Medicare announces first 10 drugs subject to price negotiations

The Centers for Medicare and Medicaid Services yesterday announced the first 10 prescription drugs that will be subject to Medicare price negotiations under the Inflation Reduction Act.

Under the act, Medicare will be able to directly negotiate with drugmakers over prices for the costliest medications. The negotiated prices will go into effect in 2026.

Blood thinners and diabetes drugs head up the list of prescription medications up for negotiations. The list of drugs includes:

- Eliquis, a blood thinner.

- Xarelto, a blood thinner.

- Januvia, a diabetes drug.

- Jardiance, a diabetes drug.

- Enbrel, a rheumatoid arthritis drug.

- Imbruvica, a drug for blood cancers.

- Farxiga, a drug for diabetes, heart failure and chronic kidney disease.

- Entresto, a heart failure drug.

- Stelara, a drug for psoriasis and Crohn's disease.

- Fiasp and NovoLog, for diabetes.

CMS said that together, the 10 drugs selected accounted for $50.5 billion, or 20%, of Medicare Part D spending from June 1, 2022, to May 3.

Drugmakers must sign agreements to join the negotiations by Oct. 1. CMS will then make an initial price offer to manufacturers in February 2024, and those companies have a month to accept or make a counteroffer.

The negotiations will end in August 2024, with agreed-upon prices published on Sept. 1, 2024. The reduced prices won’t go into effect until January 2026.

If a drugmaker declines to negotiate, it must either pay an excise tax of up to 95% of its medication’s U.S. sales or pull all of its products from the Medicare and Medicaid markets.

What it means for Medicare enrollees

Tuesday's announcement "highlights the importance of these potential savings in relation to overall retirement health care expenses,” said Ron Mastrogiovanni, CEO and chairman of HealthView Services, wrote in an analysis this week.

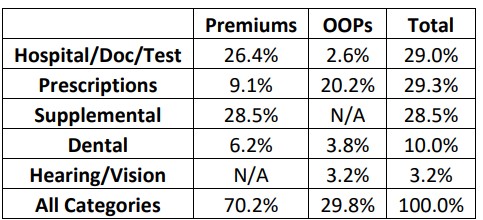

Mastrogiovanni said it is important to understand that retirees have two primary medication expenses – Medicare Part D premiums and out-of-pocket costs from co-pays. Price controls will primarily impact retirees’ out-of-pocket prescription drug expenses, which account for around 20% of total expected retirement healthcare costs, including Medicare Part B, Medicare Part D, supplemental insurance dental premiums, and all out-of-pocket costs. Long-term care is not included in these calculations.

The reduction in out-of-pocket costs for insulin and commonly prescribed drugs will benefit retirees who are dependent on these medications, he continued. Additionally, the administration's lowering of the maximum out-of-pocket payout to $2,000 for catastrophic prescription drug expenses (beginning in 2025) will serve to moderate the impact of increasing retirement healthcare costs overall. However, since these price caps only address a portion of all medical expenditures, healthcare will continue to remain a significant expense that requires special consideration during the retirement planning process.

Drawing on 530 million medical cases, inflation, actuarial, government and other data, HealthView Services’ cost projections provide a comprehensive breakdown of future retirement health care expenses. An average 65-year-old couple will spend more than $158,000 (future value) on out-of-pocket prescription drug costs throughout their retirement (age 87, male and age 89, female). When combined with Medicare Part D premiums, their overall spend on prescription drugs will exceed $228,000.

When viewed as a share of overall health care spending, more than one-fifth of every health care dollar spent in retirement will be for out-of-pocket costs related to prescription drugs. Adding in Part D premiums brings the total to nearly 30%

For both current and prospective retirees, particularly those managing chronic health conditions that require substantial prescription needs, this legislation will reduce out-of-pocket expenses. As the complete list of drugs is announced over the coming years, the actual impact on prescription spending in retirement will become clearer.

Only the start

Today’s announcement is only the start of several measures aimed at lowering prescription drugs costs for Medicare enrollees. Under the Inflation Reduction Act, negotiated prices will go into effect for 15 more drugs in 2027, followed by another 15 drugs in 2028 and 20 more in each subsequent year.

Why using AI to minimize risk should be at the forefront of the insurance industry

Mixed expectations for impending DOL fiduciary rule

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

More Life Insurance News