Powering Through Disruption

As 2022 rolls into summer, the annuity market is enduring every kind of gut punch disruption imaginable — from the pandemic to technology, from regulation to inflation.

And now you can add massive interest rate uncertainty to the mix.

But after a pandemic sales dip, Americans resumed loving on annuities, more so than ever.

Every research and intelligence tracking group reports the highest annuity sales levels in more than a decade.

“From our standpoint, especially in the retail space, it’s as though the pandemic never happened,” said Mike Downing, executive vice president, chief operating officer and chief actuary of Athene Holding, a leading annuity seller.

Annuity sellers thrived in 2021, recording the highest industry sales figures since 2008. Analysis by LIMRA, Beacon Research, Morningstar and Wink all agreed on the stunning market turnaround from the COVID-19 business shutdown.

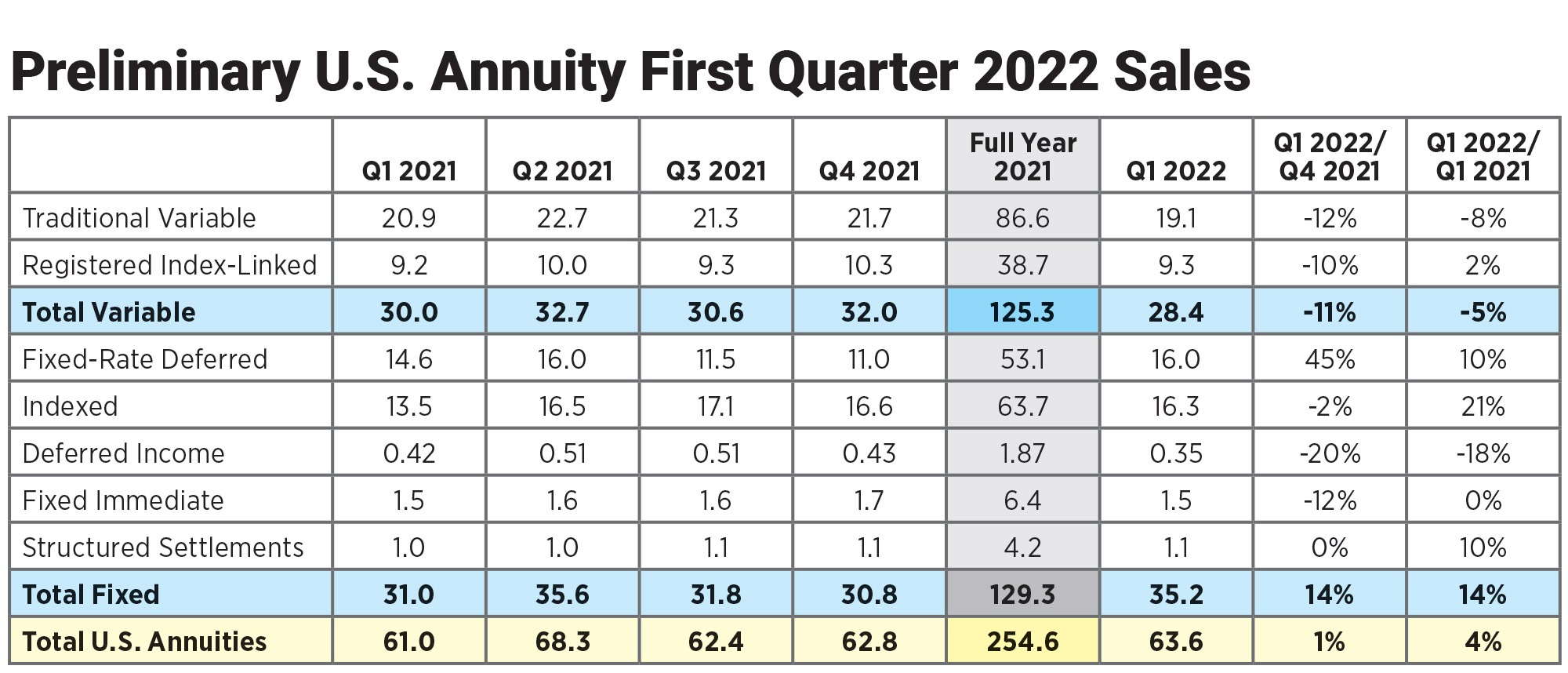

Total annuity sales were $254.6 billion, up 16% from 2020, and the third-highest recorded in history, according to results from the Secure Retirement Institute U.S. Individual Annuity Sales Survey.

“After 2020, there was significant pent-up demand for investment options that offered a balance of protection and growth,” said Todd Giesing, assistant vice president, SRI Annuity Research.

