Peak 65 to fuel digital boom in annuities

This year was always predicted to be transformative for the life insurance and annuity sector. This was largely due to Peak 65, a milestone marking the most significant surge of retiring Americans in U.S. history.

According to recent reports, more than 12,000 Americans will turn 65 every day in 2024, and the U.S. Census Bureau reports that by 2030, all baby boomers are projected to reach this milestone. As a result, working Americans — across all generations — are shifting their attention toward financial planning, particularly retirement planning, to help secure future financial stability for themselves and their families.

At the same time, we are also witnessing a sharp growth in annuities. In the first half of 2024, LIMRA reported a 19% increase in sales compared with the same period last year. Additional data reinforces this trend, as evidenced by a nearly 27% year-over-year increase in annuities sales according to network metrics from iPipeline. While undoubtedly impressive, this trend indicates just a fraction of the market’s potential. The 2024 Insurance Barometer Study revealed that 54% of Americans surveyed expressed a strong intent to purchase life insurance, yet a large segment remains hesitant due to lack of information. This presents an opportunity that carriers and distributors cannot afford to ignore.

While the L&A industry has long been one to trail other industries in digital transformation, the arrival of Peak 65 could be the catalyst needed to modernize and digitally transform industry practices.

Prioritizing education and elevating customer experience

Reaching prospects with the right information is imperative. But traditional processes within the industry are not meeting this standard, particularly regarding opportunities presented by Peak 65. Customers are simply not receiving the financial planning information they need in a timely and efficient manner, which is limiting their knowledge of the options available to support their financial security. Peak 65, however, will provide the catalyst for carriers and distributors to revisit their processes, where the importance of education and readily available information stand at center stage while technology plays a supportive but key role.

Agents and brokers can help make financial products easier to understand for their clients with the right digital illustration software. In addition, digital sales platforms — such as e-applications and e-signatures — can significantly enhance the process by streamlining transactions and delivering a unified user experience. This approach aligns with the seamless interactions customers expect, and now demand, for a smooth end-user experience.

