Inflation Reduction Act contains ‘unprecedented’ health care provisions

Congress passed a sweeping bill that will impact everything from energy to health care - and is good news for those who are on Medicare or who rely on enhanced tax credits to pay for health insurance.

The Inflation Reduction Act was passed in the House of Representatives Friday and will go to President Joe Biden for his signature. The $430 billion climate, health care and tax overhaul also provides tax credits for clean energy, invests in climate initiatives, boosts funding for the IRS and enacts a 1% excise tax on stock buybacks.

The health care provisions in the Inflation Reduction Act are “unprecedented,” especially regarding the ability for Medicare to negotiate drug prices. That was the word from Larry Levitt, vice president for health policy with KFF, during a webinar this week.

The bill makes major changes to Medicare as well as extends the enhanced tax credits that enable Americans to buy health insurance through the Affordable Care Act exchanges. Those enhanced tax credits were due to expire at the end of this year, leaving an estimated 3 million people without coverage.

Medicare and prescription drugs

The ability for Medicare to negotiate prices with drug manufacturers “is the most major improvement in Medicare benefits since the ACA was enacted,” said Tricia Newman, KFF senior vice president and executive director of The Program on Medicare Policy.

“We come face to face with the costs of our prescription drugs every time we go to the pharmacy,” she said. “Everybody knows somebody who is struggling to pay for their medications.”

Prescription drug provisions in the Inflation Reduction Act include:

- For the first time, the federal government is required to negotiate prices for some of the highest-spending drugs covered under Medicare.

- Requires drug companies to pay rebates if prices rise faster than inflation for drugs used by Medicare beneficiaries.

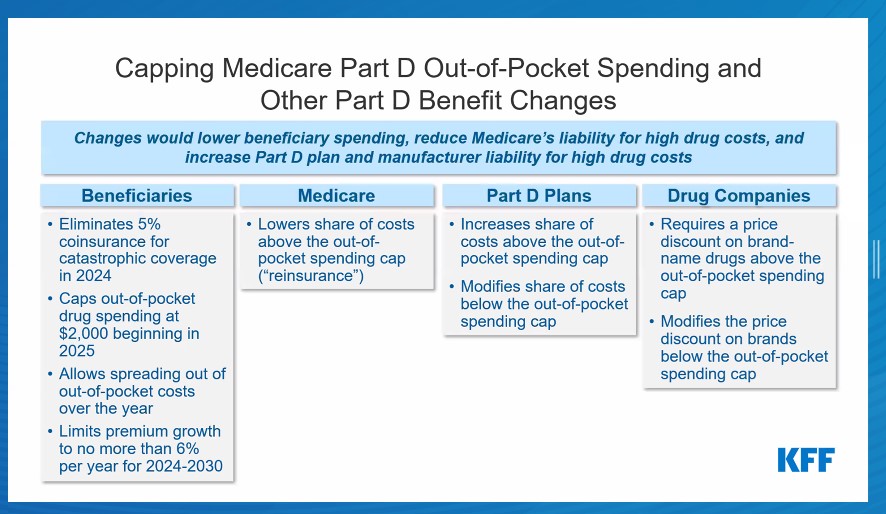

- Eliminates the 5% coinsurance for catastrophic coverage in Medicare Part D in 2024, adds a $2,000 cap on Part D out-of-pocket spending in 2025 and limits annual increases in Part D premiums for 2024-2030.

- Limits monthly cost sharing for insulin products to $35 for people with Medicare.

- Expands eligibility for Medicare Part D low-income subsidy full benefits.

- Eliminates cost sharing for adult vaccines covered under Medicare Part D and improves access to adult vaccines under Medicaid and the Children’s Health Insurance Program.

Although the bill empowers the Secretary of Health and Human Services to negotiate drug prices, only certain drugs qualify, said Juliette Cubanski, deputy director of The Program on Medicare Policy.

Qualifying drugs are high-spending brands and biologics without generic or biosimilar equivalents that are nine years or more (for small-molecule drugs or 13 years or more (for biologicals) from Food and Drug Administration approvals (with some exceptions). Ten Part D drugs will qualify for price negotiations in 2025; 15 Part D drugs will qualify in 2027; 15 Part D and Part B drugs will qualify in 2028, and 20 Part D and Part B drugs will qualify in 2029 and beyond.

The new law also requires drug manufacturers to pay rebates for drug price increases above the rate of inflation. In addition, Medicare Part D out-of-pocket spending is capped.

Beginning in 2023, the new act limits copayments to $35 per month per prescription for covered insulin products in Medicare Part Dl plans and for insulin furnished through durable medical equipment under Medicare Part B, with no deductible. For 2026 and beyond, monthly Part D copayments for insulin will be limited to the lesser of:

- $35

- 25% of the maximum fair price in cases where the insulin product has been selected for negotiation.

- 25% of the negotiated price in Part D plans.

The act also expands eligibility for full benefits under the Part D low-income subsidy program and improves Medicaid and Medicare coverage of adult vaccines.

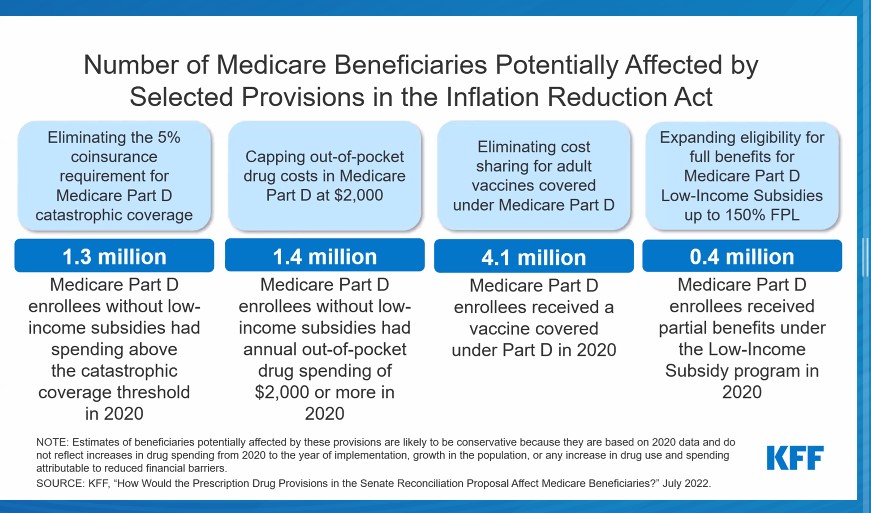

How many Medicare beneficiaries would potentially be affected by the Medicare-related provisions in the Inflation Reduction Act?

Rescuing the ACA subsidies from the American Rescue Plan Act

The American Rescue Plan Act of 2021, enacted as COVID-19 continued to ravage the nation, increased the premium tax credits for purchasing ACA insurance coverage and extended those credits to more people. This enabled more people to purchase health insurance, swelling the ranks of those covered under the exchanges to a record of 14.2 million.

The Inflation Reduction Act continues those subsidies through 2025. It also prevents premium hikes that enrollees would have face had ARPA expired.

Without the extension of the enhanced premium tax credits, nearly all 13 million people who receive subsidies to buy health insurance would experience a premium hike, said Cynthia Cox, KFF vice president and director for the Program on the ACA. In addition, the average ACA premium payment would be 53% higher, or about $700 annually.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

UnitedHealthcare introduces new business unit Surest

Commentary: CMS Medicare recording requirement could risk senior data

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News