“As a result, registered index-linked annuity sales had a record year and fixed indexed annuities experienced the strongest growth in three years. Together, sales of these products represented 40% of total sales in 2021.”

Whether sales keep climbing will depend on how annuity product designs work with the expected economic turbulence ahead. Industry execs insist they are projecting solid sales increases and smooth sailing for quarters to come.

Chameleon Product

Annuity designers are a smart group. The use of caps, participation rates, riders and proprietary indices and other mechanisms enables designers to tweak products to fit any range of economic circumstances — from boom to bust times.

Registered indexed-linked annuities are just the most-recent example of that ingenuity. Also known as buffered or structured annuities, RILAs are leading the growth spurt in recent quarters.

RILAs provide a menu of index-linked accounts of varying durations, with crediting methods like those seen on indexed annuities. The index buckets are coupled with downside protection options in which the insurer will absorb initial index losses up to a predetermined percentage.

Because the client takes on any additional downside, or percentage “floors” where clients take the first losses, less risk is assumed by the carrier. Insurers are seizing the product opportunity, continuing to replace traditional variable annuities that offer living benefits with RILAs.

RILA sales checked in at $38.1 billion in 2021, reported Wink, which classifies the products as “structured” annuities.

“The 2021 sales topped the prior year’s record by nearly 59%,” said Sheryl Moore, CEO of Wink. “And soon, more companies will enter this growing market.”

However, RILAs have done well in the sweet spot for clients seeking tax-deferral who want more growth than they can get with fixed instruments in a low-rate environment but unwilling to endure significant equity risk. Those factors are changing.

The stock market is certainly more turbulent — a situation that favors RILAs — but interest rates are on the rise, too. At their May meeting, the Fed boosted interest rates by 0.5 percentage points to a target range of 0.75 to 1 percent. Expectations are for further rate hikes this summer.

Even Sweeter Spot?

St. Louis Fed President James Bullard wants to go further and hike rates to 3.5% by year’s end. The Fed is trying to bring inflation down by raising rates.

Rising interest rates should be good news for annuity sellers and buyers. As the old Chinese phrase states, a rising tide lifts all boats. A higher interest rate means insurers can get better returns on investments. Likewise, the products become more attractive as well.

Fixed annuities, which pay out a specific, guaranteed rate, are most directly affected by interest rates. Simply put, the higher the interest rate, the better the payout investors will receive for the same premium.

Regardless of where interest rates land, Downing said RILAs are likely to remain strong sellers. In fact, higher rates should help a wide range of annuities, he added.

“In general, rising rates are good for insurance because it means we can offer more competitive products,” he explained, “and create a more compelling alternative to other choices that customers might have with respect to traditional equities or variable annuities.”

It remains to be seen how other interest-bearing investments, such as bonds and money market accounts, adjust to higher rates.

“Rising rates are great, because in terms of the promise that’s available to customers, protecting the downside and the traditional fixed indexed annuity, flooring the downside at zero, but there’s just that much more upside potential,” Downing said. “That creates more interesting decision points for customers and more options and opportunities for customers.”

Psychological Impact

A typical baby boomer planning to retire soon was in their 20s when inflation reached a peak 14% in 1980. Their parents probably carried forward generational scars of Depression-era struggles for work and food and money to pay bills.

Those experiences will impact the investing decisions for many as they adjust their retirement planning. It’s part psychology, but also a very real problem for retirees and near-retirees. High inflation can drastically shrink a retirement nest egg.

The Department of Labor reported that its consumer price index jumped 8.5% in March from 12 months earlier — the biggest year-over-year increase since December 1981. Prices have been driven up by bottlenecked supply chains, robust consumer demand and disruptions to global food and energy markets worsened by Russia’s war against Ukraine.

A recent survey by Voya Financial found Americans of all generations worried about the impact of inflation on their retirement plans.

Voya found that three-quarters (73%) of millennials and Generation X (74%) agreed or strongly agreed that they are worried about the impact of inflation on their ability to save enough for retirement. And more than half (57%) of millennials, who now make up roughly one-third of the U.S. labor force, agree or strongly agree that, because of inflation, they will need to delay their planned retirement date.

“Because of inflation, nearly half (43%) of individuals have had to tap into finances that they previously had set aside for retirement — and not surprisingly, this is even higher among millennials (57%),” said Heather Lavallee, CEO of wealth solutions for Voya.

What does the inflation fear mean for annuity sales? Plenty, said Martin Powell, head of annuity distribution for CUNA Mutual Group.

CUNA is enjoying strong sales success with fixed annuity products, Powell said. Sales increased 36% in 2021 to $1.8 billion, and that momentum carried forward into the first quarter of 2022, he added.

The company projects continued strong sales of its flagship RILA, ZoneChoice. Introduced last year, the ZoneChoice products include a new Barclays Risk Balanced Index, which allocates between low-volatility stocks and fixed income, and was developed in partnership with CUNA.

