Senior selling: Smooth sailing or turbulent storm?

Amanda Brewton predicts rough seas ahead as the Medicare annual enrollment period approaches.

“There will be market disruptions with plans no longer being available in some counties,” she said.

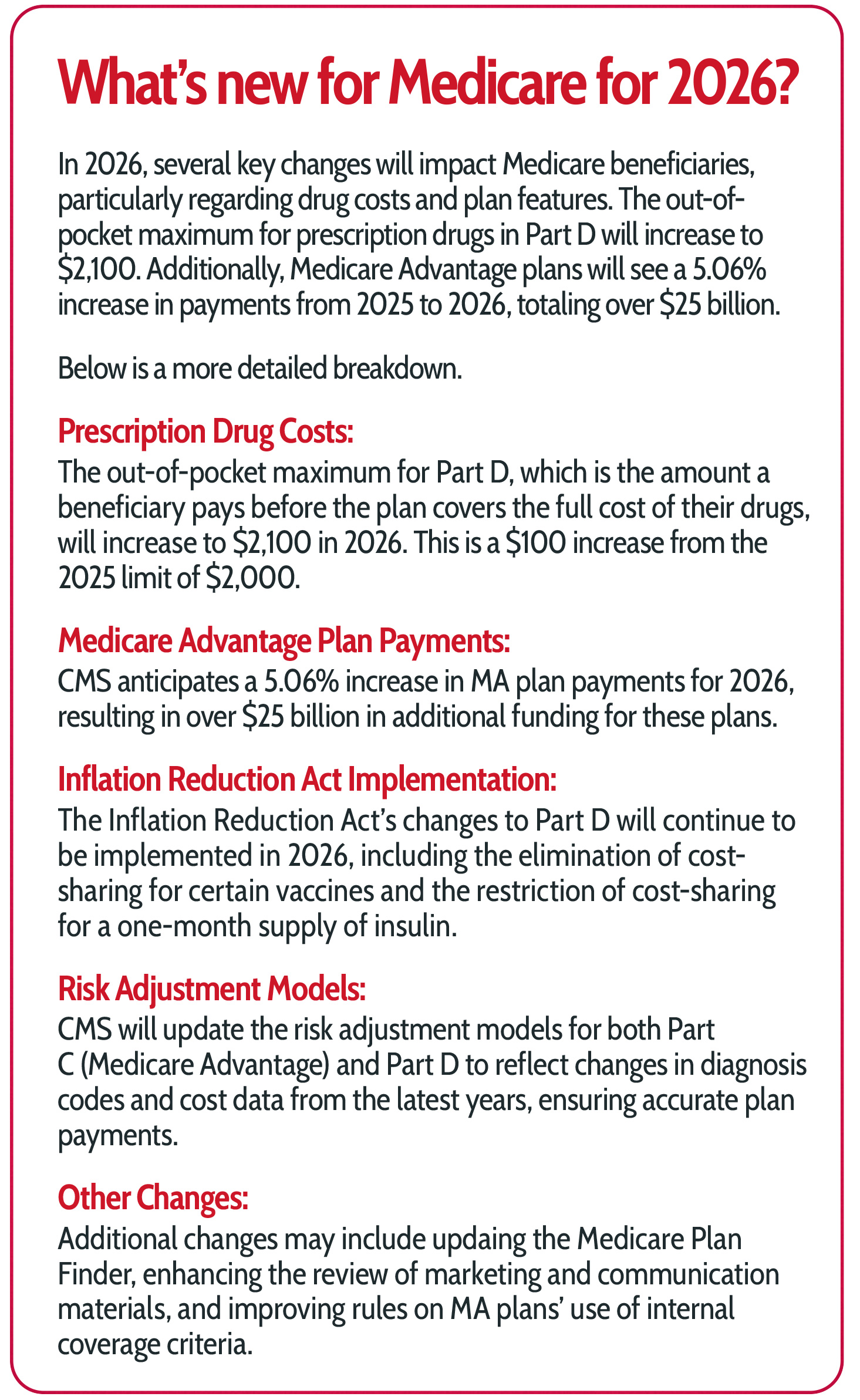

In addition, she predicted carriers will adjust their prescription formularies to account for changes brought about by the Inflation Reduction Act. Now that the IRA has been in effect for a year, carriers have a better understanding of what the act’s $2,100 annual out-of-pocket maximum for Medicare beneficiaries will mean.

