Preparation key for Sandwich Generation’s retirement readiness

Obtaining professional advice and owning an annuity are two of the factors that separate the Sandwich Generation members who are confident of their retirement and those who aren’t.

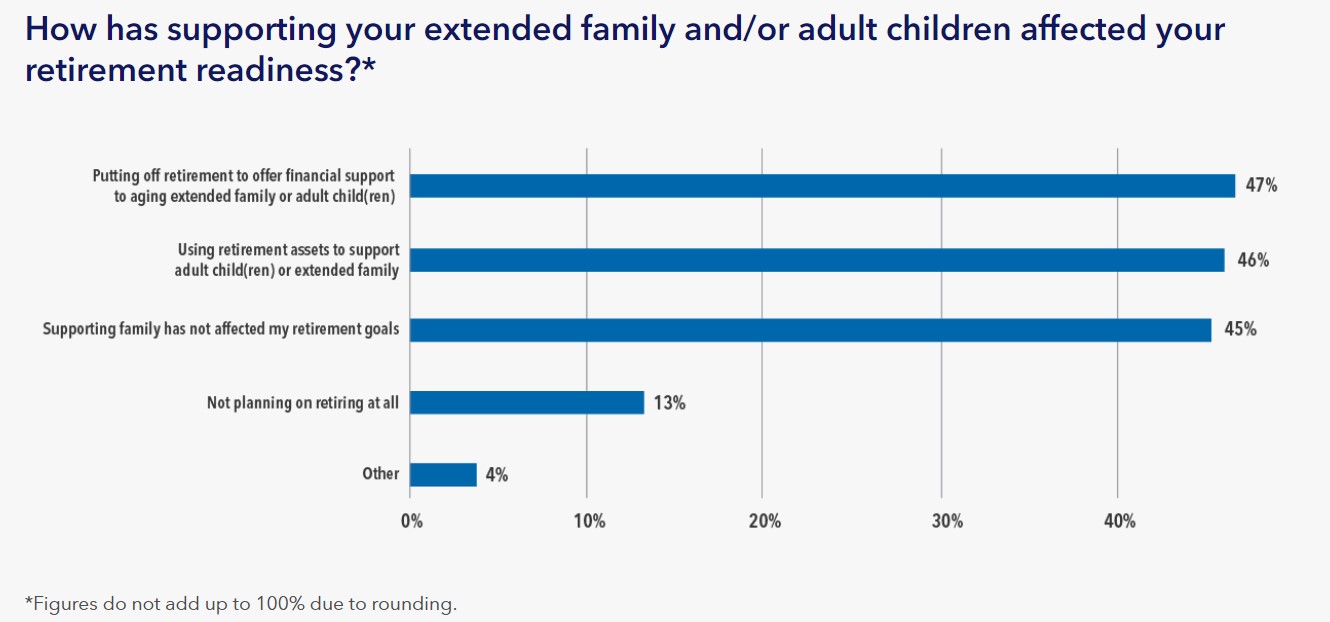

That was among the findings of an Athene survey that showed nearly half of Sandwich Generation parents (47%) are putting off retirement to offer financial support to their aging relatives or adult children. However, on the flip side, 45% of the group say that supporting their family has not affected their retirement goals or plans for the future.

“I thought it was interesting that you sort of have this mixed bag where some people felt like they were able to manage their finances and plan while others definitely felt it was a struggle,” said Amanda Steward, head of marketing with Athene.

Over the last 50 years, the number of people living in multigenerational households has quadrupled, Athene said, with many adults sharing their homes with their parents or older relatives, as well as their adult children.

Athene surveyed parents in their 40s and 50s who are caring for aging parents while raising children or financially supporting adult children. Among the findings:

- Generational generosity costs: 76% of Sandwich Generation parents say they’re financially supporting their adult children and 63% are providing this support to extended family as well.