It also offers the S&P 500 Index and a declared rate account that lets buyers lock in a pre-determined rate for one year.

The RILA offerings are a good place to park money during times of economic volatility, Powell noted.

“People are realizing, ‘Hey, I need to put a collar around my risk,’ especially with increased interest rates, increased inflation, a lot of market volatility, and a lot of uncertainty with the market,” he said.

Tax Hikes Planned

President Joe Biden never shied away from his campaign trail commitment to levy “wealth taxes” on the high earners. The idea returned this spring with the “Billionaire Minimum Income Tax” tucked into the president’s $6 trillion budget.

It would assess a 20% minimum tax rate on total income, including unrealized capital gains, on U.S. households worth more than $100 million. Over half the revenue could come from those worth more than $1 billion.

“This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters,” the document said.

As part of the tax package, the administration wants to tax appreciated assets, even if they are not sold, upon the death of their owner. If adopted, the tax plan could prevent billionaires, and their heirs, from escaping taxes via the gifting of assets at death.

Should the tax package be passed into law by Congress, it is natural to wonder whether the wealthy will look to park more money in tax-advantaged retirement vehicles. In general, the push for more taxes is a boost for tax-averse annuity planning, Downing noted.

“We are interested in exploring to see what more can be done in terms of tax strategies,” he explained. “We see opportunities to look at more investment-oriented products where the advantage of tax deferral can be a strong selling point to help deliver and meet customer needs where taxes are a bigger part of those needs.”

That type of holistic tax and retirement planning is done in the traditional advisor space.

While fee-based annuity sales remain a small piece of the overall market, those numbers are growing, noted Alison Reed, chief operating officer, Jackson National Life Distributors. Like many annuity manufacturers, Jackson is looking to capitalize on the potential in the advisor market.

During the third quarter of 2021, the company introduced Jackson Retirement Investment Annuity, a new fee-based variable annuity targeted at independent registered investment advisors.

“As we look to continue to expand our reach, we believe there is significant opportunity to provide independent RIAs with annuity product options that fit into their client portfolios,” Reed said.

Securing Retirement

Tax deferral is not a new benefit of annuity ownership. Congress is listening to financial services and delivering many more benefits via legislation. Of course, the federal government moves slowly, especially with regulation changes, but the Setting Every Community Up for Retirement Enhancement bill signed by President Donald Trump in the waning days of 2019 was a big victory.

That momentum continued when the House recently voted to pass the Strong Retirement Act of 2022, known colloquially as SECURE 2.0, with overwhelming bipartisan support, 414-5. SECURE 2.0 was in Senate hands as of press deadline, with backers confident it will follow a similar path as its predecessor legislation.

During a recent webinar hosted by InsuranceNewsNet, Diane Boyle, senior vice president for government relations at the National Association of Insurance and Financial Advisors, said retirement savings legislation is a big winner for elected officials on both sides.

“I think we’re going to see the same level of support in the Senate,” Boyle said. “We’ve heard conversations around the need for enhanced retirement savings. How can we get more people to focus on retirement savings and planning and putting together a plan for when you reach retirement? How do you get there? How do you start? And this legislation would enable that and so I think when we move to the Senate, we’re going to see that same level of excitement.”

The twin SECURE bills contain a wide range of tweaks and changes to aid retirement saving. A few big ones directly boost annuities. The first SECURE Act created a safe harbor that employers can use when choosing a group annuity to include as an investment within a defined-contribution plan, with new provider-selection rules.

Another provision of the SECURE Act requires plan sponsors to provide a statement, at least once during a 12-month period, that sets forth the “lifetime income stream equivalent” of the participant’s account balance.

While it is still too soon to know the full impact of all the provisions in the original SECURE, Boyle said industry providers are generally happy with the opportunities to date.

A Nod To QLACs

SECURE 2.0 makes it easier for plans to offer annuities by tweaking required minimum distribution requirements for annuity options. Likewise, the bill makes qualified longevity annuity contracts, or QLACs, more attractive by increasing the amount of retirement savings a client can use to buy one.

The U.S. Treasury Department authorized QLACs for the 401(k) and the individual retirement account markets in 2014 to help workers save for retirement. Modest sales followed, driven primarily by the wealthy.

SECURE 2.0 includes a number of other provisions:

» Raises the age to start required RMDs. Plan participants are required to begin taking distributions from their retirement plans at 72. The bill would raise it to 73 this year and increase it to 74 on Jan. 1, 2029, and 75 in 2032.