Hospitals also will get into the game, she said. “There will be more hospitals playing ‘chicken’ in the media with carriers as they negotiate their network contracts, which will lead to fear that Medicare beneficiaries will possibly lose their doctors.”

Technology has its own role in stirring up disruption when it comes to people signing up for coverage. “Auto-dialers and AI bots sound cool but don’t necessarily give the best experience to the beneficiary,” she said.

As the U.S. population continues to age, Medicare enrollment increases every year. As of February, about 68.5 million Americans were enrolled in Medicare — an increase of more than 1.2 million over the previous year, the Centers for Medicare & Medicaid Services reports. About 1 in 5 Americans receives health care through Medicare.

Adding to the Medicare surge is the statistic that about 15% of Medicare beneficiaries change plans in a given year, the Commonwealth Fund reports.

All this adds up to a hectic season for Medicare advisors when the 7½ week annual enrollment period begins Oct. 15 and wraps up Dec. 7.

Will the upcoming enrollment period see stability in the Medicare market or will brokers need to navigate turbulent waters for their clients? It depends on who you ask.

Brewton told InsuranceNewsNet that concern over carriers is what’s keeping agents up at night. A growing list of carriers has stopped paying commission for Medicare Part D prescription drug plans and certain Medicare Advantage plans, meaning that agents do the work of enrolling clients in coverage but receive no payment from the carriers for their efforts.

“Many are worried about carriers and about the public seeing the value in the service and guidance that agents/brokers provide,” she said. “Many go above and way beyond just the initial sale of a plan, including help with obtaining services their plan covers, enrolling in Medicare, handling claims issues and so much more.”

‘Continued meaningful disruption’

“I think the first thing brokers should expect for this annual enrollment period is continued meaningful disruption,” he told InsuranceNewsNet. “Last year, during open enrollment, we had carriers in midstream take their plans off of enrollment platforms or go commission-less to try to suppress some of the business that was coming in a surprising way, and it’s reasonable to expect more of that this year.

“Especially with some of the major carriers struggling, we’ll probably see a number of plans pulled out of a number of markets where they are unprofitable. So it’s important to get a sense of whether you’re in markets where the carriers are currently struggling or not, because if they are struggling in your market, you’ll see a lot of extra disruption.”

Enrollment in MA plans continues to increase, with 51.1% of Medicare beneficiaries choosing MA plans in 2025, up from 50.4% in 2024.

Melamed said he believes MA will hold on to its market share for next year but not expand as much as in prior years because of continued disruption in the MA space. One disruption he sees with MA is a pullback on dental, vision and over-the-counter drug benefits that make MA a popular choice with many enrollees. He also predicts a drop in the number of zero-premium MA plans.

“The utilization of these benefits has been very high these days, but at the same time, carriers are struggling,” he said. “So if you see continued pressure there, that will probably lead to even more market pullback. It’s possible we’ll start to see some shift away from $0 premium plans. It still may be too early for that, but carriers are talking about that as well.”

Brokers also are feeling the impact of instability and disruption in the Medicare market, Melamed said.

“The biggest concern I hear from brokers is that a complicated business gets more complicated every year. It sometimes feels like the walls are closing in on all sides. Every year, there are new regulations to comply with. Meanwhile, the carriers are skittish and pulling commissions from some plans. So it feels pretty unstable to be a broker in today’s market.”

Despite the negatives that Melamed described, he is optimistic about the role of a broker in helping people enroll in the right plan.

“I think it’s never been easier for retail brokers to demonstrate their expertise,” he said. “A lot of the larger national brokers are only able to work with a few carriers, but a local broker who really knows their local market can work with every carrier in their market. They know when you go to the doctor in your neighborhood, when you use the hospital system, and they have a fluency with the local health care landscape that really matters.

“Local retail brokers also understand the networks, the formularies and the intricacies of the benefits, so it’s easy for them to become that local trusted source of information and get a lot of referrals.”

Marketing challenges with MA

“In particular, the Biden administration had proposed broadening what they defined as marketing,” Fingold said. “Marketing has had kind of a two-part definition, where the item material — the marketing piece — would have to have the intent to promote and to attract the right enrollee. But it also needed to have a certain substantive component about benefits, premium and about the specifics of the plan to be considered marketing. The importance of this is, a marketing piece has a number of regulatory provisions that must be met, plus it must be submitted to CMS for approval.”

This process can be challenging for agents and brokers, she said.

