By Year 3, you’re executing your plans. But the lame duck president year – Year 4 – is usually negative when it comes to the last year of a re-elected president.”

Historically the next six months of a four-year presidential cycle are the strongest, Detrick said.

Since 1950, the S&P 500 has seen its strongest returns in the November-May period following a midterm election.

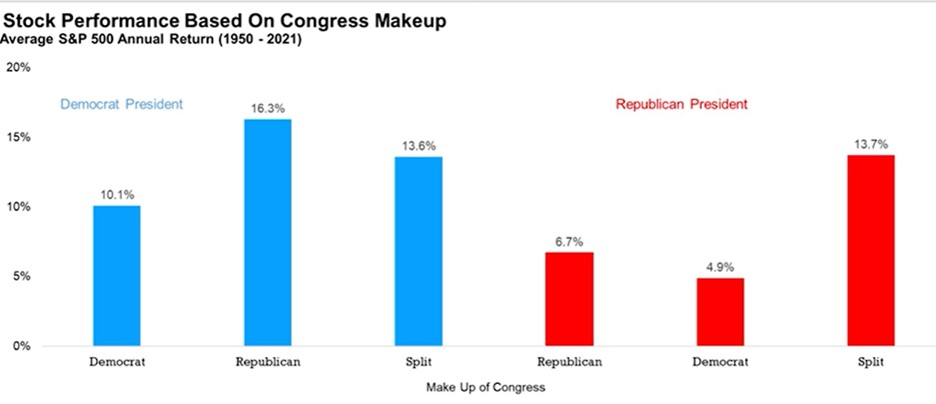

Gridlock in Washington is not necessarily a bad thing when it comes to stocks, Detrick said. Looking at the average S&P 500 annual return between 1950 and 2021, the highest stock performance occurs when we have a Democratic president and a Republican Congress. Stocks also perform well when Congress is split, as we are likely to see going in to the new Congress.

The main takeaway from the midterm elections, Hopkins said, is “patience.”

“You should feel pretty comfortable with the way things are going,” he said. “I feel good about where a lot of the policy is going. We are not going to see sweeping bills that impact business go through Congress.”

Detrick also was optimistic.

“As bad as things have been, there could be some better times coming.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

NAIFA members meet with Congress

What employers must know about mental health parity

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News