Study: Digital Preference Just As Strong Among Older Clients

The wind is changing direction in the wealth advisor sector. Although traditionally focused on in-person interactions, investors are demanding a more digital experience from their wealth advisors.

As 30% of investors, and a staggering 55% of billionaires, either switched wealth manager provider or transferred significant funds to multiple wealth managers in the last year, it is more important than ever to keep up with recent developments and innovations to meet the clients’ needs.

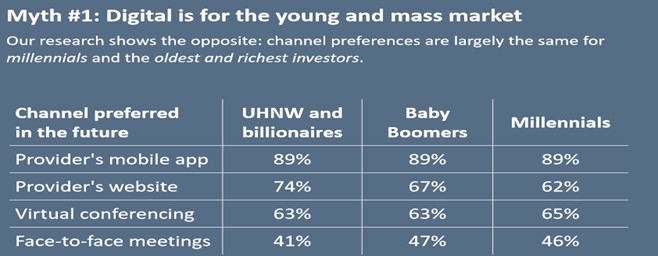

Recent ThoughtLab research, “Wealth And Asset Management 4.0- How Digital, Social, And Regulatory Shifts Will Transform The Industry,” shows a widespread preference for digital services. Almost all interviewed investors - whether ultra-high net worth, millennials or baby boomers - indicated that digital would be their preferred communication channel in the future. More specifically, 89% would prefer mobile apps, while websites remain popular among 74% of ultra-high net worth individuals, 67% of baby boomers and 62% of millennials.

Source: ThoughtLab

Know your clients: digital channel preference among UHNW individuals, baby boomers and millennials

One clear example of this preference towards digital communications is a different attitude towards virtual conferencing. In the world before COVID-19, wealth managers typically relied on in-person meetings to convey the type of white-glove service that clients expected and required. The pandemic that forced social distancing and work from home arrangements, also made everyone more comfortable with digital meetings. Today, an increasing percentage of investors, across all demographics and income brackets, would prefer to meet virtually rather than in-person. That trend is expected to continue in the future.

Virtual conferencing was highlighted as the preferred mode of interaction by 47% of baby boomers. This is perhaps because they find remote meetings are a better fit to their time-poor agendas. Boomers are not alone in this feeling; 46% of millennials and 41% of UHNWs share their opinion.

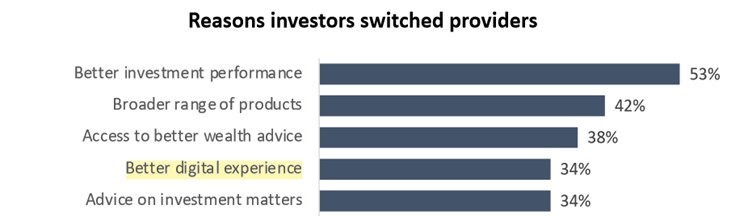

Why clients are switching their wealth management service provider

More and more investors are scratching their itch to switch. This doesn’t appear to be a passing trend as 44% of investors declare they intend to transfer funds to multiple managers in the next two years. It is therefore crucial for wealth advisors to get the channel balance right, and to offer a superior digital experience to their clients. For wealth managers, this means dealing with the need to balance a higher demand for digital with UHNW demands for multi-jurisdictional practices and complex specialized investment vehicles.

The main reasons behind the choice of switching provider are the pursuit of better overall investment performance (53%) and access to a wider range of products (42%). In addition to these more traditional motives, a lack of digital presence has recently become an issue for 34% of investors, highlighting the key role of digital touchpoints in the investor experience. Investors also reported switching wealth managers for various other factors ranging from lack of social impact investment through to fees and trust issues.

The wealth advisory industry is undergoing a phase that is dramatically redressing the balance between touchpoints. Wealth managers and advisors need to take note of these results as soon as possible to avoid being left behind by clients and the industry alike.

How to prevent the switch

The previously fundamental tenet that older, wealthier customers want only face-to-face interaction is no longer valid, and this new reality requires immediate action. Although more than 40% of respondents say they would prefer in-person interactions in the future, remaining anchored to outdated assumptions and way of doing business could prove counterproductive.

To stay competitive, advisors must consider that a sound digital client experience is no longer just a nice-to-have addition, targeted almost exclusively to the small demographic of millennials. Today, all types of investors, including UHNW individuals and older investors, expect a vast array of digital tools and services.

This could be because video conferencing helps them juggle busy lives, or because they would rather perform some activities in self-service mode via an app. ThoughtLab’s survey shows no significant difference between the channel preferences of boomers, millennials, the UHNW or the mass affluent in terms of their digital expectations when it comes to the relationship with their wealth management advisor.

Advisors must focus on improving overall digital experience, starting with implementing a seamless digital onboarding solution that provides a simple, intuitive and efficient process that benefits both clients and wealth managers. First impressions are crucial. Offering the right range of effectively managed touchpoints right at the start of the investor relationship will assure investors their advisor understands their needs, shares their values and considers their communication preferences and precious time.

Mark Shields is director of solution marketing at Appway. He may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Non-Retirees More Worried Than Retirees About Finances, Survey Finds

Execs Warily Eye A Shaky World, McKinsey Survey Shows

Advisor News

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Data from University of Michigan Provide New Insights into Managed Care (Attitudes About Administrative Burdens for Beneficiaries and Dental Care Providers in Medicaid): Managed Care

- Study Data from St. Christopher’s Hospital for Children Provide New Insights into Managed Care (Emergency Dental Care in the ACA Era: Rural-Urban Disparities and Their Association With State Medicaid Policy): Managed Care

- Researchers from University of California Discuss Findings in COVID-19 (Assessing the Use of Medical Insurance Claims and Electronic Health Records to Measure COVID-19 Vaccination During Pregnancy): Coronavirus – COVID-19

- 85,000 Pennie customers dropped health plans as tax credits shrank and costs spiked

- Lawsuit: About 1,000 Arizona kids have lost autism therapy

More Health/Employee Benefits NewsLife Insurance News