NY Reports 3.7% Health Insurance Rate Hike For Individual Market

The New York State Department of Financial Services reduced health insurers’ 2022 requested rates, despite health care costs increasing to pre-pandemic levels. Rates in the individual market will increase by only 3.7%, saving consumers over $138 million, DFS said in a news release.

In the small group market, insurers requested premium increases of 14% on average, which DFS reduced to 7.6%, saving small businesses over $468 million. Over 1.1 million New Yorkers are enrolled in individual and small group plans.

“New York has made huge strides in fighting the pandemic and ensuring New Yorkers are vaccinated. As the state continues to reopen, people have been seeking long-postponed non-essential and elective health services, increasing costs and putting pressure on premiums. However, particularly due to the economic fallout from the pandemic, we must strive to ensure that quality, affordable health care remains available to all New Yorkers,” said DFS Superintendent Linda Lacewell. “I’m proud of the work DFS has done to scrutinize these rate applications and save over $600 million in premium costs for New Yorkers. We will continue our other cost-reducing initiatives such as the Administrative Simplification Workgroup and the DFS Drug Advisory Board."

Enhanced Federal subsidies under the American Rescue Plan, enacted on March 11, 2021, lower the cost of coverage available through NY State of Health to the lowest it has been in recent years. The amount of these tax credits depends on an enrollee’s income and where that individual lives.

For example, an individual earning $35,000 per year in New York City who was eligible for a tax credit of $359 per month, or $4,308 per year, is now eligible for a tax credit of $478 per month, or $5,736 per year. Under the law, no one will pay more than 8.5% of their income toward the benchmark plan available in their county. Over 60% of NY State of Health enrollees currently receive the federal Advance Premium Tax Credit (APTC).

As in prior years, the continued increase in health care costs is the main driver of premium rates. Medical claims decreased significantly in 2020 due to the postponement of elective and non-emergency services, but medical claims have increased in 2021 as New Yorkers catch up on medical appointments and postponed services.

As a result, medical claims trends, the rate at which medical costs and utilization increase, have returned to pre-pandemic levels. The 2022 individual rates announced today are consistent with pre-pandemic premium rate increases. Drug costs account for the largest share of medical expenses (38.7%), followed by inpatient hospital costs (17.3%), primary care (8.1%), outpatient hospital costs (7.9%), and radiology (5.7%).

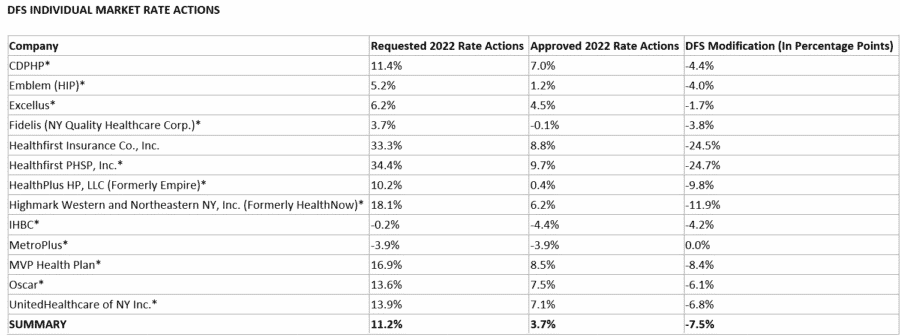

Individual Market

Approximately 264,000 New Yorkers are currently enrolled in individual commercial plans. DFS reduced insurers’ total weighted average increase requested for individuals by 67%, from 11.2% to 3.7%, the second lowest increase ever approved, saving consumers over $138 million. These rates will be further reduced for many consumers who are eligible for federal tax credits.

Last year, 58% of individuals who enrolled in a Qualified Health Plan from the Marketplace received the federal APTC. That number has grown to 63% in 2021 and is expected to grow further in 2022 as a result of the American Rescue Plan. Individuals who purchase the benchmark silver plan and receive the APTC are effectively held harmless from the impact of premium increases.

These rate decisions do not include the Essential Plan, available only through NY State of Health, which as of June 1, 2021, has no premium for lower-income New Yorkers who qualify. More than 893,000 New Yorkers were enrolled in the Essential Plan as of May 31, 2021.

While the impact of the expanded subsidies is not expected to be fully realized until 2022, they are already having an effect. Individual enrollment, which typically decreases after March, increased in June by just over 1%, and more than 140,000 individuals are already benefitting from the enhanced tax credits.

Small Group Market

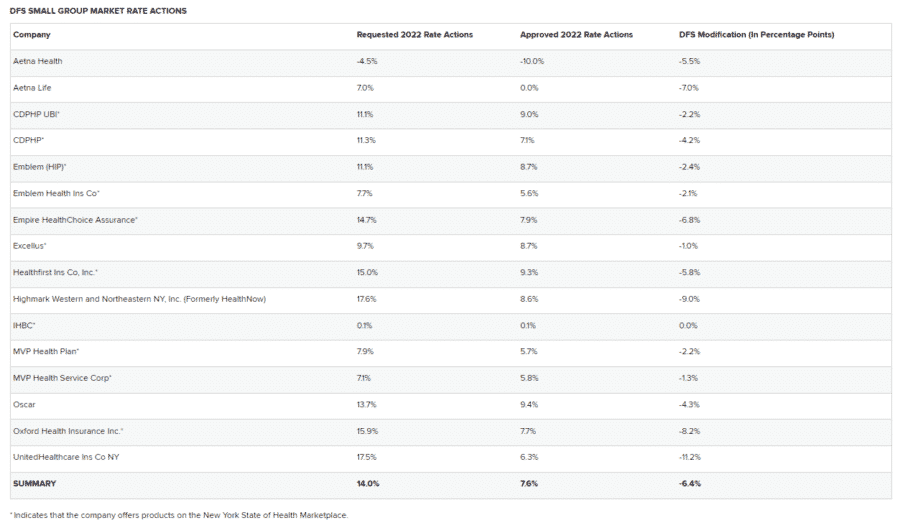

Almost 900,000 New Yorkers are enrolled in small group plans, which cover employers with up to 100 employees. Insurers requested an average rate increase of 14.0% in the small group market.

DFS cut the weighted average requested rate increases by 46% to 7.6% for 2022, saving small businesses over $468 million. A number of small businesses will also be eligible for tax credits that may lower those premium costs even further.

Transition From LIBOR Will Impact Existing Annuity Contracts

New York Advisor Charged With Defrauding Clients Of $8 Million

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

- Lawmakers try again to change ‘reflection in the mirror’ for cancer patients

- IF FINALIZED, PROPOSED CHANGES TO MEDICARE ADVANTAGE AND MEDICARE PART D WOULD IMPACT SENIORS' COVERAGE AND CARE IN 2027

More Health/Employee Benefits NewsLife Insurance News

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

More Life Insurance News