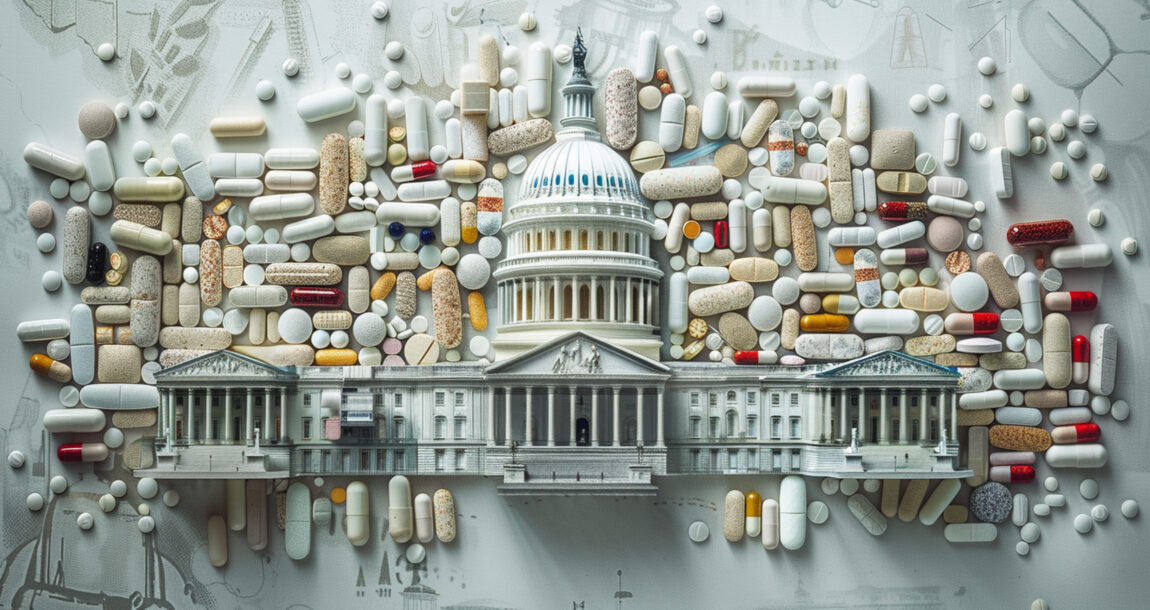

Prescription drug issues dominate health care policy in 2024

You can’t talk about health care regulation and legislation without discussing prescription drug pricing, and prescription drugs are dominating health care policy in 2024.

That was the word from Michael Kolber, partner with Manatt Health, during a recent webinar on legislative and regulatory trends shaping health care this year.

Medicare drug price negotiations, which were part of the Inflation Reduction Act, are well underway, Kolber said, with prices for the first round of 10 drugs under negotiations to be announced in September. The next 15 drugs covered under Medicare Part D to have their prices negotiated will be announced in February 2025.

However, several lawsuits in federal court aim to stop implementation of the IRA’s Medicare prescription drug price negotiation provision.

In the wake of the IRA, pharmacy benefit manager reform is one of the few areas related to health care in which Congress agrees on policy, said Nick Bath, partner at Manatt Health. Multiple bills relating to PBMs await reconciliation in Congress’ lame duck session. They are:

- Lower Costs, More Transparency Act, H.R. 5378: Pieces of this legislation regulate the commercial market, Medicare and Medicaid. The bill targets spread pricing, transparency and vertical integration.

- PMB Reform Act, S. 1339: Would regulate commercial market plans with policies targeting spread pricing, rebate pass-throughs, transparency and step therapy.

- Modernizing and Ensuring PBM Accountability Act, S. 2973: Regulates Medicare and Medicaid with policies targeting spread pricing, transparency, and pharmacy and therapeutics committees.

No Surprises Act leads to high number of payment disputes

The No Surprises Act was enacted by Congress in December 2020 to protect commercially insured patients from surprise bills after emergency treatment by an out-of-network provider, treatment by an out-of-network provider at an in-network facility or transport by an out-of-network air ambulance provider.

The NSA requires plans to charge patients only their in-network cost-sharing amount and separately determine provider reimbursement. To settle these payment disputes, the NSA created a federal arbitration process, commonly referred to as independent dispute resolution, to adjudicate disputes and render payment determinations.

However, the IDR process has been used more than the administration projected, Bath said, with more than 490,000 disputes submitted between April 2022 and June 2023 - more than 25 times higher than originally projected.

CMS has had to pause the IDR system while it smooths some of the barriers to timely determinations and payments.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Retirees shifting portfolio focus from growth to new target, study finds

Market reacts positively to Nippon stake in Corebridge Financial

Advisor News

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

More Advisor NewsAnnuity News

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News