Selecting The Right Annuity Requires Dialogue & Partnership

With millions of Americans entering retirement over the next decade, many will benefit from the unique features of annuities. Although the core and defining value of annuities is guaranteed lifetime income, deferred annuity products offer various combinations of downside protection and upside potential. Investors of varying levels of risk tolerance will have an abundance of options to meet their financial needs.

In the current investment environment — where interest rates are low and stock market returns have generally been strong — annuity carriers and distributors need to understand which annuity product concepts have the greatest appeal and which investors favor certain products. Aligning specific annuity products with clients’ needs is a service usually performed by advisors. Because of this tendency, simply looking at sales patterns may not reveal investors’ preferences on a conceptual level. If investors are given the opportunity to select for themselves, what would they want?

A recent Secure Retirement Institute study examined investor preferences for the four main types of deferred annuities now on the market: fixed-rate, fixed indexed, registered index-linked and variable. We asked investors to consider their current financial situation and to select one of four investment options with varying degrees of downside protection and upside potential in which to “invest” $100,000 for five years. Rather than use the industry terms for the product types, we provided study participants with a basic description and hypothetical outcomes.

Nearly half of investors (46%) selected the “full downside protection, limited upside potential” option, which corresponded to an FIA. The top reason was their placing more value on protecting savings than seeking maximum gains. FIAs are especially popular among older, more conservative and less financially knowledgeable investors. Another 35% of investors chose the “limited downside protection, limited upside potential” option, which corresponds to a RILA. Those who selected RILAs tend to believe the stock market will perform well over the next five years and value the ability to maximize gains. These two product classes were much more popular than were either VA or FRD products.

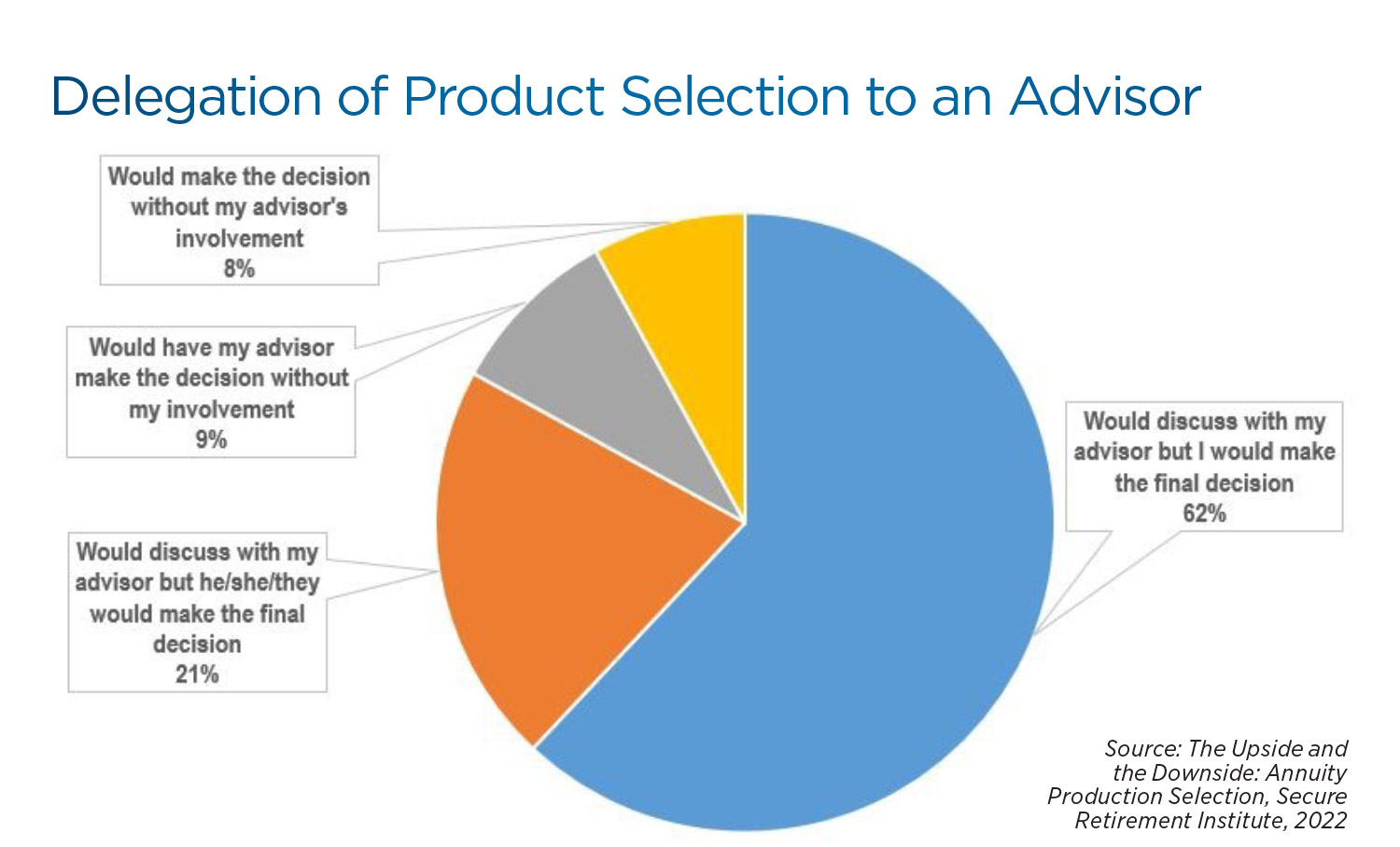

If investors have such strong preferences for FIAs and RILAs, could they simply seek out and purchase these products on their own? The SRI research suggests otherwise: Among the 57% of investors who regularly work with paid professionals to assist with the household’s financial and investment decisions, the vast majority (92%) would involve their advisors in this kind of product selection decision. Only 9% of those surveyed would fully delegate the decision to their advisors without the investor’s involvement. Older, retired and higher-income investors were more comfortable delegating this product selection decision to their advisors.

This overall selection pattern reveals that most investors appreciate the combination of upside potential and downside protection offered by FIAs and RILAs. In the context of a multiyear bull market, the notion of protecting assets clearly has traction. However, with interest rates so low, many investors also want to avoid locking in a low rate of return.

Our study clearly shows that most investors do not want the sole responsibility for such a complex financial decision. Even if clients give their advisors discretion over day-to-day buying and selling decisions in their portfolios, selection of a deferred annuity clearly requires dialogue and a partnership. When working with carriers, advisors will be successful by connecting the specific objectives of annuity products with the needs and mindsets of investors.

Matthew Drinkwater, Ph.D., FSRI, FLMI, AFSI, PCS, is corporate vice president, LIMRA and LOMA. He may be contacted at [email protected].

More States Eyeing Financial Literacy As A Graduation Requirement

Adults List The Financial Mistakes They Don’t Want Their Kids To Make

Advisor News

- Todd Buchanan named president of AmeriLife Wealth

- CFP Board reports record growth in professionals and exam candidates

- GRASSLEY: WORKING FAMILIES TAX CUTS LAW SUPPORTS IOWA'S FAMILIES, FARMERS AND MORE

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- FINAL DAY OF OPEN ENROLLMENT ON COVERME.GOV FOR 2026 COVERAGE

- What the ACA marketplace could mean for your health insurance premiums

- Harshbarger hopes bill will reduce red tape for those with a terminal illness

- Uninterrupted coverage for thousands as Graves Gilbert, Humana announce new contract

- Unholy alliance of Democrats, insurers has ruined the system

More Health/Employee Benefits NewsLife Insurance News