Q1 life premium down; Northwestern Mutual tops first LIMRA sales list

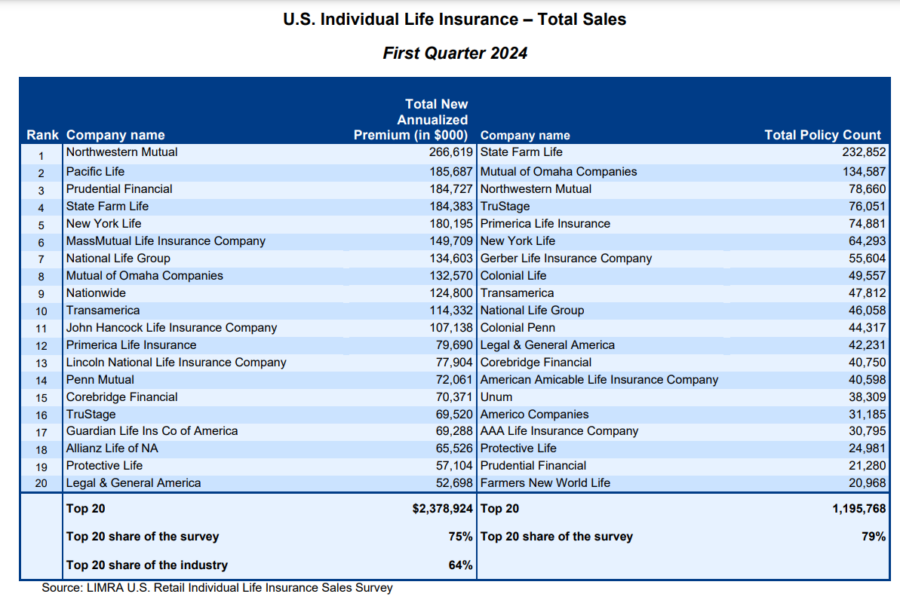

Northwestern Mutual is the king of life insurance premium, according to the first sales rankings compiled by LIMRA.

The mutual insurer recorded nearly $267 million in new annualized life premium during the first quarter. Trailing were Pacific Life, Prudential Financial and State Farm, all with $184 to $186 million in life premium.

Althought Northwestern Mutual is a private company, executives have self-reported record sales numbers in recent years.

Overall, total life insurance new annualized premium fell 1% year over year to $3.73 billion in the first quarter, according to LIMRA’s U.S. Life Insurance Sales Survey. The total number of policies sold in the first quarter of 2024 were level with prior year’s results.

“Given the dominant role the top 20 carriers have on the U.S. life insurance market (representing 65% of the total new premium), LIMRA believes transparency is important and has decided — for the first time — to begin publishing the top 20 life insurance sales leaders," said John Carroll, senior vice president, head of Life and Annuities, LIMRA and LOMA. "LIMRA has been publishing top 20 annuity sales rankings for the past decade, which has helped the broader industry stakeholders distinguish the key factors driving annuity market growth. Similarly, we expect knowing the life insurance sales leaders will help expand understanding about the market dynamics at play.”

LIMRA provided a sales breakdown by life insurance product area:

Indexed universal life

In the first quarter 2024, indexed universal life (IUL) posted the largest growth year over year in absolute dollars, up 4% to $871 million. More than half of IUL carriers reported gains in the first quarter, including 7 of the top 10, which sold more than three quarters of the industry’s IUL premium. The number of policies sold jumped 13% in the first quarter, with a majority of carriers posting positive growth. IUL premium represented 23% of the total new annualized premium in the first quarter.

“Carriers that reported the strongest sales growth cited an increased sales force, rising demand for accumulation-focused products, and/or higher survivorship sales, due to the scheduled drop in the estate tax exemption amount next year,” said Karen Terry, assistant vice president and head of LIMRA Insurance Product Research. “Given the current economic environment, LIMRA is forecasting IUL sales to experience moderate growth in 2024 and 2025.”

Term life

Term new premium rose 4% in the first quarter to $762 million with all of the top 10 carriers posting premium gains. Policy count grew 3% in the quarter. This is the fifth consecutive quarter of growth in both premium and policy sales.

The sales increase is credited to the expansion of digital platforms and accelerated underwriting, additional distribution partners and product enhancements. In the first quarter, term new annualized premium held a 20% share of the total U.S. individual life insurance market.

Fixed universal life

For the third consecutive quarter, fixed universal life (fixed UL) new premium increased. In the first quarter. Fixed UL new premium was $247 million, up 6% year over year. While several companies reported an increase in their lifetime guarantee UL sales, the rise in fixed UL premium was mainly driven by hybrid life/long term care product sales.

The number of fixed UL policies sold fell 4% from first quarter 2023 results. Fixed UL premium represented 7% of the total new annualized premium in the first quarter.

Whole life

Whole life new premium totaled $1.46 billion in the first quarter, down 7% from prior year’s results. Half of the whole life carriers reported declines in the quarter, including 7 of the top 10, which represent more than 50% of the whole life market. The number of whole life policies sold fell 5% in the first quarter, compared with first quarter 2023. Whole life insurance new premium held 39% of the total new annualized premium sold in the first quarter.

Variable universal life

Variable universal life (VUL) new premium fell 7% in the first quarter to $398 million. While half of the VUL carriers reported sales growth, the carriers that reported declines represent several of the top VUL manufacturers. The number of policies sold, however, grew 4%, compared with first quarter 2023. VUL premium held 11% of the total U.S. life insurance market in the first quarter.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Wisconsin releases enforcement actions for May

What’s behind the optimism surrounding the Medicare trust fund?

Advisor News

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

- NEW YEAR, NEW LAWS: GOVERNOR HOCHUL ANNOUNCES AFFORDABLE HEALTH CARE LAWS GOING INTO EFFECT ON JANUARY 1

- Thousands of Alaskans face health care ‘cliff in 2026

- As federal health tax credits end, Chicago-area leaders warn about costs to Cook County and Illinois hospitals

- Trademark Application for “MANAGED CHOICE NETWORK” Filed by Aetna Inc.: Aetna Inc.

More Health/Employee Benefits NewsLife Insurance News

- One Bellevue Place changes hands for $90.3M

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

More Life Insurance News