“It’s a multistep process, and it can take an extended period of time,” she said. “This is significant because CMS doesn’t allow materials to be submitted for the following contract year before June 1, and then Oct. 1 is when marketing starts. So if you want to have something in place, you must have it processed in that time frame.”

The proposed rule would have broadened the types of materials that must go through the CMS approval process, she said.

“The two-part requirements were the intent and the content,” she said. “The Biden administration proposed limiting it to just the intent. So anything that intended to attract attention, to promote the plan, would have been included in this, and that was fairly broad.”

CMS also limited marketing of supplemental benefit amounts in MA plans, she said.

“CMS seemed to be concerned that beneficiaries were making plan choices based on supplemental benefit offerings. Some plans have a bucketed proposal where you could get a certain dollar value toward a bucket of benefits. But the way it was, marketing was telling people they could get $500 on a benefit card and made it sound like it was about the money and not about the benefits. CMS was concerned that this was misleading.”

The Trump administration has not dismissed or moved forward on the Biden proposal, Fingold said.

“We’re waiting and seeing what the impact will be,” she said. “But my message is, don’t let down your compliance guard.”

‘A little breath of fresh air’

“I do believe brokers will have a little breath of fresh air when it comes to this year’s enrollment; they’ll have a little bit more of a normal AEP than what they’re used to,” he said.

Adair said he believes the Medicare market has calmed down since last year, with carriers having a chance to adapt their pricing to changes brought about by the IRA’s lowering of prescription drug costs to Medicare enrollees.

“Last year, there were big changes and the plans didn’t know how to react to them. They didn’t know how other plans would react to them, and nobody knew how it would affect their bottom line,” he said. “Carriers didn’t know how to make sure their plans would be profitable, and they also didn’t know how they would compare with their competition.”

Carriers continue to announce that they are not paying commissions on certain plans, “So it’s still crazy,” Adair said. “Some have told me that they think the enrollment period for 2026 will be just as bad as 2025, but I don’t think that will be the case.”

Adair gave some reasons why he believes the upcoming enrollment period will be easier for brokers.

“I believe carriers have a better idea of what their plans and their competitors will look like. When carriers do their planning to figure out how much membership they expect and how much they want, they will have a better idea on what their competition will be able to do now that we have one year of new rules under our belt and there isn’t anything crazy changing this year,” he said.

CMS is increasing funding for MA plans in 2026, with a final rate increase of 5.06%. This is a significant increase compared to the 2.23% increase proposed by the previous administration. The higher rate is estimated to result in an additional $25 billion in payments to MA plans in 2026. The higher payments are expected to provide more financial stability for MA plans, particularly after two years of cuts and plan closures.

Adair said he believes the increased federal payment will result in stronger plans and a more stable marketplace.

But brokers remain concerned about carriers not paying commission on certain plans, he said. “I believe that’s more to do with the fact that these plans aren’t as profitable for the carriers. Especially on the prescription drug plans, there’s not a huge profit there.”

Consumer demand for MA will continue to grow, Adair predicted, especially as consumers with health conditions will get priced out of the Medicare Supplement market.

“I’m seeing brokers offering Medicare Advantage plans and pairing them with a hospital indemnity plan so that people can have the coverage they need without the rates going up,” he said.

Adair said he has seen more brokers leave the business in the past six months than he did in the past five years.

“This is not a good sign, because I believe strongly that the best way for someone to get the best plan for their needs is to work with a knowledgeable local broker. For brokers seeing the uncertainty of the market and a lot of them wanting to leave over the past few months, that is not a good sign.

“But I’m hopeful that this annual enrollment period will see a little bit more certainty and have brokers a little less uneasy than I’ve seen them in the past few months.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

An ‘agents first’ philosophy for growth — With Pan‑American Life’s José Suquet

Commentary: State Farm wildfire claims handling sparks regulatory scrutiny

Advisor News

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

More Advisor NewsAnnuity News

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

More Annuity NewsHealth/Employee Benefits News

- Illinois Medicaid program faces looming funding crisis due to federal changes

- ICYMI: GOVERNOR MURPHY SIGNS LEGISLATION PROTECTING VACCINE ACCESS AND AFFORDABILITY IN NEW JERSEY

- Mayer: Universal primary care

- Trump administration announces health plan concept

- Fewer people buy Obamacare coverage as insurance premiums spike

More Health/Employee Benefits NewsLife Insurance News