Leveraging data to bridge the gap

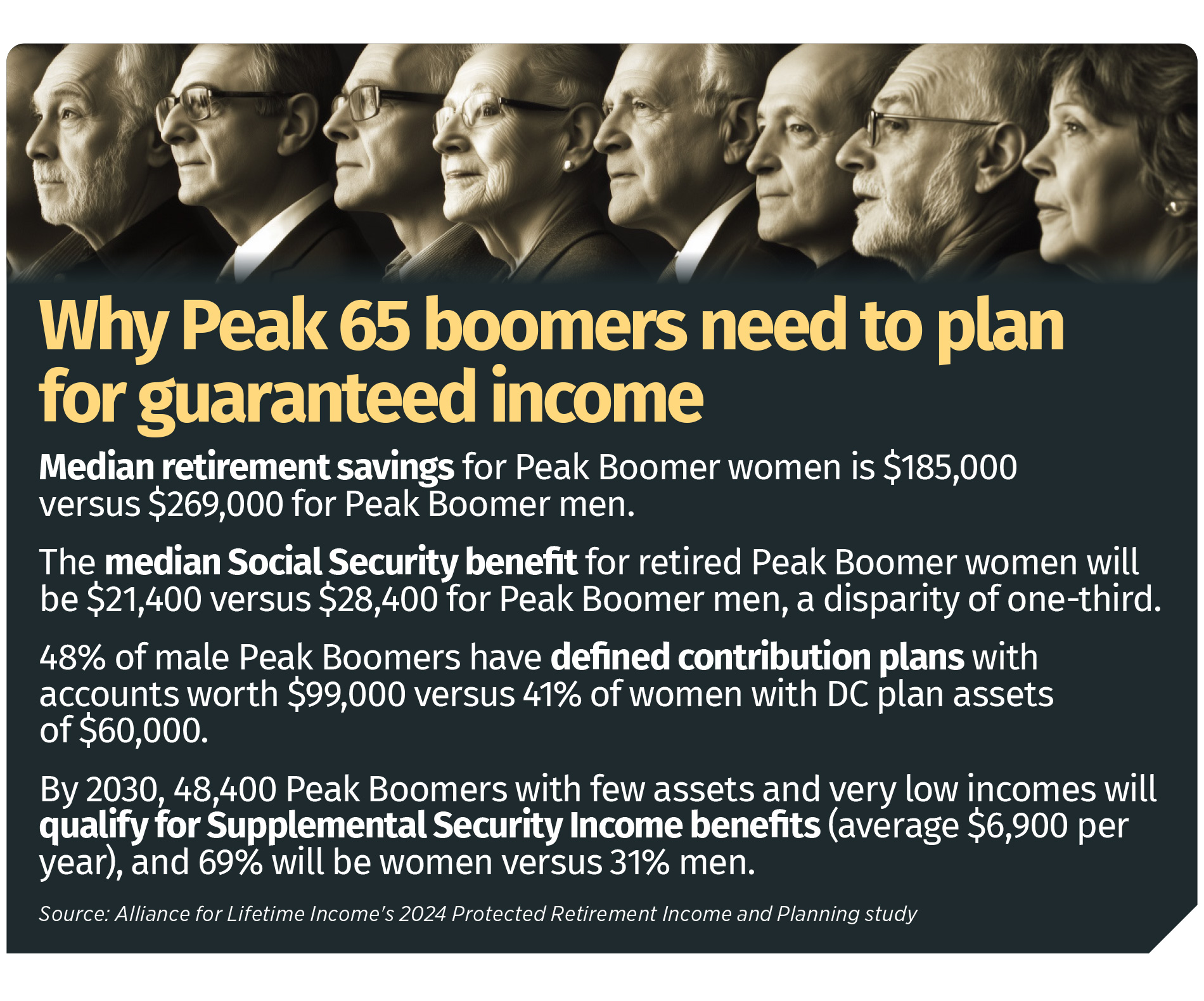

Data from digital solutions can be instrumental in propelling growth in the industry. Recent research from the Peak Boomers Impact Study shows that although both men and women are saving for retirement, there is a disparity between the sexes, as the median retirement savings for “Peak Boomer” men is $269,000 versus just $185,000 for “Peak Boomer” women.

Delving deeper, the Alliance for Lifetime Income suggests that 51% of women in the Peak 65 age group own less than $100,000 in retirement assets, which spikes up to 67% for single women. While these figures are concerning, they demonstrate the need for targeted and tailored financial planning. By leveraging advanced data, carriers and distributors, advisors can better understand their audiences’ needs as well as where they are in their unique financial planning journeys. As a result, advisors can provide tailored strategies and products that help users build comprehensive retirement portfolios — a win-win.

Removing the blindfold and leaning into automation

Digital solutions are breathing new life into the L&A space. Advancements in technology now allow carriers and distributors to automate and track the annuity sales process. This is a game changer as annuities have long been known for their complexity and behind-the-scenes processes.

By incorporating advanced digital solutions, advisors have the capability to monitor, track and rectify every step of the annuity sales process. This transparency permits carriers and distributors to gather valuable information and insights to effortlessly share periodic updates, thereby improving the overall customer experience. As annuities continue to gain interest, streamlined operations and enhanced transparency will only help to propel the market forward.

Regulatory hurdles

In addition to supporting meeting customers’ demands and expectations, digital transformation can also help to successfully navigate the shifting sands of regulations. Recent regulatory movements have left us in a “wait and see” position regarding the impact on the L&A industry, which includes the back-and-forth on the Department of Labor fiduciary rule. This legislation, which extends a fiduciary standard of responsibility to most annuity transactions, for now remains on hold as appeals are heard, however the DOL is demonstrating a commitment to un-freezing the rule.

The lesson to take from this is that agility will be paramount, with digital platforms providing the nimbleness to quickly adapt if needed. This is vastly different than manual processes, which remain disjointed, slow and prone to errors.

With regulatory changes persisting and becoming more stringent, embracing digital solutions should remain a top priority. In doing so, carriers and distributors can streamline compliance processes, remain in line with the latest legal standards and adjust quickly to any further changes.

Coming into the digital age

Peak 65 is a massive opportunity, but it doesn’t necessarily mean that success in the annuities market is guaranteed. Only those that align themselves at the forefront of digital transformation will be well positioned to capitalize on this pivotal period and turn changing demographics and shifting sentiments into business growth.

Katie Kahl is chief product officer, iPipeline. Contact her at [email protected]. Adam Ducorsky is associate vice president, iPipeline. Contact him at [email protected].

ICHRAs: A choice for small employers

Pros and Cons of AI in the industry

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News