Execs Warily Eye A Shaky World, McKinsey Survey Shows

The good news is that corporate executives are not as worried about the COVID-19 pandemic as they have been the past few years, but the bad news is they are more worried about world splitting at the seams, according to a McKinsey survey.

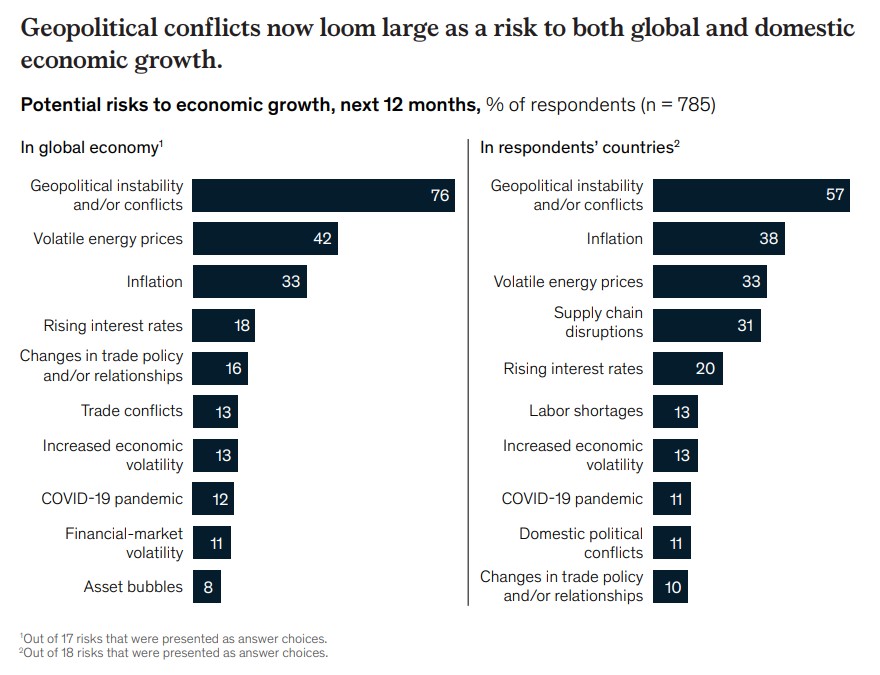

A clear majority (76%) of the 785 executives surveyed said “geopolitical instability and/or conflict” was the top risk to economic growth globally and 57% said the same was true in their own country, according to the quarterly economic conditions outlook survey that McKinsey conducted four days after the invasion started.

The pandemic dropped from 57% as the top risk in the previous survey to 12% in the current one. After two years in the top risk slot, the pandemic was pushed down by geopolitics, energy prices and inflation.

Even with some indications of economic improvement in the United States, such as job growth, the bloom is fading a bit for executives.

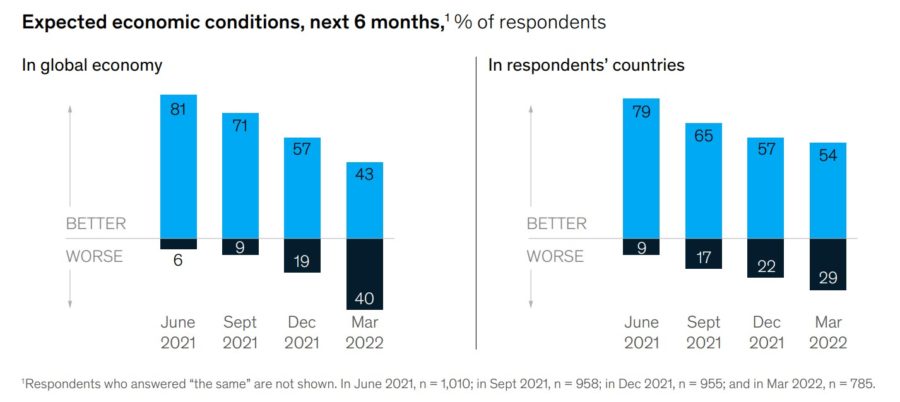

“Overall sentiment about the economy remains largely positive, but it continues to trend downward. For the third quarter in a row, respondents are less likely than in the previous one to report that economic conditions in their respective countries and across the globe are improving,” according to the report. “The near-term economic outlook is especially gloomy among respondents in developed economies, whose views are increasingly downbeat compared with their emerging-economy peers.”