» Expands automatic enrollment in employer-sponsored retirement plans, while reducing the service requirements for part-time employees to participate in an employer plan. It requires 401(k) and 403(b) plans to automatically enroll participants, with an employee opt-out. The initial automatic enrollment amount is at least 3% and no more than 10%, but the amount would be increased by a percentage point each year until the total reaches 10%.

» Increases the catch-up contribution level to retirement accounts for people nearing retirement. Under current law, the limit on IRA contributions is increased by $1,000 for individuals who have reached age 50, but the bill would index such limits starting in 2023. It would also increase the limits on catch-up contributions for employees.

» Reduces administrative burdens for plan sponsors by modifying retirement plan design rules, and changes regulations on pooled employer plans and multiple employer 403(b) plans. Small businesses with 10 or fewer employees, new businesses (those that have been operating for less than three years), church plans and governmental plans are excluded from automatic opt-in requirements.

» Expands “Rothification” by requiring a section 401(a) qualified plan, section 403(b) plan, or governmental section 457(b) plan that permits an eligible participant to make catch-up contributions to treat those contributions as after-tax Roth contributions, according to a Deloitte report. The bill would also allow plan participants to designate employer matching contributions as Roth contributions, and permit SEPs and SIMPLE IRAs to be designated as Roth IRAs.

Fiduciary Specter

Regulation change is the one disruptive factor facing annuity sellers that is nearly impossible to turn into a positive. Under Biden, rumblings of a fiduciary standard are again percolating from the Department of Labor.

As this issue went to press, the DOL had yet to publish its revised definition of “fiduciary.” But industry critics are concerned that it could put the clamps on annuity sales just when business is great.

“There’s not a need for a fiduciary-only rule,” Boyle said. “Why are we doing this again? … If you’re going back to putting in play something that’s a fiduciary only, you’re going to lose access to that personalized advice.”

In February 2021, the DOL allowed the investment advice rule, written by the Trump administration, to take effect. That rule replaced the 2015 fiduciary rule produced by the Obama administration. A federal appeals court later vacated the fiduciary rule.

The DOL is certain to build on the new prohibited transaction exemption 2020-02, included in the investment advice rule, legal analysts say.

PTE 2020-02 applies to recommendations for rollovers and other movement of retirement money. Broker-dealer representatives and investment advisors can use the exemption to collect compensation for transactions involving 401(k)s or IRAs. Insurance producers can still use PTE 84-24 for annuity and life insurance sales involving retirement funds.

Meanwhile, state insurance regulators are making terrific progress getting states to pass annuity sales rule updates based on a best-interest model. In April, Wisconsin became the 23rd state to adopt the model put forth by the National Association of Insurance Commissioners. Seven more states have efforts in the works, Boyle said.

The federal regulations take precedence when selling insurance products using retirement dollars, Boyle noted, adding that industry leaders are lobbying for a uniform standard as the best way to provide financial advice and products to those in need.

Regardless of where annuity sales rules end up, Athene is planning strong sales for some time to come, Downing said.

“It’s not a big disrupter. I think it would be, at best, a potential nuisance,” he said of the regulation talk. “The demand for products is there and will continue to be there. And so, when the demand is strong, even though there may be regulations that could make the delivery of those products a little bit more challenging. Generally, the industry is very good at coming to grips with how to address it.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Don’t Worry; Retire Happy – With Moshe Milevsky

Fixed annuity sales boom after 1Q interest rate hikes, SRI says

Advisor News

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

- Prudential study: Babies born today will likely need nearly $2M to retire

More Advisor NewsAnnuity News

- Perspectives: Should I trust my retirement to an insurance company?

- Prudential Financial to Reinsure $7B Japanese Whole Life Block with Prismic Life

- Nationwide Financial Services President John Carter to retire at year end

- Pension Rights Center: PRT deals could lead to ‘nationwide catastrophe’ regulated

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

More Annuity NewsHealth/Employee Benefits News

- Nebraska mental health providers say federal change puts vulnerable at risk

- NC bill would limit insurers' prior authorizations

Proposed NC bill limits reach of insurers' prior authorizations

- UnitedHealth Group, two Blues plans had highest denial rates for ACA health plans in 2023

- Oakland University William Beaumont School of Medicine Researcher Targets Geriatrics and Gerontology (Association of Healthcare Access And Dual Eligibility Status Based on Enrollment in Managed Care): Aging Research – Geriatrics and Gerontology

- MHS’ Health Equity Program, MHS Serves, Launches Youth Mental Health Partnership

More Health/Employee Benefits NewsLife Insurance News

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- Court names special master to unwind Greg Lindberg’s holdings, pay victims

- 9th Circuit: proof of harm required in California life insurance lapse lawsuit

- Legals for January, 24 2025

- U-Haul Holding Company Schedules Third Quarter Fiscal 2025 Financial Results Release and Investor Webcast

More Life Insurance News