Service is key driver in placing business with an intermediary

It has been said that being a financial professional is all about relationships. One of the key relationships for many is the connection financial professionals have with brokerage general agencies or independent marketing organizations.

LIMRA recently collaborated with the National Association of Independent Life Brokerage Agencies to follow up on a survey conducted last year on the challenges and opportunities for producers who work with independent marketing organizations and brokerage general agencies (intermediaries). All producers in the survey primarily serve personal/individual customers and have contracts to place life insurance business with a BGA or an IMO.

The study found that producers with intermediary contracts place roughly 80% of their total life insurance business with a BGA or an IMO.

On average, producers work with three intermediaries and place about two-thirds of their business with their top intermediary. Their main reason for deciding which will be the top intermediary is strong customer service/client experience.

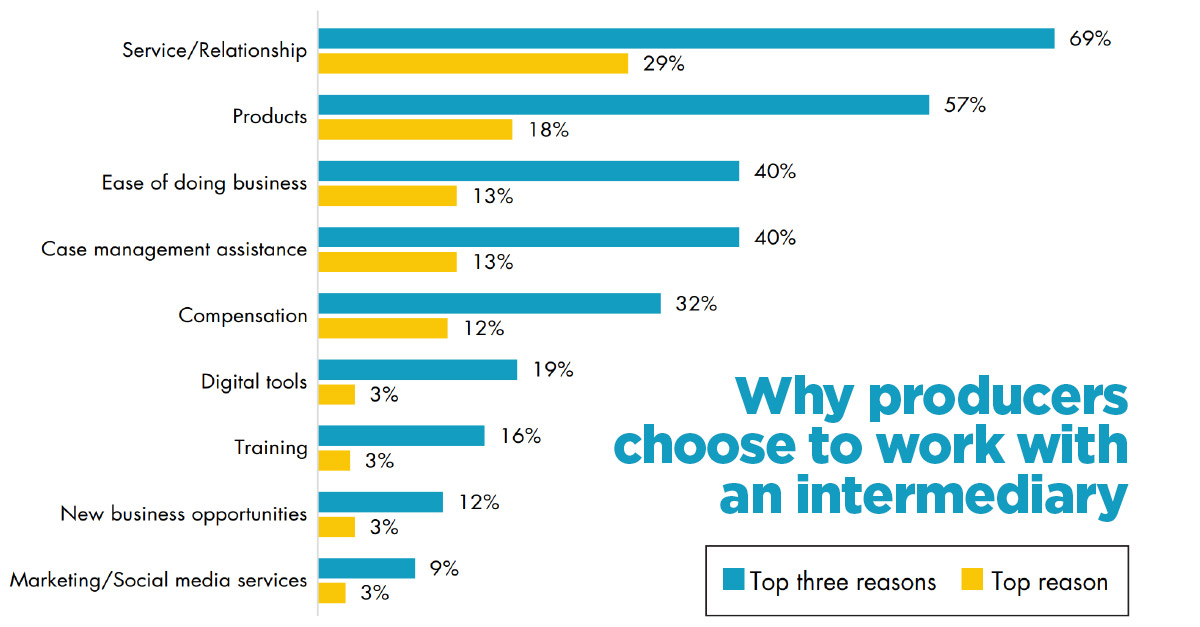

Seven in 10 producers say the service or relationship is one of the top three reasons they place business with an intermediary, and nearly a third say it is the most important reason.

Producers also prioritize the intermediaries’ product portfolios (57%) and the ease of doing business (40%) when considering placing business with a specific intermediary. Only 32% said compensation is a top three factor — with just over 1 in 10 citing it as the top factor.

When it comes to services, more than half (56%) of producers feel they are receiving the same number of services as two years ago. Over a third (37%) say they’re receiving more services from their contracted BGAs/IMOs.

From the BGA/IMO perspective, the majority of intermediaries (72%) said they are providing more services than they did two years ago, and more than a quarter (27%) said they’re providing the same number of services.

Among the top four business priorities for intermediaries are growing their network of producers/advisors, increasing sales of their current product offerings, improving sales support and service-related issues, and improving technology solutions.

What the future holds for intermediaries

Many individual life insurance sales in the U.S. are made with the help of BGAs and IMOs. This business is expected to grow over the next few years. In fact, 7 in 10 intermediaries expect their producer networks to grow in the next three years, up from 57% when the study was conducted in 2021. Year-over-year sales growth expectations remain strong with 69% of intermediaries projecting an average of 16% sales growth in 2022 over 2021.

Technology also will shape the future. The research shows nearly all (96%) intermediaries are making technology advances, which include investments in back office and marketing.

The types of services intermediaries offer also are changing. Currently, more than 6 in 10 intermediaries (63%) do not offer financial planning/wealth management products and services, but 73% expect they will in the next three years.

Mergers and acquisitions will shape how intermediaries and producers work together in the future. Four in 10 producers (41%) say merger and acquisition activity among intermediaries will affect where they choose to place business and will make it more complex. More than half of intermediaries expect mergers and acquisitions to increase in the next three years, driven by private equity money and succession planning.

Going forward, regardless of what happens with mergers and acquisitions, producers will look to those intermediaries that they have a strong relationship with and that can provide the products, services and support they need to have successful businesses.

Laura A. Murach, ACS, ALMI, LLIF, is associate research director, distribution research, LIMRA. Laura may be contacted at [email protected].

Conventional wisdom and a three-year plan

This overlooked asset could help optimize your clients’ financial plan

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

More Annuity NewsHealth/Employee Benefits News

- UnitedHealth Group shares fall nearly 20% as company forecasts lower sales this year

- Progress on nurses' strike as Mt. Sinai, NYP agree to keep health plans

- Nevada health insurance marketplace enrollment dips nearly 6% but 'remained fairly steady'

- AM Best Assigns Credit Ratings to CareSource Reinsurance LLC

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE INSURED

More Health/Employee Benefits NewsLife Insurance News