Pros and Cons of AI in the industry

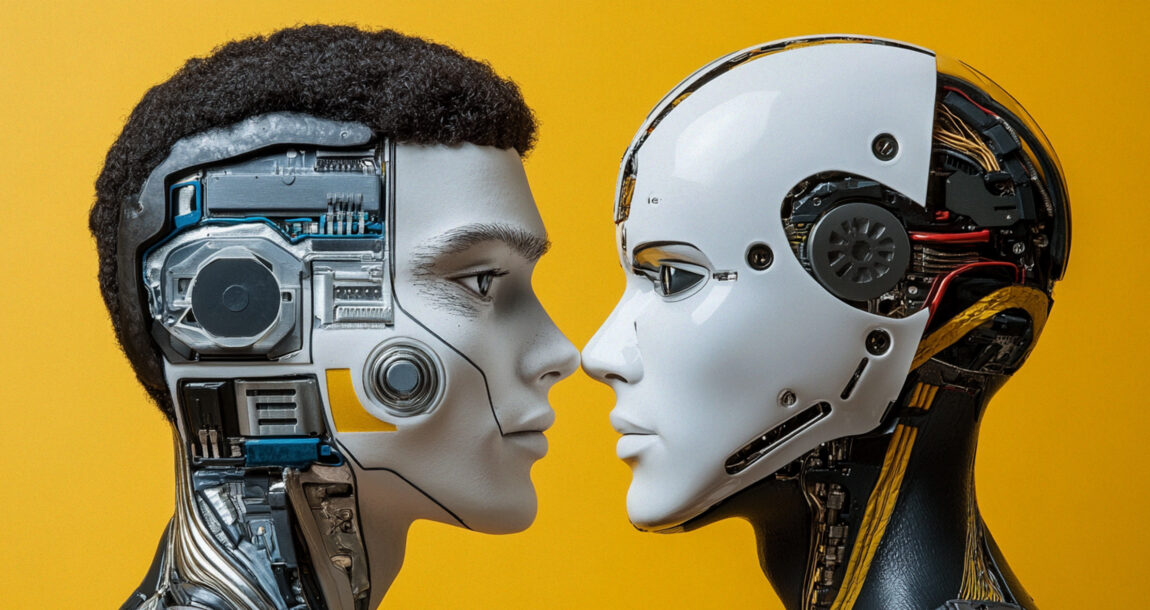

Despite its relatively recent appearance on the scene, artificial intelligence has become one of the most transformative technologies of the 21st century. The insurance industry, traditionally reliant on human judgment and paper-heavy processes, is no exception to this transformation. While AI’s integration into the insurance sector offers opportunities for agents, it also introduces some dangers and complexities.

Pros of AI in the insurance industry

1. Improved customer insights

One of the key advantages AI offers agents and advisors is its ability to analyze massive datasets and provide actionable insights. With AI-powered algorithms, agents can understand their clients better, anticipate their needs and provide personalized policies that are more likely to appeal to them. Predictive analytics, a subset of AI, can identify patterns in customer behavior, enabling agents to offer timely recommendations. This results in a more personalized customer experience, which can enhance client satisfaction and loyalty.

2. Automation of administrative tasks

AI-driven automation can significantly reduce the administrative burden that agents and advisors face. Tasks such as processing claims, underwriting and even routine customer inquiries can be automated through AI tools. Chatbots, for example, can handle initial or routine customer interactions, freeing agents to focus on more complex tasks that require human expertise.

3. Improved risk assessment and fraud detection

AI can enhance the accuracy of risk assessment and improve fraud detection processes. By analyzing vast amounts of data, AI can identify suspicious activities or inconsistencies that would otherwise go unnoticed. This helps insurers minimize fraud-related losses and allows agents to better protect their clients from potential risks. AI also can provide more accurate risk profiles for customers.

4. Faster decision-making

AI enables faster decision-making in various aspects of the insurance process. Whether it’s offering instant quotes, automating claims adjudication or streamlining policy approvals, AI reduces the time taken for each step. In a competitive market where speed is often a critical factor, this can give agents a significant edge.

5. Scalability

AI tools can help insurance agents scale their operations. By automating routine tasks and leveraging AI-driven customer insights, agents can handle a larger client base.

Cons of AI in the insurance industry

1. Reduced human interaction

As AI takes over more customer-facing roles, such as handling queries via chatbots or automating claims processing, there is a risk that the traditional personal touch will be lost. Removing human interaction could alienate some clients, particularly those who prefer face-to-face communication. Agents must strike a balance between using AI for efficiency and maintaining a strong human connection with clients.

2. Job displacement concerns

The rise of AI brings with it fears of job displacement in the insurance sector. As AI systems become more advanced, they can handle more complex tasks that were once the sole domain of agents. However, while AI may reduce the need for some tasks, it is unlikely to replace the human element in insurance. Agents are crucial to provide the personal understanding, judgment and nuanced decision-making required to best serve clients.

3. High implementation costs

Adopting AI technologies can be expensive, especially for smaller insurance agencies. The initial investment in AI tools, along with the training required for agents to use these tools effectively, can be a significant financial burden. Smaller firms or independent agents may struggle to keep up with technological advancements, potentially putting them at a competitive disadvantage.

4. Data privacy and security issues

AI systems rely on vast amounts of data to function effectively. The increased use of AI introduces new challenges related to data privacy and security. Agents and insurers must ensure that their AI systems comply with emerging regulations.

5. Bias in AI algorithms

Another potential pitfall is the risk of bias in AI algorithms. AI systems are only as good as the data they are trained on, and if that data contains biases — whether racial, gender-based or socioeconomic — then the AI’s recommendations and decisions may reflect those biases.

Will AI improve success for insurance agents?

In the long run, AI has the potential to significantly improve the success of agents and advisors. By automating mundane tasks, enhancing customer insights and providing more accurate risk assessments, AI enables agents to work more efficiently and effectively. Those who embrace AI and leverage its strengths will likely find themselves better equipped to serve clients in an increasingly competitive market.

Despite the advantages provided by AI, the human element remains irreplaceable. Clients still value trust, empathy and personal interaction. The future of insurance will not be about choosing between AI and human agents — it will be about using both to deliver superior service.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

50 years of ERISA: A look back at its roots

Transferring generational wealth involves more than financial assets

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- Ambler Brook Announces Strategic Growth Investment in Claimify

- Sarepta Therapeutics Announces Commercial Launch of ELEVIDYS in Japan

- Howell, Watson propose bill to create oversight commission

- HEALTH INSURER FINANCIAL PERFORMANCE IN 2024

- THREE CONGRESSIONAL MISSTEPS ON HEALTHCARE

More Health/Employee Benefits NewsLife Insurance News