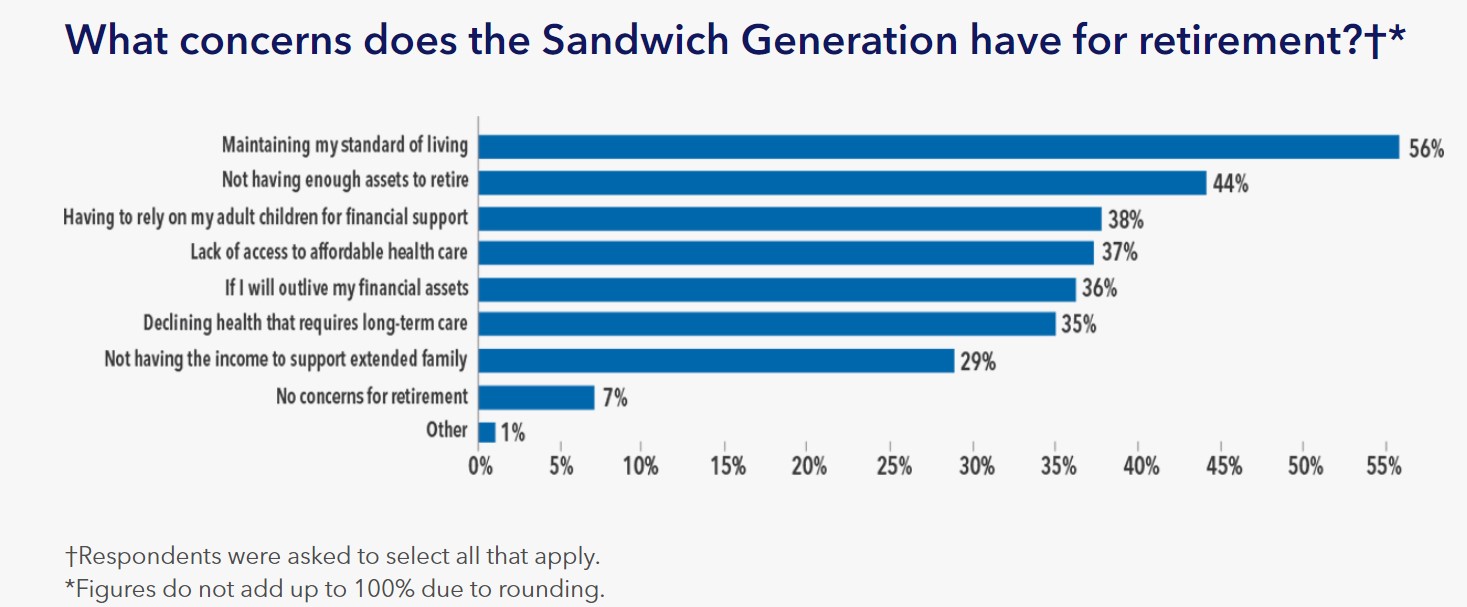

- Concerns about retirement: 55% of respondents said they were most concerned about their lack of assets to retire, followed by a worry they would not be able to maintain their standard of living once in retirement.

- The annuity difference: 70% of Sandwich Generation parents with annuities, which comprised 20% of the overall sample, say that caring for loved ones has not altered their retirement readiness.

Balancing personal and family finances for the Sandwich Generation

Of the group of Sandwich Generation parents surveyed, 58% of households have adult kids at home and another 76% of individuals financially support them. Even with a vast majority of their children having a source of income, parents are helping with a variety of expenses.

- Daily expenses (groceries, clothing, cell phone, etc.) – 82%.

- Housing – 65%.

- Insurance (health care, vehicle, etc.) - 57%.

- Education – 53%.

- Transportation – 44%.

In addition, 50% of this group is also managing all or a portion of their children’s debt.

More income could help boost retirement confidence

Among the respondents, 55% made less than $100,000 per year. For this group, they said they were most concerned about their lack of assets to retire, followed by a worry they would not be able to maintain their standard of living once in retirement. But among those who made more than $100,000 per year, 66% of respondents said they were concerned about not being able to maintain their lifestyle once retired, but were more confident in their ability to take care of their adult children and aging parents successfully.

Preparation also makes a difference in retirement confidence, Steward said.

“Of those who said that they felt more prepared for retirement, 70% of them had annuities. And those who used a personal financial advisor and have had those conversations with their loved ones and put a plan together also reported more confidence.”

The study showed a difference between men and women in financial decision-making, seeking professional advice and overall confidence in providing for their family members. Men are more likely to be the sole decision maker of the household, more likely to work with a financial professional and are more confident in their ability to take care of their families. Around 29% of women said they share this confidence, but only a small percentage connect with a financial professional for assistance.

In looking ahead to their own retirement, 66% of the surveyed group are counting on Social Security as a source of income, followed by 401(k)s and investments. Nearly a quarter of respondents have annuities as part of their financial portfolio. Close to 50% of respondents reported that supporting family has not affected their retirement goals, while 70% of those with annuities (22% of overall sample) said that caring for loved ones has not altered their retirement readiness.

For many who are a part of the Sandwich Generation, they may face a unique challenge of supporting multiple generations while also trying to keep their own goals in mind. This will require a flexible financial plan and empowering their family members to take part in their own financial futures.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Fiduciary institute ads take stance against broker dealers

Insure your building project from the ground up

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

More Life Insurance News