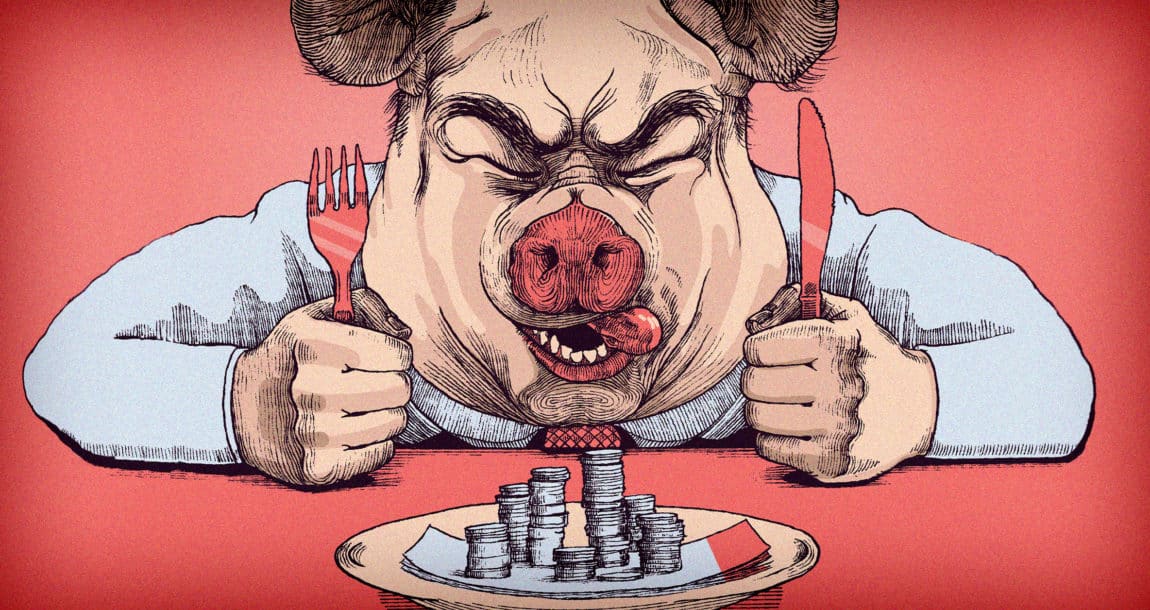

New York Advisor Charged With Defrauding Clients Of $8 Million

Martin Ruiz is charged with investment adviser fraud in connection with a scheme to defraud investors using his investment advisory firm, Carter Bain Wealth Management, federal officials say.

Ruiz appeared Friday before Magistrate Judge Barbara C. Moses.

Manhattan U.S. Attorney Audrey Strauss said: “As alleged, Martin Ruiz promised his elderly investment advisory clients safe investments but in fact stole his clients’ retirement savings and lined his own pockets. Now, for this alleged violation of the law and of his fiduciary duty to his clients, Ruiz faces federal criminal charges.”

Special Agent-in-Charge Peter C. Fitzhugh said: “As alleged, with more than $8 million in misappropriated funds, Ruiz acted with impunity while building his own personal investments. Ruiz allegedly padded his lavish lifestyle by defrauding investors, many of them elderly working-class retirees, out of their life savings.

"No one should live their own version of ‘Lifestyles of the Rich and Famous’ by swindling others out of their hard-earned money. HSI New York’s El Dorado Task Force worked closely with the United States Attorney’s Office for the Southern District of New York to see that Ruiz will now face the consequences of these alleged actions.”

According to the allegations contained in the complaint unsealed Thursday in Manhattan federal court:

From at least in or about March 2011 through in or about the present, Ruiz induced multiple individual investment advisory clients of CBWM, many of whom are elderly, to retain Ruiz and CBWM to advise them on how they should invest their retirement savings.

While ostensibly acting in his fiduciary capacity as their investment adviser, Ruiz instead induced more than a dozen such clients to invest more than $10 million in an investment fund called RAM Fund through the purchase of limited partnership interests. Ruiz did not disclose to those clients that Ruiz controlled RAM Fund and that he planned to misappropriate their funds.

In fact, rather than invest the funds in legitimate investment projects and real estate, as he represented to clients, Ruiz misappropriated more than $8 million of client funds from the RAM Fund, transferred those funds through a series of entities Ruiz also controlled, and spent the vast majority of the funds on personal expenses, including the purchase of a home, rent payments on several apartments, and the payment of his personal credit card bills. In so doing, he violated his fiduciary duty to act in his clients’ best interest and avoid self-dealing.

* * *

Ruiz, 45, of New York, New York, and Santa Fe, New Mexico, is charged with one count of investment adviser fraud. He faces a maximum sentence of five years in prison.

The maximum potential sentence in this case is prescribed by Congress and is provided here for informational purposes only, as any sentencing of a defendant will be determined by the judge.

Ms. Strauss praised the investigative work of HSI. Ms. Strauss also thanked the Securities & Exchange Commission, which brought a related civil action against Ruiz.

This case is being handled by the Office’s Securities and Commodities Fraud Task Force. Assistant U.S. Attorney Kiersten A. Fletcher is in charge of the prosecution.

The charges contained in the complaint are merely accusations, and the defendant is presumed innocent unless and until proven guilty, officials stressed.

NY Reports 3.7% Health Insurance Rate Hike For Individual Market

Michigan Reaches Deal To Cover Uninsured Vehicle Accident Victims

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News