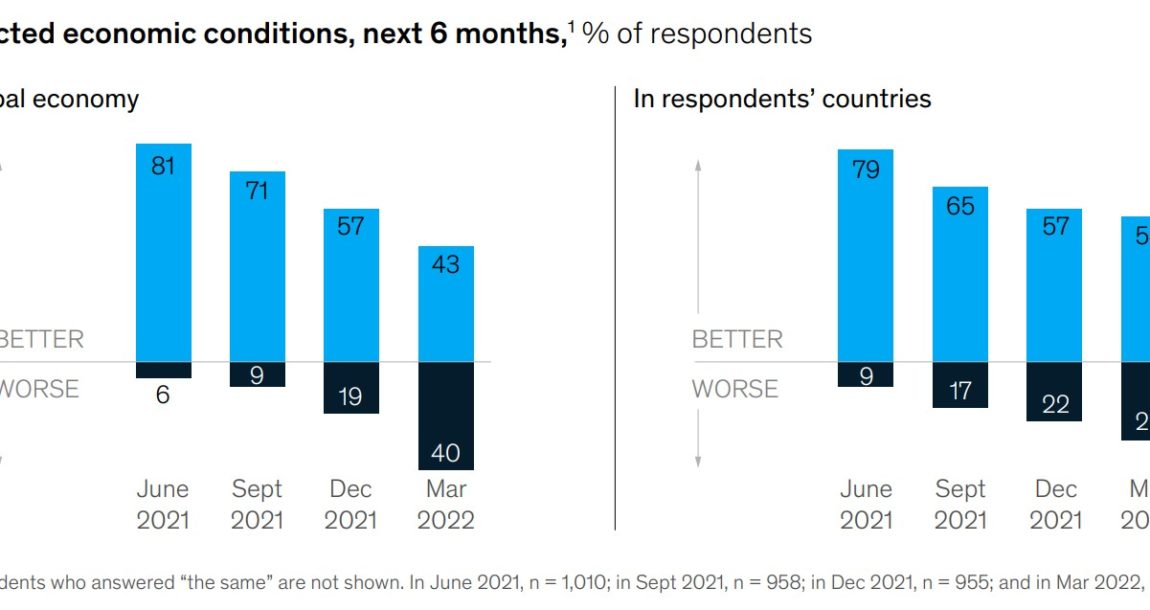

Half of the executives (49%) said they thought economic conditions were better globally and 59% thought the same for their own country. But that number drops for the outlook over the next six months, with 43% thinking positively and 40% negatively.

Another rising concern was interest rates, making it into the top five risks to near-term growth, according to the report, which said the share of respondents citing the risk had doubled over the quarter.

Mixed Indicator Signals

The latest indicators from the Bureau of Economic Analysis also reflected the divided outlook.

Gross domestic product increased a healthy 6.9% in the fourth quarter of 2021.

“Real gross domestic product (GDP) increased in 47 states and the District of Columbia in the fourth quarter of 2021, as real GDP for the nation increased at an annual rate of 6.9%,” according to the BEA. “The percent change in real GDP in the fourth quarter ranged from 10.1% in Texas to –2.3% in Iowa.”

Finance and insurance were main contributors to the increase nationally and was the leading contributor in 10 states. Other leaders nationally were information services; professional, scientific, and technical services; and real estate and rental and leasing.

Personal income increased 0.5% and consumer spending rose 0.2% in February. Although that increase represents a raise in compensation, it was offset by a drop in government benefits – a trend that will continue over at least the next few months. Another good sign though is that the savings rate ticked up in February to 6.3%, up from 6.1% in January.

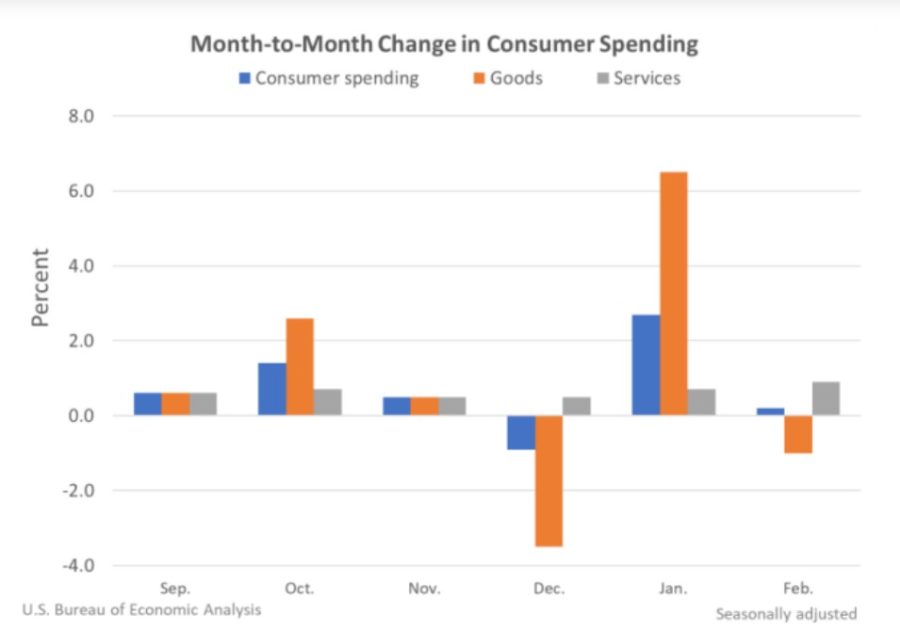

Although consumer spending ticked up slightly, with a boost in spending on services, consumers did an about face on goods after a blistering January.

The increase in services was propelled by a 33% increase in people getting out to restaurants and accommodations. The motor vehicle and parts market was the primary drag on goods with a 30% drop in purchases (although there was a 27% increase in gas and other energy goods).

Conditions are still shaky globally. International transactions were down $218 billion in the fourth quarter and international trade was down $89.3 billion in February, just before the invasion. The BEA reported that the pandemic was continuing to affect trade and that recovery was slow, but that was reporting from data gathered before the invasion.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Study: Digital Preference Just As Strong Among Older Clients

Some Creditors Miffed By Shurwest’s ‘Sham Bankruptcy’ Plan

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News